Bangladesh has been experiencing massive infrastructural growths in recent years. However, the country’s economy still depends heavily on the garment industry and remittances. Not only the family, but also the entire economy is dependent on the expatriates’ income. As Bangladesh is having a tough time due to the reserve crunch, the decline in remittances has also been a cause of concern in the country’s financial circuit. Although the number of remitters working in foreign countries is increasing at a good rate to hit more than a million in December 2022, experts claim that the sloth in remittance has emerged especially because the inflow of remittance is handled through illegal hundi channel rather than the country’s designated financial institutions.

YOU CAN ALSO READ: IS BANGLADESH READY TO FACE ANY MORE WAR CRISIS?

The reserve crisis has been a heavily debated issue in the country in recent times. This problem has caused the imports to outpace the exports – thereby creating an export deficit, and illegal money is being brought into or transported out of the country through money laundering. The term ‘hundi’ is undoubtedly connected to all of these activities. According to research findings, hundi is the main gateway for both domestic money laundering and illegal remittances coming from overseas. As a result, the government suffers a huge financial loss. However, even if expatriates send their income back home, the hundi prevents it from being deposited in the foreign exchange reserves of the central bank – thereby creating a vacuum in the process.

HOW HUNDI WORKS?

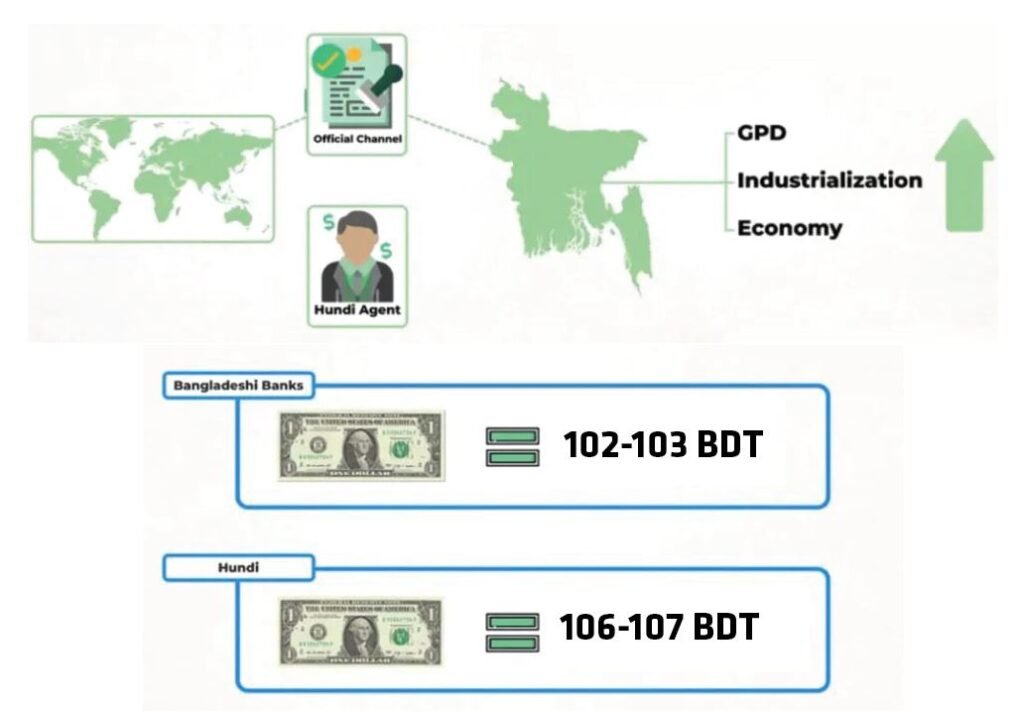

A hand-to-hand transfer of transactions outside the legal channel is generally what hundi is meant for. An expatriate living in Dubai who needs to send $100 to Bangladesh via bank would receive BDT 101 in exchange for each dollar, which may extend to BDT 102-103 by receiving BDT 2–3 incentives from the banks. To send the money through the banking channel, he has to show various documents and send it to an account in the country. He can, however, use hundi to transfer money directly through a representative. The agency might provide him BDT 106–107 in return for a dollar. In this medium, the hundi agent is responsible for money collection and transfer.

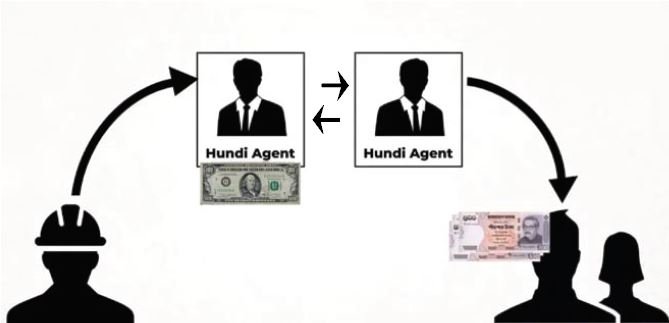

Now the question is: how does the hundi agent send money to the country? Of course, they aren’t transferring the funds through the banking system. Hundi agents look for someone wealthy in Bangladesh who would send their black money abroad. The wealthy person transfers his money to an agent because of not being able to send the black money through any legitimate financial institutions or channels from his native country.

The agent then contacts his mate, who is staying near the destination, and refers him to hand over the money to the appropriate person. Both parties prefer hundi as there are no paperwork or regulatory requirements in this transaction.

On the one hand, thousands of businessmen are using the cash they smuggled into the nation to give money to the families of the expats. On the other hand, it is giving dollars to the smuggled traders with expatriates’ dollars in Dubai. In this case, the expatriate workers do not need to stand in line, fill out the documents, and send money to the country, where the money will be accessible after a certain time. Through hundi, he can send money from his workplace within an hour, and his relatives would get the money sitting right at home.

HUNDI EFFECTS ON REMITTANCE AND FOREIGN RESERVE

There are currently 10.3 million Bangladeshis living abroad who routinely send money home, according to the expatriate welfare ministry. Nonetheless, the country’s economy is being seriously harmed as a result of their tendency to send money through illegal hundi racket. According to Bangladesh Bank, the country received $19.19 billion of remittances in the 2021–22 financial year, which was $22.83 billion in FY 2020–21. This implies that, in one fiscal year, the remittance banking channel has decreased by $3.64 billion. Even in the fiscal year 2022–2023, Bangladesh is not in a particularly fortunate position. In the first six months of the current fiscal year, Bangladesh received remittances totalling $10.49 billion only.

Finance Minister AHM Mustafa Kamal said in a discussion that, of the total remittances coming into Bangladesh from foreign countries, senders are using legal and authorised channels for 51% of the amount. But the rest 49% amount of foreign currencies are coming in the country through hundi. The Bureau of Manpower Employment and Training (BMET) says millions of Bangladeshi workers are working in 168 countries around the world. Of these countries, a total of $4.5 billion in remittances have come from Bangladesh’s most lucrative foreign market, Saudi Arabia, according to Bangladesh Bank’s statistics for the 2021–22 fiscal year.

But the cause of concern here is that this rate of remittance from Saudi Arabia was $5.7 billion in the previous year. That means Bangladesh received a decreased rate of remittance from this particular country, and this decreased amount is large enough to mention: $1.2 billion. However, most of these remittances from Saudi Arabia came into Bangladesh through hundi.

WHY SENDING REMITTANCE THROUGH HUNDI IS HARMFUL?

Bangladesh often spends more foreign currency on imports than it earns from exports. This country has experienced a record trade deficit of 33 billion dollars in the fiscal years 2021–2022. For the country, remittances are a significant source of foreign currency. But, there hasn’t been any good news in this industry for a while. According to the most recent data, Bangladesh’s foreign exchange reserves at present slightly exceed the total of $3.2 billion.

However, the downward trend of exports and remittance income has made some economic analysts concerned, as these two are the primary sources of foreign cash earnings for the country.

Despite the government’s efforts to increase foreign exchange reserves, analysts are attempting to pinpoint the reasons for the drop in remittances and export revenues as well as the direction of the Bangladeshi economy.

Dr. Selim Raihan, Director of the South Asian Network on Economic Modelling (SANEM), thinks that this is the result of the long-term, continual fall in expatriate income. According to him, one of the main causes of the fall in remittances could be the significant exchange rate imbalance.

He explained the circumstances by saying that formal channels bring in less money than the open market. This may be the reason why, despite returning to the country, expats’ income is not recorded as remittances by the Bangladesh Bank.

He asserts that because of the poor exchange rate for expatriate income in the banking system, the expat may be using hundi or other unofficial channels to send money home rather than the established banking system. He also suggested increasing the incentive rate for remittances due to the one-day trade imbalance and the drop in reserve cash. If dollars came through formal channels, the banks of the country could receive it.

The amount would have been added to the foreign exchange reserve of Bangladesh Bank. These dollars could be utilised to pay import bills. The current crisis would not have been so evident. Even though families of expatriates receive money from remittances, dollars are not actually coming into the country through legitimate financial institutions. On the contrary, the country’s money is being smuggled.

WHY HUNDI IS STILL POPULAR?

Hundi has been a tradition for a very long time. In the Mughal era, hundi first emerged on the subcontinent. The provinces were too far away from Delhi, the national capital. In addition, the roads were treacherous and tough. So, to transmit the funds collected from the provinces to Delhi, the Mughal rulers of the various provinces sought the assistance of local moneylenders. These local lenders established networks of their own all over India. They used a type of acceptance or document—similar to a check in modern banking—to exchange money among themselves. This document was referred to as “hundi.” One of the culprits of the 1757 Palashi tragedy, Jagat Seth, was also a well-known hundi moneylender. He operated a hundi business all over India. The hundi acquired popularity during the British era as a continuation of the Mughal period. Because of its efficiency, the British also adopted it as a national method of money transactions. It even introduced the use of a stamp with the Queen’s seal to validate it.

Starting from Kabuliwala in Afghanistan, many merchants resorted to this hundi to do business without paying rent. Hundi was even legalised during the foundation of British authority in the Indian subcontinent. Official hundi forms have an image of Queen Victoria. Even if there was a problem with the hundi, it was taken to the court. A lot of money was smuggled through this hundi after the partition in 1947 and the independence of Bangladesh. So historically speaking, “hundi” is a familiar term for people in this subcontinent.

According to the International Labour Organization, 30 percent of the remittances are coming into the country through hundi currently. Today, even though hundi is illegal in all countries, why do people still resort to hundi? Bangladesh Bank’s former Chief Economist, Biru Paksha Paul, mentioned several issues in a report on this aspect.

Firstly, Sunday is the weekend for expatriate workers. And on that day, the banks of those countries are also closed, so they cannot transact on holidays. Since they don’t have any spare time or vacation during the bank’s set business hours, their transactions becomes more challenging at that time. Likewise, Bangladesh has weekends on Fridays and Saturdays.

That is why it is not possible to withdraw money from the banks of Bangladesh these days. Altogether, there is trouble in remittance transactions on these three consecutive days, Friday, Saturday, and Sunday. Secondly, banks are located far from migrant workers’ places of employment. Also, before sending the money, the sender must fill out a number of documents at the bank, which is a bothersome and time-consuming matter for the workers. Furthermore, the attitude of bank employees towards these foreign personnel is not favourable either.

Thirdly, banks offer less favourable exchange rates than hundi brokers. If the banks give BDT 101 against the dollar, the hundi agent is giving BDT 106 or 107. Meanwhile, a five-dollar fee must be paid each time a remittance is sent to the bank. In all, there is a 2.5 percent incentive on remittances for using banks, but expatriates are getting more benefits through hundi. Moreover, the banking systems take an average of 3 days to send the remittance, whereas the hundi needs less time to send money to the recipients.

The hundi agents go to the expats’ places of employment to collect the money and deliver it to their relatives’ homes in their home countries. There are no difficulties with paperwork or regulations at all during this process. Moreover, the money gets transferred through hundi immediately. Earlier, expatriate Bangladeshis working in Middle Eastern countries, including Saudi Arabia, Dubai, Qatar, and Bahrain, used to send money to Bangladesh using banking channels. Because they used to get a 2.5 percent incentive to get a better exchange rate. But for the last few months, the exchange rate for the dollar became unstable, and therefore the dollar rate was suddenly fixed. As a result, many of the expatriates stopped using banking channels for remittance and started sending money to the country through informal channels.

FEW GOVERNMENT DECISIONS FAVOURING HUNDI?

The Bangladeshi government deducts Advance Income Tax (AIT) by waiving the tariff on the import of raw materials as soon as the export revenues are brought home. Consequently, traders tend to retain a portion of their export earnings abroad or refrain from exchanging dollars or foreign money for imports. Allegedly, in order to evade AIT, the businessmen conspired with foreign customers and brought the remainder of the funds into the country via hundi by declaring a low export LC value. As a result, legal traders are using intermediary systems like hundi to transfer legitimate money into the nation.

Meanwhile, due to the lack of good payment gateways, the freelancers of the country are still resorting to hundi. Freelancers face many problems when bringing money earned abroad. Besides being harassed by the banks, they do not get the desired rate. Furthermore, they have to be more accountable to the bank while bringing money from abroad. Unfortunately, without hundi, illegal expatriates are unable to send money. Numerous Bangladeshi expatriate employees abroad lack valid identification. They are unable to conduct bank transactions using their own documents as a result. In that case, their easy solution to sending money to the country is hundi.

WHAT’S GOVERNMENT DOING WITH REGARD TO LONG-TERM POLICY PLANS?

A country should increase its rate of remittances or exports if it wants to increase its GDP. However, if the inflow and outflow of money took place through unofficial means like money laundering or hundi, then that country would suffer huge financial losses. Although Bangladesh’s economy is still in its infancy in comparison to other nations around the world, the country’s economic growth has been hampered for a long time due to hundi and money laundering activities. Therefore, preventing hundi can be a useful way of increasing Bangladesh’s GDP by a good margin.

If well-planned policies and strict laws are imple- mented, the total rate of hundi and money laundering can be reduced by at least 20–50%

The Bangladesh government has announced a 2% incentive for remittances sent through legal channels in order to stop the transactions through hundi. Later, this incentive rate increased to 2.5%. But in recent times, the rate of remittance from countries like Saudi Arabia, Malaysia, Kuwait, the UAE, the UK, and Oman has decreased alarmingly. In addition, due to not having enough formal channels, expats leaving in South Korea, the Maldives, and Iraq are forced to send money through hundis.

Considering the current situation of Bangladesh’s economy in the case of “hundi dominancy,” it will not be possible to hold the leash of this alarming problem overnight. However, if well-planned policies and strict laws are implemented, the total rate of hundi and money laundering can be reduced by at least 20–50%, which will be a significant boost to Bangladesh’s economic circuit. Bringing people involved with hundi under trial can be an effective procedure in this case.

Though the hundi businessmen are out of control of the law, the Bangladesh government is showing some signs of trying to stop them. The government has given the CID and an anti-corruption commission the authority to charge these illegal businessmen.

HOW CAN CURRENT DIPLOMATIC CHANNELS BE UTILISED TO CHECK HUNDI?

A report from last year revealed that Bangladeshi people in 2021 had deposited a total of 871 million Swiss francs, which is equivalent to BDT 8,266 crore. This rate was 55% higher than the previous year’s deposition to that bank. People are depositing this huge amount of money in the Swiss Bank instead of Bangladeshi banks because most of this money has been gained in illegal ways, like corruption. So, if deposited in native banks, the person holding this money will be at risk of getting caught or investigated. So they are smuggling this money abroad using hundi channels. Again, many dishonest businessmen are sending their money to countries like Thailand, Malaysia, the Middle East, Singapore, Canada, and the USA to invest in various sectors or deposit in banks, where they may face fewer hazards.

Bangladesh, in order to control hundi, can use diplomatic channels. This can be accomplished by increasing cross-country cooperation and coordination. The governments of both countries can share important information regarding the illegal flow of money across their borders and use intelligence to track down those involved. Embassies, consulates, and international organisations like the Financial Action Task Force (FATF) and Interpol can be handy bodies to take action in this regard. Diplomatic channels can help in another way to control hundi. This is the way of strengthening antimoney laundering and counterterrorism financing (AML/CTF) framework among related nations. Countries that lack of certain capacity to build this AML/ CTF framework can be brought under training sessions to make them aware of the fact.

In addition, encouraging countries in adopting and implementing best practices that are acclaimed on the international circuit can be a good option to promote awareness about money laundering.

HOW TO PUT A STOP TO HUNDI SYSTEM?

Amid the ongoing dollar crisis in the country, new discussions have started on the rise of the hundi. The Criminal Investigation Department (CID) of the police recently said that at least 5,000 agents of Mobile Financial Service Providers (MFS) companies like Bkash, Nagad, and Rocket are involved in bringing remittances from abroad and sending money illegally. About BDT 25 thousand crores of expatriate income (remittances) has been distributed through them in four months. In this way, the country is deprived of remittances worth about 780 crores of US dollars, or BDT 75 thousand crores, annually.

Meanwhile, money exchange companies are acting as agents of hundi. CID and Bangladesh Bank sources said that at least 700 illegal money exchanges are trafficking money through hundi across the country. As people are having difficulties opening LCs due to the dollar crisis, large companies like Pran and S. Alam are gradually developing industries outside Bangladesh. So, they are becoming able to make any payments outside Bangladesh through the income of their branches located outside Bangladesh, which is saving a significant amount of money for these companies. This is a notable threat to our banking sector, for sure. But the prevention of the hundi system lies in the prevention of money laundering. According to the report of the Washington-based international organisation Global Financial Integrity (GFI), from 2009 to 2018, 49.65 billion dollars were smuggled out of Bangladesh under the guise of foreign trade, which is equivalent to 400,000 crores in Bangladeshi currency.

Dr. Mustafizur Rahman, an honorary fellow at the Centre for Policy Dialogue (CPD), said that the capacity of the Bangladesh Financial Intelligence Unit (BFIU) to prevent money laundering should be increased. Apart from this, organisations working to prevent corruption should be more active. Visible action needs to be taken against traffickers. Only then it is possible to prevent hundi activities and money laundering.

Least 700 illegal money exchanges are trafficking money through hundi across the country.

In contrast, hundi is a two-pronged approach. The dollars of the expatriates are given to money smugglers by hundi agents, and the relatives of expatriates are paid with black money from smugglers. Therefore, limiting hundi’s destructive potential requires blocking off just one of its entry points. Several measures in this area have been suggested by economists.

First, increasing the services of some banks in countries where there are more expatriate workers. Also, arrangements can be made to send remittances through a transparent process to the concerned mobile banking institutions. If used as a body of the banking system through a proper campaign, Bkash, Nagad, and other MFS can be useful tools in this regard.

Secondly, there are 1 crore 30 lakh expatriates working abroad. The main responsibility of the Labor Welfare Wing is to ensure their rights, protection, and security. Although Bangladeshi workers travel to 168 countries around the world, there are only 29 Labor Welfare Wings in the Bangladesh Mission in 26 countries to protect their rights and safety. So, increasing the number of wings is mandatory.

Thirdly, incentives against remittances as well as special recognition or reward systems will increase encouragement among workers to pay through established banking channels. Again, people should be made aware of the risks of losing money due to theft when sending money to relatives via hundi.

Fourth, cases of buying remittance houses to collect dollars are also being heard. The dollars of expatriate’s earnings collected by remittance houses are not coming to the country. Hence, increasing diplomatic activity in this regard is another step that can be taken.

Fifth, the source of the illegal money must be traced; since money laundering encourages two-way hundi. The question now is, does the government really want to stop hundi and catch money smugglers? The government’s efforts to combat money laundering serve as evidence of this. On August 8 last, the National Board of Revenue (NBR) announced that money that has been laundered abroad can now be brought back into the country through banking systems by paying a 7 percent tax. Nobody will raise any objections during this procedure. However, there was no information provided that anyone had used this method to bring money home. As a result, there was no inflow of dollars at this time. Overall, it leaves a bigger question: Did NBR recognise the money laundering by notifying the facility?