A recent quarterly analysis of global economic performance delves into the third quarter of 2023, unveiling a diverse economic landscape. Within this landscape, there are clear indications of progress in the United States and China, while other regions continue to grapple with persistent economic sluggishness.

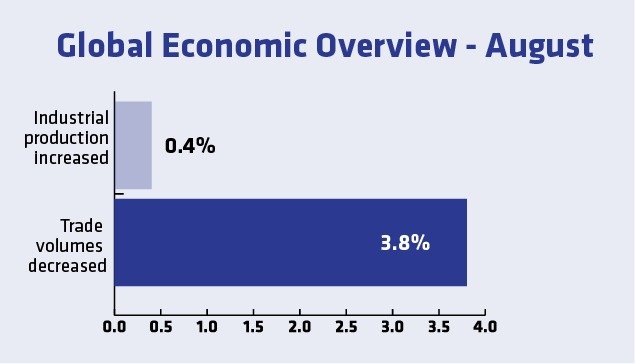

According to recent estimates by the Netherlands Bureau for Economic Policy Analysis (CPB), global industrial production experienced a modest uptick of just 0.4 percent in August 2023 when compared to the same month in the previous year. However, the global trade sector painted a different picture, with trade volumes plummeting by 3.8 percent in August compared to the previous year. This marks a full year of stagnation—a concerning sign closely associated with recession, as reported in the “World Trade Monitor” by CPB on October 25.

You can also read: Geopolitical Tensions Could Hit Global Economy

“Stagnation refers to a state of little or no growth, activity, or development. In an economic context, it often describes a situation where an economy experiences prolonged periods of slow or no growth, high unemployment, and limited economic activity.”

US and China lead the way

Despite these global challenges, the United States and China, the world’s two largest economies, showcased promising signs of rejuvenation during the third quarter, following a pronounced slowdown in the initial half of 2023.

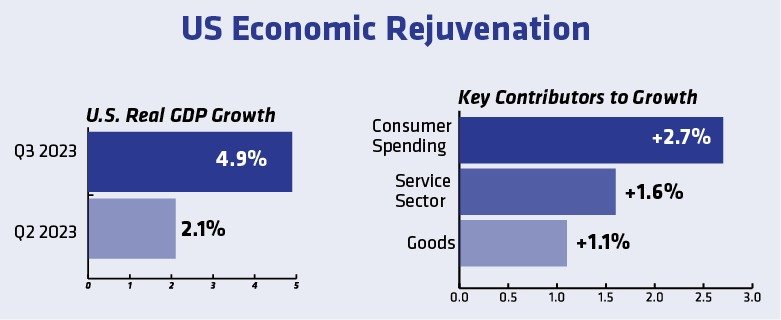

Preliminary estimates indicate that the U.S. real gross domestic product (GDP) surged at an impressive annualized rate of 4.9 percent from July to September this year, a significant leap from the 2.1 percent observed in the preceding three months from April to June. This notable resurgence was primarily fuelled by a substantial surge in consumer spending, which made an impressive contribution of 2.7 percentage points. Particularly, the service sector played a significant role, adding 1.6 percentage points, while goods contributed an additional 1.1 percentage points to this remarkable growth.

This rebound comes after a slight slowdown in the preceding quarter, underscoring the resilience and vitality of the service industry. Simultaneously, the manufacturing sector exhibited a continued decline but displayed unmistakable signs of approaching a cyclical trough, hinting at imminent expansion.

Is the recovery sustainable?

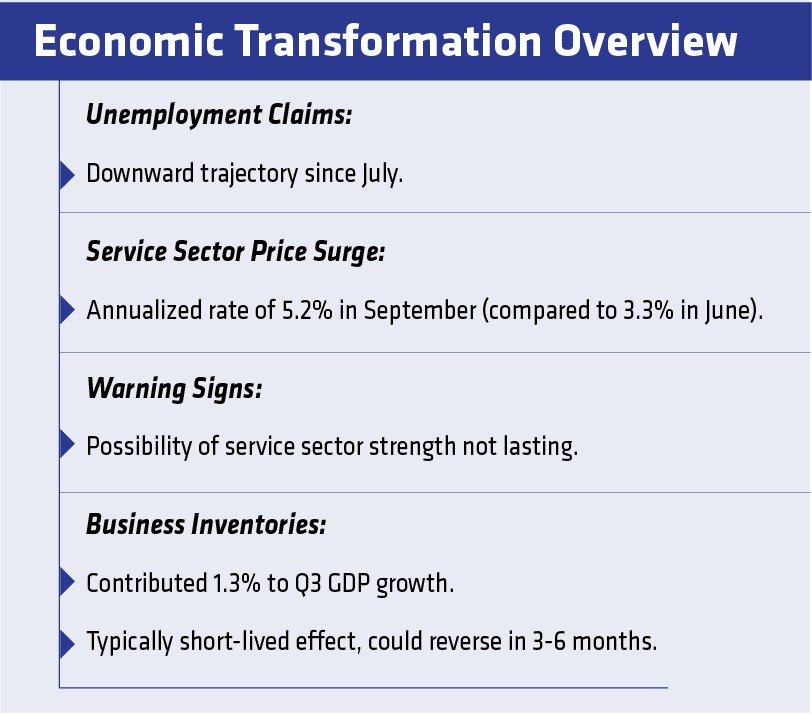

Over the past few months, the economic landscape has seen a remarkable shift. Initial claims for unemployment benefits have steadily declined since July, contrasting with the earlier rising trends of the year. The service sector has witnessed a notable price surge, with a 5.2 percent annualized rate in the three months ending in September, up from 3.3 percent in the previous quarter, indicating growth.

However, warning signs suggest this strength may not persist in the coming quarters. Business inventories played a crucial role in boosting real GDP growth in the third quarter, but such contributions are often short-lived, potentially becoming a headwind in the fourth quarter.

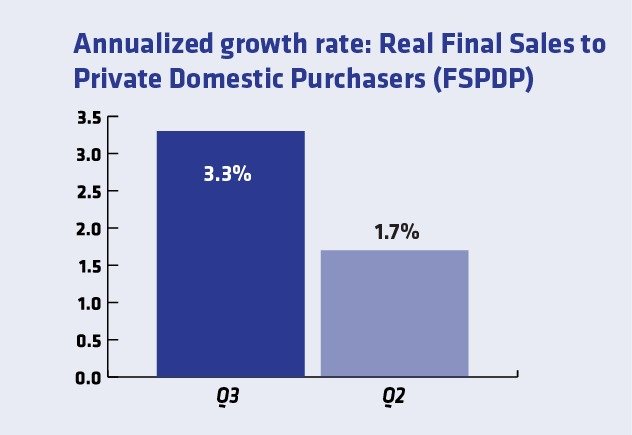

Real final sales to private domestic purchasers (FSPDP), a vital measure that excludes inventory changes, trade fluctuations, and government spending, experienced a significant annualized growth rate of 3.3 percent from July to September. This marks a rebound from a brief slowdown at the end of 2022 and the start of 2023, but the key question remains: Is this rebound sustainable?

Why the apprehension?

First, the labor market shows little room for spare capacity, with the unemployment rate hovering at just 3.8 percent in September. This raises concerns about inflation pressures as the economy attempts to grow further. Second, a potential energy supply crunch is on the horizon, with inventories of diesel and other distillate fuel oils plummeting to 19 million barrels, marking a 15 percent drop or -1.29 standard deviations below the previous 10-year seasonal average.

As the world watches these intriguing economic dynamics unfold, the question remains: Is this recovery sturdy enough to weather the uncertainties and challenges ahead? The answer will undoubtedly shape the future of global economies and the well-being of nations.

China’s economic rebound fuels hope in Asia, but global challenges persist

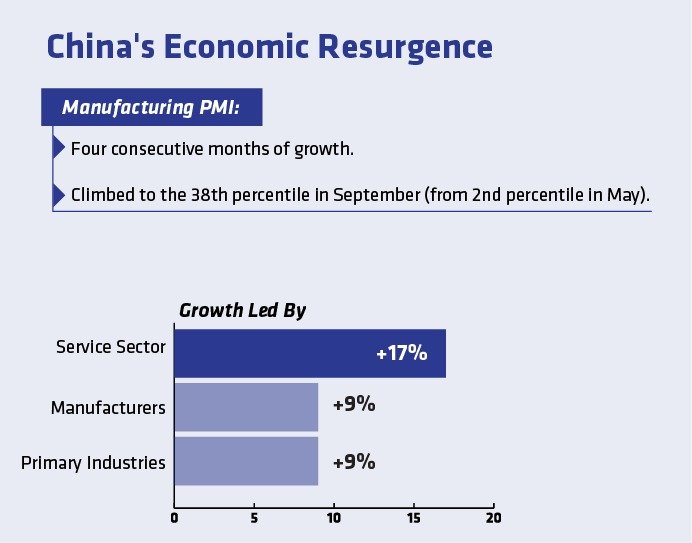

China’s manufacturing PMI has seen a remarkable four-month growth streak, reaching the 38th percentile in September compared to the 2nd percentile in May, signifying a positive trend for the industrial sector. Coastal port container volume in China surged nearly 8 percent in September year-on-year, and electricity generation showed a robust 9 percent increase, with the service sector, manufacturers, and primary industries driving this growth.

China’s resurgence is impacting regional economies, with Singapore’s freight volumes accelerating and handling a record number of containers. However, Japan’s air cargo volume remains low, and South Korea’s KOSPI-100 equity index has weakened, reflecting global trade index downturns. China’s economic performance has a notable influence on its neighbors, but the regional outlook varies.

Europe’s economic struggles continue

The global trade landscape continues to face challenges as well. Global container shipping rates have dropped in both September and October, following a summer of gains, signaling persistently sluggish demand in the global trade arena.

Meanwhile, Europe remains mired in economic difficulties, grappling with the combined impact of soaring energy prices and trade flow disruptions stemming from Russia’s invasion of Ukraine. Persistent inflation and higher interest rates have added to the region’s woes. Euro zone manufacturers are reporting a decline in business activity for the 16th consecutive month in October, with the purchasing managers index hovering at just the 5th percentile for all months since 2007.

As the world navigates these turbulent economic waters, the resurgence of China offers a glimmer of hope for Asia, but the global economic horizon remains rife with challenges and uncertainties.

Global economic prospects remain uncertain amidst shifting tides

Germany’s energy-intensive manufacturers are still grappling with a slump, with output in August 2023 remaining 16 percent below January 2022 levels. This ongoing decline adds to the global economic uncertainty experienced at pivotal business cycle junctures.

Two major players, the United States and China, are crucial in shaping the global economic landscape. Their growth acceleration could potentially trigger a worldwide economic resurgence in 2024, following a recent slowdown.

However, the twist lies in the growth trajectory favoring the services sector over merchandise, which may hinder international trade flows. Persistent inflation in the service sector and limited industrial capacity and raw material inventories raise concerns of merchandise inflation resurfacing sooner than expected.

This situation may lead the U.S. central bank to maintain higher overnight interest rates to combat resurging price pressures in 2024, a move closely monitored by interest rate traders. The global economic outlook remains shrouded in ambiguity and elusive data at this critical juncture.

A warning sign for borrowers

Adding to the complexity, yields on longer-term government securities, which serve as a benchmark for corporate and household borrowing, are steadily climbing. Currently, 10-year U.S. Treasury notes are trading at around 4.9 percent, the highest in 16 years, a substantial increase from the 3.5 percent recorded at the end of April.

The longer these rates remain elevated, the more lending stands to be repriced at higher levels, with consequential impacts on business investment and household spending. In the United States, this has already become apparent, with business spending on new equipment taking a hit from increased borrowing costs and lingering economic uncertainties. New orders for nondefense capital equipment, excluding aircraft, a key indicator of business equipment spending, have exhibited essentially no growth in nominal terms over the last 12 months.

In this intricate and ever-evolving economic landscape, uncertainty prevails, and the global financial community remains on edge, eagerly watching for the next turn in the road.