Key Highlights:

- Electronic Money Transfer Service (EMTS) charges a commission fee of Tk 5 per thousand, allowing individuals to send Tk 50,000 for a total cost of only Tk 250

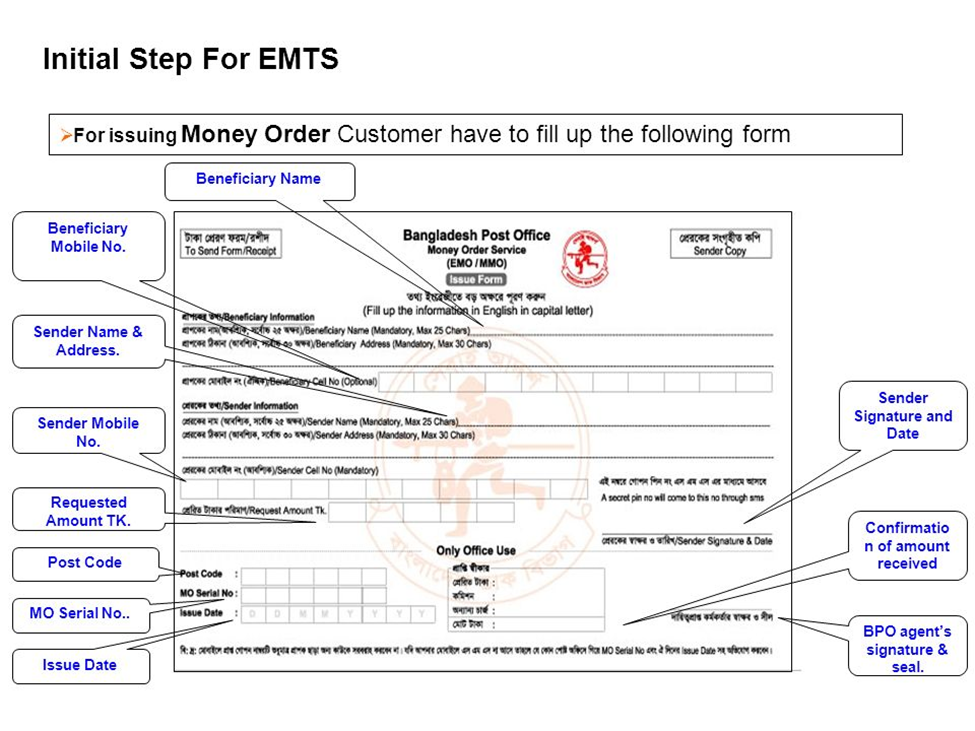

- To send money through the post office, the sender completes an Issue Form (EMO-1) with the necessary details

- The EMTS service is currently accessible at 2,752 post offices throughout Bangladesh

Unlike traditional methods burdened with hefty fees, the Bangladesh Postal Department offers the Electronic Money Transfer Service (EMTS), commonly known as Mobile Money Order Service provides a streamlined and cost-effective solution. EMTS charges a commission fee of Tk 5 per thousand, allowing individuals to send Tk 50,000 for only Tk 250. This streamlined process allows customers nationwide to send and withdraw money from any post office, regardless of location.

You can also read: What Revolution Attached in Digital Pay Bills?

In many parts of the country, a lack of robust financial infrastructure means that banks are scarce. However, almost every area has a post office, albeit often in less-than-ideal condition. For marginalized people seeking to send money, the post office remains their primary and often sole option. Consequently, unbanked and rural communities predominantly rely on this service.

Initiated by the Directorate of Posts, this modern financial service was inaugurated on March 26, 2010, and officially launched on May 5, 2010, following comprehensive training. Beyond Bangladesh, countries like India Pakistan, Kenya, and the Philippines have embraced similar systems, revolutionizing financial transactions for millions.

Bangladesh’s Post Offices Are More Than Mail

EMTS revolutionizes the traditional paper-based money order system offered by the post office. Available through mobile and web platforms at all major post offices, EMTS enables senders to transfer money within minutes, with recipients receiving immediate access.

Both parties receive instant notifications confirming the transaction and disbursement on their mobile devices.

To send money through the post office, the sender completes an Issue Form (EMO-1) with necessary details such as their name, address, mobile number, recipient’s name, recipient’s address, and the amount to be sent. This information is transmitted to the central server by post office staff using a computer or official EMTS mobile phone.

Upon acceptance, the server sends a confirmation SMS to the sender, including a unique 16-digit PIN. Simultaneously, the issuing post office receives a separate confirmation message.

The sender then informs the recipient to collect the money from their nearest post office. At the post office, the recipient fills out a Disbursement Form (EMO-2) and presents the received PIN. The post office counter operator verifies the recipient’s details against those provided by the sender and confirmed by the server.

If everything matches, the disbursement is processed, and a confirmation SMS is sent to the sender, confirming the successful disbursement.

Bangladesh’s EMTS Potential: Where Are We Now?

EMTS Service in Bangladesh

Access Points:

- 2,752 post offices

Transaction Data (2010-2023):

- 27.7 million transactions

- Tk 7,677 crore total value

Revenue Generated:

- Tk 90 crore

The EMTS service is currently accessible at 2,752 post offices throughout Bangladesh. Official records indicate that between 2010 and 2023, over 27.7 million transactions, totaling Tk 7,677 crore, were conducted via EMTS. During this period, the Directorate of Posts generated approximately Tk 90 crore in revenue.

According to the Bangladesh Bureau of Statistics, money orders peaked over a decade ago in 2011-12, with 2,218 transactions totaling Tk 625.92 crore. However, by 2015-16, the number had plummeted to 796 transactions amounting to Tk 197.91 crore—a clear sign of the initial shift towards digital methods.

As time progressed, the decline accelerated. By 2019-20, transactions had dropped by 62.19% to just 301, valued at Tk 114.34 crore. In the fiscal year of July-December 2023-24, a mere 99 money orders worth Tk 22.76 crore were recorded, marking a nearly complete transition to digital alternatives.

Conversely, digital transactions have surged. From Tk 13,282 crore in January 2019, the total rose sharply to Tk 42,230 crore by March 2024, as reported by Bangladesh Bank. This increase reflects both higher transaction frequencies and larger individual values.

Additionally, internet banking transactions saw substantial growth, exceeding Tk 97,100 crore in April 2024, up significantly from Tk 3,790 crore in December 2018.

Decline in Money Orders

2011-12

- Transactions: 2,218

- Total Value: Tk 625.92 crore

2015-16

- Transactions: 796

- Total Value: Tk 197.91 crore

2019-20

- Transactions: 301

- Total Value: Tk 114.34 crore

July-December 2023-24

- Transactions: 99

- Total Value: Tk 22.76 crore

EMTS’s Unique Edge in Money Transfer

- EMTS offers a cost-effective way to transfer money, albeit with operational limitations such as no deposits or withdrawals after 5:00 pm and closure on Fridays and Saturdays, which hinders its widespread adoption.

- However, EMTS surpasses modern technology in certain aspects. Senders can freeze transfers and request refunds, a feature unavailable in mobile financial services.

- The security of transactions is ensured through PINs issued to both senders and receivers, further bolstered by transaction receipts provided by the post office.

- There is a current proposal to extend EMTS availability through a dedicated app, pending approval from the Ministry of Finance.

How the Rural-Urban Divide Is Bridged by Post Offices in Other Countries?

Postepay, a leading payments service provider (PSP) in Italy, manages approximately 30 million cards and 11 million digital wallets, processing 2.3 billion transactions annually.

India Post provides widely-used money transfer services such as Money Orders and electronic money transfer services (eMO), particularly popular in rural areas. Additionally, Western Union Money Transfer is available at 7212 Post Offices, while MoneyGram services are offered at 500 locations.

Chile, Spain, and Uruguay have also launched electronic money transfer service connecting their countries, expanding Latin America’s participation in the Universal Postal Union’s international financial network. The service is accessible through 110 locations in Chile, 2,300 post offices in Spain, and 60 in Uruguay, ensuring fast and secure transfers completed within 15 minutes.

Posta Kenya offers financial services, including money transfers via PostaPay, which are vital in areas with limited access to traditional banking.

Correios in Brazil provides financial services through Banco Postal, including money transfers that are widely utilized, particularly in less urbanized regions.

Russian Post offers popular money transfer services, especially valued in remote and rural areas with limited banking services.

Global Postal Financial Services

Italy: Postepay

- Cards Managed: 30 million

- Digital Wallets: 11 million

- Annual Transactions: 2.3 billion

India: India Post

- Money Transfer Services: Money Orders, eMO

- Western Union Locations: 7,212 Post Offices

- MoneyGram Locations: 500 Post Offices

Latin America: International Financial Network

- Countries: Chile, Spain, Uruguay

- Chile: 110 Locations

- Spain: 2,300 Post Offices

- Uruguay: 60 Locations

Ways to Streamline EMTS in Bangladesh

- Increasing the budget for the Directorate of Posts and advancing ICT infrastructure can make the EMTS service more functional and efficient.

- Promote financial literacy and inclusion initiatives to educate users about the benefits and safe usage of EMTS, especially targeting underserved populations.

- Conduct targeted campaigns to raise awareness about the convenience and benefits of EMTS among businesses, individuals, and government entities.

EMTS in Bangladesh exemplifies how innovation can transform everyday transactions. By leveraging the expansive reach of post offices nationwide, this service has not only slashed costs but also empowered marginalized communities with reliable financial access. As we look ahead, the evolution of EMTS promises continued enhancements, potentially bridging the digital divide even further and cementing Bangladesh’s place at the forefront of inclusive financial solutions.