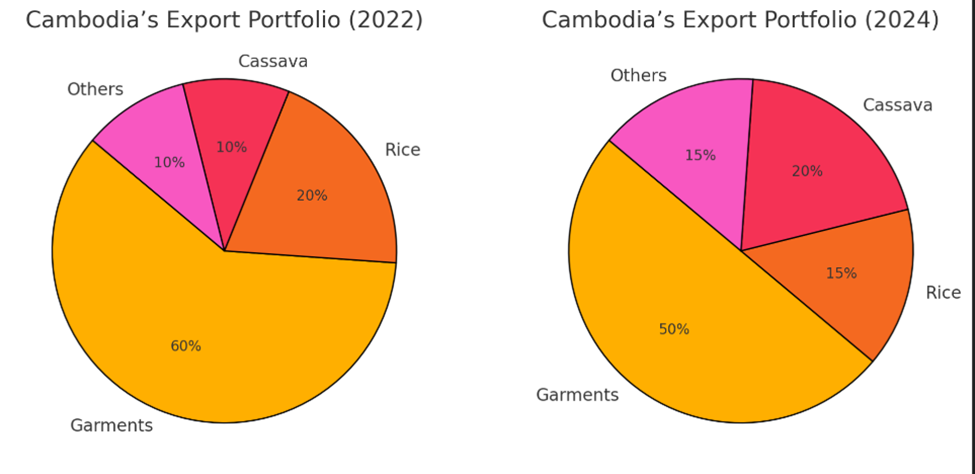

Cambodia’s cassava sector is undergoing a dramatic transformation, fueled by a bold national policy that has already begun to yield results just over a year after its implementation. The government’s ambitious plan to modernize cassava production, boost value-added processing, and expand export markets is not only revitalizing rural economies but also positioning Cambodia as a rising star in the global cassava trade.

With global demand for cassava surging—driven by its use in food, biofuels, and industrial applications—Cambodia’s strategic focus on this resilient crop is proving timely. The country exported a record 7.2 million tons of cassava in 2024, generating $1.3 billion in revenue, a 30% increase from the previous year, according to the Ministry of Agriculture, Forestry, and Fisheries.

This growth has been propelled by the national cassava policy, which has prioritized productivity gains, infrastructure development, and market diversification.

The Policy in Action: Early Wins and Challenges

Launched in late 2023, the national cassava policy was designed to address long-standing bottlenecks in the sector, from low yields and limited processing capacity to over-reliance on regional intermediaries. One year in, the results are promising but uneven, reflecting both the policy’s potential and the hurdles that remain.

Productivity Gains

The introduction of high-yielding cassava varieties and improved farming techniques has already boosted average yields from 20 to 25 tons per hectare in key growing regions like Kampong Thom and Tbong Khmum. Farmers like Meas Sopheak, who grows cassava on a five-hectare plot in Kampong Cham, credit government-backed training programs and subsidized fertilizers for the increase. “I used to struggle to get 18 tons per hectare. Now, with better seeds and techniques, I’m hitting 27 tons,” he says.

However, these gains are not universal. Many smallholders in remote areas still lack access to quality inputs and technical support, highlighting the need for more inclusive outreach.

Value Addition Takes Root

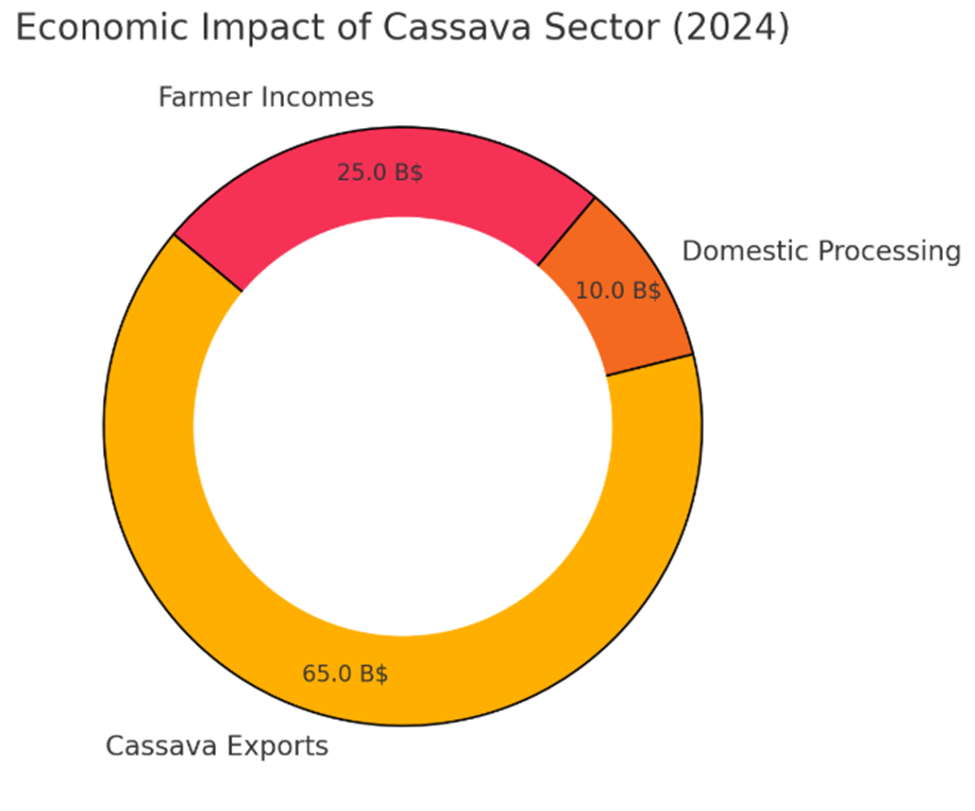

A cornerstone of the policy is the shift from raw cassava exports to value-added products like starch, flour, and bioethanol. In 2024, Cambodia opened three new cassava processing plants, with a combined capacity of 500,000 tons annually. These facilities, supported by tax incentives and public-private partnerships, are helping to capture more value domestically.

“We’re no longer just a supplier of raw materials to Thailand and Vietnam,” says Chea Vuthy, CEO of Angkor Cassava Processing, one of the new plants. “Now, we’re exporting directly to markets in China, India, and even Europe.”

Despite this progress, the sector remains underdeveloped compared to regional competitors like Thailand, which has a well-established cassava processing industry. Analysts warn that Cambodia must continue to attract investment and build technical expertise to fully realize its potential.

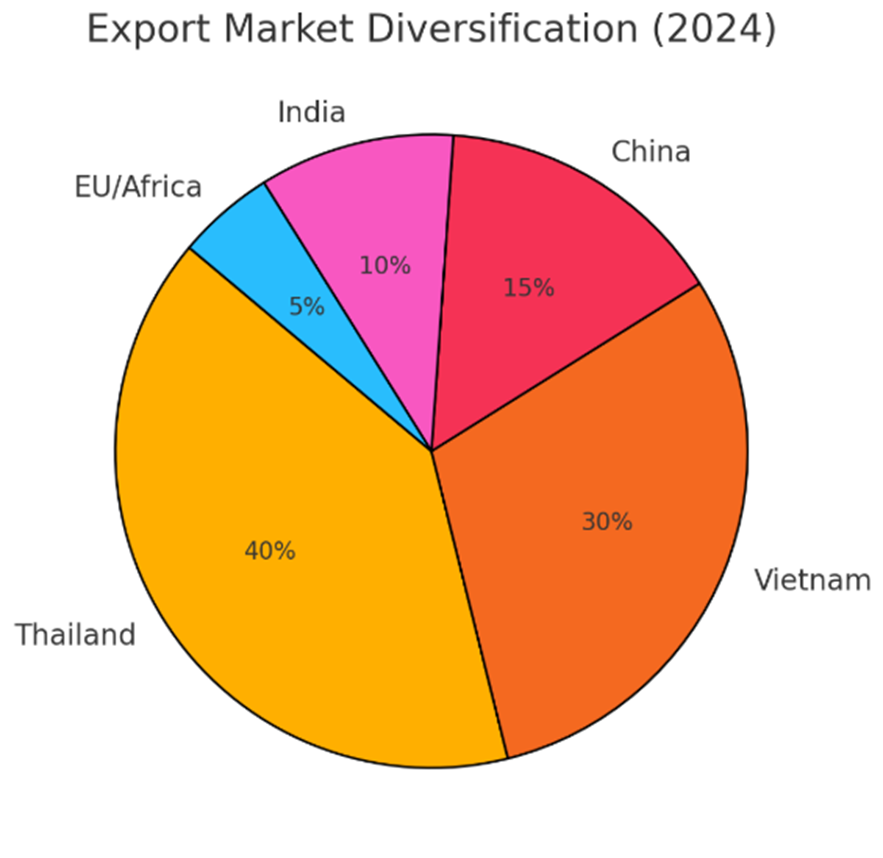

Export Diversification Gains Momentum

Cambodia’s efforts to reduce its reliance on traditional markets like Thailand and Vietnam are paying off. In 2024, the country secured new export deals with China, India, and several African nations, where cassava is increasingly used for food security and industrial purposes. The European Union, a growing market for cassava-based biofuels, has also emerged as a key destination.

“Cambodia is becoming a serious player in the global cassava trade,” says Prak Sereyvath, an agricultural economist at the Royal University of Phnom Penh. “But to sustain this momentum, the government must address infrastructure gaps and ensure consistent quality standards.”

Rural Transformation and Social Impact

The cassava boom is having a tangible impact on rural livelihoods. In provinces like Kampong Thom and Preah Vihear, where cassava is the primary cash crop, farmers report higher incomes and improved access to credit. The government’s price stabilization fund, established in early 2024, has also helped shield farmers from volatile global prices.

“Before, we were at the mercy of traders who set the prices,” says farmer Sok Vannak from Tbong Khmum. “Now, with the government’s support, we have more bargaining power and stability.”

However, challenges remain. Many farmers still lack access to modern storage facilities, leading to post-harvest losses. Additionally, the rapid expansion of cassava cultivation has raised concerns about deforestation and soil degradation in some areas.

Global Context: Cassava’s Rising Star

Cambodia’s cassava push comes at a time of growing global demand for the crop. According to the Food and Agriculture Organization (FAO), cassava production worldwide is expected to increase by 25% by 2030, driven by its versatility and climate resilience. The crop is increasingly used in biofuels, animal feed, and gluten-free products, making it a strategic commodity for food security and industrial applications.

“Cambodia is well-positioned to capitalize on this trend,” says Maria Garcia, a senior analyst at the FAO. “But it must balance growth with sustainability to avoid the environmental pitfalls seen in other cassava-producing countries.”

Opportunities and Risks

As Cambodia’s cassava sector continues to evolve, the government faces a critical juncture. Sustaining the current momentum will require significant investments in infrastructure, research, and farmer support. The upcoming launch of a $50 million cassava innovation fund, backed by international donors, is a step in the right direction.

However, risks loom. Global cassava prices remain volatile, and competition from other producers like Nigeria and Thailand is fierce. Additionally, the sector’s rapid growth could exacerbate environmental challenges if not managed carefully.

“The policy is a game-changer, but it’s not a silver bullet,” says Sereyvath. “Cambodia must stay focused on long-term sustainability and inclusivity to ensure that the benefits reach all stakeholders.”