In 2024, the world experienced yet another wave of extreme weather events, including record-breaking wildfires and severe flooding fueled by El Niño, highlighting the urgent need for global action on climate change. But for Africa, the stakes are even higher.

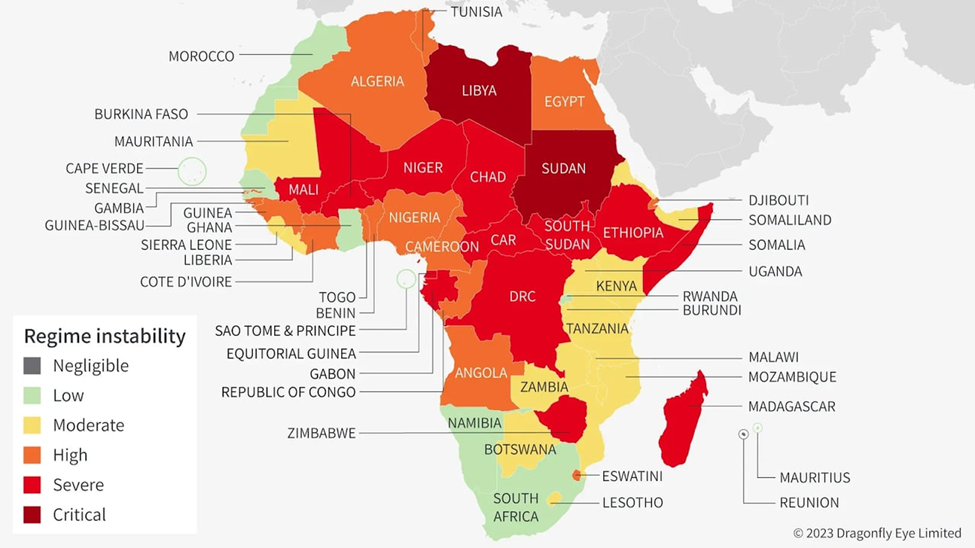

With 17 of the 20 countries most vulnerable to climate change located on the continent, Africa faces the compounded challenges of climate-induced disasters and a looming sovereign debt crisis. Addressing this dual threat is essential for the continent’s path to sustainable development, but progress hinges on meaningful debt relief.

Africa’s Climate Vulnerability and Debt Dynamics

Since 2008, public debt in African countries has surged by 240%, driven by external shocks like inflationary pressures, rising interest rates in advanced economies, geopolitical tensions, and internal conflicts.

The consequences of this debt burden are stark: over half of African nations now spend more on servicing debt than on essential public services such as healthcare. This undermines their ability to invest in climate adaptation and sustainable development, trapping many countries in a vicious cycle of economic and environmental instability.

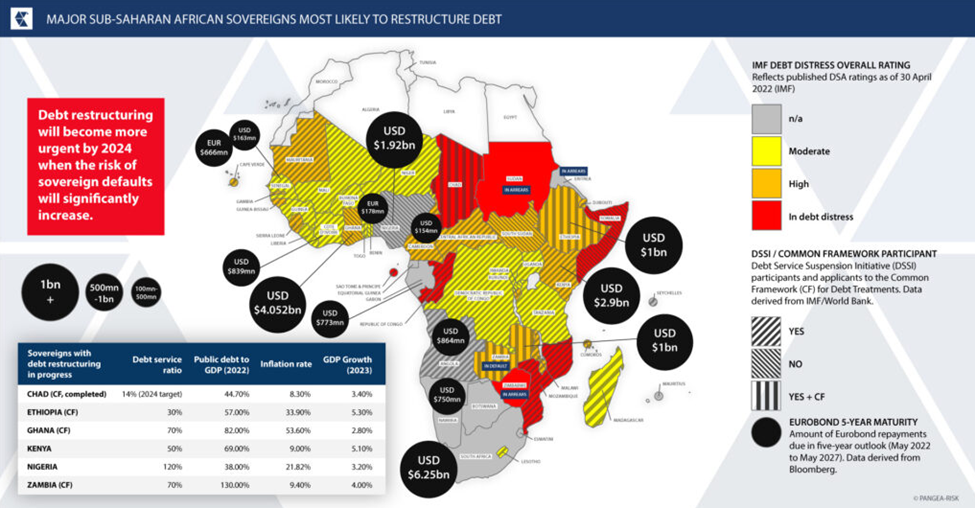

Current estimates indicate that at least 34 African nations require significant debt restructuring to free up fiscal space for green investments and climate action. Without this, the dream of a sustainable and resilient Africa will remain elusive.

Yet, multilateral debt relief initiatives like the G20’s Common Framework for Debt Treatments have fallen short, offering slow and insufficient relief due to the reluctance of private creditors and the exclusion of multilateral development banks (MDBs).

Debt Relief: A Prerequisite for Green Growth

For Africa to achieve its green growth aspirations, large-scale debt relief is critical. Such a restructuring would provide African governments with the breathing room to invest in renewable energy, resilient infrastructure, and climate mitigation strategies. According to the latest data, Africa needs to increase investments in renewable energy by an estimated 25% annually to meet its climate targets by 2030. Without significant financial relief, these targets will remain out of reach.

Debt relief efforts must rest on three essential pillars. First, MDBs and bilateral creditors must accept a haircut, allowing debtor countries to regain fiscal stability. Second, reforms should include binding incentives for private creditors to participate in restructuring. Current figures show that In 2023, private debt made up 54.3% of Africa’s total debt, which is more than half. This is an increase from 2008, when private debt made up 18.8% of GDP, yet they remain resistant to restructuring efforts. Lastly, credit enhancements must be offered to non-distressed nations to maintain access to affordable capital, helping them avoid future crises.

Climate Considerations in Debt Sustainability

A fundamental reform to the global debt architecture involves integrating climate risks into debt sustainability analyses (DSAs). Currently, DSAs focus solely on a country’s ability to service its debt, ignoring the long-term investments needed for the energy transition and climate resilience. By incorporating climate risks, the International Monetary Fund (IMF) could better align debt relief efforts with sustainability goals. The IMF’s most recent reviews show that only 15% of debt relief programs globally incorporate climate-related risks, an oversight that hampers meaningful progress toward green development.

Unlocking Africa’s Potential

Africa’s renewable energy potential remains largely untapped, despite the continent having vast solar, wind, and hydropower resources. Analysts project that with adequate investments, Africa could become a leader in clean energy exports, helping to power not only its own economic development but also the global energy transition. The International Renewable Energy Agency (IRENA) estimates that Africa could generate up to 60% of its energy from renewable sources by 2050, but this would require a $2 trillion investment over the next three decades. Without debt restructuring, such investments remain financially unsustainable for most African countries.

A Crucial Year for Reform

Looking ahead to 2025, African leaders are poised to push for reforms at upcoming global summits. South Africa’s presidency of the G20 and Uganda’s leadership of the G77 offer the continent a unique opportunity to advocate for sweeping changes to the global financial system, with debt relief and climate investments at the forefront of the agenda. As the African Union gains permanent membership in the G20, the continent’s voice in global financial discussions will grow, but the international community must respond with concrete actions.

The interconnected crises of climate vulnerability and debt distress in Africa require a coordinated, long-term strategy. Short-term liquidity injections are insufficient. Without large-scale debt restructuring and targeted green investments, Africa risks being locked into a cycle of unsustainable debt, worsening climate impacts, and economic stagnation.

In the battle against climate change, Africa holds a key role. But the continent’s green future depends on the international community’s willingness to address both its climate challenges and its debt burdens in tandem. The time to act is now.