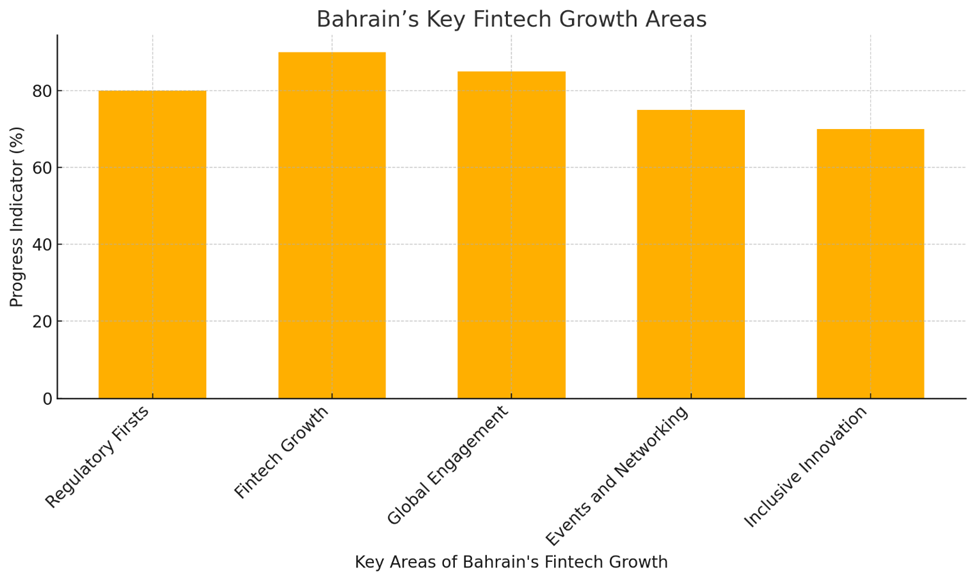

Key Highlights:

- Fintech Growth: With Bahrain FinTech Bay hosting over 100 fintech companies and contributing substantially to the nation’s economy

- Global Engagement: Bahrain FinTech Bay has established international partnerships with fintech hubs like Fintech Australia and Fintech Japan

- Events and Networking: The 2024 Fintech Future Forum attracted 1,700 attendees, bringing together industry leaders from around the world

Bahrain’s journey to becoming a fintech leader in the Gulf has been remarkable, with strategic initiatives and progressive regulatory frameworks driving the country’s success. As the region embraces digital banking, blockchain, and crypto technologies, Bahrain is carving out a niche as a hub for financial innovation and technology.

Strategic Foundations of Bahrain’s Fintech Ecosystem

Bahrain’s rise as a fintech hub is anchored in its robust regulatory support and strategic investments. The Central Bank of Bahrain (CBB) has been a pioneer in developing frameworks for digital banking, cryptocurrency, and blockchain, making it one of the first regulators in the region to do so. This regulatory approach has paved the way for digital asset licenses, facilitating the entry of global players into the Bahraini market.

In addition to regulatory support, Bahrain has invested heavily in infrastructure and talent development. Bahrain FinTech Bay (BFB), established as a central component of Bahrain’s fintech ecosystem, plays a critical role in research, development, and innovation. The recent partnership with the BENEFIT Company has further empowered BFB to create specialized programs, including the establishment of a Fintech Academy, which provides training in AI, data analytics, and entrepreneurship.

Several key companies are driving Bahrain’s fintech sector, leveraging the country’s supportive regulatory environment and strategic location. Here are some of the leading companies:

- BENEFIT

- Bahrain FinTech Bay (BFB)

- National Bank of Bahrain (NBB)

- Rain Financial

- Tamkeen

- Bank ABC

- Ila Bank

Key Developments in 2024: Events and Partnerships

Bahrain’s commitment to fintech was underscored at the 2024 Fintech Future Forum, where leaders discussed trends in open banking and crypto regulations. Events like these not only showcase Bahrain’s forward-thinking stance but also attract global attention, reinforcing its status as a fintech hotspot. The forum featured speakers from renowned institutions like Morgan Stanley, highlighting Bahrain’s international connections and the country’s role in shaping the future of finance.

Bahrain is also expanding its influence through strategic partnerships. BFB has formed alliances with international fintech hubs, including Fintech Australia and Fintech Japan, which will enhance Bahrain’s capabilities and foster knowledge-sharing. This outreach ensures that Bahrain remains connected to global fintech innovations, positioning it as a gateway for firms looking to enter the Middle East.

Inclusive Growth and Youth Empowerment

One of Bahrain’s standout initiatives is its commitment to fostering diversity and inclusion within the fintech sector. The “Innovate for Bahrain” (I4BH) initiative, backed by the Supreme Council of Women (SCW) and Bahrain Development Bank (BDB), promotes gender inclusion and encourages youth entrepreneurship. Such initiatives are essential in creating a fintech ecosystem that is not only innovative but also reflective of Bahrain’s diverse talent pool.

Bahrain hosts several prominent fintech events that draw regional and international attention. Here are some of the top fintech events held in Bahrain:

1. Fintech Future Forum

This is one of Bahrain’s flagships fintech events, held annually. It attracts leaders and innovators from the fintech and financial services industries worldwide. The forum covers a wide range of topics, including open banking, blockchain, digital banking, and cryptocurrency.

2. Fintech Forward Bahrain

This event aims to solidify Bahrain’s role as a global fintech hub by focusing on innovation and the future of financial technology. Key areas include insurtech, crypto, and regtech, with an emphasis on industry trends and regulatory developments.

3. MEFTECH

As a major financial technology conference in the Middle East, MEFTECH focuses on innovation in the financial services sector. The event covers digital payments, cybersecurity, and financial inclusion.

4. Bahrain FinTech Bay Events

Bahrain FinTech Bay (BFB) hosts various events throughout the year, including workshops, networking sessions, and specialized conferences. These events cover a broad spectrum of fintech topics, including AI, data analytics, and blockchain.

5. Seamless Middle East

Though it is a regional event, Bahrain often hosts sessions or participates in Seamless Middle East, which is a major conference on payments, fintech, and e-commerce. The event explores digital transformation in payments, banking, and retail.

Bahrain is actively working to attract and develop fintech talent through several strategic initiatives and supportive frameworks. Here’s how Bahrain is drawing in fintech professionals and fostering a skilled workforce:

- Educational Initiatives and Partnerships

- Government and Regulatory Support

- Incubators, Accelerators, and Coworking Spaces

- Fintech Events and Networking Opportunities

- Diversity and Inclusion Programs

Through these multifaceted approaches, Bahrain is building a robust fintech workforce, making the Kingdom an increasingly attractive destination for fintech talent from both the region and beyond.

Bahrain’s Path Forward

With a supportive regulatory environment, a growing network of strategic partnerships, and a focus on talent development, Bahrain is well-positioned to lead the Gulf’s fintech revolution. As the global fintech landscape evolves, Bahrain’s proactive strategies are likely to attract further investment and drive innovation. The nation’s efforts underscore its commitment to becoming a global fintech hub, offering an inviting environment for investors, entrepreneurs, and innovators alike. Bahrain’s success in fintech sets a precedent for other Gulf nations and serves as a model for building a sustainable and inclusive fintech ecosystem in the region