The Prime Minister emphasized that, as an independent and sovereign nation, Bangladesh’s economic framework must be self-reliant and sovereign, with the goal of minimizing external dependencies.

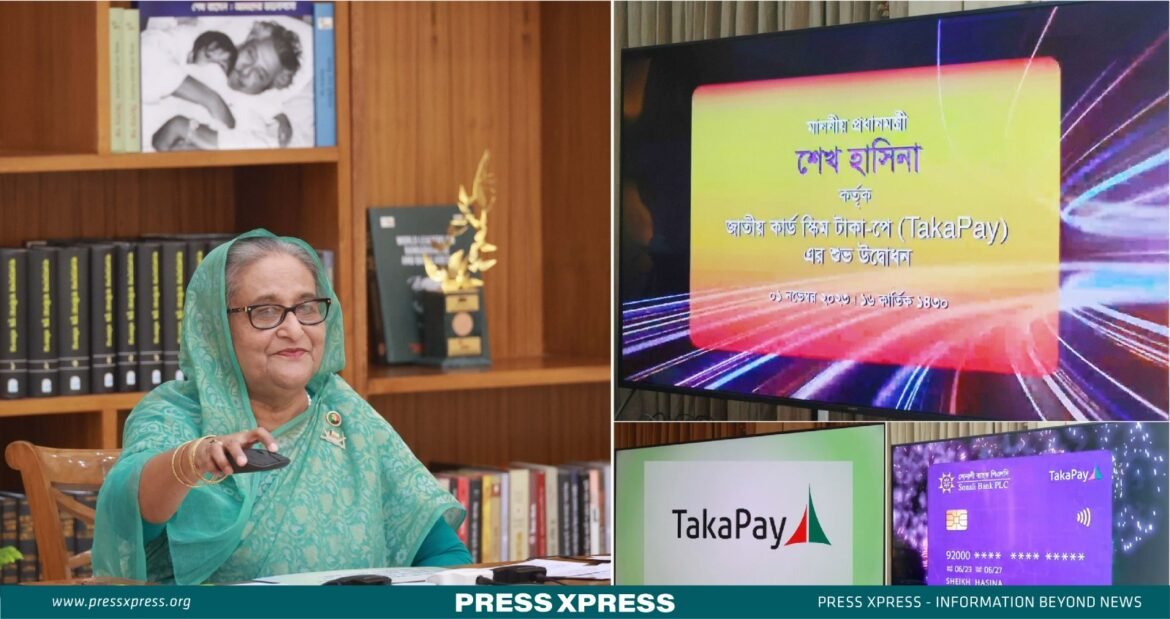

Prime Minister Sheikh Hasina has lauded the introduction of TakaPay, Bangladesh’s official debit card, as a major stride towards the realization of a modern, cashless society. The launch of TakaPay is poised to transform the way financial transactions are conducted in Bangladesh, promising a brighter and more digital financial landscape for its citizens.

“For an extended period, we’ve been dependent on international card networks for local transactions, leading to a significant drain of financial resources. However, this era has officially concluded, as all TakaPay card transactions will henceforth be processed through the Bangladesh Bank’s National Switch,” Prime minister said this, while inaugurating the card via video link on Wednesday 1st November 2023.

In a remarkable development, Bangladesh has become a global reference for progress, with significant strides made over the past decade. This progress is attributed to two major initiatives led by Prime Minister Sheikh Hasina’s administration: vision 2021 and vision 2041.

Why TakaPay launched?

The launch of TakaPay was driven by the objective of diminishing dependence on international card networks like Visa and Mastercard. This strategic move was made to safeguard foreign exchange reserves. TakaPay is designed to provide a secure local payment solution and has future plans to introduce the Taka-Rupee card. The Taka-Rupee card will facilitate cross-border transactions, with a specific focus on enhancing economic cooperation with neighboring India.

Benefits

The benefits of the TakaPay card encompass its role as a convenient channel for electronic transactions among banks, financial institutions, and businesses. The government’s objective is to diminish dependence on global card networks such as Visa and Mastercard, thereby reducing foreign exchange costs. Furthermore, it seeks to establish a secure framework for managing local payments, leveraging the ‘National Payment Switch of Bangladesh’ to enhance the efficiency of domestic financial transactions.2

Expansion of TakaPay Card Issuers and Future Features

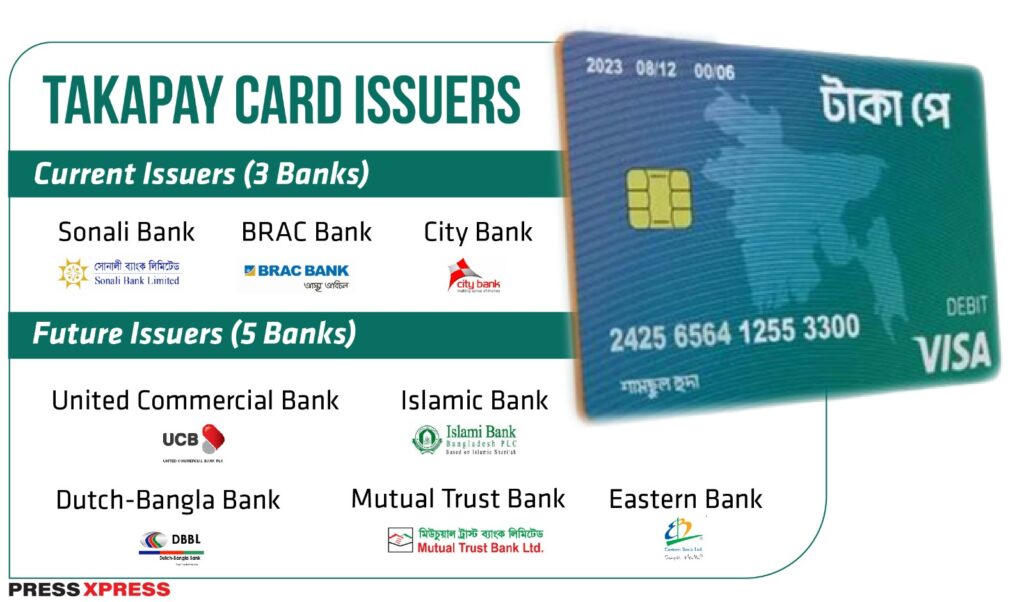

At present, the TakaPay card is being issued by Sonali Bank, BRAC Bank, and City Bank. These three banks have been entrusted with the responsibility of issuing the TakaPay card in collaboration with the Central Bank of Bangladesh. In the near future, an additional five banks, including United Commercial Bank, Eastern Bank, Islamic Bank, Dutch-Bangla Bank, and Mutual Trust Bank, will also join in issuing the card.

To make use of TakaPay, individuals must hold a bank account, and currently, this service is available for debit card users. Existing account holders can transition to TakaPay by deactivating their linked debit cards. As per government assurances, TakaPay will enjoy widespread acceptance at ATMs, point of sale (PoS) terminals, and online platforms across the nation. In the upcoming phases, there is the possibility of introducing a credit card option featuring robust security measures.

Fostering a Cashless Society

Prime Minister Hasina has also brought attention to the broader initiative of cultivating a cashless society. She cites the formulation of the Bangladesh Mobile Financial Services Policy as a crucial step in this direction. Emphasizing the nation’s sovereignty, she declared, “We are an independent, sovereign country, and we’ve been able to establish an independent sovereign economic system.”

Changing the Game

Presently, all payment cards used in Bangladesh are produced by foreign companies, and banks offer these card services for a fee, with foreign-owned card providers receiving a share of these fees. Additionally, there are extra charges when using a card at another bank’s ATM. However, the TakaPay card will operate seamlessly through the Bangladesh Bank’s National Payment Switch Bangladesh, ensuring compatibility with any ATM booth and swift, hassle-free transactions.

Bangladesh Bank is on a trajectory to introduce debit, credit, and eventually international cards, further enhancing financial flexibility for its citizens. Additionally, there are plans to enable the use of dual currencies, including the Indian rupee, with the TakaPay card, set to kick off in December. This groundbreaking development will empower Bangladeshis to use the TakaPay card for rupee transactions when traveling to India, eliminating the need to carry foreign currency. Notably, Bangladeshi nationals are among the highest consumers of foreign currency in India.

With TakaPay at the forefront, Bangladesh is not only shaping its financial landscape but also propelling itself toward a future where financial transactions are efficient, sovereign, and smart, in line with its vision of a “Smart Bangladesh.”