HOW CAN 3Fs BE THE CAUSE OF TENSION?

First the covid-19 pandemic, then the Ukraine-Russia war have put the world in a dire situation. food, energy, financial sectors have become unstable due to these events. The impact of everything is now beginning to hit Bangladesh. Economists fear that an economic crisis is approaching soon and the situation is likely to worsen in the coming days.

Many economic indicators have weakened. Energy and electricity crisis has increased. The fear of food crisis is all over the world including Bangladesh. The Prime Minister is also talking about famine. Foreign exchange reserves have fallen by more than $14 billion this year. Exports and expatriate earnings have slowed down. Transaction deficit is now a record amount as foreign exchange earnings are low. However, Minister of State for Planning Shamsul Alam expressed hope about the economic situation. He said there is some kind of pressure in the economy. But there is nothing to panic.

YOU CAN ALSO READ: CAN BANGLADESH CASH ON $5 BILLION NDB LOAN PROVISION?

There is nothing to be disappointed with the levels of economic indicators so far. He further said, “If the electricity supply is regularised, the production system will return to normal. Then inflation will also come under control. With the support from the IMF-World Bank, the dollar crisis will also ease. There is talk of food crisis. But our Aman yield has been good. Preparations are underway to improve the yield of Boro. We are careful about the agricultural production system”.

But the biggest problem of the general people now is inflation. It has increased the cost of living, decreased real income. The fear of global recession is increasing. The International Monetary Fund (IMF) says bad times are yet to come. Global growth will slow further, inflation will increase. Food, energy and financial crises are expected to deepen.

FOOD CRISIS

Blockade of Ukrainian ports by Russia’s Black Sea fleet and Western sanctions against Russia have changed the known image of global food exports. The world organizations are warning of food crisis around the world. Bangladesh is also mentioned in the risk of food crisis that the World Food Organization is talking about. According to the World Food Organization, 33 of the 45 countries in the world that need additional food imports in 2023 are from Africa. 9 Asian countries including Bangladesh are also named in that list. There is now enough reason to be worried. Realizing the situation, Prime Minister Sheik Hasina has repeatedly urged the country’s people to be ready for the worst situation if it comes. She emphasized that every inch of the country’s arable land must be used for food production. Because, there is a danger of food crisis and possible famine all over the world. She also called upon the public to stop wasting food and try to produce as much food as possible.

If such a danger comes, how ready Bangladesh is to deal with it, the question is also in the public mind. Despite overcoming the shock of the Corona epidemic, a World Bank recent survey revealed that about 30 percent of the country’s people are facing food shortages. The rice and flour market in Bangladesh has been on the rise for the past few months due to overall inflation. According to the market monitoring cell of the government agency TCB, now the price of flour and flour per kg in the country’s retail market is 50 percent higher than a year ago. The price of rice has also increased by 10 percent compared to a year ago. The government has taken several initiatives but still could not reduce the price of food products.

Russia and Belarus are important fertilizer exporters. About 50 percent of the world’s fertilizers are supplied from Europe. Fertilizer production and supply systems like all commodities have been severely affected due to Corona and war. Meanwhile, the production of fertilizers is being hindered due to gas crisis in the country resulting in the price hike of fertilizers and other agricultural inputs. As a result, the cost of agricultural production is increasing as well as the price of agricultural products. Besides, the outbreak of natural disasters increases the fear of food shortage in the country every year. The presence of large numbers of refugees is also seen as a major threat to the country’s food security.

Agriculture Minister Abdur Razzak believes that even though the price of food products including rice and flour has increased in the country due to the global crises, the situation has not yet reached a level to be worried. On the other hand, the government is trying help country’s poor people through supplying product through TCB. However, many have opined that monitoring should be increased on the food that is being given to one crore families through TCB and this number should also be increased. Economist Amartya Sen, who has studied many of the world’s most talked-about famines, has shown that famines occurred simply because people did not have access to food, even when there was sufficient food grain for the population. So the government should pay attention to this aspect as well.

ENERGY CRISIS

Due to the impact of the war, Bangladesh is facing a deep energy crisis like the whole world. And it is known to everyone that the world market of fuel, gas and oil is always sensitive. So, it is not unusual that the Russia-Ukraine war has made this market volatile and expensive. Russia has cut gas supplies to Europe due to economic sanctions. Europe, dependent on Russian gas, is now increasing its imports of LNG from the Middle East as an alternative. Suddenly the demand for LNG increases and it becomes expensive for a country like Bangladesh. Due to the impact of the war, Bangladesh is facing a deep energy crisis like the whole world. And it is known to everyone that the world market of fuel, gas and oil is always sensitive. So, it is not unusual that the Russia-Ukraine war has made this market volatile and expensive. Russia has cut gas supplies to Europe due to economic sanctions. Europe, dependent on Russian gas, is now increasing its imports of LNG from the Middle East as an alternative. Suddenly the demand for LNG increases and it becomes expensive for a country like Bangladesh.

Meanwhile, Bangladesh government’s electricity and energy department says that 58 power plants, from where 3 thousand 931 megawatts electricity was produced, are currently closed due to the increase in the price of fuel oil and gas in the international market. There are currently 52 gas-based power plants in the country. Its production capacity is 7 thousand 169 megawatts. Of these, more than 5,000 MW of gas-based power plants are now closed. Apart from this, 1100 MW power generation centers are closed due to lack of fuel oil.

At present, power sector problem shifted from a lack of generation capacity to a shortage of primary energy, putting the country at an international price and supply fluctuation risk. To face this, sources of the government said, the production of several power plants which are not diesel-powered will start soon. It is expected that if these power plants are started, the government will be able to come out of the power crisis. Official sources in the government said that the government is taking initiatives to explore new gas wells and upgrade the existing wells to supply the energy for power generation.

FINANCIAL CRISIS

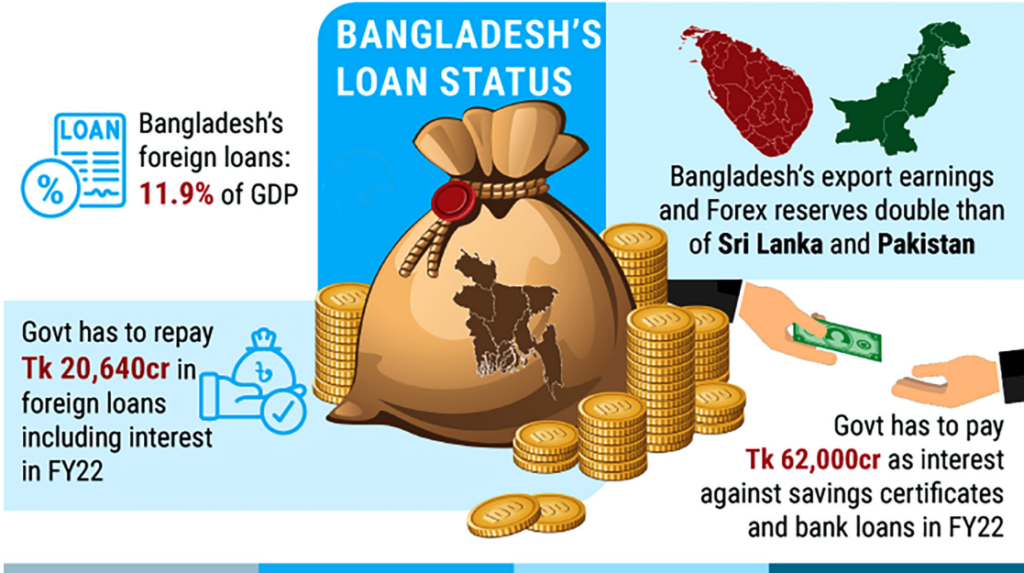

For the past several months, there has been a crisis in Bangladesh’s foreign exchange. According to a recent central bank report, expenditure has been increasing more than foreign exchange earnings for the past few years. On August 24, 2021, Bangladesh’s foreign currency reserve reached its highest level of $48.06 billion. However, on November 17, barely 15 months later, it fell to a recordlow $34.24 billion, which is the lowest since June, 2020. Ironically, all sources of foreign currency – export, remittance and foreign loan – have been on the decline. On the contrary, import expenditures, though marked some fall following central bank’s recent restrictions, are still high. As a result, foreign currency reserves are depleting.

Despite the Bangladesh Bank’s intense efforts, external sector performance continued to weaken the main foreign currency earning sources widening the trade deficit and increasing pressure on foreign exchange reserves. The trade deficit stood at a record $33.25 billion at the end of the outgoing fiscal year 2021-22. At the same time, the current account deficit also surpassed $18.50 billion. Fuel import bills show no sign of slimming, fertilizers remain pricier and if food prices go up further, foreign reserves will be under more stress.

Despite increasing the cash incentives to 2.5% from 2% in the current fiscal year, inward flow of remittance saw a fall of 25% in September compared to August. In October, remittances declined further in the face of dwindling foreign exchange reserves.

Though the number of workers going abroad is increasing, the remittance flow is declining because of their preference to send money through informal channels. The inflow of remittance has been on a downward trend since February that, in fact, posing a threat to the country’s economic stability as a whole.

Dollar exchange rate has broken all previous records. Economists say that Bangladesh is now seeking a loan from the IMF to deal with that crisis. Besides, efforts are being made to get loans from other institutions including World Bank, Asian Development Bank. Economist Dr. Ahsan H. Mansoor said in the media, “All developing countries around the world are facing two problems – one, they are facing large deficits in the balance of payments and two, inflation is rising due to the inability to keep exchange rates under control. Bangladesh is no exception. Reserves are decreasing to deal with these deficits. Therefore, we have to work in this place now.”

DIFFERENT TAKE

Economists say the present crisis is not just because of the Ukraine war but a build-up of legacy issues. The warning signs were present long before the Russia-Ukraine conflict. Persistent current account deficits, large trade deficits, and increasing liabilities over foreign assets are nothing new. The reserve pressure was already there and it became more visible because of the war, according to their views.

Dr. Debapriya Bhattacharya, distinguished fellow at the Centre for Policy Dialogue, said “there is a narrative that the economy would be normal if the Ukraine war would not happen. However, there are legacy issues that make it difficult to solve the current situation. The legacy issues comprise the banking sector’s poor health, energy shortage, low revenue collection and depleting reserves. Were the tax-to-GDP ratio higher, the government would have been in a comfortable situation.

If the efficiency of public expenditure was better, we would have a better result with the limited resources.” He further said, the policymakers are saying that the present economic turmoil will dissipate in three months, but a global recession is looming large in 2023. So, it would be one of the toughest years in the recent decades where three problems will be the cause of tension: food, fuel and finance.

In regard to energy, Professor Badrul Imam, the energy expert, said, it’s not possible for Bangladesh to attain energy security with this low rate of exploration. The current energy crisis in the country has more to do with the government’s reluctance to explore natural gas than the ongoing Russia-Ukraine war. He pointed out that Bangladesh, the biggest delta in the world, has huge unexplored gas resources. “We find gas in one in three wells we drill while the global average is five. He further said. “We have the key to solving this problem. We need to find the gas reserves that remains undiscovered and extract gas as soon as possible.” In line with his view, experts opine the main focus of the government should be on energy generation from native sources rather than importing fuels and strengthen the state-run Bapex, instead of prioritising foreign companies.

Talking about the financial sector, Nora Dihel, the senior economist at World Bank (WB) explained why reform is necessary for Bangladesh’s uninterrupted economic growth. “Comprehensive reforms are required to enhance financial sector intermediation capacity to support economic growth while preserving financial sector stability”. Regarding the banking sector, WB said in a report that despite major progress over the past four decades, Bangladesh’s financial sector still lags behind its peers.

The deepening of the financial sector has remained stalled. The WB report also notes that “weaknesses in the regulatory and supervisory framework do not properly equip the authorities to deal with potential internal and external shocks in a timely and cost-effective manner.” Bangladesh needs to continue to build better financial sector infrastructure, improve its legal and regulatory frameworks, and phase out the existing distortions to enable a larger and more efficient flow of financing to the private sector, including to underserved segments.

To conclude, economists and experts opined that the ongoing challenges may continue for many more months, and the scenario is uncertain. Therefore, policy responses of the relevant authorities will have to be prompt and pragmatic. It is the time now that policymakers should focus on strengthening the macro-fundamentals so that our economy is strong enough to navigate through these uncertain and difficult times. As experts view, if we want to tackle the food crisis in Bangladesh, we must focus on local production, provide incentives to producers, provide timely fertilizer and seed supply and irrigation. Truly, it is difficult to meet the demand by importing food products in this country of huge population.

So, we have to face any difficult situation by increasing our domestic production. In regard to energy, there is a shortage of energy supply in the country. Industries are suffering due to lack of gas and electricity. Initiatives should be taken to save energy by reducing system loss and wastage. All avenues for immediate exploration of both onshore and offshore gas and oil prospects needs to be undertaken. Special care should be taken for the most productive sector such as industry and agriculture in allocating both gas and power. To ease the financial crisis, restructuring of financial sector is necessary. Unnecessary imports have to be discouraged and more exports should be promoted. Undoubtedly, Bangladesh government has taken many precautionary initiatives to tackle the food, fuel, and financial crisis. At the same time, if we are all aware of the situation and take appropriate measures, we may be able to tackle the challenges better.