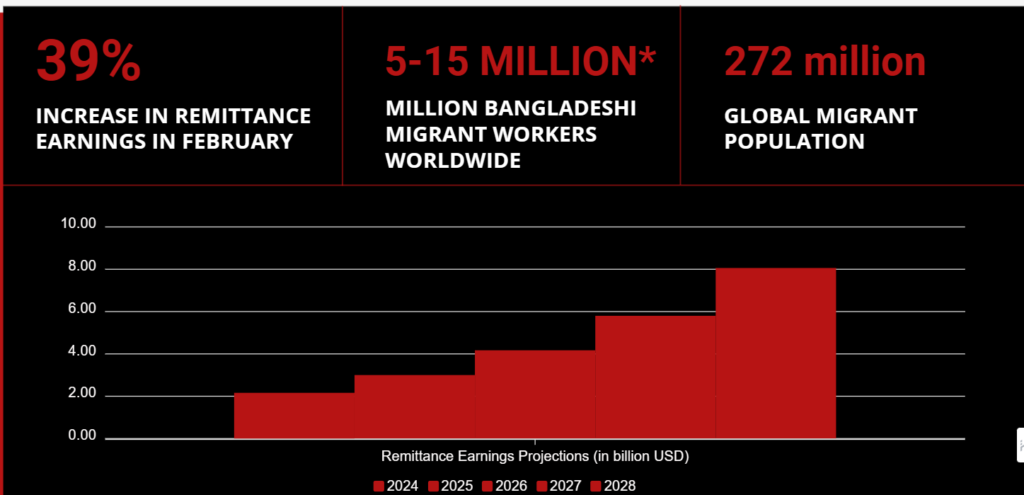

Bangladesh has witnessed a remarkable surge in remittance inflows in recent years. In February 2024, Bangladesh received a record high of $2.16 billion in remittances, up 39 percent from the same month last year, according to the Bangladesh Bank. This was the highest monthly amount in eight months, and the second highest ever after June 2023, when remittances reached $2.19 billion. Remittances are the money sent by migrant workers to their families back home, and they play a vital role in the country’s economy and development.

Why Remittances Matter for Bangladesh

Remittances are a major source of foreign exchange earnings for Bangladesh, second only to the readymade garment (RMG) sector. In the first eight months of the fiscal year 2023-24, remittances amounted to $15.06 billion, up 7.5 percent year-on-year, and accounted for about 10 percent of the gross domestic product (GDP). Remittances help to reduce the country’s current account deficit, increase its foreign exchange reserves, and support its balance of payments.

You can also read: Bangladesh Embraces Fashion Evolution with Non-Cotton Garments

Remittances also have a significant impact on the welfare of millions of households in Bangladesh, especially the poor and the rural. Remittances help to alleviate poverty, improve nutrition, health, and education outcomes, and increase savings and investment. Studies have shown that remittances can reduce the poverty headcount ratio by 1.5 percentage points, increase the per capita income by 2.6 percent, and raise the human development index by 0.06 points. Remittances also enable households to cope with shocks, such as natural disasters, health emergencies, and income losses, and to build resilience for the future.

What Drives the Rise of Remittance Earnings

*BBS and Expatriate Welfare and Foreign Employment Ministry have Conflicting Data Regarding Number of Migrant Workers

Several factors have contributed to the increase in remittance earnings for Bangladesh in recent years. One of them is the growth in the number and income of migrant workers, who are mostly employed in the Middle East, Southeast Asia, and Europe. According to the Bureau of Manpower, Employment and Training, a record 13.05 lakh workers went abroad for jobs in 2023, up 15 percent year-on-year. The demand for migrant workers, especially in the construction, manufacturing, and service sectors, has remained strong despite the COVID-19 pandemic and the global economic slowdown.

Another factor is the improvement in the data collection and reporting of remittance flows, which reflects the greater awareness and recognition of the development potential of remittances by the government and the central bank. The Bangladesh Bank has taken several initiatives to encourage remittance inflows through formal channels, such as offering a 2 percent cash incentive, expanding the network of authorized dealers and money transfer operators, and facilitating online and mobile banking services. These measures have helped to reduce transaction costs, increase convenience, and enhance the security and transparency of remittance transfers.

A third factor is the appreciation of the Russian ruble against the US dollar, which has increased the value of remittances from Russia to Bangladesh in dollar terms. Russia is one of the major sources of remittances for Bangladesh, accounting for about 12 percent of the total inflows in 2023. The ruble has gained strength due to the recovery of oil prices and the easing of geopolitical tensions in the region.

How to Boost Remittance Earnings Further

While remittance earnings have been impressive, there is still room for improvement and optimization. Some of the recommendations to increase remittance earnings are:

Diversify the destinations and skills of migrant workers to reduce the dependence on a few markets and sectors, and to increase the bargaining power and income of workers. This can be done by enhancing the quality and accessibility of pre-departure training, skills certification, and information services, as well as by strengthening bilateral and multilateral agreements and cooperation with host countries.

Promote financial inclusion and literacy among remittance recipients to enable them to access a range of formal financial services, such as savings, credit, insurance, and investment products, and to make informed decisions about their financial management. This can be done by expanding the coverage and outreach of banks and non-bank financial institutions, especially in rural and remote areas, and by providing financial education and awareness programs through various channels and platforms.

Leverage remittances for productive and innovative uses to foster economic growth and development at the household, community, and national levels. This can be done by creating an enabling environment and incentives for remittance-linked entrepreneurship, business development, and social impact initiatives, as well as by facilitating the engagement and contribution of diaspora communities and organizations.

Conclusion

Remittances are a lifeline for millions of families and a catalyst for economic growth and development in Bangladesh. The country has achieved remarkable progress in increasing its remittance earnings in recent years, despite the global headwinds and challenges. However, there is still potential to further enhance and optimize the benefits of remittances for the country and its people. By implementing the above-mentioned recommendations, Bangladesh can harness the full power of remittances to achieve its vision of becoming a developed country by 2041.