Key highlights:

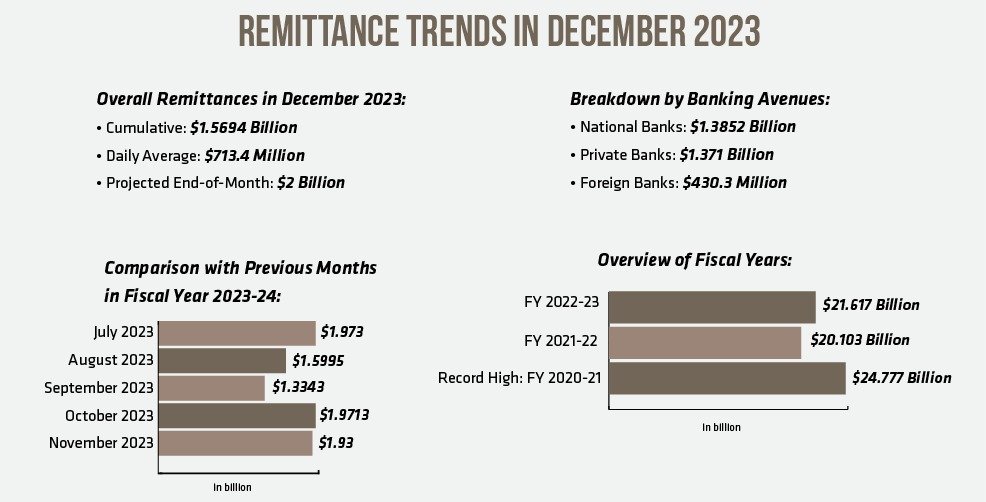

- The daily average influx of remittance in Bangladesh stands at $713.4 million

- A detailed analysis reveals that, within these 22 days, national banks have received $1.3852 billion, with a specific bank handling $547.2 million

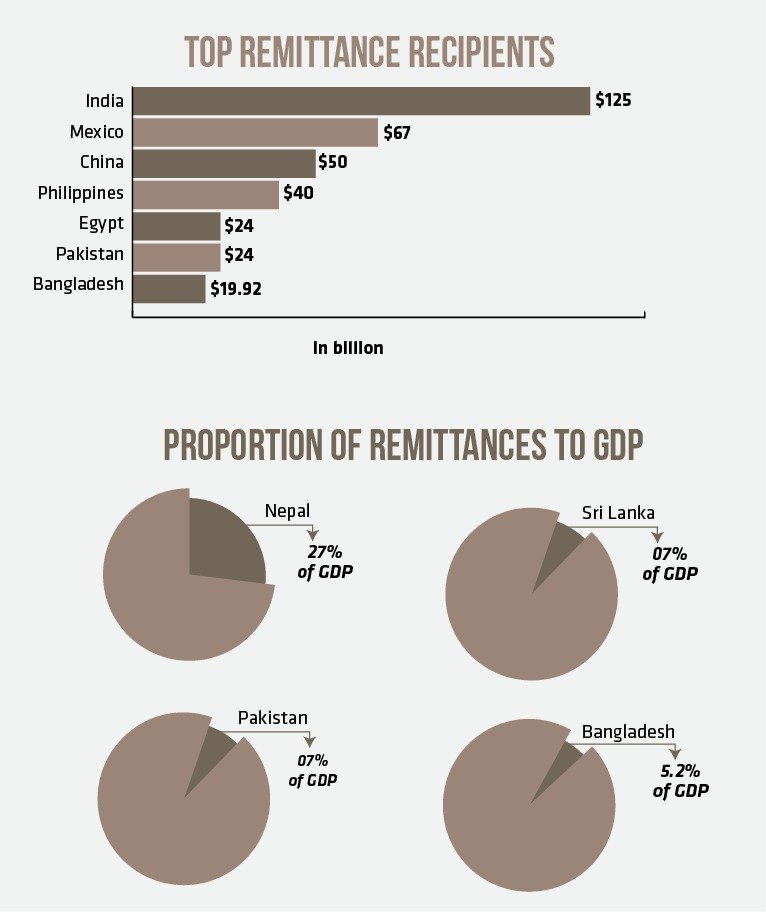

- According to the World Bank report, Bangladesh is the 7th largest remittance recipient in the world

Bangladesh experiences a profound transformation in economic development due to the substantial impact of remittances. Families utilize the financial support to invest in education and skill-building, culminating in an increasingly educated and skilled labor force, thereby fostering human capital development in the nation.

You can also read: Remittance Inflow High Trends in Bangladesh

Over the last 22 days in December, Bangladeshi expatriates have channeled remittances into the country through both legal and banking avenues, resulting in a cumulative sum of $1.5694 billion. The daily average influx stands at $713.4 million. Should this pattern persist? Remittances from expatriates are poised to surpass the $2 billion mark by the month’s end.

A detailed analysis reveals that, within these 22 days, national banks have received $1.3852 billion, with a specific bank handling $547.2 million. Concurrently, private banks have contributed $1.371 billion, while foreign banks have facilitated the transfer of $430.3 million in remittances.

In the inaugural month of the fiscal year 2023-24, July witnessed remittances amounting to $1.973 billion. Subsequent months saw figures of $1.5995 billion in August, $1.3343 billion in September, $1.9713 billion in October, and $1.93 billion in November. The total remittances for the fiscal year 2022-23 amounted to $21.617 billion, surpassing the previous fiscal year’s total of $20.103 billion. Notably, the fiscal year 2020-21 holds the record for the highest remittances in the country’s history, reaching an unprecedented $24.777 billion.

World Bank Reveals Global Remittance Giants in 2023

According to the World Bank report, Bangladesh is the 7th largest remittance recipient in the world. The highest remittance-receiving countries in 2023 are India, taking the lead with an estimated total of $125 billion, followed by Mexico with $67 billion, China with $50 billion, and the Philippines with $40 billion. Egypt and Pakistan both stand at $24 billion each.

Nepal maintained its position with the highest proportion of remittances relative to gross domestic product (GDP) in South Asia at 27 percent. In contrast, Sri Lanka and Pakistan saw remittances accounting for approximately 7 percent of their GDP, while Bangladesh recorded 5.2 percent in 2023.

In Sri Lanka, the inflow of remittances witnessed growth this year following the restoration of macroeconomic stability, with migrants showing a positive response and contributing to an uptick in remittances due to the effects of an IMF-supported program. Bouncing back from a consistent and sharp downturn over the past two years, remittance inflows to Sri Lanka are projected to climb steadily, reaching $6 billion in 2024.

However, the utilization of devaluation and exchange rate control strategies has prompted migrants in Bangladesh, Pakistan, and Sri Lanka to exploit black-market premiums, facilitating the transfer of funds through both informal and formal channels, according to the report.

Bangladesh Government’s Anti-Hundi Drive

In 2021, the government introduced a 2 percent incentive for legal remittances via channels like banks, but Bangladesh Bank emphasized concerns related to Hundi transactions. Despite the incentive, Hundi continued to dominate almost half of the remittance market. In the face of the ongoing global COVID-19 pandemic, remittances stood at $24.77 billion for the fiscal year 2020-21 and $21.3 billion for 2021-22. Furthermore, during the initial half of the current fiscal year 2022-23, remittances amounted to 10.492 billion US dollars.

Expert Opinion

Lecturer Department of Economics

Noakhali Science and Technology University.

Governments initiative to provide 5% incentive along with a fixed exchange rate has reduced the gap between the gains from formal and informal channel. This, as an immediate effect, made the expatriates attracted to formal channel. People who are not habituated to banking sector can now get access to formal channel more easily since mobile banking has been used in this purpose. Besides, the policy to ease the procedural steps, made it easy to adopt the formal channel and its scope became more open to very general people.

Remarkably, the lockdown resulted in a surge in remittance flows across various sectors, including the informal economy, over the last two years of the pandemic. It is worth mentioning that expatriates increased their financial support to family members amid the prevailing family crises. Additionally, the imposition of travel restrictions played a significant role in the heightened utilization of formal remittance channels.

How Neighboring Countries Confront Illegal Channels?

Nepal relies significantly on remittances to fuel its GDP. The availability of a legitimate avenue, from an agent’s perspective, extends ubiquitously in the absence of banking facilities, much like the widespread presence of mobile top-up points. It can be found even in the remotest corners of the mountainous landscape.

To collect the funds, the recipient merely has to present a photocopy of their national identity card or passport. Likewise, the sender has the option to transfer funds instantly using their smartphone. Connecting with and mobilizing migrant workers through legal channels necessitates both prompt action and a diverse range of options, along with enhanced accessibility.

Within the dynamic environment of global remittances, Bangladesh stands as a clear illustration of the transformative force carried by these financial flows. It not only guides the nation’s economic path but also plays a crucial role in shaping policies and initiatives that effectively address the intricate challenges within the remittance landscape.