Spearheaded by visionary leadership, notably under Prime Minister Sheikh Hasina, Bangladesh’s journey to achieve remarkable socio-economic development and earning global recognition as a model of growth is well-posted in the world. Amidst such progress, the United States has stood as a steadfast ally, contributing significantly to its development over five decades of diplomatic ties.

You Can Also Read: WHY BANGLADESH EYES ON FTA PARTNERS AHEAD OF LDC GRADUATION?

As Bangladesh and the USA mark their 50th year of partnership, the economic relationship between the two nations has flourished, with the USA emerging as Bangladesh’s third-largest bilateral trade partner. Particularly noteworthy is the USA’s role as the primary destination for Bangladesh’s renowned readymade garments (RMG), a sector pivotal to the nation’s economic landscape.

Bangladesh’s Economic Evolution in the USA Market

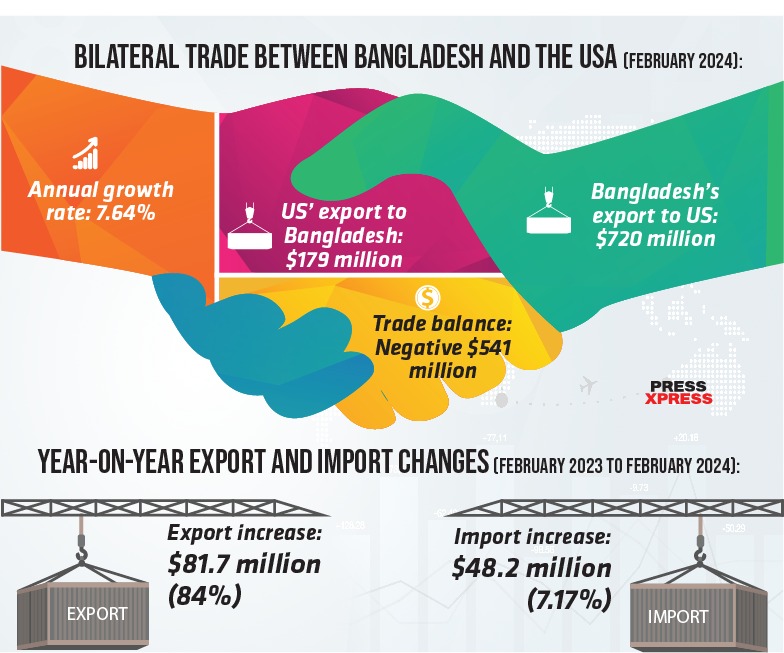

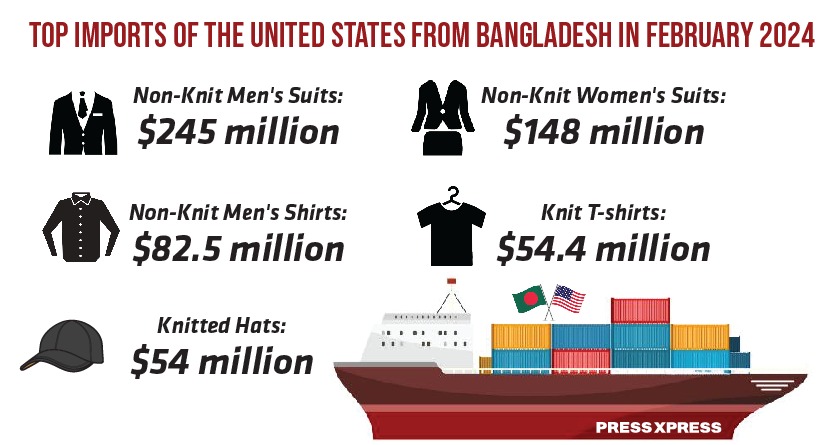

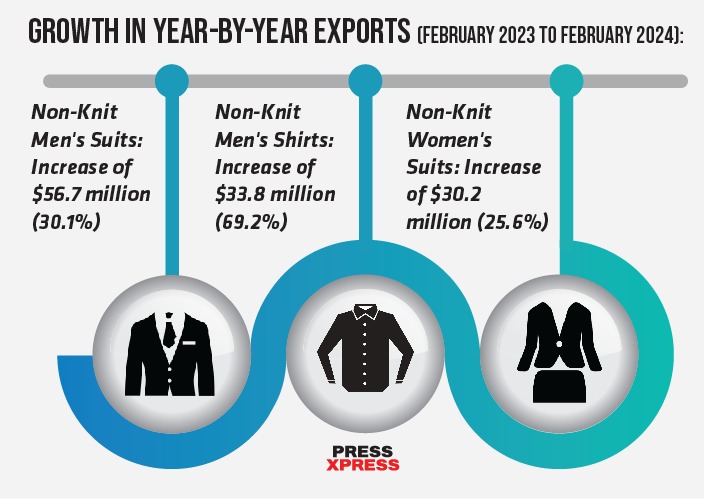

Bangladesh and the USA have seen their economic ties deepen, with bilateral trade growing steadily at 8.64% annually. In fiscal year 2021-22, trade reached USD 13.24 billion, with Bangladesh exporting USD 10.41 billion and importing USD 2.82 billion from the USA. The readymade garment sector dominates Bangladesh’s exports to the USA, comprising over 87% and totaling USD 9.01 billion in the latest fiscal year. Despite challenges, including the phasing out of duty-free access under the Multi-Fiber Agreement, Bangladesh remains resilient in its role as a crucial trading partner for the USA. However, trade barriers like accessing the US Generalized System of Preference could unlock further growth opportunities.

However, amid economic symbiosis, uncertainty shadows garment factory owners are facing volatile global dynamics. Still Bangladesh remains resolute with uncertainty, showcasing economic evolution’s enduring nature. Despite Covid-19’s tumult, garment exports surged to the US market, symbolizing resilience. However, a new narrative emerges as pandemic effects linger, with Bangladesh facing dwindling fortunes in its crucial market. Garment exports peaked at $2.17 billion in late 2022 but sharply declined to $1.85 billion by early 2023, reflecting the volatile nature of global trade. The downward trend persisted, with a 3.5% drop in exports to the US market in the following quarter, signaling a shifting paradigm post-Bangladesh’s LDC graduation.

Bangladesh imports mainly from China, with the USA ranking sixth. Despite the gap in import figures, reflecting a trade balance, imports from the US span mineral fuels to machinery, indicating a symbiotic exchange. Bangladesh aims to diversify its export base for resilience. By June 2023, American investment soared, reaching $3.5 billion, bolstering Bangladesh’s FDI to $20.24 billion. Various sectors, from gas to textiles, bear the imprint of this investment influx, enriching Bangladesh’s economic landscape.

A Land of Promise for US Investors in High-End Sectors

As Bangladesh strides towards Sustainable Development Goals, USA’s support becomes pivotal. To further strengthen bilateral ties, future focus areas include enhancing employment opportunities, fostering decent working conditions, and advancing green industry initiatives. Collaboration between Bangladesh and the USA holds the key to realizing these shared aspirations for a sustainable and prosperous future.

As we strive to uphold our achievements in social and environmental progress, our focus now turns to enhancing our business capabilities. Collaborative capacity building across the supply chain will propel us towards a shift from quantity to quality, and from volume to value, fostering a win-win scenario for all stakeholders.

The United States stands as a significant source of Foreign Direct Investment (FDI), offering expertise and technologies crucial for our next phase of growth. With opportunities abound in high-end textile sectors, specialized fabrics, technical textile manufacturing, pharmaceuticals, footwear, leather products, frozen foods, and shipbuilding, Bangladesh emerges as a land of promise for foreign investors.

Benefiting from a demographic dividend with 70% of our population under 40 years of age, Bangladesh offers favorable fiscal and non-fiscal policies, including full repatriation of capital and profits, tax exemptions, and the establishment of economic zones. These conditions create an inviting environment for US investors to engage and contribute their expertise.

Writing the next chapter of US-Bangladesh relations requires deeper commitment and collaboration between business leaders and policymakers of both nations. By seizing the present opportunities and aligning with emerging priorities, we envision a future where the USA becomes a critical partner in Bangladesh’s journey towards prosperity driven by trade and investment.

Navigating the Complexities of US Engagement

Envisioning a future of tangible trade and investment relations, the focus lies on sectors ripe for growth like technology and energy, including deep-sea exploration. Beneath the veneer of optimism, a shadow of apprehension persists as the Policy Research Institute (PRI) voices concerns over strained Bangladesh-US relations. Economic issues intertwine with political complexities, casting a somber tone over bilateral interactions.

The warning is clear—Bangladesh must navigate these uncertain waters cautiously, safeguarding its democratic principles from external scrutiny. The diplomatic dance between Dhaka and Washington unfolds delicately. Despite shockwaves from US sanctions on the Rapid Action Battalion in December 2021, Dhaka responded adeptly, strengthening diplomatic ties. Assistant Secretary of State Donald Lu applauds Bangladesh’s progress in reconciliation, citing “tremendous strides” in navigating diplomatic challenges.

The historic ties that bind the two nations, dating back to Bangladesh’s struggle for independence, find resonance in the diasporic tapestry of over 220,000 Bangladeshi lives thriving in the United States, enriching both societies with their contributions.

Beyond sentiments lies a complex web of strategic imperatives and diplomatic intricacies. In Washington, the call for alignment with US principles on human rights and democracy challenges Dhaka’s delicate balance of friendship and sovereignty.

The US is committed to a “worker-centered trade policy agenda” applied universally, integrating climate goals and supporting agriculture. In its 2022 report, the USTR reaffirmed a focus on worker rights in Bangladesh, highlighting engagement through mechanisms like TICFA and the Labor Working Group. Bangladesh can anticipate continued US pressure on labor issues and alignment with international standards.

Last year, the US advocated for various reforms in Bangladesh, including market access for US agricultural products, digital trade policies, ease of doing business improvements, and enhanced IP protection. This proactive stance continues, highlighted in recent TICFA meetings where labor reforms were prioritized by the Biden-Harris Administration. Bangladesh faces challenges with the US-led Indo-Pacific Economic Framework for Prosperity (IPEFP) too, despite not being directly involved, adding complexity to its foreign policy strategy.

As the US continues to advance its trade policy agenda in the coming months, the trajectory is unlikely to witness significant deviations until the declaration of a new annual policy. However, substantial changes are improbable, particularly concerning trading partners like Bangladesh, where achieving desired outcomes on labor rights, IP regulations, and access to agricultural products requires sustained effort and mutual cooperation. Bangladesh remains cognizant of these challenges and the necessity for collaborative endeavors to address them effectively.