Bangladesh Bank (BB) has reduced the US dollar-retention limit for exporters who maintain foreign-currency accounts with profits from shipments.

The Bangladesh Bank (BB) has once again taken significant steps to address the ongoing shortage of the US dollar in the country. In a recent circular issued by the Foreign Exchange Policy Department (FEPD), the central bank has decided to lower the US dollar retention limits that exporters must maintain in their foreign currency accounts from the proceeds of their shipments. This move aims to alleviate the scarcity of the American greenback and maintain stability in the foreign exchange market.

According to bankers, approximately $700 million is currently held in the ERQ account. They stated, ‘Upon the implementation of this circular, half of this amount will be converted into cash, resulting in a significant increase in the inflow of dollars into the market.’

You can also read: Bangladesh Bank embraces dual foreign exchange reserve calculation methods

Commenting on the issue, Mohammad Hatem, the executive president of the Bangladesh Knitwear Manufacturers and Exporters Association (BKMEA), expressed strong concern about the central bank’s action, emphasizing its unfavorable implications for exporters and its potential to impact efforts to diversify the market. He stated, ‘Currently, our exports to emerging markets constitute approximately 23% of our total exports. This decision is likely to disrupt this growth trajectory.’ Hatem further stressed that such a significant decision should have been made after consulting with stakeholders of the central bank.

Revised Retention Limits

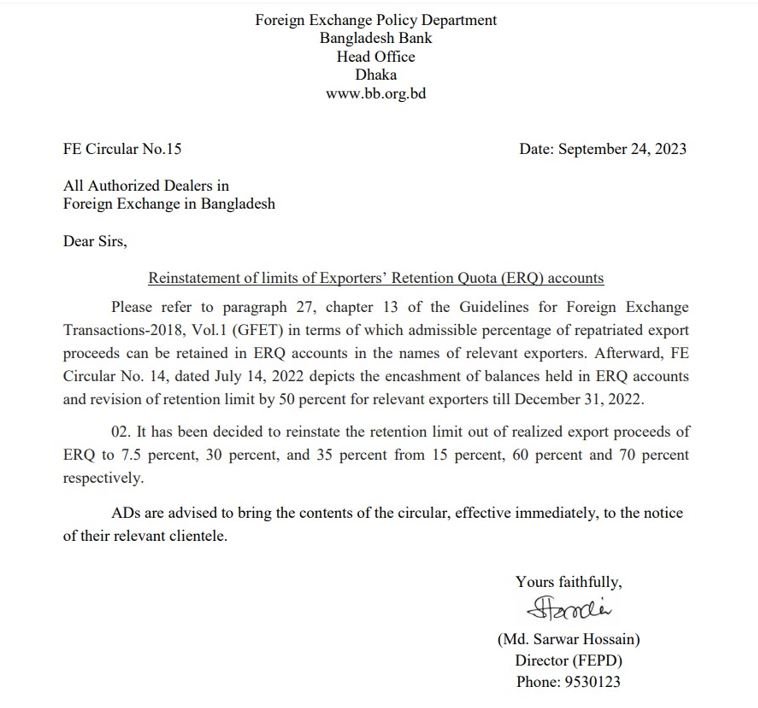

The Bangladesh Bank’s (BB) circular announces the reinstatement of retention limits, which have been adjusted as follows:

- For merchandise exporters: The retention limit has been reduced from 60 percent to 30 percent of the repatriated FOB (free on board) value of their exports.

- For exporters of goods with high import content (e.g., naphtha, furnace oil, bitumen, garments made of imported fabrics, and electronic goods): The retention limit has been decreased from 15 percent to 7.5 percent.

- Exporters of software, data entry, processing, and other ICT-related services: The retention limit is now 35 percent of net export earnings, down from 70 percent.

These changes reflect a significant reduction in the amount of US dollars that exporters can retain in their accounts, impacting their ability to settle back-to-back letters of credit liabilities without incurring exchange losses.

The Background

The central bank’s decision to adjust the retention limits follows a series of changes made over the past year. In July of the previous year, the Bangladesh Bank (BB) ordered banks to encash 50 percent of the balance held in the export retention quota (ERQ) accounts immediately. Additionally, it revised the retention limits from 15 percent, 60 percent, and 70 percent to 7.5 percent, 30 percent, and 35 percent, respectively. These revised limits were initially set to expire on December 31, prompting a return to the previous levels from January 1 when no further orders were issued.

However, the Bangladesh Bank (BB) has now once again lowered the retention limits to the levels mentioned above, without specifying how long these changes will remain in place. This uncertainty adds to the challenges faced by exporters, as they adapt to changing regulations in the foreign exchange market.

Forex Shortage and Economic Context

Bangladesh continues to grapple with a shortage of foreign exchange, primarily due to the depletion of its forex reserves. This situation has arisen from higher import bills, lower-than-expected remittance inflows, and reduced export receipts. As of September 21, 2023, the country’s forex reserves stood at $21.45 billion, underscoring the urgency of addressing the issue.

A central bank official explained that if exporters keep a lower amount of their export proceeds in ERQ accounts, it can help improve liquidity in the banking system.

‘It has been decided to reinstate the retention limit out of realised export proceeds of ERQ to 7.5 per cent, 30 per cent and 35 per cent from 15 per cent, 60 per cent and 70 per cent respectively,’ said a BB circular issued by the Foreign Exchange Policy Department (FEPD).

However, this adjustment presents challenges for businesses that rely on the stability of foreign exchange rates to manage their international transactions.

Conclusion

The Bangladesh Bank’s recent decision to lower the US dollar retention limits for exporters is a reflection of the ongoing efforts to manage the foreign exchange shortage in the country. While this move is aimed at addressing immediate liquidity concerns, it also introduces uncertainty for businesses dealing in international trade.

As the central bank continues to navigate the challenges of balancing the nation’s economic interests, exporters will need to adapt to these changing regulations while remaining agile in their financial strategies. The future of these retention limits remains uncertain, and it will be essential to monitor further developments in Bangladesh’s foreign exchange policies closely.