The latest data on US inflation in September 2023 has raised concerns about the need for potential interest rate hikes by the Federal Reserve.

In September 2023, US inflation exceeded the initial forecasts, potentially prompting the Federal Reserve to consider raising interest rates, given the consistently robust recent data concerning the strength of the job market.

As per the Bureau of Labor Statistics, the consumer price index showed a year-on-year increase of 3.7 percent, maintaining the same pace as the previous month, contrary to economists’ expectations of a slight decline.

You can also read: Inflation rates in Eurozone and US show signs of easing

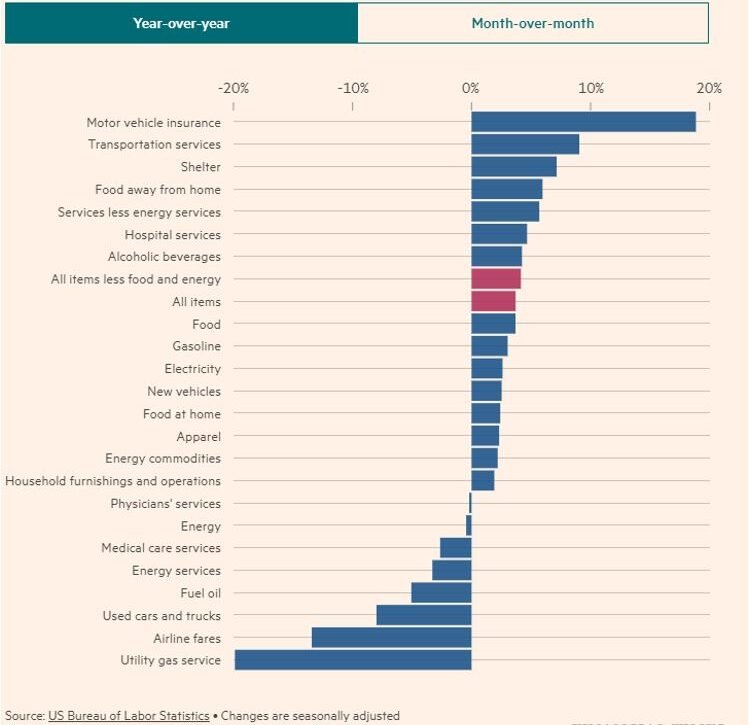

On a monthly basis, inflation decelerated from 0.6 percent to 0.4 percent, partly due to reduced pressure from energy prices. Nevertheless, “core” inflation, which excludes volatile energy and food prices, remained unchanged at 0.3 percent month on month.

Alisher Khussainov, who heads inflation at Citadel Securities, cautioned that the report sends a clear message to the Federal Reserve: “The data we’ve received—growth, payrolls, inflation—are all indicating the same trajectory, suggesting an economy that’s reaccelerating rather than facing an imminent recession… This will require increased vigilance from the central bank’s perspective.”

US annual inflation remained flat in September

In the most recent year that ended in September, the Consumer Price Index stayed at 3.7%.

- Month on month inflation decelerated from 0.6 percent to 0.4 percent

- Year-on-year basis inflation dipped from 4.3 percent to 4.1 percent

The core CPI’s yearly growth rate is at its lowest level in two years. From what was observed in August, the monthly growth in the core remained constant.

Overall Inflation is Still High, But Core Prices are Falling

Many investors were willing to overlook a recent increase in the headline inflation rate as it was primarily driven by energy prices. However, the report released on Thursday revealed higher-than-anticipated inflation in more essential sectors, notably housing costs, which saw a 0.6 percent month-on-month increase.

“The housing component is a bit concerning,” warned Agron Nicaj, a US economist at MUFG. “While it’s based on just one month of data, it would be unwise to draw too many conclusions. However, it’s a factor the Fed should closely monitor moving forward. They cannot assume it’s following a deflationary trajectory.”

Last week’s unexpectedly robust jobs data had already raised concerns that inflation might persistently exceed the Federal Reserve’s 2 percent target.

Following the release of the Consumer Price Index data, Treasury yields saw an increase, although they remained below the 16-year highs observed after last week’s jobs data. However, the bond market sell-off accelerated during afternoon trading, triggered by a new government debt auction that experienced weak investor demand.

The two-year yield, which is particularly sensitive to interest rate expectations, rose by 0.06 percentage points to 5.07 percent, while the yield on the benchmark 10-year note increased by 0.11 percentage points to 4.71 percent. As yields climb, bond prices decline.

The Fed Will Raise Rates Again

Barclays anticipates the Federal Reserve will raise its key interest rate by an additional quarter percentage point later this year, following a 5.25-point increase over the past 16 months. However, some other economists argue that the declining wholesale costs will lead to a quicker reduction in inflation.

“Overall, there’s nothing in this situation that would persuade Federal Reserve officials to increase rates at the upcoming meeting. We maintain our expectation of a more pronounced decline in inflation and a more substantial cut in interest rates next year than what the market currently anticipates,” says economist Andrew Hunter of Capital Economics.

Beginning in March 2022, the Fed increased its benchmark rate at ten consecutive meetings, the longest stretch of rate increases in four decades. The benchmark federal funds rate was left unchanged in June when it halted that streak, but it was raised again the following;

By month, by a quarter point, to a range of 5.25% to 5.5%.

Inflation Continues to Be Driven by Service-Related Costs

US stocks experienced a decline as Treasury yields increased, resulting in losses exceeding 1 percent for both the S&P 500 and Nasdaq Composite during afternoon trading.

Traders also slightly raised their expectations for the Fed to implement another interest rate hike by the end of the year, although the chances of this happening are still approximately 50/50.

Throughout this week, several Fed officials have suggested that the rise in Treasury yields could tighten financial conditions without necessitating an additional interest rate hike by the central bank. This message had previously boosted both stock and Treasury prices, but Khussainov of Citadel Securities warned that if the trend of improving financial conditions through rallying bonds and higher stock prices continues, it could place the Fed in an uncomfortable position, especially in light of the robust inflation report released on Thursday.

The federal funds rate was nearly at zero in March 2022 and 5.25-5.5 percent now

At the time of the Fed’s most recent policy meeting in September, officials were leaning towards the likelihood of another rate increase by year-end, followed by a gradual series of reductions over the next two years.

Conclusion

The latest data on US inflation in September 2023 has raised concerns about the need for potential interest rate hikes by the Federal Reserve. Despite some optimism regarding slowing annual inflation, persistently high core prices and unexpected increases in essential sectors like housing costs have prompted investors to react. While predictions vary, many anticipate a future rate increase, despite differing views on the extent and timing. The Fed faces a delicate balance in managing inflation and interest rates in the coming months, and the markets remain watchful for further developments.