Key Highlights:

- The Chinese government has established a growth target of approximately 5%, as disclosed during the National People’s Congress.

- Contributing 5.8% to national economic growth, the services sector outpaced agricultural and industrial production in 2023.

- China’s economic slowdown is anticipated to lower global oil prices, and deflation within the country is causing a reduction in the prices of exported goods worldwide.

As the second-largest economy with over 1.4 billion people, China grapples with issues like slow growth, high youth unemployment, and instability in its property market. Despite these hurdles, China remains committed to technological progress, aiming for around 5% growth, according to the National People’s Congress.

Premier Li Qiang, in his recent address to parliament, emphasized continuity in economic targets, shying away from expected stimulus measures. The focus is on boosting domestic consumption while addressing issues like industrial excess and local debt.

You Can Also Read: CHINA’S ECONOMY IN 2023: IMPACTS ON GLOBAL ORDER

China’s tech and service sectors show resilience, backed by government support. The services sector, in particular, grew significantly in 2023, contributing 5.8% to the economy, surpassing agriculture and industry. However, challenges persist, including reduced property investment, growing debt risks, and slow consumption growth.

With these issues piling up for Beijing, what significance do they hold for the broader global context?

Debt, Consumer, and Market Woes: The New Normal?

The contraction observed in the property market isn’t a recent development, originating from a series of policy crackdowns starting in late 2020. Notably, the ‘Three Red Lines’ policy was implemented to address significant risks posed by numerous property developers burdened with escalating debt. Beijing has consistently stressed that housing should serve residential purposes rather than speculative investments, reiterating its commitment to managing risks in the housing market.

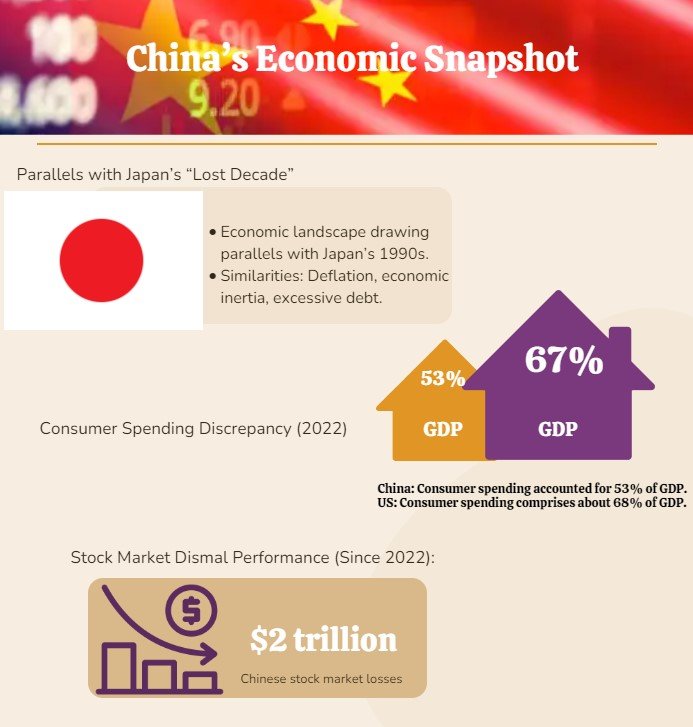

By the close of 2023, China’s accumulated debt had surged to nearly triple its economic output, reaching a historic peak. Some economists draw parallels between China’s current economic landscape and Japan’s “lost decade” in the 1990s, marked by deflation and economic inertia fueled in part by excessive debt.

While most developed economies hinge on consumer spending to propel economic expansion, China diverges from this trend. In 2022, consumer spending accounted for only around 53% of its GDP, contrasting with the US where it comprises about 68%.

Compounding the challenges, the Chinese stock market has witnessed dismal performance since 2022, with losses totaling $2 trillion. Despite maintaining a trade surplus, China faces hurdles in exporting goods as it did previously, with Western nations aiming to lessen their dependence on the Chinese manufacturing sector amid geopolitical tensions with the US and Europe.

China’s Slowdown and Its Global Ramifications

Policymakers are preparing for economic challenges as China’s imports decline across various sectors, ranging from construction materials to electronics. However, amidst the concerns, there are silver linings. China’s economic slowdown is anticipated to lower global oil prices, and deflation within the country is causing a reduction in the prices of exported goods worldwide. This presents an advantage for nations like the US and UK, which are contending with high inflation.

Certain emerging markets, such as India, perceive opportunities in this scenario, aiming to attract foreign investment potentially leaving China. Nevertheless, should the rest of the world, particularly the US and Europe, slide into recession alongside China’s continued weakness, it would pose significant challenges not only for China but for the entire global economy.

Africa and Asia have experienced substantial economic setbacks, with import values decreasing by over 14% during the initial seven months of 2023. This decline can be attributed in part to reduced demand for electronic components from South Korea and Taiwan, while plummeting commodity prices, such as fossil fuels, are also impacting the value of goods shipped to China.

The price of Chinese goods unloaded at US ports has seen a decline each month in 2023, a trend expected to continue until factory prices in China shift into positive territory. Economists at Wells Fargo & Co. estimate that a potential ‘hard landing’ in China—defined as a 12.5% deviation from its trend growth—would result in a 0.7 percentage point reduction in the baseline forecast for US consumer inflation in 2025, down to 1.4%.

Economic Setbacks (Jan – Jul 2023)

Overview:

- Africa and Asia faced significant economic setbacks.

- Import values dropped by over 14% in the first seven months of 2023.

Impact on Chinese Goods in the US:

- Monthly decline in prices of Chinese goods throughout 2023.

- Expected to persist until factory prices in China turn positive.

Potential ‘Hard Landing’ in China:

- Defined as a 12.5% deviation from its trend growth.

US Consumer Inflation Forecast (2025):

- ‘Hard landing’ in China could reduce the baseline forecast for US consumer inflation by 0.7 %.

- Forecasted to decrease to 1.4%.

What is China’s New Economic Plan?

The fresh economic strategy aims to bolster consumer spending by tackling the nation’s demographic hurdles, notably by advocating for increased childbirth to counteract China’s aging populace, which poses a fundamental risk to its economic future. Additionally, the plan encompasses initiatives to lift restrictions on foreign investment in manufacturing and reaffirms the commitment to global competitiveness in pivotal technologies like quantum computing, big data, and AI.

Reforms also involve restructuring local finances, where the majority of the country’s debts are concentrated, along with channeling more funding towards private enterprises and removing barriers to internal migration and land utilization, which have hindered consumer spending. Such reforms would also entail imposing higher taxes on state-owned enterprises, which presently retain most of their profits, and implementing property taxes to support local governments.

The Chinese leadership’s emphasis on rivaling the US reflects ongoing geopolitical tensions. The US and China have been engaged in a protracted trade dispute, and China’s endeavors to boost its manufacturing and innovation sectors constitute a direct challenge to the Western world, potentially escalating economic confrontations.

In the context of global economics, China’s path holds profound implications for the world at large. From the ebbs and flows of its property market to the burgeoning embrace of high-tech innovation, China’s economic pulse resonates far beyond its borders. As the dragon redefines its economic terrain, the world watches with bated breath, knowing that within China’s economic evolution lies the thread that weaves the fabric of our interconnected world.