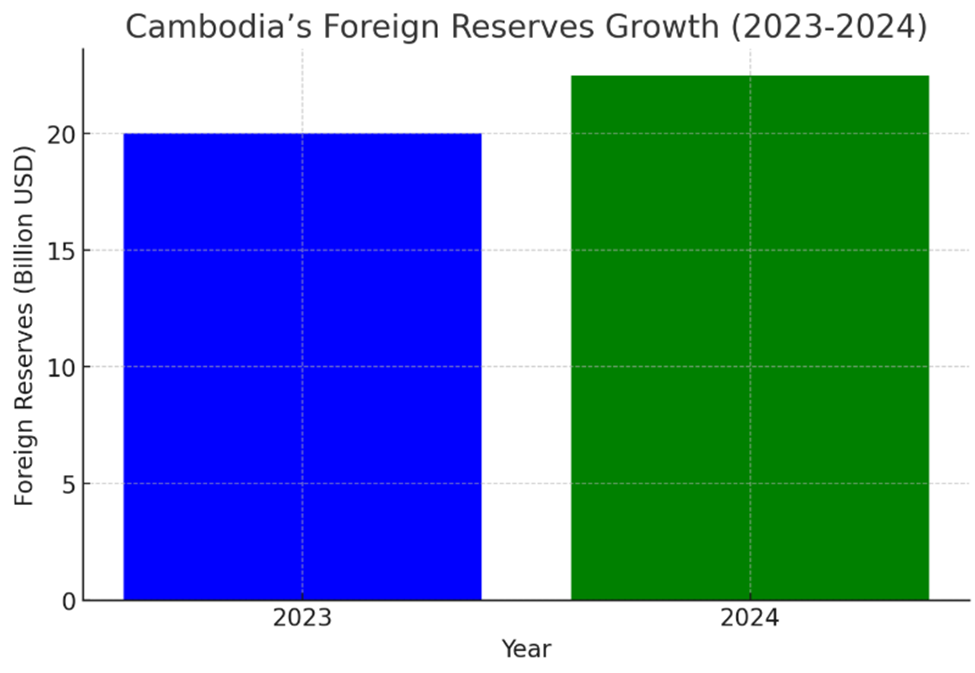

Cambodia’s foreign exchange reserves reached a record $22.5 billion in 2024, marking a 12.6% increase compared to the previous year, according to Chea Serey, Governor of the National Bank of Cambodia (NBC). The sharp rise in reserves highlights the country’s efforts to maintain macroeconomic stability, curb inflation, and manage international reserves effectively.

Speaking at NBC’s annual conference, Serey emphasized that Cambodia’s inflation rate remained low at just 0.8% in 2024, largely due to falling fuel and food prices, while other goods and services saw moderate increases. The exchange rate averaged 4,071 riels per US dollar, reflecting a slight 0.9% rise from 2023, demonstrating the local currency’s relative stability.

The NBC Governor credited the country’s macro-financial policies with maintaining economic stability, ensuring that inflation remained under control while foreign reserves continued to rise. She noted that Cambodia’s international reserves are now sufficient to cover around seven months of imports, providing a critical buffer against global economic uncertainties.

Economic Growth Driven by Exports and Tourism

Despite global financial challenges, Cambodia’s economy grew by 6% in 2024, supported by strong export performance and a steady recovery in tourism. The country’s garment industry, a key driver of exports, showed significant growth, while tourism rebounded following pandemic-related disruptions. However, the construction, real estate, and agriculture sectors continued to experience slow growth, reflecting broader economic trends in the region.

Serey noted that while credit growth had slowed due to cautious lending by financial institutions and subdued demand from key sectors, deposits increased by 16.3%, demonstrating strong public confidence in the banking sector. The robust deposit growth indicates a high-liquidity environment, positioning Cambodia’s banking system as resilient and well-capitalized amid regional and global economic uncertainty.

Banking Sector Stability and Leadership Transition

The NBC Governor acknowledged that Cambodia’s banking system remains on a strong foundation, built under the leadership of former NBC Governor Chea Chanto. She credited decades of financial sector reforms, macroeconomic stability, and peace-building efforts for the nation’s economic resilience.

Serey also reaffirmed the government’s commitment to the ‘Pentagonal Strategy – Phase One’, a long-term economic framework designed to sustain growth, investment, and financial inclusion. This strategy has helped Cambodia navigate economic uncertainties while reinforcing monetary policies that align with broader government objectives.

The conference, attended by NBC Deputy Governor Yim Leat and financial sector leaders from across the country, outlined key priorities for 2025. These include further strengthening monetary policy frameworks, enhancing financial sector resilience, and expanding Cambodia’s economic integration with regional and global markets.

With Cambodia’s foreign reserves at an all-time high and economic growth steady, the country remains on a path toward greater financial stability, investment attractiveness, and long-term prosperity.