As Bangladesh’s export earnings reached all time high in the just-concluded financial year defying challenges emanating from the ongoing global economic backlash, the country has set new target looking forward. Although the lion-share of the robust export proceeds came last year from the ever-growing RMG sector, analysts and observers are of the view that the country needs to diversify its export basket in its bid to firstly sustain the recent success and then to set any new export target whatsoever in line with fast-changing global economic scenario, writes SM TANJIL-UL-HAQUE

If you want , you can also read related topic about :

You can also read another article about: Boom in Bangladesh’s Export Earnings: Garments’ Transition to High-value Industry

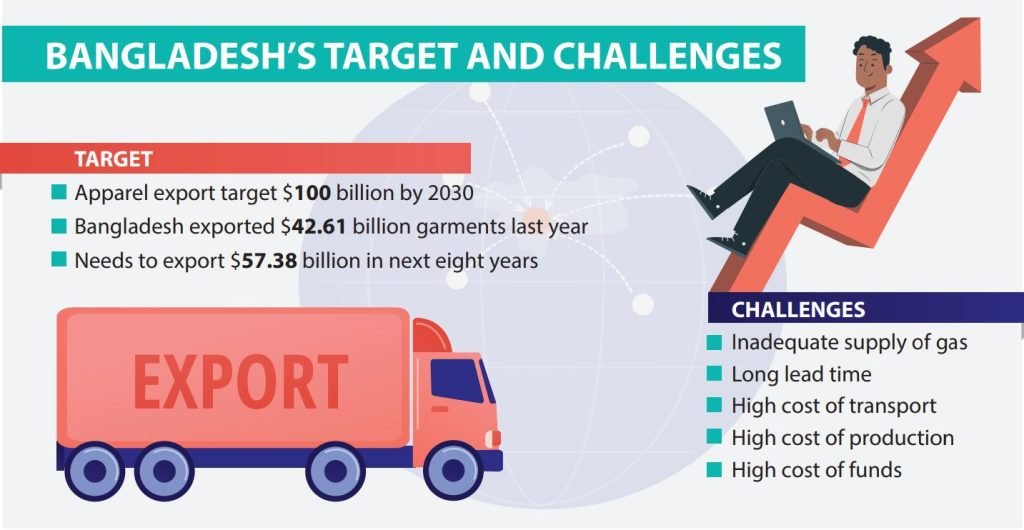

Bangladesh has recently logged record earnings in the country’s ever-growing export sector – thanks largely to the robust performance of ready-made garments (RMG) industry. The export sector has crossed the $50 billion milestone for the first time as high-growth in export continued throughout the year with 34.38 percent recorded as the total growth in export income. Thus, the industry has already reached the target set for the current financial year with a month to spare. Consequently, the apex trade body of the country’s RMG sector – Bangladesh Garment Manufacturers and Exporters Association (BGMEA) set a new target of $100 billion export by the year 2030, which is twice more than the figure the country achieved in the just-concluded fiscal year. But experts say $100 billion is a completely different and trickier proposition. There remain numerous other significant challenges the industry might face in this endeavor.

EXPORT HITS ALL-TIME HIGH

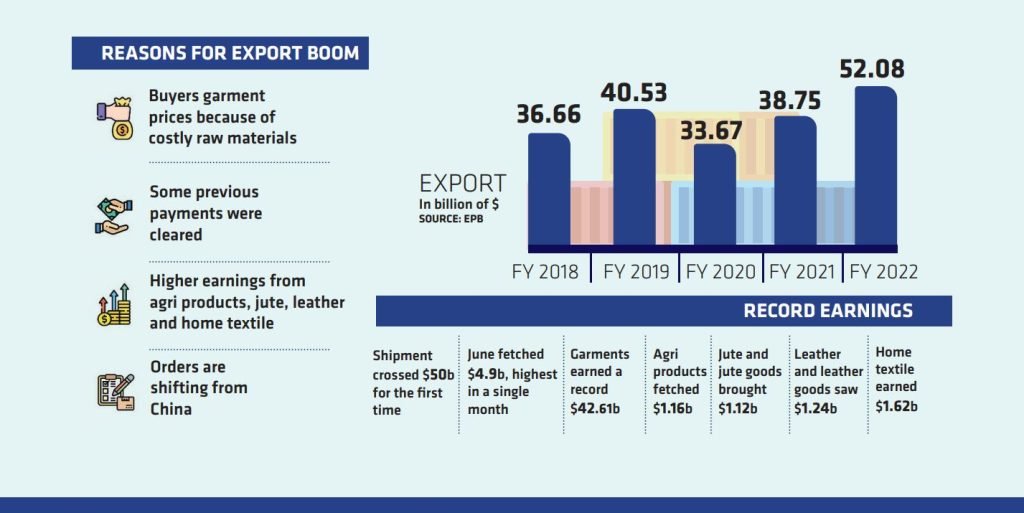

The Export Promotion Bureau (EPB) on July 3 released preliminary data revealing the record export of goods for the just-ended 2021-2022 fiscal year. The data provided by EPB shows that Bangladesh in 12 months of the last financial year exported goods worth $52.08 billion, which is 19.73 percent ahead of the target and 34.38 percent more than the previous fiscal. Earlier, the target for the next financial year was set at $43.50 billion based on export of goods worth $38.75 billion in the 2020-2021 fiscal. Industry insiders say this is the highest income in Bangladesh’s export history with growth throughout the year also being higher than any time in the past. Observing the overall situation of exports, Commerce Minister Tipu Munshi mentioned this was the result of a planned effort to increase exports. Prime Minister Sheikh Hasina kept a close watch on the sector. The overall situation was well in the aftermath of Covid pandemic, there were all kinds of cooperation from the government.

“Our exports have increased with many new items crossing the billion dollar mark. Hopefully things will improve further this year. We previously had set a target of $51 billion for services and products combined. But the amount reached $60 billion threshold.” The minister further highlighted that $52 billion of the income came from exports of goods and $8 billion came from exports of services. That’s about 18 percent more than the target, which is really good news…in the next financial year, we want to set a target of $65 billion,” he added.

SECTOR-WISE ANALYSIS

According to the sector-wise analysis of the export sector, the highest ever export earnings came from the readymade garments sector at $42.61 billion, which is 81.81 percent of the total exports. In the last financial year, the income of the garment sector has increased by 35.47 percent. In addition to the garment sector, several other sectors have now surpassed one billion dollars in exports. Exports from the home textile sector rose to $16.22 billion, while exports of leather and leather products grew by 32.23 percent to $12.45 billion. As a result of 13 percent growth in the export of agricultural products, the total export has reached $11.62 billion. Exports of jute and jute products amounted to $11.27 billion, although the sector grew at a negative rate of 3 percent.

HIGHEST EXPORT IN JUNE

June, the last month of the financial year, had the highest export earnings in a single month. Export in this month was $4.91 billion, 35 percent greater from the target set for the month and 37 percent higher than the same month last year.

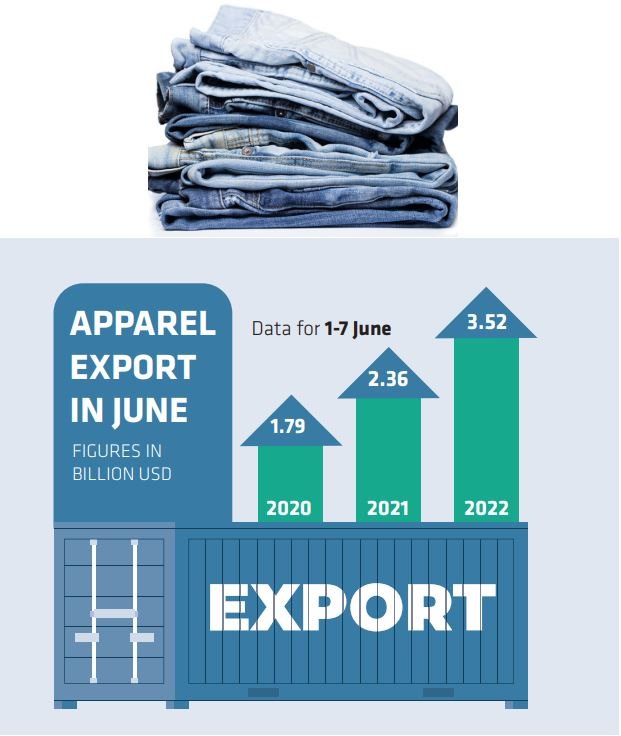

APPAREL EXPORT SEES 50% GROWTH AMID HIGH INFLATION

Bangladesh’s apparel exports registered a near 50 percent growth compared to last year. The export amounting to USD 3.52 billion, just within the first 27 days of June, shrugging off the 40-year high record inflation in the US and European countries prompted by the Russia-Ukraine war. BGMEA sources said the sector enjoyed an over 12 percent growth year-on-year in a single day during the period, but the shipment also witnessed up to 39 percent negative growth year-on-year in three days’ export out of those 27 days. Furthermore, in July-May of Fiscal Year2022, readymade garment shipment saw about 35 percent growth to $38.52 billion compared to the same period last year, according to data published by the EPB.

BGMEA President Faruque Hassan highlighted that apparel exports saw a good growth even during the war, as huge orders were booked with the trend expected to continue in the next two months. However, he said the next year would be tough due to global inflation and recession as some buyers with good inventory would be careful in placing new orders. The BGMEApresident also hoped that this year would be concluded with about 36 percent growth and the positive growth should be maintained next year. “Definitely the industry will try to maintain a double-digit growth,” he added.

Bangladesh Knitwear Manufacturers and Exporters Association (BKMEA) former President Fazlul Hoque said the apparel industry was still enjoying some excess orders and shipment benefits owing to increased global demand. He also said the falling price of cotton was also a reflection that there was a fear of inflationary pressure in the global apparel market. Resonating the BKMEA former president, a leading multinational buying house business head, seeking anonymity, said they also observed the order placement is going slow for the USA and EU markets. The order placement for Japan and South Korean markets also maintained the same growth till now, adding, he during a recent visit to Korea observed that all product prices marked rise, except for apparels due to the global inflation. He also feared that this additional pressure might affect the consumers’ apparel buying habits.

ROBUST PERFORMANCE IN PROFITABLE DESTINATIONS

In the midst of a slew of dismal news, from the rise of inflation to a grim scenario of the global economic slowdown, the substantial growth of prices against apparel export from Bangladesh to the US and the EU markets is undoubtedly uplifting. The US International Trade Commission (USITC) and Euro Stat data reveal that RMG export growth to the US and the EU in the first nine months of the current fiscal year was 6.5 percent and 10.7 percent respectively. In this period, the average unit price rose by 6.5 percent to $3.3 billion for the US market, which was $3.1 billion for the same period in the last fiscal. For the European market, per kilogram of clothes was bought for Euro 14, which was Euro 12.6 for the same timeframe in the last fiscal.

According to the Export Promotion Bureau (EPB), the US remained the top apparel export destination for Bangladesh in the last fiscal with an export earning worth $9.01 billion, registering a 51.57 percent growth compared to the last fiscal. In the meantime, Bangladesh also maintained its great start in exporting apparel items to the US market in the calendar year 2022. In the first five months (January-May) of the current calendar year, Bangladeshi exporters shipped apparel items worth $4.11 billion to their biggest single destination fetching a growth of 59.06 percent, according to recent data from the Commerce Department’s Office of Textiles and Apparel (Otexa). According to the Otexa data, Bangladesh exported apparel items worth $2.58 billion at the same time last year.

POTENTIALS OF PHARMA AND ICT SECTORS

Experts believe that Bangladesh’s Pharmaceutical export have great potentials. Prime Minister’s Private Industry and Investment Adviser Salman F Rahman said, “The pharmaceutical sector of the country has the potential to raise export earnings to $5 billion annually in the next five years – from the existing $200 million.” He made the remarks during a seminar on the pharmaceutical sector organised by the Dhaka Chamber of Commerce and Industry (DCCI) on July 23. He also recommended prioritising production of biologic drugs alongside general medicines to reach the target. Speakers on the occasion corroborated his statement, saying the sector can flourish like the RMG industry, the largest export earning sector of the country.

Meanwhile, information and communication technology (ICT) exports from Bangladesh have been maintaining a sharp rise as global clients have infested local IT firms with orders for high-end software, data processing and other digital service solutions. Following this, the local IT companies saw their export earnings climbing to 52 percent year-on-year to $369 million in the July-April period of fiscal 2021-2022, revealed EPB data.

POWER SUPPLY HOLDS KEY TO FUTURE GROWTH

The ongoing global crisis has once again showed that power and energy supply remains crucial for a country’s growth, economy and infrastructure. Bangladesh’s power generation capacity currently stands around 24,000 megawatt (MW) – thanks to 146 power plants and off-grid sources. The government is nevertheless embarking on several other large-scale power projects, including seven coal-fired plants with total capacity of 6,830 MW and installing 1200 MW nuclear power plant, which is expected to become operational by 2025, and a second one is also under consideration.

Additionally, eight small-scale gas and liquefied natural gas plants with total capacity of 1609 MW, are currently under construction. And five large-scale gas plants, with capacity of 8,750 MW, are in the planning stage. Together, these projects, when implemented, will boost Bangladesh’s total power generation capacity to 40000 MW by 2030, according to the Bangladesh Power Division. Till then, garment makers will have to make do with the power shortage. But, there is an option for Bangladesh to overcome this by importing power from neighbouring countries. Bangladesh is likely to have a new avenue for importing electricity from Nepal after the Himalayan kingdom agreed to install a cross-border electricity transmission line through West Bengal of India to make up for the current power shortage situation. Nevertheless, question mark still remains on the availability of gas.

DEVELOPING MANPOWER CRUCIAL TO FURTHER GROWTH

If Bangladesh wants to expand the industry further, there’s no alternative to developing manpower. According to BGMEA reports, the apparel sector currently employs around 4 million people, which ought to go up to around 12 million by 2030 as the industry works resolutely towards tripling its current export value. Manufacturing industry in Bangladesh comprises around 22 percent of the country’s total workforce, while remaining 78 percent is employed in agriculture and service industry. But, as Bangladesh graduates to a developing nation by 2026, hiring another 7.50 million work-force in the garment industry will be a challenging task as the demand for manpower in other sectors such as ceramic, leather energy, tourism, cement, construction amongst others are already growing, and will continue to grow.

As per President of the Bangladesh Apparel Workers Federation, Towhidur Rahman, and President of the Sammilito Garment Sramik Federation, Nazma Akter, the current shortage of garment workers ranges from 15 percent to 20 percent after a large number of workers migrated to other professions during the pandemic period when factories remained closed for prolonged periods on account of countrywide lockdowns. “We have lost about 200,000 workers during the pandemic and many of them have started their own business,” claimed BKMEA Executive President Muhammad Hatem. Given the existing scenario, there is marked scepticism amongst industry people on how to make available those many hands, which would be needed to meet the expanded capacities. A concerted and holistic approach is the only option, they said calling to embrace the India model to address the situation.

The neighbouring country has achieved a great deal of success in mitigating the critical gap of skilled manpower by implementing Integrated Skill Development Scheme aimed at creating robust human resources for the country’s textile sector, through a multi-pronged approach – thereby developing manpower through various channels, incentivising them sufficiently and providing fiscal assistance to individual factories engaged in workers’ training. Even though, BGMEA has already started training workers through a good number of institutes that it runs across the country, while also signing an MoU recently with the Skills for Employment Investment Programme (SEIP) as part of which anyone wishing to work in the apparel industry can be imparted necessary skills. Additionally, workers and midlevel management already employed in the sector can also be re-skilled and up-skilled as part of this project.

OTHER KEY CONCERNS

Although all the data discussed above show an uplifting picture for our apparel industry, it should also be noted here that the optimistic figures are due mainly to the buyers temporarily leaving other manufacturing nations as a result of the pandemic, prolonged shutdowns of factories, and political turmoil. Fortunately, the Covid-induced pandemic recovery in Bangladesh has been swifter than in many other countries, leading to the complete opening of factories and prompting buyers to come here. What’s needed now is to ensure that these buyers who came to us due to unforeseen circumstances do not take away their orders in the future. Undoubtedly, the RMG industry has been a critical factor in propelling the economic boom of Bangladesh. However, in a world post-Covid and polarised by the Ukraine conflict, trade dynamics will also see a sharp shift. In such a scenario, with big buyers looking for alternative manufacturing destinations, Bangladesh can emerge as a preferred country due to its low production costs. With need for diversifying its export basket, Bangladesh is also offering several special economic zones (SEZs) with world-class features. The BGMEA’s comment that Bangladesh should bargain more to get the best price is a suggestion that must be taken seriously. Often, due to the failure to persuade through convincing arguments, we do not get the best price for products, which eventually adversely impacts wages and workers’ bonuses. To counter this, ‘Brand Bangladesh’ has to be promoted with the right mixture of business attraction and marketing oomph. The data relating to RMG exports from last year till now may be heartening. However, with the war in Europe becoming protracted, Bangladesh has to be prepared for a possible decline in orders. Anticipating a potential pitfall and acting on it pre-emptively minimises the repercussions. For a good reason, the priority for the government should be to seek out new markets in Africa and South America. Bangladesh government had earlier expressed a desire to open new embassies, which can be pursued now following market assessment.

To wrap up, if opening new missions in overseas clashes with current austerity drives, appointing Consul Generals can be a viable option. These officials can come to Bangladesh and return to work to publicise Bangladesh’s potential areas of expertise. One downside of RMG production in Bangladesh, regularly underlined by industry insiders, is reportedly the unreliable availability of raw materials. Experts suggest that with a robust supply chain mechanism, this too can be remedied. It also makes sense to follow a two-pronged approach, seeking new markets overseas and securing a robust supply chain operation for raw materials. But, the challenges do not end there! The country’s policymakers must be prolific and focused as well as remain open to ideas like diversifying export basket and expanding export market for addressing the challenges ahead.