The rapid rise in interest rates is creating major economic challenges in the U.S. and jeopardizing the Federal Reserve’s efforts to control inflation without causing a recession. Since summer, long-term interest rates, like the 10-year Treasury note yield, have been steadily increasing, leading to higher borrowing costs for mortgages, auto loans, and credit card debt. This is also a threat to the government’s financial stability.

These rising rates come at a time when there are other challenges, such as Middle East tensions, surging gas prices, student loan payments resuming, autoworker strikes, and the looming possibility of a government shutdown. These factors may reduce consumers’ disposable income, affecting economic growth. Despite a strong summer marked by robust consumer spending on travel, concerts, and movies, the economy is expected to slow down in the final quarter.

You can also read: US Inflation Soars Beyond Expectations in September

Goldman Sachs economists estimate that after a healthy 3.5% growth rate in the July-September quarter, the economy will slow to a modest 0.7% growth rate in the last quarter due to elevated borrowing rates and ongoing high inflation, causing consumers (who drive 70% of economic growth) to be more cautious with their spending.

Soaring inflation create economic strain for American families

Amearah Elsamadicy, a law student and mother of two, is feeling the impact of the U.S. Federal Reserve’s determined efforts to control high inflation. She described how rising interest rates and inflation have strained her family, leading to disagreements at home. They had to skip a family wedding due to financial concerns, prioritizing debt reduction over family outings.

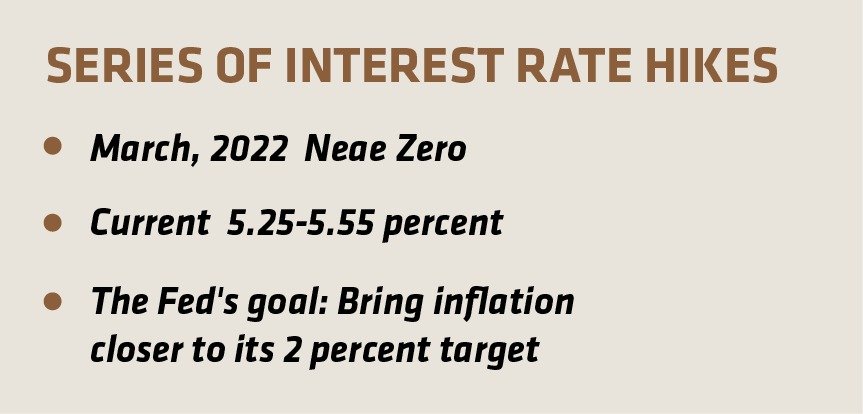

Elsamadicy’s experience mirrors that of many Americans affected by the Fed’s aggressive stance on tackling high inflation, which peaked at over 9 percent in June the previous year. The Fed has been working diligently to bring inflation closer to its 2 percent target, resulting in a series of interest rate hikes from near zero in March 2022 to the current 5.25-5.55 percent. Despite holding off on raising rates in its last meeting in September, the Fed has indicated that interest rates will remain “higher for longer” as it combats inflation.

Housing boom and borrowing blues

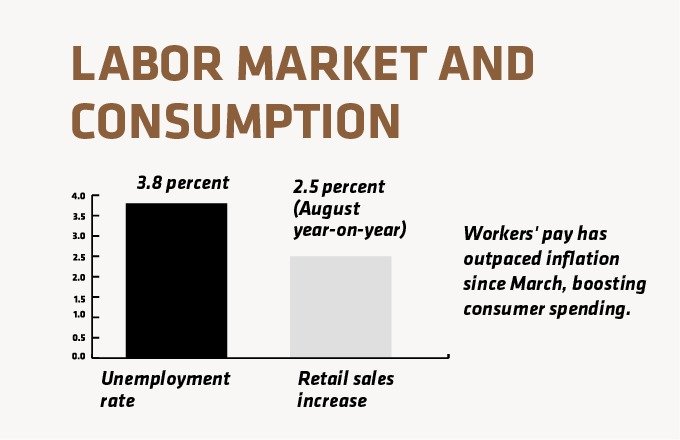

The Federal Reserve faces a tough challenge as it tries to control inflation, with unemployment remaining at a low 3.8%. Despite inflation impacting real wages in 2021 and 2022, workers’ pay has been outpacing inflation since March, boosting consumer spending. In August, retail sales were up by 2.5% compared to the previous year.

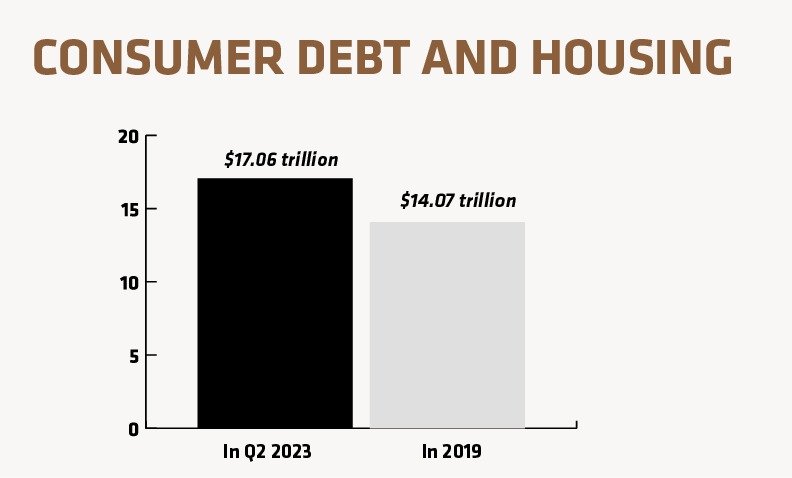

Dean Baker, co-founder of the Centre for Economic and Policy Research, described the U.S. economy as complex, with rising borrowing costs affecting some, while the labor market remains strong and spending continues. Total consumer debt hit a record high of $17.06 trillion in Q2 2023, largely tied to housing, as home prices keep rising.

Elevated borrowing costs lead to higher liabilities for many Americans. When the Fed raises its benchmark rate, it affects new lending, credit card payments, auto loans, mortgages, and existing floating-rate contracts. These challenges cast uncertainty on the U.S. economic outlook, with the possibility of a recession increasing if rates stay high for an extended period. However, the Fed aims to avoid triggering a wave of bankruptcies.

US face sky-high mortgage rates and escalating prices

The traditional American dream of homeownership is under threat, with a homeownership rate of 66 percent, and home equity being the main source of wealth for most Americans. The pandemic boosted the housing market as remote workers sought larger homes outside urban areas, causing the median home value to surge by $52,667 in a year, surpassing the median worker’s annual income of around $50,000.

Despite high demand, the housing market faces significant challenges. Mortgage rates have doubled in the past 18 months, reaching 7.79 percent for 30-year fixed rates, and more than 40 percent of mortgages originated when interest rates were nearly zero in 2020-2021. This has made many hesitant to sell their homes due to higher mortgage costs if they move.

As a result, there are 40 percent fewer homes for sale compared to before the pandemic, leading to rising prices. Harvard University reports that 2.4 million potential homebuyers have been priced out of the market in the past year. The steep mortgage costs have worsened wealth inequality, with homeowners’ median net worth now 40 times greater than that of renters, much of which has accumulated since 2020.

Soaring interest rates pinch American pockets, driving up new car costs

Rising interest rates in the U.S. are affecting more than just the housing market; they’re also putting pressure on major purchases like cars. Monthly payments for new cars have reached a historic high, peaking at $730 in the second quarter of this year, meaning the average American now allocates about 10% of their monthly income for their new vehicle.

This increase in car payments compounds the challenges posed by already high vehicle prices. Demand during the pandemic and supply shortages due to factory closures, semiconductor shortages, and disrupted shipping lines have raised new vehicle prices by a significant 30% from March 2020 to March 2023, according to Kelley Blue Book.

As a result, paying off a new car at current prices now takes the average American household 42 weeks of income, up from 33 weeks before the pandemic. Auto loan delinquencies have increased in the first two quarters of 2023 across all age groups, with the biggest rise among those under 30, and the financial pressure on young borrowers is set to intensify with the expiration of student loan payment holidays last month.

Rising Credit Card debt squeeze households

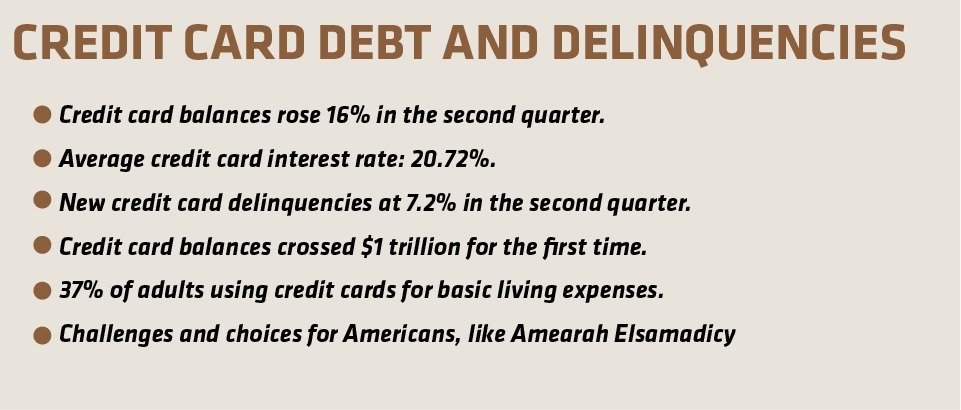

As interest rates continue to rise, Americans are grappling with increasing credit card debt, the most common form of debt in the country, held by 84% of adults. Credit card balances have been rising for five consecutive quarters, surging by 16% in the second quarter of this year due to the escalation in interest rates, which now average 20.72%.

New credit card delinquencies, marking accounts 30 days past due, reached 7.2% in the April-June quarter, surpassing pre-pandemic levels. In 2020, credit card balances decreased due to COVID-19 stimulus checks and deferred spending, but this trend reversed in 2021 as inflation rose, leading consumers to turn to debt to maintain their standard of living. By February, 37% of adults were using credit cards for basic living expenses.

The latest household debt report from the New York Fed reveals that credit card balances increased by $45 billion in a quarterly 4.6% increase, crossing the $1 trillion mark for the first time.

In this financial challenge, individuals like Amearah Elsamadicy face difficult choices, having to weigh the quality of food against what they can afford to buy on credit. She notes the significant increase in credit card rates and the struggle to stay on top of bills by cutting back on restaurants and vacations.