On May 16, Bangladesh’s national currency taka got weakened to its lowest level at Tk 102 against the ever-gaining US dollar, which was never seen before in the transaction history of the kerb market, which is an illegal trading platform for selling and buying foreign currencies. Experts attributed it mainly to the huge deficit in the current account, which stood at over $14 billion in nine months till March 2022 of the current fiscal year.

Usually, the current account gives a glimpse of future exchange rates. The current account measures the amount of money flowing in and out of a county through trading in goods and services, interest payments, and aid.

A current account surplus indicates that a nation has excess hard currency in hand and it can prompt the strengthening of the domestic currency as plentiful foreign currency bolsters confidence in the local market. A current account deficit, meanwhile, means a county must come up with additional funds to cover the shortfall in the money flowing into the country, the absence of which can lead to weakening of the domestic currency. This is the explanation of how a local currency moves over a foreign currency.

WHAT’S THE IMPACT OF WEAKER TAKA?

A weaker taka makes the Bangladesh-made exports more competitive or cheaper to export destinations. For example, if a clothing manufacturer sells a T-shirt at $1.0 he now gets higher prices in local currency when taka faces depreciation against the American greenback.

Depreciation of taka also helps boost the country’s remittance inflow as local people staying abroad send more money sensing that they will get much higher values of their hard-earned foreign currency.

A weaker taka may also make imports to Bangladesh more expensive thereby potentially driving up inflation and creating strains on the national economy as well as pushing currency holders to invest in other as- sets.

WHY’S ONUS ON THE US DOLLAR?

Bangladesh is not a formally dollarized economy, but the US dollar has a huge influence on the country’s forex market. During the 1970s, Great Britain’s pound sterling was the most influential foreign currency in Bangladesh. However, this time, taka against euro and pound declined significantly on the grounds of Russia- Ukraine war and poor economic prospects in the UK.

WHY’S THE DOLLAR PRICE RISING?

The most important reason behind the rise in US dollar price is the increase in Fed rate. If the Fed rate rises, global capital flows move into dollar-denominated as sets thereby chasing higher rates of return and as such the US dollar gets strengthened.

Meanwhile, Russia’s self-initiated war in Ukraine and global sanctions on Russia as counter-measures also played a key role in strengthening the dollar in the international market. Of late, lockdowns in China might have pushed the dollar movement further upwards.

In kerb or open market, the dollar price is rising on the back of poor supply, according to the traders representing the money exchanges. The money changers usually collect the notes from the people who come to visit Bangladesh. If its supply falls, then the dollar price moves up and vice versa.

According to the money changers, people with a lower rate of coronavirus infections were traveling in increased volume these days compared to the previous two years, which is why they needed dollars in growing sum to go abroad thereby fuelling the dollar price up significantly.

POOR REMITTANCE GROWTH

The flow of inward remittances dropped more than 16 per cent to $17.31 billion during the July-April period of FY’22 from $20.66 billion in the same period of the previous fiscal. Analysts are of the view that the remittance inflow is declining as the global dollar movement remains up. This volatility in the international forex market will remain as long as the war in Ukraine continues.

Many argue that use of hundi, which is an informal channel for transferring money, is on the rise as the economies have opened up. Bangladesh had received huge foreign currency inflow from the non-resident Bangladeshis (NRBs) during the corona-prompted lock- downs as hundi users at that time remained almost quiet. As people’s movement was restricted globally, NRBs found no choice but to send money through formal channels.

DEPLETING FOREIGN CURRENCY RESERVES

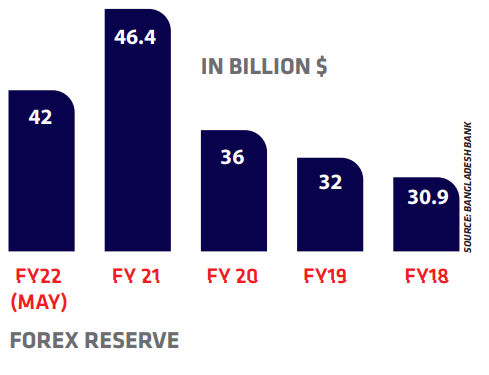

The foreign currency reserves fell to $41.95 billion on May 11 after the payment worth $2.24 billion to the Asian Clearing Union (ACU) against the imports of the March-April period of 2022 from $44.11 billion on the previous working day.

Bangladesh’s reserves have been maintaining a falling trend in re- cent months following higher im- port payments alongside a lower flow of inward remittances.

The monthly import has shot past $7 billion, dealing a major blow to the reserves since exports and remittances flow have not kept pace. Between July and March, import payments escalated to $61.52 billion, up 44 per cent year-on-year while exports grew 33 per cent to $36.61 billion. This inflicted the highest-ever trade deficit of $24.90 billion on Bangladesh during the period.

The trade deficit reduced the re- serves to $41.92 billion in the middle of May in contrast to $46.15 billion on December 31. The reserves had surpassed $48 billion in August.

WHY’S DEVALUATION OF TAKA SO FREQUENT?

Bangladesh Bank on May 23 further depreciated taka by 40 paisa on a single day against US dollar. In fact, BB lowered its currency valuation to as many as five times since January this year against the American greenback to stabilise the forex market. Bangladesh has been maintaining floating exchange rates since 2003, but it is not free-floating, which means that the country now depends on the supply and demand of the foreign currency market. In economic literature, it is called a dirty floating exchange rate regime. Un- der such a situation, the central bank intervenes in the market by buying or selling foreign currency. And such a situation is observed when the foreign exchange re- serve fluctuates. If the foreign exchange reserve falls, then the central bank as regulator intervenes in the market by selling the US dollar.

Bangladesh bank has so far sold $5.31 billion from the reserves directly to the commercial banks as liquidity support for settling their import-payment obligations in the current 2021-22 fiscal year (FY).

BB TIGHTENS LETTER OF CREDIT RULES

Bangladesh Bank in a bid to discourage the nonessential commodities has tightened the letter of credit (LC) rules – thereby doubling the margin for all imports to help save some essentials. Under the move, the central bank instead of 25 per cent has imposed a pro- hibitive 50 per cent cash LC margin at the minimum on all non-essential items. Besides, such LC margin for high-end motor vehicles like SUVs and Sedan cars along with electrical and electronic products, which are being used as home appliances, have been jacked up to minimum 75 percent from 25 percent.

This move is due as the prices of key essential items including fuel oils are on the rise in the global mar- ket following the ongoing Russia-Ukraine war in the world’s one of the major supply belts.

IS THERE ANY MANIPULATION?

A brigade of 12 inspection teams of Bangladesh Bank started on-site inspections into alleged ‘distortion’ to foreign-exchange rate by some banks. Until the report is finalised, none can comment on the matter. A simi- lar inspection may be conducted in the capital’s money changing houses.

Rate distortion means banks charge a higher price of the US currency bypassing their announced rates par- ticularly for BC (bills for collection) selling and TT (tele- graphic transfer) clean.

Besides, the investigation teams are scrutinising whether import items have been received properly or not even after settling import-payment obligations with the forex. The investigators have been assigned to check the allegations of importers about charging a higher price of the American greenback ignoring the official rates – particularly for import payments.

At least 20 banks, including the four state-owned commercial banks, have been included in the list for the inspection, according to the BB.

The latest regulatory move came against the backdrop of allegations that some banks are offering higher rates of the American greenback to their customers for settling import-payment obligations as well as purchasing export proceeds.

Some banks, however, traded the US currency ranging between Tk 95 and Tk 96 for settling import- payment obligations of their cus- tomers, according to the operators in the market. Some banks, which are handling lower volume of ex- port business, offer higher rates to exporters for purchasing export proceeds. In some cases, the banks quoted the US dollar between Tk 92 and Tk 93 for purchasing export proceeds instead of Tk 86.70. However, the central bank is providing foreign-currency liquidity support to the banks continuously on a pri- ority basis to settle their import- payment obligations.

HOW DO BUSINESSES REACT?

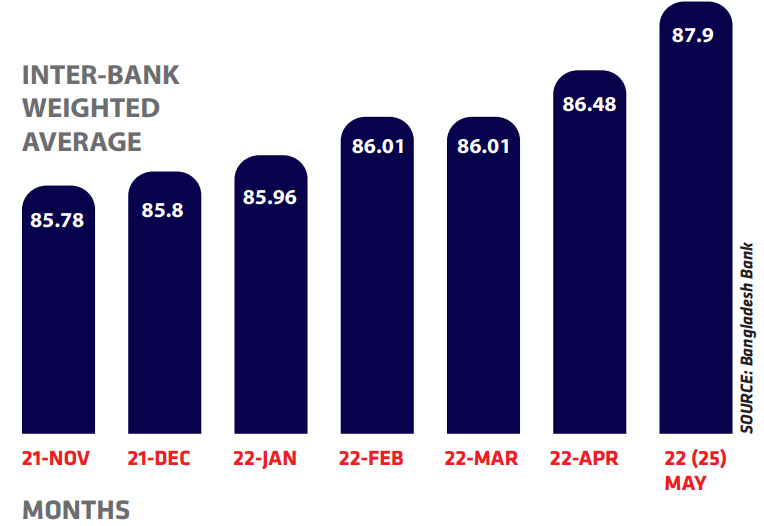

The local currency lost its value by 80 paisa on the inter-bank foreign exchange (forex) market on May 16. It was Tk 86.45 on May 08. Private entrepreneurs who bor- rowed a dollar from the inter- national market on grounds of cheaper rates of interest are now struggling to service their debts as the US dollar has abruptly be- come expensive.

Such corporates had borrowed from overseas sources a total of $23 billion or over 25 per cent of the country’s total external debt as of December last. However, this rise in dollar price has been impacting the public sector as well, but government borrowings are mostly conces- sional and on long terms. Con- trarily, the private-sector loans are mainly short-term.

Of the $23 billion in private bor- rowings, nearly 70 per cent ac- count for short-term loans taken by the corporations as buyer’s credits, on deferred payment, export discounting, and foreign back-to-back letters of credits.

Over the past decade, local big companies have doubled their dollar-based debt – thereby tak- ing advantage of lower interest rates. This loan helps them pur- chase goods from the international market to be competitive in the local market.

Enterprises said they are the worst sufferer as almost all ingredients of rod are the imported ones. They note that not only the pain of borrowing from external sources, but the prices of the raw materials are also on the rise following the dollar surges. There- fore, they suggest that the central bank goes on the issue gradually. Bankers who are familiar with the treasury and foreign management said the borrowers, who used to gain 3.0 to 4.0 per cent earlier, are now losing by 4.0 to 5.0 per cent. They said not only the local currency has shed value over the past six months but the LIBOR also soared significantly leading to debt build-up from both sides.

IS THERE ONLY ONE OPTION LEFT?

Dr Zahid Hussain, former lead economist at the World Bank’s Dhaka office, thinks that the demand for dollars has surged worldwide compared to its supply due to skyrocketed global commodity prices and spike in domestic demand in emerging countries, leading to its highest rate in nearly two decades among selective currencies. And the situation is no longer temporary as the war shows no sign of ending anytime soon.

Whenaskedwhatthecentralbankcan do now, he said there are two ways to deal with the demand-supply imbalance in the foreign exchange market allowing the dollar rate to adjust or meeting the deficit from the reserve. “The BB has already used roughly $5.2 billion from its reserves to meet the deficit so far in this fiscal year. But how long will it be able to continue using its reserve that has already reached almost its minimum level?” he said. “The reality of the situation leaves no option but to let the rate go and let the market do its own adjustment,” viewed the economist.