HSBC Holdings Plc suggests that global investors should pay greater attention to Bangladesh’s stock market due to increasing consumer spending and foreign investments, which are positively impacting the potential for company profits.

In a note dated August 16th, strategists Herald van der Linde and Prerna Garg stated that, similar to India twenty years ago or Vietnam a decade ago, Bangladesh presents opportunities for substantial long-term capital appreciation fueled by the expansion of earnings. They anticipate a 20% growth in earnings over the next three years.

HSBC Holdings plc

HSBC Holdings plc (Hong Kong and Shanghai Banking Corporation), a British universal bank and financial services conglomerate headquartered in London, England, holds distinctive historical and business connections to East Asia and maintains a significantly multinational presence. It holds the position of being Europe’s largest bank.

You can also read: Vietnam Aim for $2 billion trade in 2023

HSBC’s origins can be traced back to a Hong trading house in British Hong Kong. The bank initiated its presence in Shanghai in 1865 and achieved formal incorporation in 1866. The current parent legal entity, HSBC Holdings plc, was established in London in 1991. The original Hong Kong-based bank, whose initials inspired the group’s name, became a wholly-owned subsidiary of this new entity.

Operating across 64 countries and territories in Africa, Asia, Oceania, Europe, North America, and South America, HSBC boasts a customer base of approximately 40 million. As of 2023, it secured the 20th position in Forbes’ rankings of large companies worldwide, determined by factors including sales, profits, assets, and market value.

Global Emphasis on ESG Spurs Transparency

In recent years, there has been a notable global surge in the importance placed on and acknowledgment of ESG (environmental, social, and governance) considerations. This trend has resulted in a higher desire for companies to provide transparency regarding their ESG practices due to the increased demand for such information.

A unique optimistic perspective on the South Asian country offered by an international brokerage indicates a possible shift in the fortunes of the emerging market. Additionally, Bangladesh is poised to emerge as a significant consumer market by 2030. According to HSBC, the number of individuals with a daily income surpassing US$20 (RM93) is projected to surpass that of both Vietnam and the Philippines.

Bangladesh’s Robust Economic Growth Continues Amidst Challenges

Bangladesh is projected to experience an average economic growth rate of 7% over the next five years until fiscal year 2027, as indicated by the International Monetary Fund. This places Bangladesh among the rapidly expanding economies in Asia. Over the past decade, the country has maintained an average gross domestic product (GDP) growth rate of over 6%, and recently, its GDP per capita has surpassed that of India.

In a recent development, Bangladesh has embraced a policy of allowing its currency to be traded freely and has implemented a unified exchange-rate system. This move enhances transparency and efficiency in foreign exchange transactions, which proves beneficial for businesses operating in the country. Furthermore, in January, Bangladesh secured a financial bailout of US$4.7 billion from the IMF, aimed at reinforcing its economic stability.

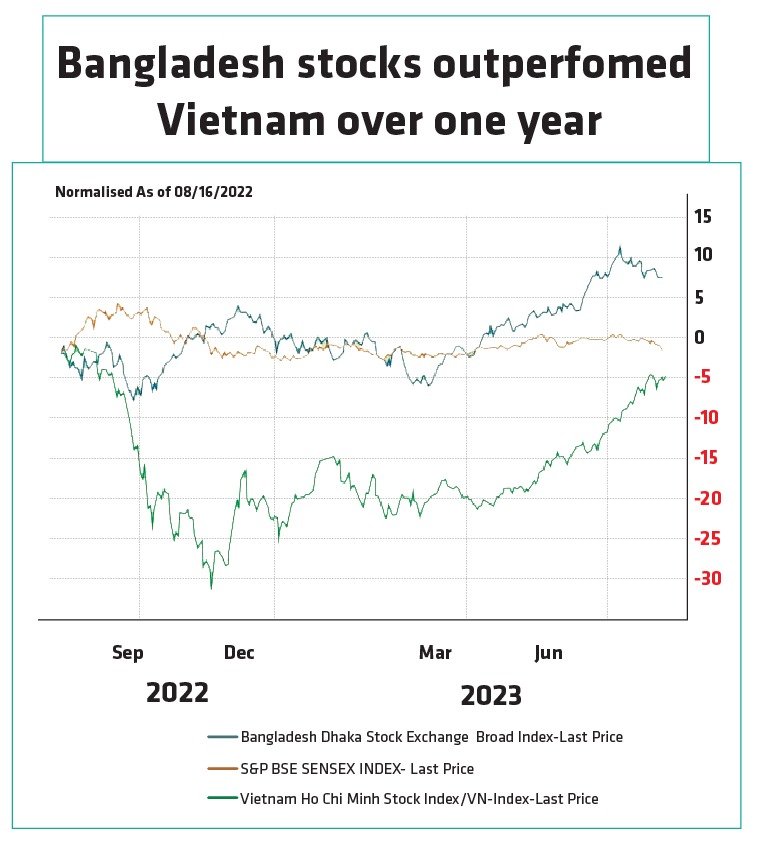

However, it’s important to acknowledge that Bangladesh is not without its challenges. These include the presence of non-performing loans, restrictions on stock prices, volatility in its currency, and the potential for political instability. Additionally, the nation’s stock market is relatively modest, comprising fewer than 450 companies, and it suffers from limited liquidity. In terms of performance, the Bangladesh Dhaka Stock Exchange Broad Index saw a marginal increase of less than 1% in the current year, following an 8% decline in 2022.

HSBC: India

HSBC has elevated its rating on Indian equities from ‘underweight’ to ‘neutral’ within the regional context. This shift is motivated by the notably low levels of investor holdings and the moderation of valuations to more reasonable levels. Additionally, the current supportive stance of oil prices contributes to this adjustment, as stated by the company. Notably, HSBC becomes the third entity to offer positive feedback on India, following similar sentiments expressed by Morgan Stanley and Credit Suisse.HSBC analysts noted that India had experienced an underperformance since the end of August, which was attributed to challenges within local banks, currency depreciation, and fluctuations in oil prices. This information was conveyed in a note by the HSBC analysts.

HSBC: Vietnam

HSBC believes that once these issues are resolved, Vietnam will be on MSCI’s review list and will attract additional capital inflows ‘There is a lot of excitement about Vietnam’s potential inclusion in EM indices, but many funds already have Vietnam on their radar,’ the HSBC researchers wrote in the report.

In addition to a potential market upgrade, Vietnam also shows consistency in its market growth, resulting in approaches by various foreign investment funds. Growing export activities, major foreign capital inflows, low production costs, and a young and qualified workforce will maintain Vietnam’s growth momentum, the report pointed out.

In addition, banks and financial services have benefited in many ways. Vietnam’s banks used to have problems with bad loans, but thanks to strong growth and profitability, their finances are better than a decade ago.

However, experts suggest that the country’s banks are poised to gain advantages from an upsurge in credit expansion driven by substantial investments in infrastructure and factories. Additionally, there is potential for technology firms to benefit from a concerted effort to enhance Bangladesh’s digital landscape.