Key Highlights:

- The 2024 Insurance Claims Management Guideline applies to insurers, reinsurers, surveyors, agents, intermediaries, service providers, customers, and relevant stakeholders

- Directors, shareholders, CEOs, managers, or other officers of insurers may be fined between Tk 1 lakh to Tk 10 lakh for various offenses described in the existing law

On Sunday, April 28th, the Bangladesh Insurance Development and Regulatory Authority (IDRA) issued the “Insurance Claims Management Guideline 2024” to promote transparency and accountability within insurance operations and protect the interests of customers. The directive was circulated to all life and non-life insurance firms and affiliated bodies.

This guideline applies to various entities, including insurers, reinsurers, surveyors, insurance agents, intermediaries, and service providers, as well as customers and other relevant stakeholders identified by IDRA. It delineates the responsibilities of insurers, obligations of Bangladesh insurance customers, duties of reinsurers and surveyors, and the necessary criteria for efficient insurance claims management.

You Can Also Read: BANCASSURANCE IN BANGLADESH: A NEW MODEL FOR INSURANCE SECTOR

Furthermore, it emphasizes the establishment of insurance company help desks, such as call centers, and clarifies the roles and responsibilities of boards of directors and their committees. The guideline also enumerates 5 crucial actions that insurance customers must take, such as promptly informing the insurer of any losses or accidents within the specified timeframe outlined in the insurance contract, and subsequently providing all relevant documentation for the insurance claim.

Moreover, it outlines 17 actions that Bangladesh insurance companies must undertake to effectively manage insurance settlement claims.

Surge in Insurance Complaints Exposes Challenges in Bangladesh

A regulatory official from IDRA disclosed that over the past 10 months, approximately 25,000 complaints concerning life insurance policies were lodged against 14 life insurance companies. Predominantly, about 95% of these complaints revolved around claim settlements.

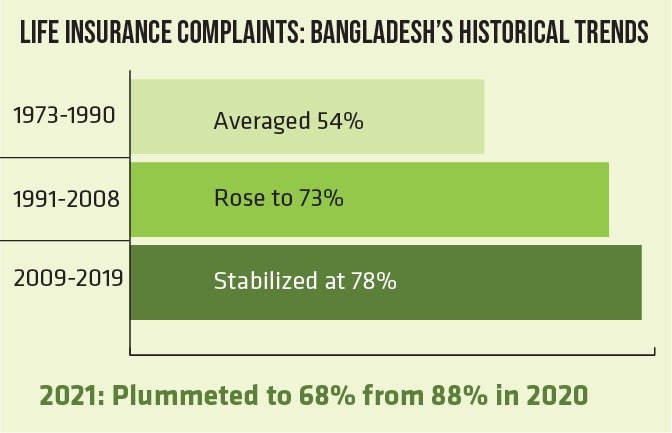

Comparatively, the global average claim settlement ratio stands at 98%. Even neighboring India maintains a similar average of 98%. Historical data reveals that Bangladesh’s claim settlement ratio fluctuated significantly over the years. Between 1973 and 1990, it hovered around 54%, which then rose to approximately 73% during 1991-2008. Subsequently, from 2009 to 2019, it reached 78%. However, in 2021, the ratio plummeted to 68% from 88% in 2020.

Bangladesh’s insurance landscape comprises a total of 81 companies, with 35 specializing in life insurance and 46 in non-life insurance. Insurance in Bangladesh is often perceived as a product with negative demand, with many individuals and businesses reluctant to invest in non-mandatory insurance coverage. Furthermore, the industry has yet to adopt strategic or innovative measures to alter this behavior.

In developed nations like Canada, Japan, Sweden, Australia, and New Zealand, insurance coverage is nearly ubiquitous, even a decade ago. Comparatively, India and Pakistan insure 27% and 12.5% of their populations, respectively, while Sri Lanka, boasting a high literacy rate, sees near-universal coverage.

Regarding asset insurance, many businesses are hesitant unless compelled to obtain coverage for dealings with financial institutions, ports, and governmental bodies. Consequently, insurance contributes only around 0.5% to the country’s GDP, placing Bangladesh ahead of Nigeria among comparable nations.

Sweeping Reforms Proposed for Bangladesh Insurance Sector

Insurers will be prohibited from assisting company directors, shareholders, their families, or other related parties in obtaining loans from financial institutions by using company assets as collateral. Additionally, the IDRA aims to amend certain provisions that conflict with other laws to streamline operations within the industry.

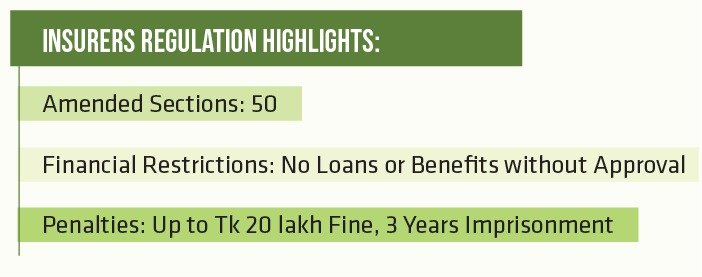

In total, the insurance regulator seeks to amend 50 sections of the act. The draft proposes adding a new section requiring insurers to appoint independent directors who would be free from influence by company management or shareholders. These independent directors will be responsible for ensuring regulatory compliance and providing recommendations for operational improvements.

Another proposed section states that insurers cannot avail loans or financial benefits from the company, its subsidiaries, or any entities controlled by directors, shareholders, their families, or other related individuals without IDRA’s approval. The draft also mandates that only individuals with IDRA-prescribed qualifications should be appointed as chief financial officers or company secretaries of insurers, subject to regulatory approval.

Moreover, any person found providing misleading, false, or fraudulent statements to lure customers into Bangladesh insurance contracts could face fines up to Tk 20 lakh and potential imprisonment of up to 3 years.

Furthermore, directors, shareholders, CEOs, managers, or other officers of insurers may be fined between Tk 1 lakh to Tk 10 lakh for various offenses described in the existing law. Repeated offenses could result in additional daily fines of up to Tk 10,000.

IDRA Guidelines Put Policyholders First, Prohibit Forcible Selling

IDRA’s new guidelines aim at ensuring the swift settlement of insurance claims and protecting the interests of policyholders. This move comes at a crucial time when around 10 lakh policyholders are awaiting payments against their claims, amounting to Tk 3,050 crore over the past 4 years, due to a liquidity crisis faced by 29 life insurance companies operating in the country.

According to the guidelines, all insurance plans or products must receive prior approval from IDRA before being offered for sale. During the sales process, insurers are required to clearly explain the actual benefits and conditions of the proposed product to customers simply and understandably. Insurers are strictly prohibited from making any verbal, written, or implied assurances that are not part of the approved insurance plan.

The guidelines emphasize the importance of recommending suitable insurance plans or products that align with the customer’s specific needs or demands. Forcibly selling insurance schemes or products to customers is strictly prohibited.

Customers must be informed about any restrictions, penalties, or investment risks associated with the insurance policies, particularly in cases of policy maturity or withdrawal. Furthermore, the guidelines stipulate that no changes can be made to the insurance contract without obtaining written consent from the insured.

The Insurance Claims Management Guideline 2024 marks a significant stride towards overhauling Bangladesh’s insurance sector and protecting customer interests. By mandating transparency, streamlining claims processes, and prohibiting unethical practices like forcible selling, the IDRA aims to restore trust and accountability within the industry.

However, their effectiveness will hinge on robust implementation and a cultural shift to embrace insurance as a vital risk mitigation tool. If successful, these sweeping changes could propel Bangladesh’s insurance penetration towards levels on par with regional peers, catalyzing growth and encouraging economic resilience.