Prior to the 12th national parliament election, the Bangladesh Awami League released its manifesto. Intending to create a smart Bangladesh, the ruling party has set 11 issues as priorities. First and foremost, every effort should be made to maintain the affordability of basic goods for everybody. The article explores if maintaining the price of goods within the purchasing power can solve the first problem. Given the macroeconomic strength of the Bangladesh economy over the past decade, as indicated by the statistics available, a rapid drop in the price level is anticipated, provided that monetary policy is appropriately implemented, and financial market discipline is restored.

You can also read: A Timely Manifesto to Build a Developed and Smart Bangladesh

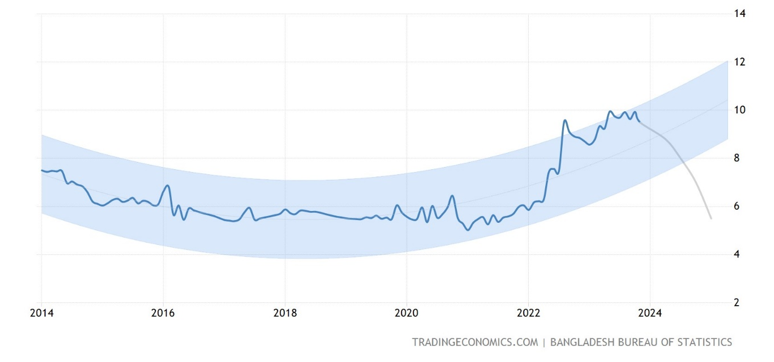

Based on the data presented in Figure 1, Bangladesh has had very low inflation, with an average annual rate of 6 percent from 2014 to 2021. It was made feasible by the monetary policy that was in place at the time. The money market held steady throughout COVID-19. However, the inflation rate began to rise in 2022 as a result of the Russian-Ukrainian War related global economic slowdown and volatility in the foreign exchange market. Despite remaining steady at 8 to 9 percent in 2023, a steep decrease is anticipated starting in 2024.

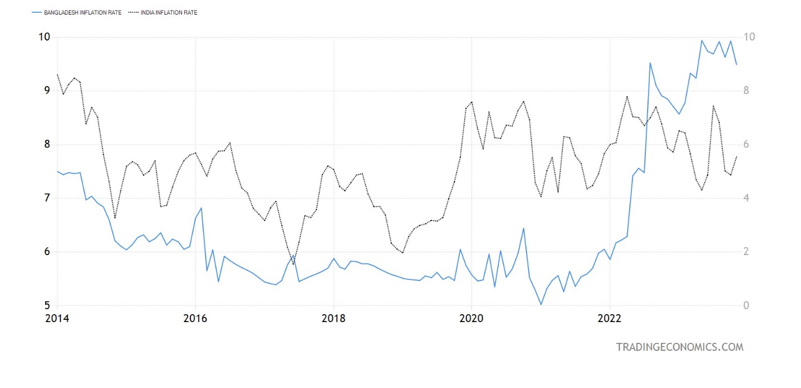

Figure 2 illustrates that between 2014 and March 2023, Bangladesh’s inflation rate was less than India’s. Despite the fact that the difference between the two rates has lately begun to narrow marginally, the situation changes starting in April 2023.

In order to control inflation, Bangladesh Bank (BB), the nation’s central bank, has already appropriately implemented a “contractionary” monetary policy stance for the months of July through December 2023. Some estimates suggest that the entire impact of monetary policy takes one to two years. There is a lot of ambiguity surrounding these numbers, too, because the economy is dynamic and susceptible to changes in circumstances. Because of the monetary authority’s subsequent actions, we believe that the inflation rate will drop significantly. We are excited about the operational facets of it.

- The policy rate is raised by the BB. The policy rate, often known as the repo rate, is raised from 6.0 percent to 6.5 percent by 50 basis points. Effective July 1, 2023, the Standing Deposit Facility (SDF) will see an increase of 25 basis points, from 4.25 percent to 4.50 percent. It is thought that this move will increase borrowing costs, which could minimize its influence on the inflation of the consumer price index (CPI).

- The lending-rate cap that was previously in place would be replaced with a market-driven reference lending rate for all bank loan categories, according to the BB. The purpose of this action is to improve lending conditions for both consumers and businesses, as well as to increase competition in the banking industry. In actuality, banks will be subject to SMART (the six-month moving average rate of Treasury bill) plus a margin of up to 3.00 percent, while non-bank financial institutions (NBFIs) will be subject to SMART plus a margin of up to 5.00 percent. To pay the costs of supervision, lending operations for consumer loans and CMSMEs (Cottage, Micro, Small, and Medium Enterprises) may be subject to an additional fee of up to 1.00 percent.

- The Monetary Policy Statements (MP) provide predictions for money and credit. The broad money target has been lowered to 9.5 percent until December 2023, which is 1.0 percentage points less than the estimate from June 2023.

- The objective for domestic credit has been set at 16.9 percent, which is 0.5 percentage points higher than the estimate from June 2023.

- The assumed credit to the public sector is 43 percent, which is 3.0 percentage points more than the estimate from June 2023.

- The credit to the private sector is now 10.9 percent, which is 0.1 percentage points less than the estimate from June 2023.

The economy’s two main problems, the fastest-depleting foreign exchange reserves, and exchange rate volatility must also be our main priorities. The recent increase in prices in Bangladesh is largely due to the loss in foreign currency reserves. Bangladesh’s diminishing remittance inflow, substantial reliance on imported gas and oil, and negative export-import balance have all contributed to the country’s declining foreign exchange reserves since 2022. The value of the taka relative to the dollar declines when the foreign exchange reserve in dollars is insufficient. To reduce excessive inflation, the foreign exchange reserve situation must be improved.

The following policy plans are recommended in order to boost the foreign exchange reserve and lower the level of prices: Encourage migrant workers to send their money home through authorized channels. Ensure that only funds entered the country lawfully through approved remittance methods are eligible for financial incentives. Allow expatriate White employees to invest in their home country. Expand investment opportunities for White expatriates and Blue laborers in the bond and real estate markets; Diversification of exports; the government may also borrow money by issuing FDRs, or fixed deposit receipts, or short-term bonds; Reduce the amount of government spending that is dependent on foreign exchange; Limit the import of luxuries; Recognize the remittance warrior in airports; Ensure that no Bangladeshi citizen can hold two citizenships; and implement the policy of a pension fund for laborers employed abroad.

The government should continue to subsidize farmers and exporters in addition to these policy initiatives in order to minimize production costs and decrease the competitiveness of exports.