Bangladesh’s external debt situation has been a subject of growing concern to pay back, but this debt is not a burden, but a rather synergized force in the development sector, and that newly generated capacity will help the country to pay back the whole volume of foreign debt. Indeed, all this debt was used for mammoth developments from urban centers to rural villages to take the country towards a modern phase. If we visualize this progress from the pyramid pick, it will give us a scenario spanning from the capital to the countryside.

Recently, Bangladesh’s external debt situation has sparked discussions due to various reasons. While the IMF’s Debt Sustainability Report (November 2023) deems Bangladesh’s external debt as manageable, concerns have arisen regarding the substantial increase in debt servicing obligations. The mounting burden is attributed to high-interest expenses, a larger share of non-concessional loans, and stricter loan conditions imposed by lenders, leading to a rise in foreign loan liabilities. This situation also poses a threat to the country’s low foreign exchange reserves.

Current Debt Status

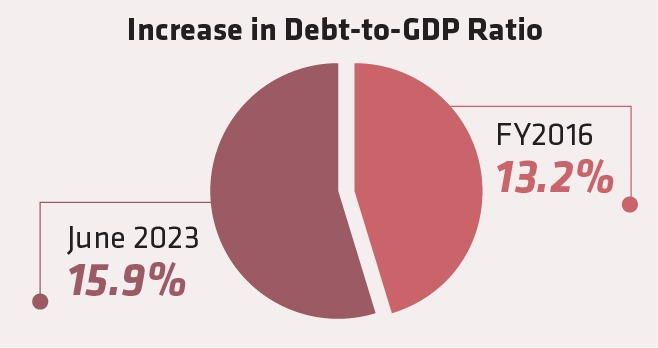

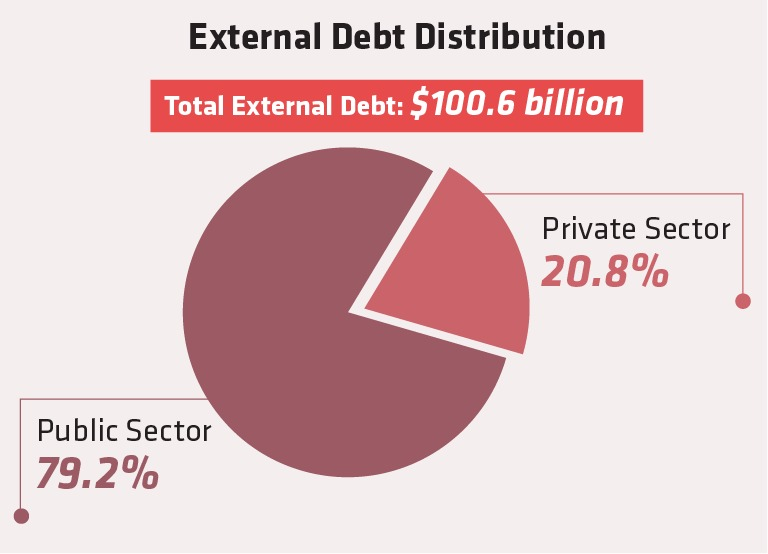

In December 2023, Bangladesh’s external debt hit $100.6 billion, with the public sector accounting for 79.2 percent and the private sector for 20.8 percent of this debt. This marked a 4.3 percent increase from the previous year (2023). Moreover, the debt-to-GDP ratio has been on a steady ascent, reaching 15.9 percent in June 2023, compared to 13.2 percent in FY2016.

Key Indicators and Concerns

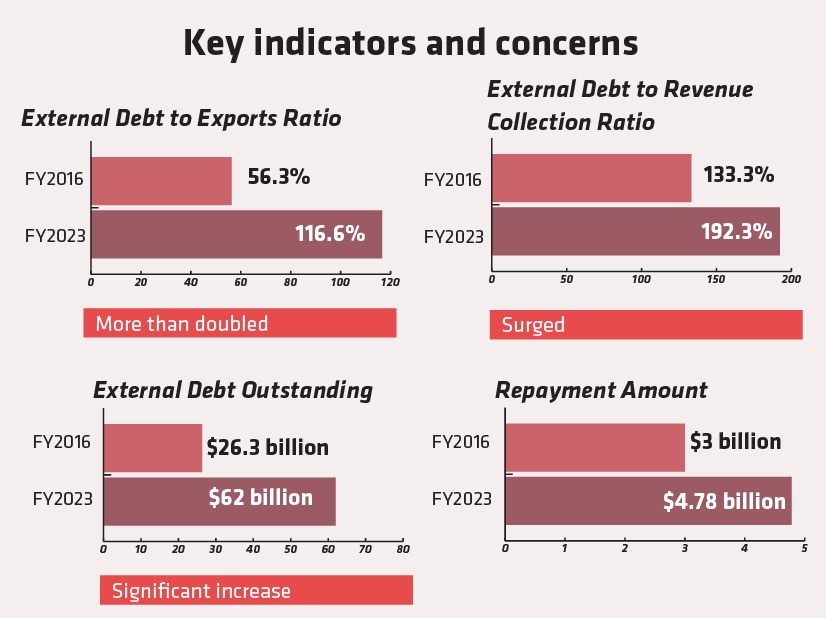

Several indicators highlight the growing burden of external debt on Bangladesh’s economy. The ratio of external debt to exports has more than doubled from FY2016 to FY2023, signaling a potential strain on resources to meet repayments. Similarly, the ratio of external debt to revenue collection has also surged, underlining the need for enhanced revenue generation. The escalation in external debt outstanding and the repayment amount further compound the challenges ahead.

Notably, the ratio of external debt to exports escalated from 56.3 percent in FY2016 to 116.6 percent in FY2023, signaling a potential shortfall in resources for impending repayments. Similarly, the ratio of external debt to revenue collection surged from 133.3 percent in FY2016 to 192.3 percent in FY2023, underscoring the imperative for augmented revenue generation.

Changing Borrowing Landscape

As Bangladesh transitioned from a low-income to a lower-middle-income country in 2015, borrowing terms from institutions like the World Bank and ADB have become less concessional. This shift, coupled with rising interest rates and stricter borrowing conditions, poses additional hurdles for debt management. Moreover, the replacement of LIBOR with SOFR has led to higher borrowing costs, adding to the debt burden.

What expert says

Bangladesh’s external debt has surpassed $100 billion for the first time, with the overall external debt reaching $100.6 billion by the end of 2023, up from $96.5 billion the previous year.

Of this debt, $79.69 billion was taken by the public sector, and the remaining by the private sector, with 85% of the loans being long-term. The increasing external debt, although within the IMF’s recommended threshold, poses challenges due to unfavorable economic developments.

Experts like Ahsan H Mansur and Mustafizur Rahman have expressed concerns about the rising debt and the need to address it. To manage the situation, halting supplier credit from China and Russia has been suggested. The government’s interest payments on foreign debt have surged significantly, emphasizing the importance of careful debt servicing.

Additionally, the private sector has seen a decline in foreign loans due to higher interest rates, which have risen from 1-2% to 8-9%. This increase in costs highlights the importance of prudent financial management to avoid future repayment difficulties.

“This is concerning that the external debt is increasing,”

– Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh.

Strategic Solutions

- Diversification of Funding Sources: Bangladesh should explore avenues beyond traditional lenders to diversify its funding sources, potentially tapping into alternative financing mechanisms such as green bonds or public-private partnerships.

- Enhanced Revenue Mobilization: The government must prioritize efforts to increase revenue collection to reduce reliance on external borrowing. This could involve tax reforms, cracking down on tax evasion, and promoting a more business-friendly environment to stimulate economic growth.

- Selective Borrowing and Project Prioritization: Bangladesh should carefully evaluate borrowing needs and prioritize projects that yield high economic returns. This entails conducting thorough cost-benefit analyses and focusing on projects with long-term sustainability and developmental impact.

- Efficient Debt Management: Implementing robust debt management practices is crucial to mitigate risks associated with external borrowing. This includes actively monitoring debt levels, managing exchange rate risks, and refinancing existing debt to secure more favorable terms when possible.

- Improving Governance and Transparency: Ensuring transparency and accountability in the utilization of borrowed funds is essential to prevent misuse and maximize the impact of investments. Strengthening governance frameworks and promoting transparency in procurement processes can help build investor confidence and attract more favorable terms.

IMF’s trust in Bangladesh for loan repayment

The IMF is confident that Bangladesh would be able to pay back its loans, and one of the main goals of the program was to protect reserves. Rahul Anand, the IMF’s mission chief in Bangladesh, highlighted during a press conference at the Finance Division that while reserves initially rose during the pandemic due to increased exports and limited imports, this was a temporary surge. He explained that the formal remittance channels and a stimulus package led to a boost in exports, along with trade diversion from other countries. Despite a subsequent rise in imports post-conflict, the soaring costs eroded reserves, creating an artificial surplus.

Rahul reassured, “Bangladesh’s loan repayment was not a concern, citing the country’s history of timely repayments and strong partnership with the IMF. He emphasized that the election cycle was unlikely to impact this track record. He also noted that global reserve pressures were a common challenge faced by nations worldwide.” Put as quote

Conclusion

In conclusion, Bangladesh can mitigate the risks associated with its burgeoning external debt and pave the path towards long-term economic resilience and stability. Indeed, recent developments in Bangladesh are undergoing a thorough review, impacting the nation from urban hubs to rural areas. This progress resembles a pyramid, with improvements cascading from cities to villages.