The global economic landscape finds itself entangled in a web of crises, spanning inflation, growth, trade, cost of living, housing, energy security, climate change, and deglobalization. A myriad of challenges confront policymakers, painting a daunting picture that seems destined to persist in the years to come.

In the realm of inflation, the scenario is complex. While headline inflation is on the decline in many countries, core inflation—excluding the volatile food and energy prices—has taken an unexpected upward turn. The US, as per the US Bureau of Labour Statistics, witnesses a steady rise in core inflation, reaching 3.9 percent for the 12 months ending in January 2024. This trajectory, holding steady from December 2023, adds a layer of concern to the global economic narrative.

You can also read: ADB’s $500 Million Initiative to Strengthen Bangladesh’s Social Safety Resilience

The German economy, not immune to these challenges, experienced a 0.3 percent year-on-year contraction in 2023. Ruth Brand, Head of the German Federal Statistical Office, attributes this downturn to high inflation, soaring energy prices, and weakened foreign demand. The pervasive high prices across the economic spectrum act as a wet blanket on growth prospects.

IMF Challenges Conventional Wisdom, Pinpoints Profits as Primary Culprit

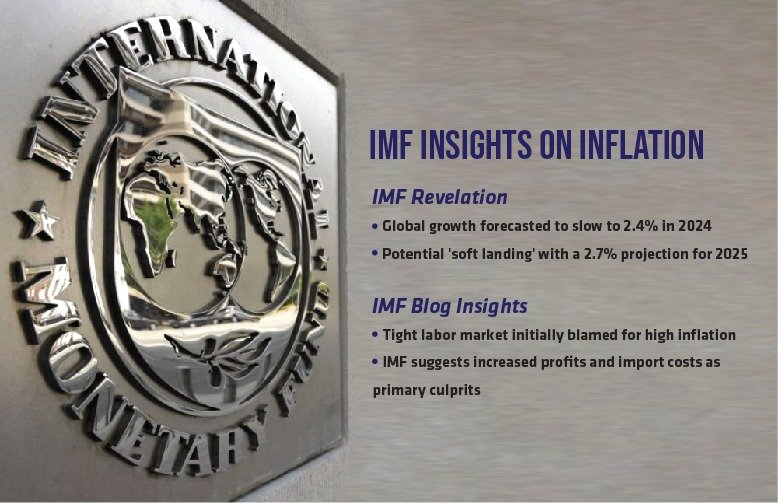

The World Bank’s Global Economic Prospects report presents a sobering outlook, forecasting a global growth slowdown to 2.4% in 2024, signaling forthcoming economic challenges. Despite this decline, a glimmer of hope emerges with a projected uptick to 2.7% in 2025, hinting at a potential ‘soft landing’ scenario.

According to prevailing wisdom echoed by the IMF, the tightening labor market is blamed for persistently high inflation. However, a nuanced perspective from the IMF blog suggests that increased profits and import costs, rather than labor costs, are the primary drivers of escalating prices.

Escalating inflation, a concern since 2022, remains a significant issue globally, impacting both developed and developing economies due to rising food and energy costs. While a global recession may be avoided, Mathias Cormann of the OECD warns of the persistent threat of high inflation.

In the macroeconomic sphere, traditional economic theories fall short of explaining the root causes of inflation. Factors such as escalating food and energy prices, fiscal and monetary policies, non-competitive markets, and rising input costs contribute to inflationary pressures.

Central banks grapple with the challenge of bringing inflation back within target levels despite tightening policy rates. The IMF attributes current inflationary pressures to strains in domestic demand, escalating input costs, and a rising share of profits, posing ongoing challenges for central banks in maintaining tighter monetary policies globally.

Rising Interest Rates and Softening Labor Markets Shape Global Spending Trends

In OECD countries, the unemployment rate is expected to remain at 5.3% throughout 2024, below pre-pandemic levels. However, the continued elevation of interest rates, peaking in 2023, poses challenges for businesses and consumers alike.

High interest rates threaten to restrict access to finance, hinder investments, and increase debt servicing costs. Despite easing inflation, urban consumers proceed cautiously, facing surging mortgage rates and borrowing costs. This strain on household budgets leads to a projected moderation in real per capita urban spending growth to 0.3% in 2024, down from 1.4% in 2023.

Globally, cities like Vancouver, Calgary, and Toronto feel the impact, especially with high household debt levels in Canada. Conversely, emerging urban centers in the Asia Pacific exhibit resilience, driven by robust consumption potential and steady demand-side growth, offering a contrasting narrative amid prevailing uncertainties.

Developing Countries Face Debt Sustainability Concerns with 10% Projections

Adding fuel to the fire, the Red Sea crisis presents a new threat to exacerbate inflation. Disruptions in energy and supply chains have already doubled ocean freight rates from Asia to Europe in the past five weeks. Soaring shipping costs and an uptick in oil prices intensify concerns of a resurgence in global inflationary pressures. The World Bank issues a warning of surging energy prices, heightened inflation, and slower growth, amplifying the risk of disruptions to global trade.

This looming prospect of inflation escalation due to supply chain disruptions is poised to compel central banks to maintain high-interest rates for an extended period beyond current expectations. The combination of elevated interest rates and increased geopolitical and economic uncertainty creates a perfect storm, depressing investment and further weakening overall economic growth.

A growing worry emerges about the continuation of rising interest rates into 2024, potentially triggering delinquency and debt default across various loan categories. The United Nations (UN) and its Department of Economic and Social Affairs (DESA) highlight the challenges faced by developing countries, grappling with high external debt levels and escalating interest rates, hindering access to international capital markets. Debt sustainability has become a critical concern, with a quarter of developing countries projected to experience annual inflation exceeding 10 percent in 2024. Since January 2021, consumer prices in developing nations have surged by a cumulative 21.1 percent.

Geopolitical tensions further add to the uncertainty, with events like the Russia-Ukraine conflict and the Israeli invasion of Gaza potentially driving up oil prices and, consequently, inflation. The OECD Economic Outlook from November 2023 underscores the world economy’s vulnerability to heightened geopolitical tensions, especially in conflicts like the Israel-Hamas war, warning of broader consequences if the conflict were to escalate.

Geopolitical Unrest, from Russia-Ukraine to Red Sea Crisis, Casts Shadows on International Flows

Recent supply disruptions in the Red Sea shipping lane, impacting the Suez Canal, highlight the fragility of global trade. Simultaneously, ongoing tensions between China and the US over Taiwan pose a threat to vital global supply routes through the South China Sea. These developments underscore how swiftly geopolitics can play a decisive role in shaping the global economic landscape, injecting an element of uncertainty into the future outlook.

The specter of food price inflation looms large, intensifying food insecurity and poverty in developing nations. The UN reveals a distressing statistic, indicating that 238 million people faced acute food insecurity in 2023, a rise of 21.6 million from the previous year. The surge in inflation in these regions threatens to exacerbate the already dire food security situation, hindering progress in poverty eradication, particularly in the least developed countries.

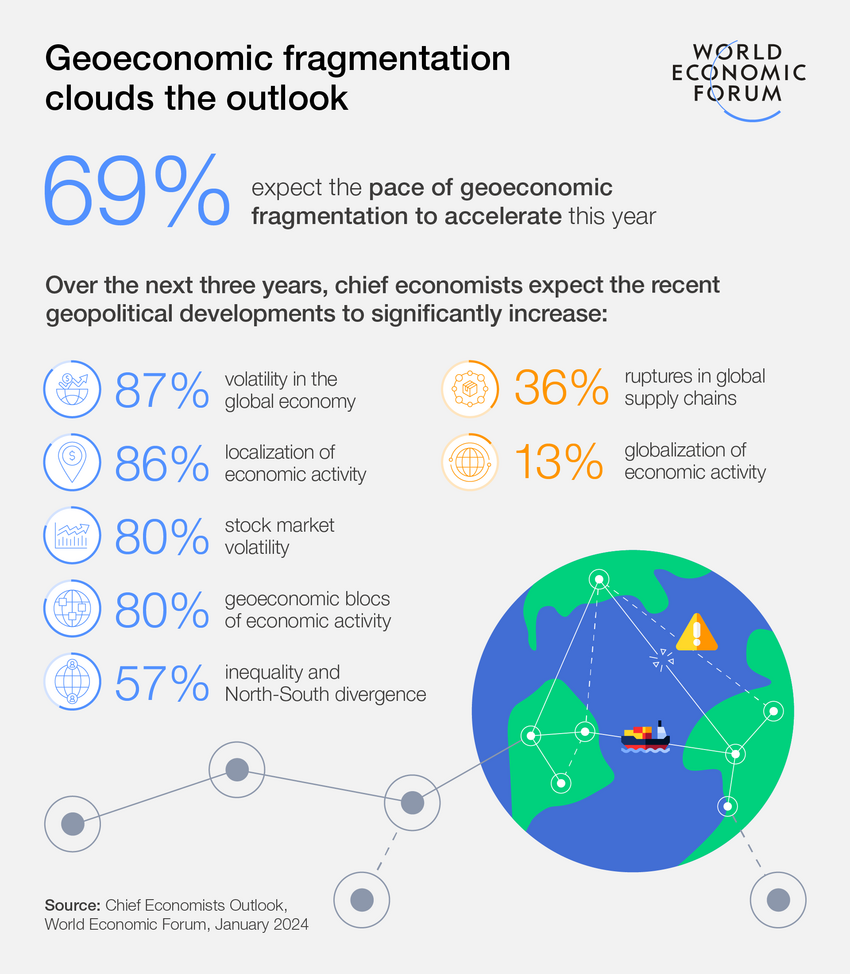

Despite attempts to counter inflation through tightening policy rates, the IMF recommends maintaining elevated real policy rates until there is a definitive reduction in underlying inflation. However, the increasing trend of geo-economic fragmentation poses a significant challenge, profoundly affecting the international flows of goods and services. Escalating conflicts, such as the Russia-Ukraine confrontation, persistent Israeli aggression in Gaza, and the recent Red Sea crisis, threaten to further destabilize energy and food markets, contributing to the fragmentation of the global economy.

UNCTAD presents a bleak outlook, forecasting adverse effects on global trade in 2023 due to geopolitical tensions, ongoing inflation, and reduced global demand. Their projection for 2024 remains uncertain and generally pessimistic.