Key Highlights

- Annual average inflation rate surged to 9.02% in FY23 from 6.15% in FY22

- As of June 2023, the gross NPL ratio in the banking sector was 10.11%

- Export growth increased by 6.28%, while imports decreased by 15.76%

- The central bank disclosed plans to implement a “crawling peg” system to stabilize the economy

In the recent annual report, Bangladesh Bank highlighted various factors that could impede the country’s growth and potentially contribute to inflation. The economic performance in FY23 witnessed a slowdown compared to the previous year, attributed to both domestic and external shocks. This downturn manifested in reduced demand domestically and internationally, evident in negative import growth and sluggish export expansion.

You can also read: Delta Plan-2100 Aims to Secure Sustainable Bangladesh

FY23 saw heightened inflationary pressures, with the annual average inflation rate reaching 9.02%, a notable increase from 6.15% in FY22. Additionally, foreign exchange reserves experienced a declining trend. Bangladesh’s economy is yet to recover to its pre-COVID-19 growth levels. Looking ahead, challenges such as global commodity price hikes, rising global inflation, exchange rate volatility, and a high prevalence of non-performing loans (NPLs) pose potential threats to future economic growth.

While there is optimism about a projected decline in global commodity prices in 2024, according to the World Economic Outlook (October 2023), the report cautions that addressing exchange rate pressures remains a significant challenge. The report also raises concerns about the potential impact of unusual climate changes and prolonged political unrest, foreseeing these as potential obstacles to the country’s growth trajectory.

Global Inflation Threat

In the aftermath of the disruptions caused by the COVID-19 pandemic, Russia’s invasion of Ukraine, and the Israel-Palestine war, global inflation soared to multi-decade highs in 2022, surpassing central bank targets, especially in advanced economies. Projections indicate a gradual decline in global inflation, expected to reach 6.9 percent in 2023 and 5.8 percent in 2024, down from the 8.7 percent recorded in 2022. However, the forecasts for both 2023 and 2024 have been revised upward by 0.1 percentage points and 0.6 percentage points, respectively. Notably, a return to the target path for inflation is not anticipated until 2025 in the majority of cases outlined in the World Economic Outlook of October 2023.

Inflation Situation in SAARC countries

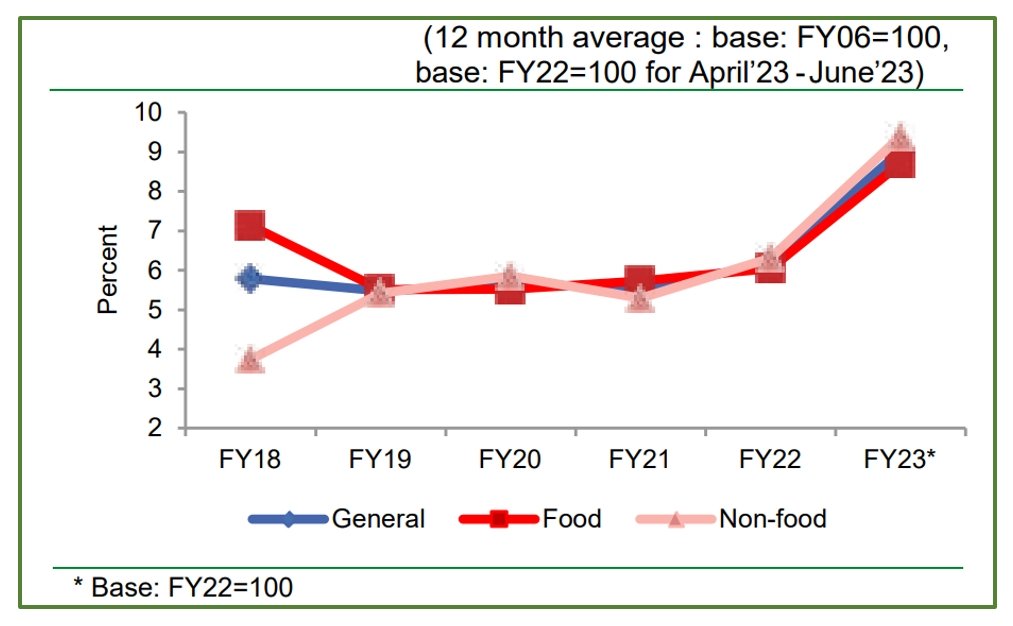

This inflation can also impact the growth of Bangladesh. Bangladesh faces economic challenges as inflation surged during FY23, with the twelve-month average Consumer Price Index (CPI) climbing from 6.15% in June 2022 to 9.02% by the fiscal year’s end. This exceeded the targeted ceiling of 7.50% by 1.52 percentage points. The upward trend was driven by increases in both food and non-food inflation, reaching 8.71% and 9.39%, respectively, in June 2023. These spikes indicate significant inflationary pressure, primarily stemming from disruptions in supply chains, posing a threat to the country’s economic stability.

Trends in National CPI Inflation

In FY23, the Bangladesh Bank pursued a cautious monetary approach with a tightening bias to manage inflation and exchange rate pressures while supporting productive activities. Aligned with the revised National Budget targets of 6.50% real GDP growth and 7.50% inflation, policy measures included an increased repo rate, substantial foreign currency sales, and relaxed lending rate caps. Additionally, refinancing facilities were enhanced for agriculture, CMSMEs, import substitutes, and export-oriented industries, supporting the implementation of government stimulus packages.

Non-performing Loans (NPLs)

As of June 2023, the gross non-performing loan (NPL) ratio in the banking sector was 10.11 percent. The trend in the ratio of gross NPLs to total loans and advances exhibited a mixed pattern from 2014 to June 2023. The overall asset quality of the banking sector slightly worsened in 2022 and continued to do so in June 2023, with a 2.0 percentage point increase in the gross NPL ratio compared to December 2022. However, NPLs were notably lower at 7.7 percent in 2020 and 7.9 percent in 2021, primarily attributed to deferral and soft repayment facilities provided during the COVID-19 pandemic.

The current state of poor asset quality is largely a result of insufficient assessment, coupled with inadequate follow-up and supervision of loans. Despite this, banks have implemented various measures, such as strengthening recovery units and initiating special recovery programs, to enhance loan recovery. Improving the asset quality of the banking industry hinges on ensuring proper monitoring of regular and rescheduled/restructured loans, coupled with an expedited pace in the recovery of NPLs.

Aggregate Position of NPLs to Total Loans

Global Commodity Price Hikes

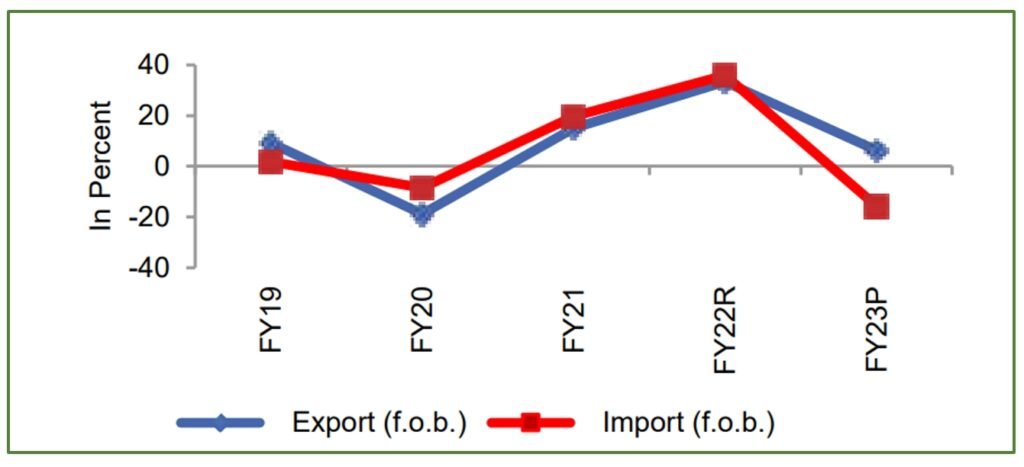

In FY23, there was a 6.28 percent increase in exports (f.o.b) and a significant 15.76 percent decrease in imports (f.o.b). Total exports stood at USD 52,340 million, up from USD 49,245 million in FY22, while total imports decreased to USD 69,495 million from USD 82,495 million in FY22. Consequently, the trade deficit reduced to USD 17,163 million in FY23 compared to USD 33,250 million in FY22.

The narrowing of the trade deficit in the last fiscal year resulted from import-limiting measures, although it led to a larger deficit in the financial account. While continued import-limiting measures could further improve the trade balance, the reduction in imports may negatively impact overall economic activities. Exploring ways to prevent a deficit in the financial account becomes crucial in managing these trade dynamics.

Trends in Export and Import Growth

New Monetary Policy

Facing a liquidity crunch and rising money rates, Bangladesh Bank intensified efforts to tighten the money supply in response to persistent inflation, which has been gradually slowing since November of the previous year. The bank announced a 25 basis points increase in its policy rate, raising it from 7.75 percent to 8 percent. This decision aims to address demand-side pressures while ensuring the necessary flow of funds to priority and production sectors, fostering supply-side activities.

The central bank has revised downward all money supply targets, including a reduction in the private sector credit growth target to 10% for June, down from the previous 11%, and trimming the broad money supply to 9.7% from the earlier target of 10%.

Simultaneously, the central bank unveiled plans to implement a ‘crawling peg’ system aimed at stabilizing the exchange rate and preventing further depletion of foreign exchange reserves. This new mechanism will be tied to the real effective exchange rate, measured against the currency basket of trading partner countries, and will operate within a predefined exchange rate corridor.

Bangladesh Bank is committed to maintaining its stringent monetary policy until point-to-point inflation retreats to the 6% level, with a reduced emphasis on fostering economic growth.