As Bangladesh continues to explore new avenues for export growth, the successful export of Chinese cabbage serves as a testament to the country’s potential to diversify its export portfolio

In efforts to bolster export revenue, diversifying Bangladesh’s export portfolio with innovative and non-traditional items is imperative for overall national development. Concurrently, it’s crucial to establish targets for accessing new markets while upholding the quality standards of traditional products. A significant milestone was recently achieved in Bangladesh’s export sector, as the country successfully entered a new market by shipping approximately 23,610 kg of Chinese cabbage to Taiwan through the Chattogram port in January 2024. This milestone represents a noteworthy expansion of the country’s export offerings and unlocks promising new opportunities.

Entrepreneurs involved in this initiative are optimistic about the potential it holds. The two consignments of Chinese cabbage, valued at around $5,300, have sparked interest not only in Taiwan but also in other countries in the region such as Vietnam, South Korea, and Malaysia. This move diversifies Bangladesh’s agricultural export portfolio, complementing the previous exports of various cabbage varieties to Malaysia and Singapore. According to the Chattogram Customs House, Bangladesh exports around 2,000 to 4,000 tonnes of cabbage annually. The highest volume recorded was 4,737 tonnes in the fiscal year 2021-22, with prices exceeding Tk44 per kg.

Recently, cabbage prices have nearly halved. In fiscal year 2022-23, the average export price of cabbage exceeded Tk20 per kg.

Stagnation in Export Basket Growth

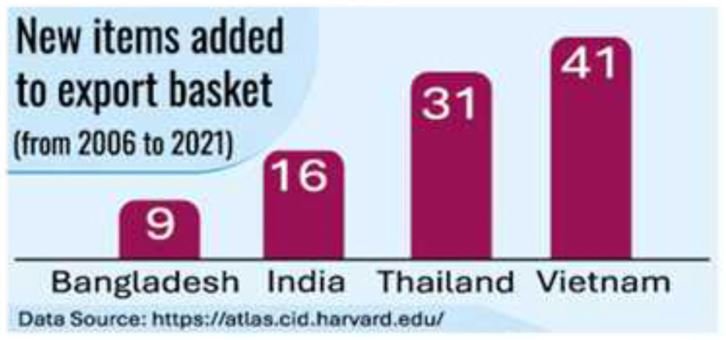

However, Bangladesh’s export portfolio has experienced limited growth compared to neighboring nations such as Vietnam, India, and Thailand. While Bangladesh has introduced just nine additional products into its export repertoire since 2006, Vietnam boasts an impressive count of 41, India 16, and Thailand 31. This discrepancy raises concerns about Bangladesh’s readiness for post-Least Developed Country (LDC) status, which it will attain in November 2026.

Professor Selim Raihan, Executive Director of Sanem and Economics Professor at Dhaka University, presented data indicating that while Bangladesh earns approximately $823 million per year from these newly added products, Vietnam generates a staggering $145 billion annually. These figures highlight the vast disparity in export performance between Bangladesh and its regional counterparts.

At a recent seminar organized by the Dhaka Chamber of Commerce and Industry (DCCI), Raihan discussed the necessity for export diversification to address the challenges and seize the potential benefits arising from LDC graduation.

“Export diversification is key to addressing these challenges and exploiting their potential. Therefore, there is a need to reform various business investment policies so that new products can be exported from the country.”

– Professor Selim Raihan

Addressing Policy Reforms

Raihan emphasizes the importance of reforming business investment policies to enable the export of new products from the country. As Bangladesh gears up to graduate from the least developed country bloc in November 2026, policy adjustments become imperative to enhance export readiness. This sentiment was echoed at a seminar organized by the Dhaka Chamber of Commerce and Industry (DCCI), where stakeholders discussed the challenges and opportunities post-graduation.

Overcoming Hurdles

The primary obstacles to export diversification include:

- Uncertainty regarding raw material sourcing: High prices and inconsistent availability pose risks to business expansion

- Complex customs and trade regulations: These create barriers to entry for new exporters

- Poor access to ports: Inefficient port facilities limit the competitive edge of Bangladeshi exports

- Tax system complexity: The current system is too cumbersome, making it difficult for businesses to comply

- High import duties: Higher than competing nations, these discourage diversification into new products

- Currency exchange rate issues: An unstable exchange rate makes export planning challenging

- Financing constraints: High interest rates and limited access to credit hamper the growth of new enterprises

- Low worker productivity: Insufficient skills training contributes to low productivity levels

A Call for Comprehensive Solutions

Professor Raihan recommended several actions to overcome these challenges:

- Reduce import duties to encourage diversification

- Simplify the tax system and increase transparency

- Adopt a market-based exchange rate regime

- Improve the logistics sector, especially customs clearance and transportation infrastructure

- Increase investments in education and health to develop workforce skills

- Attract foreign direct investment and establish favorable foreign exchange rates

- Foster Private Sector Engagement in Policy Formulation

These recommendations align with the broader objective of enhancing Bangladesh’s overall competitiveness while preparing for its imminent graduation from Least Developed Country status.

Focus Areas for Future Exports

To maximize the benefits of policy shifts, DCCI Senior Vice President Malik Talha Ismail Bari suggests concentrating efforts on bolstering exports within the Fast Moving Consumer Goods, Plastic Products, Light Engineering, Halal Products, and Information Technology sectors.

By embracing these strategic initiatives, Bangladesh will position itself more advantageously to navigate the evolving dynamics of international commerce and secure its rightful place amidst the world’s most dynamic economies.

Private Sector Engagement and Future Outlook

Engagement with the private sector is vital in formulating and implementing effective policies. Stakeholders underscore the importance of continuity and stability in policy frameworks to avoid disruptions that could harm industries. As Bangladesh prepares for its post-LDC transition, there’s a consensus on focusing efforts on increasing exports across various sectors such as fast-moving consumer goods, plastic products, light engineering, halal products, and IT.

Conclusion

The export of Chinese cabbage signifies a step forward for Bangladesh’s export sector, but sustained growth and diversification require concerted efforts and policy reforms. By addressing existing challenges, enhancing policy frameworks, and fostering collaboration between the public and private sectors, Bangladesh can unlock its export potential, contribute to economic growth, and position itself as a competitive player in the global market.