- The eurozone economy grew 0.3% in Q2 2024

- Growth matches Q1 2024 performance, showing continued recovery

- France and Spain showed strong growth at 0.3% and 0.8% respectively

- Inflation trends show significant declines from peak levels in some countries

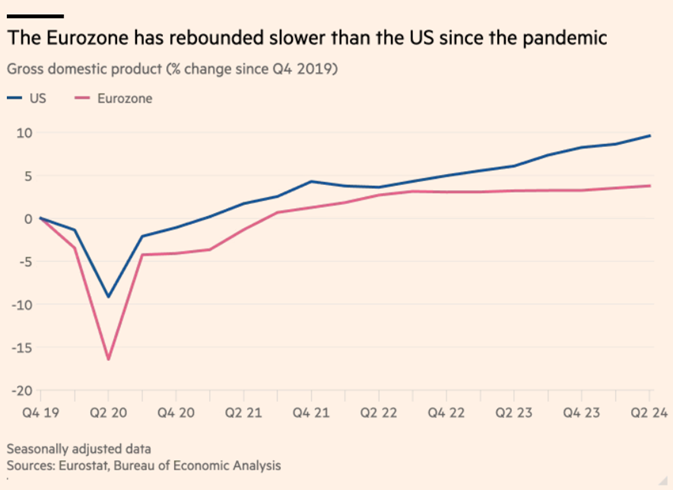

In Q2 2024, the eurozone economy outperformed expectations, growing by 0.3% according to official data. This growth rate, which matched Q1’s performance, surpassed analysts’ projections of 0.2% and marked a continued recovery from the stagnation seen in late 2023.

The robust growth may reinforce the European Central Bank’s stance on maintaining current interest rates, following a cut in June. However, concerns persist over Germany’s economic performance, as Europe’s largest economy contracted by 0.1% in Q2.

In contrast, France and Spain showed strong growth at 0.3% and 0.8% respectively, while Italy and Portugal also expanded modestly. The overall positive trend in Southern Europe contributed significantly to the eurozone’s performance.

You can also read: Arms Build-up Looms as Diplomatic Solutions Falter in East Sea

Despite these encouraging figures, recent data indicates a slowdown in eurozone business activity for July, particularly in the manufacturing sector. This mixed picture suggests potential challenges ahead.

The European Union as a whole also saw 0.3% growth in Q2. Economists note that events like the Paris Olympics could provide a slight boost to Q3 figures.

As the ECB continues to monitor economic indicators, attention now turns to the upcoming July inflation data, with consumer prices still above the bank’s 2% target. This information will likely play a crucial role in shaping future monetary policy decisions.

Olympic Dreams

Analysts warn that Germany’s economic struggles may increasingly hinder the eurozone’s overall growth in the coming months. Recent survey data indicates that other eurozone countries might soon struggle to offset Germany’s weakness. The S&P composite purchasing managers index dipped to 50.1 in July from 50.8 in June, barely above the 50-point mark that signals economic contraction.

ECB President Christine Lagarde expressed hope that the Paris Olympics might boost confidence in the region. However, the European Commission’s economic sentiment index showed a slight decline in eurozone confidence, with a notable downturn in France.

ING’s Carsten Brzeski drew a parallel between the eurozone economy and the Seine’s water quality, suggesting that while it may appear fine some days, overall it remains a consistent concern.

The ECB has recognized that the region’s tepid recovery is susceptible to global economic slowdowns or escalating trade and geopolitical tensions. Recent data suggests the economy is underperforming compared to the ECB’s June projections, which had forecast steady 0.4% quarter-on-quarter growth for 2024.

Furthermore, J.P. Morgan economist Greg Fuzesi noted that the latest PMIs indicate underlying growth momentum is falling below an annualized rate of 1%. This paints a picture of an economy facing significant headwinds and struggling to maintain robust growth.

France’s political impasse threatens a decade of solid economic progress.

France’s political landscape has shifted dramatically since 2014, with the 2024 National Assembly elections resulting in a fragmented legislature divided into three main blocs: a leftist coalition, centrists, and the far right. The distribution of powerful offices has not fully aligned with election results, potentially fueling resentment and threatening democratic stability.

This political fragmentation poses risks to France’s economic progress over the past decade. While the country has seen improvements in foreign investment, unemployment, and income equality, productivity and public finances remain challenges. The recent election campaign largely ignored these issues, with extreme parties advocating for higher taxes and increased spending.

The document highlights that France’s real problems lie in regional inequalities, with high taxation coupled with poor access to public services outside major cities. Despite high levels of redistribution and public spending, many French citizens struggle with access to healthcare, transportation, and quality education in rural areas.

All options on the table

Despite signs of economic growth, persistent inflation complicates the case for potential interest rate cuts by the European Central Bank (ECB) in September. The slight uptick in German inflation underscores both the stubborn nature of price pressures and the uncertainty surrounding future rate decisions.

ECB executive board member Isabel Schnabel recently emphasized that the September meeting remains “wide open,” contrary to market expectations of a rate cut. This stance reflects the complex economic landscape the central bank faces.

July’s inflation data across the eurozone presents a mixed picture. While Germany saw a slight increase, Spain experienced a significant drop to 2.9%, below analyst predictions. Belgium also saw a minor decrease. Economists anticipate the overall eurozone inflation rate to hold steady at 2.5% when announced.

UBS Global Wealth Management’s chief economist, Paul Donovan, advocates for a broader perspective on inflation trends. He highlights the substantial decline from peak levels – nine percentage points in Germany and seven in Spain. Donovan argues that this rapid decrease in inflation rates demonstrates the transitory nature of the initial price surge, attributing the decline to factors beyond just monetary policy.

As the ECB navigates these conflicting economic signals, the path forward for monetary policy remains uncertain, with policymakers weighing the risks of premature easing against the potential for economic stagnation.