One of the primary drivers of Iran’s persistent inflation is the extensive international sanctions imposed by the United States and its allies

Iran’s renewed effort to transition from the rial to the toman aims to address hyperinflation and restore economic stability. However, historical precedents and economic realities suggest that merely removing four zeros from the currency will not be enough to fix the country’s deep-rooted financial issues.

The plan to introduce the toman, originally proposed in 2016 and briefly launched in 2021, was designed to simplify transactions, improve confidence in Iran’s financial system, and mitigate the psychological impact of inflation. By removing four zeros from the rial, the government hoped to make pricing more manageable and reduce transactional complexity. However, the initiative stalled under the late President Ebrahim Raisi and has now been revived under Masoud Pezeshkian, with the Iranian parliament set to vote on the measure.

Why Inflation Persists Despite Currency Reform

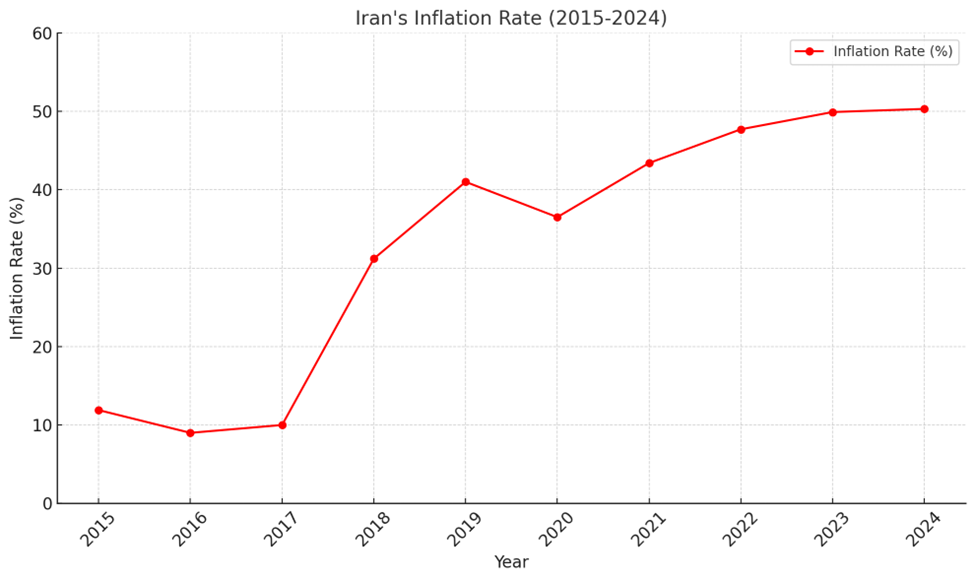

Economic experts argue that redenomination alone does not address the underlying causes of inflation. Since the reimposition of U.S. sanctions in 2018, the rial has lost over 80% of its value against the dollar, driving up the cost of essential goods. Many Iranians, struggling with rising prices, view the currency change as a superficial adjustment rather than a real economic solution.

As economic journalist Arezoo Karimi notes, removing zeros does not impact fundamental economic indicators such as GDP, liquidity, or employment. The value of money is still dictated by monetary policy, fiscal discipline, and market confidence—none of which have seen significant improvement in Iran.

The Role of International Sanctions in Iran’s Inflation

One of the primary drivers of Iran’s persistent inflation is the extensive international sanctions imposed by the United States and its allies. Since the U.S. withdrew from the 2015 nuclear deal and reinstated economic sanctions, Iran has struggled with restricted access to global financial markets, a significant decline in oil exports, and an overall reduction in foreign investments. These sanctions have led to severe shortages of essential goods, price instability, and capital flight, further exacerbating inflation. Without easing these sanctions or finding alternative avenues for trade, Iran’s economy will continue to experience high inflation, making currency reforms ineffective in achieving lasting financial stability.

Lessons from Global Currency Redenomination

Several countries have attempted similar currency reforms with mixed results.

Success Stories: Countries like Germany (1920s), Turkey (2005), and Brazil (1990s) successfully removed zeros from their currencies but complemented the changes with fiscal discipline, reduced budget deficits, and controlled inflation.

Failures: Zimbabwe and Venezuela, on the other hand, removed zeros without addressing corruption, political instability, and fiscal mismanagement, resulting in continued economic deterioration.

Iran’s economic landscape more closely resembles the latter category. Without systemic reforms, experts warn that the currency switch will not achieve its intended stabilizing effects.

Key Challenges to Iran’s Economic Stability

Sanctions and Isolation: Iran’s economy remains heavily reliant on oil exports, and U.S. sanctions have restricted access to global financial markets. Unlike Turkey or Brazil, which had international trade partnerships and financial support, Iran’s isolation limits its ability to attract foreign capital.

Outdated Financial System:Iran’s banking sector lacks modern infrastructure and struggles with inefficiencies that deter foreign investment. Economist Kamran Nadri argues that sanctions make it nearly impossible for Iran to implement necessary financial reforms.

Public Discontent and Brain Drain: A recent survey found that 75% of Iranians believe the currency reform has not improved their economic situation. Many young professionals are seeking opportunities abroad, exacerbating the country’s brain drain and reducing prospects for innovation-driven growth.

Potential Solutions Beyond Currency Reform

To achieve real economic stability, Iran needs a multi-pronged approach:

Diversification: Reducing reliance on oil revenues by investing in technology, manufacturing, and agriculture could provide alternative sources of income.

Transparency and Anti-Corruption Measures: Strengthening regulatory frameworks and reducing corruption could restore investor confidence and economic efficiency.

Diplomatic Engagement: Easing sanctions through negotiations, such as reviving the 2015 nuclear deal, could open doors to international trade and investment.

Monetary Policy Adjustments: The Central Bank of Iran must implement measures to control inflation, regulate money supply, and stabilize the exchange rate.

A Symbolic but Insufficient Measure

While Iran’s shift to the toman may reduce the complexity of transactions, it is unlikely to curb inflation unless accompanied by deeper structural reforms. Without addressing fiscal mismanagement, corruption, and international isolation, the country risks facing continued economic hardship. The government’s next steps will determine whether this currency change becomes a meaningful economic pivot or just another short-lived attempt to mask deeper financial woes.