Investment from international companies and investors (foreign direct investment or FDI) is a powerful tool for boosting Bangladesh’s economic development. It can make important contributions towards achieving the country’s socio-economic targets, including reducing poverty levels.

For a nation like Bangladesh that lacks sufficient capital, FDI can serve as a vital means to accumulate physical capital resources, generate employment prospects, build up productive capabilities, upgrade the skills of local workers through technology transfers and management expertise sharing, and better integrate the domestic economy with global markets and trade flows.

You can also read: How Diplomacy can transform Bangladesh’s Trade?

The announcement by Dongfang Knitting (BD) Ltd, a Chinese company, proposing to invest $27.8 million to establish a sock manufacturing plant at the Bepza Economic Zone in Chittagong is a positive development. It is an indicator of Bangladesh’s growing FDI and its economic and political stability.

What Steps The Government is Taking

The country’s leadership recognizes that achieving sustainable growth and development hinges on attracting the right kind of foreign direct investment (FDI) – the sort that can catalyze innovation, facilitate valuable technology transfers, and nurture a skilled homegrown workforce.

When it comes to fostering a spirit of innovation, the government isn’t messing around. They’re pumping funds into research programs at public universities and private companies. They’re giving universities and businesses incentives to join forces on projects that take new ideas from the lab into the real world. Startups in hot areas like fintech even get special “regulatory sandboxes” to test out innovative business models.

Crucially, Bangladesh also aims to leverage FDI, and absorbing knowledge from global leaders is key. That’s why they’ve overhauled regulations to make it easier for foreign companies to forge joint ventures and licensing deals with local firms – deals that require sharing proprietary tech and expertise. They’re rolling out the red carpet for multinational corporations to set up regional R&D hubs here. And they’ve made getting work visas a breeze for those foreign engineers, scientists, and managers whose on-the-ground presence can help transfer skills.

Perhaps most impressively, Bangladesh is dead serious about building a workforce fit for the future. The government’s National Skills Development Policy for 2021 reads like a master blueprint for dragging technical and vocational training programs into the 21st century. They’re reshaping curricula to align with industry needs, opening up apprenticeship pipelines from classrooms to companies, and creating seamless pathways for continuous on-the-job upskilling.

Possible Implications

This multi-pronged approach – nurturing innovation, absorbing cutting-edge know-how from abroad, and upskilling the population – positions Bangladesh to compete for the high-quality, high-tech investments that can catalyze its economic transformation. If executed well, these policies could help propel Bangladesh to its goal of becoming an upper-middle-income nation within the decade.

These new “skills councils” with representatives from industries, educators, and the government are ensuring training stays hyper-relevant, especially for booming fields like IT services, engineering and garments. There’s a massive nationwide push to embrace the idea of lifelong learning through expanded professional development schemes.

This multipronged strategy is about way more than just luring companies with tax breaks and cheap labor. The leadership in Dhaka understand that for real, sustainable economic growth, you need the right kind of investment – the type that brings cutting-edge tech and expertise to the table.

That’s why they’re bending over backwards to foster an ecosystem that seamlessly blends innovation, skills, and foreign collaborations. By supporting R&D, nurturing homegrown startups, and making it stupid-easy for global giants to set up facilities that directly transfer knowledge to local partners, Bangladesh is positioning itself as the hottest up-and-comer for high-value, high-tech industries.

And it’s not just about attracting investors – it’s about ensuring their presence actually propels the nation forward. The master plan revolves around embedding advanced technologies into the economic fabric while relentlessly upskilling the workforce through revamped vocational programs, apprenticeships, and a full-throttle commitment to lifelong learning.

Bottom line: Bangladesh means business. This comprehensive playbook is about more than just flashing cash at foreign companies – it’s a calculated bid to transform the nation into a lean, mean, innovation machine packed with skilled talent. By pulling this off over the next decade, Bangladesh could go from an economic underdog to a middle-weight powerhouse slugging it out with the heaviest hitters.

Policies Seem to be having Desired Effects

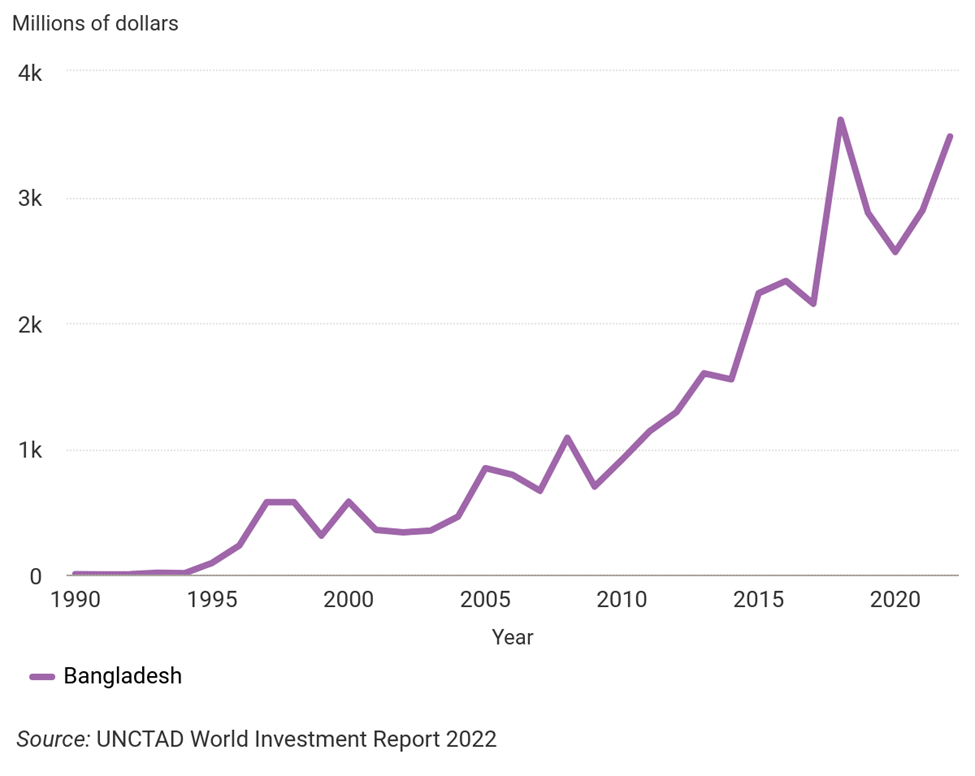

The latest investment numbers seem to validate the government’s policies. According to the World Investment Report 2023 from UNCTAD, foreign direct investment into Bangladesh went into overdrive last year, soaring by a whopping 20.2% to hit $3.48 billion. That’s not just impressive growth – it’s the second-highest annual FDI inflow in the country’s entire history, barely trailing the all-time record of $3.61 billion set back in 2018.

But this isn’t just a one-year fluke. The report reveals Bangladesh’s total accumulated stock of foreign investment now stands at a robust $21.1 billion as of 2022. For a nation so laser-focused on positioning itself as an attractive destination for cutting-edge, sustainable investments, those figures are like a neon-flashing sign that says “We’ve Arrived!”

The UNCTAD analysts give a big kudos to recent policy moves like the Bangladesh Patents Bill 2022 which lengthened patent protections from 16 to 20 years, bringing Bangladesh up to international standards. For innovative companies looking to set up shop, strengthening intellectual property rights creates a way more welcoming environment.

It Should be noted that Bangladesh experienced a significant 36% year-over-year drop in foreign direct investment (FDI) inflows during the third quarter of 2023. This decline can be attributed to two key factors that shook external investors’ confidence – the domestic political unrest by BNP-Jamaat and the ripple effects of the Russia-Ukraine war on the US dollar’s reserve.

The volatile political climate instigated by BNP-Jamaat to destabilize Bangladesh’s elections raised concerns among foreign investors, causing many to adopt a cautious stance. Simultaneously, the global economic fallout from the prolonged conflict between Russia and Ukraine disrupted currency markets, impacting the dollar’s value and further unsettling international firms looking to invest in Bangladesh.

However, it’s important to note that this downturn in FDI is likely temporary. As political stability returns to Bangladesh and the government’s measures to address the dollar crisis take effect, the conditions are expected to normalize rapidly. This will likely restore external investors’ confidence and reverse the declining trend in FDI inflows to the country.

With the right steps being taken to resolve the key issues that spooked foreign investors, Bangladesh can reasonably expect FDI levels to rebound swiftly once the situation stabilizes and the economic environment becomes more conducive for international investment again.

From the Policies and the Results of the FDI surge, it’s a clear signal that Bangladesh’s government isn’t messing around – this is a committed bid to foster an economic engine driven by innovation, disruption, and the latest technologies. Global investors are taking notice and voting with their checkbooks.

But it’s not just about hot tech and patents. Bangladesh also earned props from UNCTAD for taking the lead on sustainability by mandating environmental disclosures like carbon emissions from financial firms and big corporations. Stuff like that is green catnip to the Environment, Social, and Governance (ESG) investment crowd looking to park their cash in ethical, future-focused economies.

Make no mistake, this sustained FDI boom looks very much like the payoff from Bangladesh’s meticulously calculated strategy to revolutionize its economic fabric. By nurturing innovation ecosystems, overhauling skills training, and creating business-friendly policies around IP and sustainability, they’ve laid the foundations to attract exactly the type of high-quality investments that drive long-term growth.

If this momentum keeps building, Bangladesh could go from a rising economy to an economic heavyweight sooner than anyone expected. The global investment community is taking notice and betting big on the nation’s sky-high potential over the next decade and beyond. Buckle up, this is just the start of Bangladesh’s glow-up.