Bangladesh has made significant progress in reducing poverty, improving human development, and diversifying its economy. However, to keep the ongoing positive economic track, one of the most pressing issues that Bangladesh needs to address is the prevention and detection of money laundering and other suspicious/illegal financial activity, which pose serious threats to the country’s economic and social development.

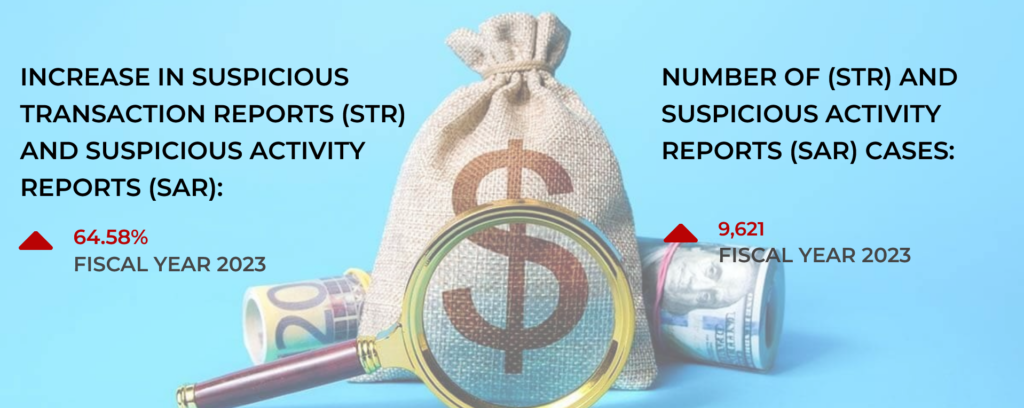

Rise in STR and SAR in FY23

According to a recent report from the Bangladesh Financial Intelligence Unit (BFIU), the number of Suspicious Transaction Reports (STR) and Suspicious Activity Reports (SAR) in Bangladesh increased by 64.58% in the fiscal year 2023, compared to the previous year.

The BFIU received 9,621 STR and SAR in FY23, up from 5,846 in FY22. The report also revealed that the BFIU identified 1,029 cases of money laundering and terrorist financing, and referred 223 cases to law enforcement agencies for further investigation and prosecution.

You can also read: Islamic Development Bank Secures $4.9B for Bangladesh’s Growth

The report attributed the rise in STR and SAR to several factors, such as the enhanced awareness and compliance of reporting entities, the improved capacity and coordination of the BFIU and other stakeholders, and the increased use of technology and data analysis.

The report also highlighted some of the common sources and methods of money laundering and other suspicious/illegal financial activity in Bangladesh, such as trade-based money laundering, hundi/hawala, illegal fund transfers, tax evasion, smuggling, fraud, corruption, and cybercrime. The report also mentioned some of the emerging trends and challenges, such as the use of cryptocurrencies, online platforms, mobile financial services, and shell companies.

2024: A crucial year for Bangladesh’s economic growth

The year 2024 is expected to be a crucial year for Bangladesh’s economic growth. The Ukraine-Russia war caused a significant dollar crisis and import pressures as the price of hydrocarbons, fertilizers, and food grain skyrocketed. Moreover, the country also faces the challenges of global economic and geopolitical uncertainties, such as the ongoing trade war between the US and China, the rising tensions and clashes in the Middle East, and the volatility of the US dollar and other major currencies.

However, all these efforts could be undermined by the prevalence and persistence of money laundering and other suspicious/illegal financial activity, which could erode the country’s financial stability, fiscal discipline, monetary policy, and external balance, as well as undermine its anti-corruption, anti-terrorism, and anti-crime efforts.

Clamping down on STR and SAR will help in tackling corruption and inflation

One of the main benefits of clamping down on STR and SAR is that it will help in tackling corruption and inflation, which are two of the major problems that affect Bangladesh’s economic and social development.

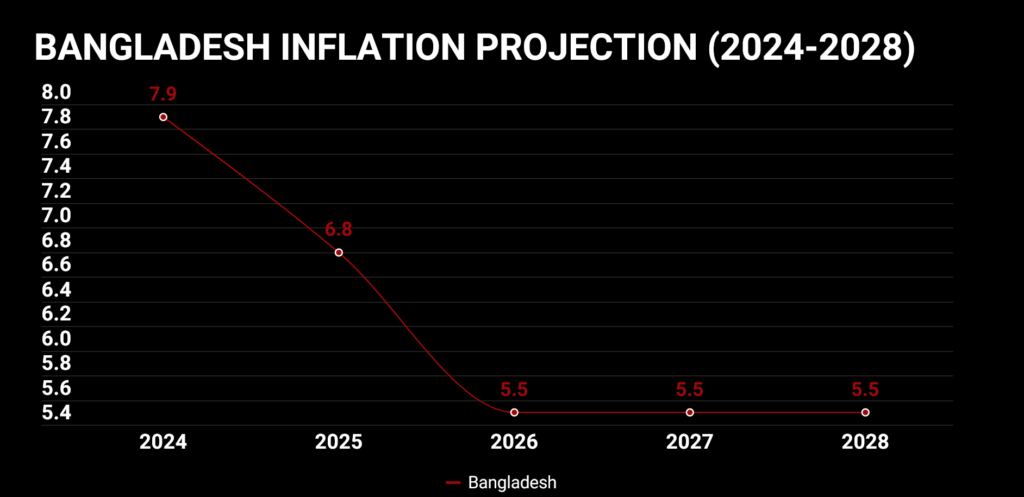

Corruption is a widespread and systemic phenomenon in Bangladesh. Inflation is another major problem that affects Bangladesh’s economic and social development.

Money laundering and other suspicious/illegal financial activity also contribute to inflation, as they increase the money supply and the aggregate demand, create artificial shortages and price hikes, and generate black markets and parallel economies.

Therefore, by clamping down on STR and SAR, Bangladesh can reduce the scope and scale of corruption and inflation, and enhance its economic and social development. By preventing and detecting money laundering and other suspicious/illegal financial activity, Bangladesh can increase its revenue collection, improve its resource allocation, strengthen its policy implementation, and restore its public trust and confidence.

By curbing money laundering and other suspicious/illegal financial activity, Bangladesh can also control its money supply and aggregate demand, stabilize its prices and exchange rate, and maintain its macroeconomic stability and performance.

The need for vigilance is crucial after the Bangladesh bank hacking

The need for vigilance against money laundering and other suspicious/illegal financial activity is crucial for Bangladesh, especially after the Bangladesh bank hacking incident that took place in 2016. The Bangladesh bank hacking was one of the largest and most sophisticated cyberattacks in history, which involved the theft of $81 million from the account of the Bangladesh Bank at the Federal Reserve Bank of New York, through the use of the SWIFT network and the Philippine banking system.

Therefore, Bangladesh needs to improve its cybersecurity, strengthen its internal controls, enhance its oversight and supervision, and update its legal and regulatory framework. Bangladesh also needs to cooperate and coordinate with the international community, especially the US, the Philippines, and SWIFT, to recover the stolen funds, identify and prosecute the perpetrators, and share the information and best practices.

Possible steps that can be taken to tackle STR and SAR

To tackle STR and SAR effectively and efficiently, Bangladesh needs to take some possible steps, such as:

- Improving the awareness and compliance of the reporting entities, such as banks, financial institutions, money service businesses, casinos, real estate agents, lawyers, accountants, and NGOs, by providing them with adequate training, guidance, and incentives, and imposing strict sanctions for non-compliance.

- Enhancing the capacity and coordination of the BFIU and other stakeholders, such as law enforcement agencies, intelligence agencies, regulators, prosecutors, judges, and civil society, by providing them with adequate resources, technology, and data, and establishing effective mechanisms for information sharing and cooperation.

- Increasing the use of technology and data analysis, such as artificial intelligence, machine learning, big data, and blockchain, to improve the detection and prevention of money laundering and other suspicious/illegal financial activity, and to generate timely and actionable intelligence and evidence.

- Updating the legal and regulatory framework, such as the Money Laundering Prevention Act 2012, the Anti-Terrorism Act 2009, and the Mutual Legal Assistance Act 2012, to align them with the international standards and best practices, such as the Financial Action Task Force (FATF) recommendations, and to address the emerging trends and challenges, such as

- Updating the legal and regulatory framework, such as the Money Laundering Prevention Act 2012, the Anti-Terrorism Act 2009, and the Mutual Legal Assistance Act 2012, to align them with the international standards and best practices, such as the Financial Action Task Force (FATF) recommendations, and to address the emerging trends and challenges, such as the use of cryptocurrencies, online platforms, mobile financial services, and shell companies.

- Strengthening the international cooperation and collaboration, such as the exchange of information, the provision of technical assistance, the participation in multilateral forums, and the implementation of bilateral and regional agreements, with the relevant countries and organizations, such as the US, the UK, the EU, the UN, the IMF, the World Bank, the Asian Development Bank, the Egmont Group, and the Asia/Pacific Group on Money Laundering (APG).

- Raising the public awareness and participation, such as the education and sensitization of the general public, the media, the civil society, and the academia, about the risks and impacts of money laundering and other suspicious/illegal financial activity, and the roles and responsibilities of the citizens and stakeholders, in preventing and combating them.

Conclusions

Money laundering and other suspicious/illegal financial activity are serious threats to Bangladesh’s economic and social development, as well as its national security and international reputation. Therefore, Bangladesh needs to stay vigilant and proactive against them, especially in the year 2024, which is crucial for the country’s economic growth and graduation from the LDC category. By taking the possible steps to tackle STR and SAR, Bangladesh can enhance its financial integrity and transparency, improve its economic performance and stability, and protect its national interests and sovereignty.