Key highlights:

- IMF predicts 2.9% global growth in 2024

- MEI forecasts Bangladesh’s consumer price inflation to dip to 7.3%

- Government’s IMF loan negotiations success and two installments disbursement are significant achievements

- 2023 peaks in infrastructure development with major project completions

- In the last 22 days of December, Bangladeshi expatriates sent a total of $1.5694 billion through legal channels, averaging a daily influx of $713.4 million

As Bangladesh ushers in a new year, the nation stands at a critical juncture, marked not only by the turn of the calendar but also by the recent echoes of democratic expression through a pivotal election. With the political landscape settling, all eyes now turn to the economic horizon, questioning what Lies Beneath 2024’s Economic Surface.

The recent democratic exercise has set the stage for a myriad of possibilities and challenges, leaving both policymakers and citizens to ponder the trajectory of Bangladesh’s economic future.

On a global scale, insistent uncertainties are expected to persist, exerting an impact on overall growth. The International Monetary Fund (IMF) forecasts a 2.9 percent global growth rate for the year 2024. The government aims for a robust 7.5% GDP growth in FY24, but the IMF projects a 6% growth, and the World Bank estimates 5.6%.

Inflation’s Retreat and GDP’s Ascent

According to The Mastercard Economics Institute (MEI), Bangladesh is projected to experience a decline in consumer price inflation to 7.3 percent, accompanied by an anticipated increase in the country’s real gross domestic product (GDP) to 6.3 percent year-on-year in 2024.

Expert Opinion

Lecturer Department of Economics,

Noakhali Science and Technology University.

Basically, zero inflation is not good for the growth of the economy while higher inflation also is harmful. Specially, poor and middle income people suffer most for the high inflation. Therefore, it is required to keep inflation within moderate range. In 2024, if Bangladesh wants to control the inflation, first it needs to find out whether the inflation is demand pull or cost push. If it is demand pull inflation then reducing government expenditure or increasing tax can be taken as fiscal policy. However, as such a growing country it will be very difficult to cut govt expenditure. Therefore, government can prioritize its expenditure sector and cut the expenditures which have lower importances right now. Again, as increasing tax creates unstability among general people, govt can impose progressive tax. On the other hand, if the inflation is decoded as supply push inflation, then government can emphisze on policies like imposing highest price bar of utilities, increasing domestic production and imports. Therefore, decoding the actual types of inflation is utmost necessary to control it in 2024.

The institute anticipates that central banks worldwide will embark on a partial normalization of monetary policies in 2024, given the easing inflation expectations in economies and a somewhat tempered economic growth outlook. MEI foresees a likelihood of monetary easing in 2024, with central banks either at or near peak rates, driven by the cooling of inflation and a subdued growth environment.

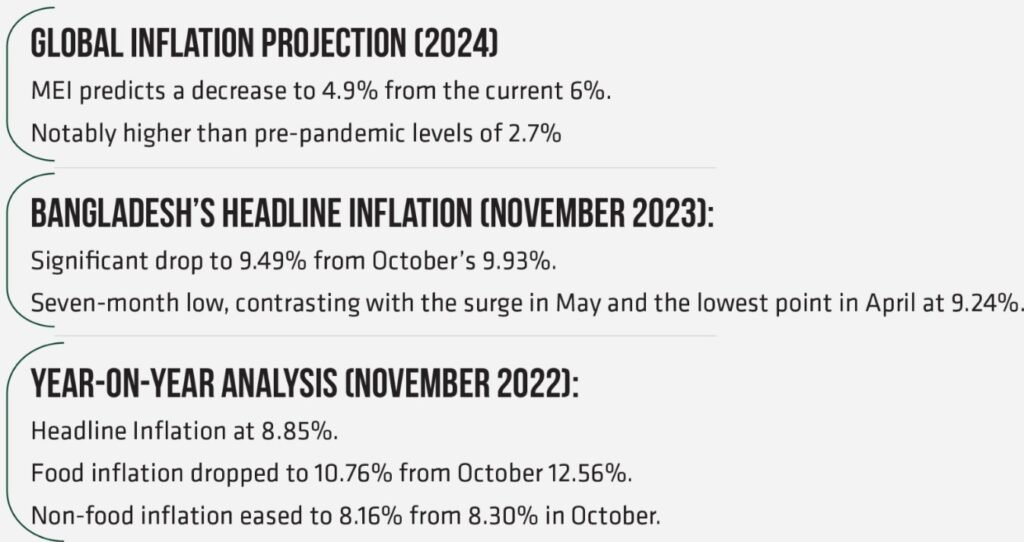

In 2024, MEI predicts a decrease in global inflation to 4.9%, down from this year’s 6% and significantly higher than the pre-pandemic level of 2.7%.

The Bangladesh Bureau of Statistics (BBS) reports a significant drop in headline inflation to 9.49% in November, marking a notable decline from the previous month’s 9.93%. This seven-month low contrasts with the surge recorded in May, following the lowest point in April at 9.24%.

In a year-on-year analysis, November 2022 saw a headline inflation rate of 8.85%, according to BBS data. Both food and non-food inflation witnessed a decrease in November, with food inflation dropping to 10.76% from the previous month’s 12.56%, and non-food inflation easing to 8.16% from 8.30% in October.

Capping Off a Year of Economic Achievements in Bangladesh

Despite exposing some vulnerabilities in the economy, the government’s successful completion of loan negotiations with the IMF and the subsequent disbursement of two installments can be viewed as a significant accomplishment. This not only aids in managing the balance of payments crisis but also compels the government to implement long-overdue reforms.

In the realm of infrastructure development, 2023 marked a pinnacle for the country as numerous major projects reached completion. The eagerly awaited Dhaka Elevated Expressway, operational since September, now provides an alternate route to and from the bustling airport road in the capital city.

The inauguration of the 82-kilometre rail line from Dhaka to Bhanga via the Padma Bridge has ushered in a new era of cost-effective rail connectivity in the southwestern region.

October saw the unveiling of the country’s first tunnel, named after Bangabandhu Sheikh Mujibur Rahman, beneath the Karnaphuli River. Additionally, the newly inaugurated terminal at Hazrat Shahjalal International Airport and Cox’s Bazar rail station are poised to enhance overall connectivity.

Over the past 22 days in December, Bangladeshi expatriates have funneled remittances into the country through legal and banking channels, accumulating a total of $1.5694 billion with a daily average influx of $713.4 million.

A comprehensive analysis reveals that, during these 22 days, national banks received $1.3852 billion, with a specific bank handling $547.2 million. Simultaneously, private banks contributed $1.371 billion, while foreign banks facilitated the transfer of $430.3 million in remittances.

Policy Reforms to Turbocharge the Economy

Achieving success in inflation control hinges on the effective implementation of a sound monetary policy, bolstering fiscal measures, and the coordinated oversight of domestic markets to counteract anti-competitive practices. The alleviation of macroeconomic strain in 2024 could be facilitated by an upswing in export and remittance growth.

Additionally, the ability to attract more remittance through formal channels relies on the adoption of an appropriate market-based exchange rate policy and the proficient regulation of hundi business.

Establishing an independent and influential central bank, free from political influence, is essential to reinstating discipline within the banking sector. All pivotal policy documents underscore the urgency of reforming crucial economic sectors such as taxation, banking, capital markets, and export diversification, alongside an increase in public spending on social sectors.

Simultaneously, the government must address structural challenges by enhancing the efficiency of institutions like the National Board of Revenue, the Bangladesh Bank, the Securities and Exchange Commission, the Anti-Corruption Commission, and other regulatory bodies critical to the Bangladesh economy.

Saying goodbye to the hurdles of the past, Bangladesh eagerly greets the opportunities on the horizon, positioning itself to adeptly intertwine the economic threads of 2024. Armed with resilience, foresight, and a steadfast commitment, the nation aims to uncover the latent potential beneath the surface.