Bangladesh is now considered as one of the world’s fastest growing countries in terms of economic growth. For the last few decades, the country has been successfully able to maintain its growth that prompted rave reviews. But how long will Bangladesh sustain this growth? Addressing the challenges lie in the economic sector of the country, experts and international financial organisations have suggested several reforms targeting the next phase of economic growth. MOHAMMAD RAFIUL HASSAN dissects the idea as to whether the government should take these into consideration

Of late, Bangladesh has secured the 95th position out of 184 countries in terms of financial development, which is slightly above lower-middle-income economies, but below upper-middle-income economies. It is one of the top 10 fastest-growing countries in the world for several decades now. But there is no reason to be complacent as an economic boom is never a permanent trend.

The World Bank (WB) in its “Bangladesh- Country Economic Memorandum: Change of Fabric” report said Bangladesh’s current growth structure is not sustainable and its GDP (Gross Domestic Product) may fall below 4 percent between 2035 and 2039 without further reform. The WB report depicts that growth in fast-developing countries is always at high risk. Few countries have sustained high growth for long periods. Only one-third of the countries in the top 10 continued to experience high growth over the next decade or so.

YOU CAN ALSO READ: MODELING THE FUTURE OF RELIGION IN BANGLADESH

An aspiration to reach upper-middle-income status by 2031, as World Bank stressed, cannot be achieved through financing sourced from the public sector alone. To reach the next stage of development, Bangladesh will require a $608 billion investment in infrastructure by 2040. As it will not be possible for the government to provide the entire investment, large investments by the private sector will be needed, the WB said. The Asian Development Bank (ADB) also recommended ensuring investment for infrastructure from the Public Private Partnership (PPP) modality of at least 1.8% of GDP, or around $5 billion each year.

The Washington-based lender, however, notes that it will be difficult to meet the investment demand by the private sector, owing to severe financial sector mismanagement, liquidity crisis in the banking sector, and the government’s excessive dependence on domestic debt. The report also points the finger at an inconsistent ratio of GDP and banking sector credit flow.

In the latest WB report, Bangladesh’s performance in the financial development index points to a disappointing situation in the financial institutions. Bangladesh scored only 0.24 points out of a total score of 1 in the financial development index of WB and the International Monetary Fund (IMF) in 2020. In a worrying development, the share of exports in GDP has been declining since 2011 – thereby raising doubts on Bangladesh’s growth model sustainability.

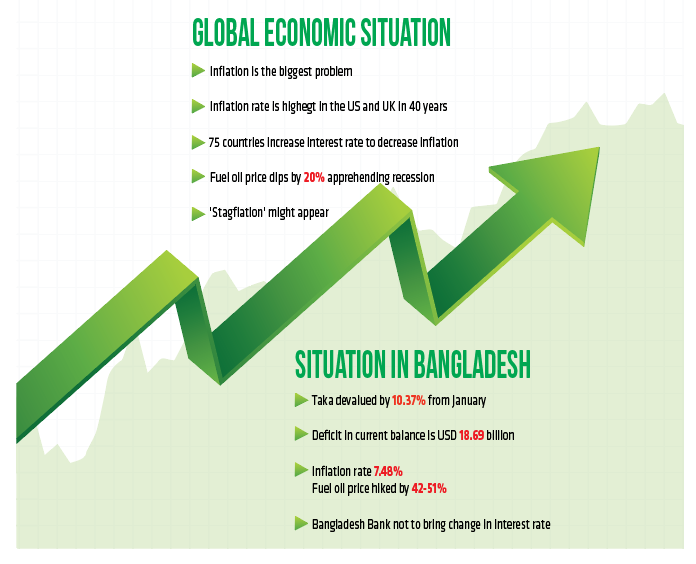

Asked what growth rate was needed for Bangladesh to become an upper middle-income country (MIC) by 2031 and a higher-income country (HIC) by 2041, WB Bangladesh lead economist Zahid Hussain said the arithmetic inferred that the baseline growth is 6.5% but Bangladesh’s GDP needs to grow at 7.8% per year to make it to the upper middle-income country by 2031. However, the current global economic condition may not allow Bangladesh to grow at that rate in the coming days.

The International Monetary Fund (IMF) has lowered its projection of GDP growth for Bangladesh to 6% in the current fiscal 2022-23 from 6.7% as projected in April. The global lender has forewarned that the worse is yet to come and the next year will feel like a recession with shrinking incomes and rising prices which may result in an even lower GDP growth rate.

Talking about the need of reform, Nora Dihel, the senior economist at WB in her presentation warned about the LDC graduation challenges and expained why reform is necessary for Bangladesh’s uninterrupted economic growth. “Comprehensive reforms are required to enhance financial sector intermediation capacity to support economic growth while preserving financial sector stability,” notes the WB report. Three obstacles to the country’s growth are identified in the report titled “Bangladesh Country Economic Memorandum – Change of Fabrics” which are as follows:

THE WORLD BANK (WB) HAS IDENTIFIED THREE OBSTACLES TO THE COUNTRY’S GROWTH:

- Declining trade competitiveness 2. A weak and vulnerable financial sector 3. Unbalanced and inadequate urbanization

DURING THE LAUNCHING OF THE REPORT TITLED “BANGLADESH COUNTRY ECONOMIC MEMORANDUM –

CHANGE OF FABRICS.” THE WB RECOMMENDED SOME ACTIONS TO SUSTAIN THE GROWTH:

- Export products should be diversified

- Bangladesh Tariff rate should be lowered

- Financial sector must be reformed

- Attention should be paid to balanced urbanization

TRADE COMPETITIVENESS

To maintain growth in exports, products should be diversified. The country’s growth model is now based on trade competitiveness based on low wages where trade preferences are eroding, overreliance on readymade garments exports and a protective tariff regime challenge the sustainability of Bangladesh’s growth. Bangladesh’s exports are extremely concentrated.

Actually, the export basket is four times more concentrate than the average developing country. The current basket is heavily relaying in readymade garments. More than 80% of export income comes from this sector. With the impending end of preferential access to markets due to graduation from the least developed country bracket, Bangladesh will need to find new drivers of exports and growth. In terms of LDC graduation, this will create further challenges, said Nora Dihel, the senior economist.

Bangladesh’s tariff rate is higher than other countries, due to which the trade capacity is decreasing. The report said Bangladesh needs to reduce the level of protection by rationalising the tariff regime as a first crucial step to support export diversification.

Paratariff needs to be eliminated gradually, making the tariff structure consistent with that of an upper-middle income country. Border and documentary compliance requirements lead to major delays for exporting firms in Bangladesh and, it requires more than 300 hours to comply, such delays are among the highest in South Asia.

The overreliance on garment exports and the perpetuation of a protective tariff regime challenge must end if the country must level up. To accelerate and sustain export growth, Bangladesh needs to diversify its export basket. Modernisation of Bangladesh’s tariff regime is the first crucial step to supporting export diversification.

FINANCIAL SECTOR

Regarding the banking sector, WB said, it will play an important role in future economic development. Despite major progress over the past four decades, Bangladesh’s financial sector still lags behind its peers. The deepening of the financial sector has remained stalled.

As per IMF’s global Financial Development Index, Bangladesh ranks 95 out of 184 countries in terms of financial development. Banks in Bangladesh have the lowest regulatory capital among the country’s peers, driven by undercapitalisation of the state-owned banks. Credit to the private sector remains low in Bangladesh compared with most of its structural and aspirational peers.

While others like China, Vietnam, Cambodia, and Thailand have bank credit-to-GDP ratios that are substantially above 100 percent, in Bangladesh this ratio has stabilised at around 45 percent since 2016. Similarly, stock market capitalisation to GDP has been declining since 2015 signalling the limited ability of Bangladeshi companies to raise long-term capital and actions needed to develop this sector as well. The WB report also notes that “weaknesses in the regulatory and supervisory framework do not properly equip the authorities to deal with potential internal and external shocks in a timely and cost-effective manner.”

The WB said that vision 2041 aims to increase national savings significantly but raising the level of savings and efficiently channelling them to productive investment will require major restructuring and greater efficiency of the financial system. Bangladesh needs to continue to build better financial sector infrastructure, improve its legal and regulatory frameworks, and phase out the existing distortions to enable a larger and more efficient flow of financing to the private sector, including to underserved segments.

According to Prof Rashed Al Mahmud Titumir, chairman of the Development Studies department at Dhaka University, financial irregularities erode the lending capacity of banks. Developing capital markets should be among the top policy priorities to unlock long-term finance for infrastructure and green investments. The reason being the high investment needs must be partially financed by external borrowing and the financial sector will become more integrated into the global financial system.

The WB identified that the board of directors of several banks were appointed from non-financial firms, political leaders, and owners of business groups. It said although some restrictions on related-party transactions exist on paper, the regulations are not consistent with international best practices and, in practice, there are few barriers to self-dealing.

The report highlighted various fraudulent schemes over the past decade, with the involvement of members of the board of directors in Sonali Bank worth losses of Tk 30 billion, BASIC Bank Tk 45 billion, and Padma Bank, formerly Farmers Bank Tk 30.7 billion.

While Bangladesh was not affected much by the Asian Financial Crisis and the Global Financial Crisis given the relatively small and isolated nature of the country’s financial system, this will not be the case going forward.

URBANISATION

Urbanisation is essential for Bangladesh’s next development stage. Attention should be paid to balanced urbanisation. Successful urbanisation will be crucial for Bangladesh to reach the next level of development, the WB said, adding that experiences of economic development around the world show that the level of urbanisation and the economic status of a country go hand in hand. But Bangladesh’s urbanisation during the past decades has been unstructured and unbalanced.

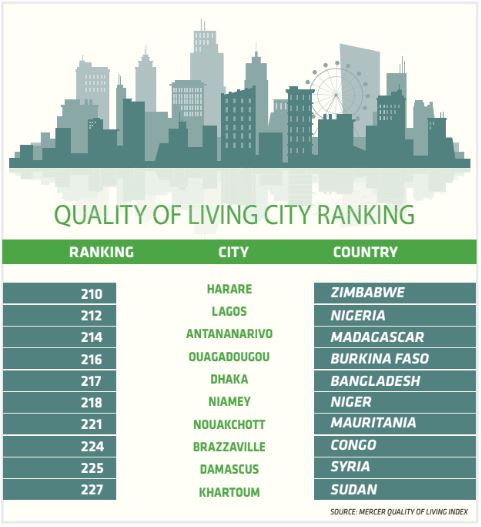

Dhaka, which is at the centre of Bangladesh’s urban hierarchy with an outsized influence on the economy, is highly congested and polluted and ranks far below cities in the peer countries on the Mercer Quality of Living Index. Secondary cities are underdeveloped and do not yet provide a conducive environment for more spatially balanced development. It is estimated that Bangladesh’s population will reach a peak of 185 million in 2041 and the urbanisation rate will reach about 60 percent in 2050.

For this massive urbanisation to generate economic growth and lift Bangladesh to high-income country status, the process of urbanisation must solve two critical challenges: how to enhance and maintain the productivity advantage of Dhaka city in the face of this massive population surge, and how to make cities other than Dhaka and Chittagong attractive to formal firms and skilled workers to create productivity advantages.

In the short term, the focus should be on the creation of jobs in tradable activities for all types of cities. Dhaka and Chittagong have the experience of nurturing a dynamic garment industry. These cities need to diversify their portfolio of tradable activities, which will require national-level policy reforms to enhance trade competitiveness, according to the report.

In the medium term, improving connectivity both within and across cities as well as some measures of climate change mitigation and adaptation should be the focus. City-level leaders should focus on reforms to ensure affordable housing and equitable access to city services. In the long term, the focus should be on dealing with the infrastructural challenges of climate change mitigation and adaptation since sea level rise or warming is happening at a slower pace.

ECONOMIC REFORMS – PAST AND PRESENT

Financial sector reforms in the country started in the mid-1980s through the work of the Money, Banking and Credit Commission, including the denationalisation of banks, licensing of private commercial banks, use of back-to-back letters of credit, and introduction of micro-credit for the poor. The reforms accelerated in the early 1990s with interest rate deregulation, restructuring of the banks’ operational procedures, and introduction of a loan classification system and provisioning framework as well as capital adequacy standards.

According to the World Bank, in the late 1990s, the reforms continued with improvements in the regulatory and supervisory framework of banks, assigning greater powers to the Bangladesh Bank. Bangladesh also progressed in adopting the Basel regulations, with the introduction of risk-weighted capital adequacy minimum requirements in 2007 as well as other prudential norms.

Further, to improve financial inclusion, the Credit Information Bureau (CIB), established in 1992, was automated in 2009. More recently, transformational advances have been made in the areas of digitisation and payment system infrastructure. Despite this remarkable progress, the World Bank said, in the development of financial institutions and financial markets, Bangladesh still lags behind its structural and aspirational peers.

NEEDS A MAJOR RESTRUCTURING?

International monetary institutions and experts advocate a major restructuring and deepening of the financial system, including increasing the efficiency and sophistication of the banking sector and developing a long-term capital market. The World Bank believes the country needs to source external resources proactively, including through international capital markets, by promoting local currency financing, easing external borrowing constraints, and attracting foreign direct investment.

Agreeing with WB’s report Planning Minister MA Mannan said, “Yes, we also have some problems in the banking sector. Our private banks are not doing as well as expected. Besides, we are aware of the necessity to diversity our exports and we have started the reform plan for this sector.” He also added, “The World Bank has been working as our development partner for a long time.

However, I will take this report and read it seriously.” Ahsan H. Mansur, executive director of the Policy Research Institute of Bangladesh said, “I fully agree with what the World Bank has said. Our first-generation reform is done. The second and third-generation reforms were to take place. But we have not yet initiated the second-generation reforms.”

To conclude, there is no doubt that our economy is progressing. But the progress has to be sustainable in order to fulfill the aspiration of 2041 to be a developed country. To sustain the economy, Bangladesh government has already taken some initiatives to take the progress further. The World Bank report and the economic experts’ views and suggestions would help the government and its related organs to take precautionary and progressive steps to sustain the growth.

In line with the view of the experts and international monetary institutions, we can expect that the diversification of trade, reformation of the financial sector, and balanced urbanization along with other necessary reformations would take our economy to the expected level envisioned by our leaders and the country people.