In a noteworthy move to combat rising inflation, Bangladesh Bank has taken a decisive step by increasing the policy interest rate by 75 percentage points, marking the highest hike in a decade. This strategic intervention aims to curtail inflation by tightening the money supply and elevating the cost of borrowing, aligning with international practices undertaken by central banks globally.

Timely Intervention In The Face Of Escalating Inflation

You can also read: Bangladesh Bank makes bold move by redefining forex forward

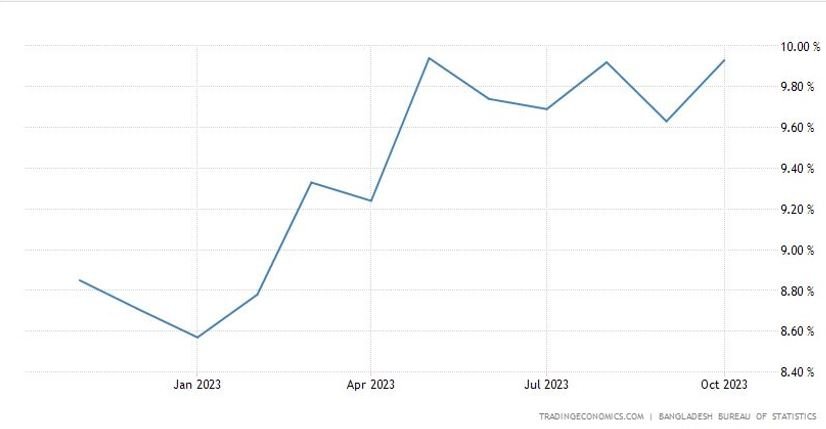

The decision to raise the policy interest rate for the second time in three months showcases the government’s commitment to addressing the growing inflationary pressures. In May 2022, inflation stood below 6 percent, only to surge past 8 percent by May of the following year. The consumer price index (CPI) has also gone up, from 118.83 points to 120.24 points. This proactive approach mirrors the efforts of other global economies, such as the U.S. and India, which have also resorted to interest rate hikes to rein in inflation.

IMF’s Perspective And Bangladesh’s Response

The IMF emphasizes the importance of aligning currency exchange rates with market demand and setting loan interest rates at sufficiently high levels. In response to these concerns, Bangladesh Bank officials are engaging with the IMF to address the issues raised and ensure a more effective implementation of the policy. The government’s responsiveness to IMF recommendations underscores a commitment to refining and enhancing monetary policies for optimal results.

The recent policy interest rate hike, also known as the repo rate, is anticipated to have a multifaceted impact on the economy. By raising the cost of borrowing from the central bank to commercial banks, it is poised to elevate interest rates on loans. This cascading effect is expected to decrease credit demand, contributing to a reduction in inflationary pressures.

According to an IMF study on Central Asian countries, a one-percentage-point increase in policy interest rates tends to correspond with a 0.5 percent decrease in inflation within the first year. The study also suggests a similar impact on inflation if the exchange rate of the currency increases by 1 percentage point.

Bangladesh Bank’s Delicate Balancing Act

Despite acknowledging the potential benefits of interest rate hikes in controlling inflation, Bangladesh Bank is cautious about the impact on private investment and imports. Balancing the need for inflation control with sustaining economic growth remains a top priority. Recognizing the delicate balance required between inflation control and sustaining economic growth indicates a nuanced and comprehensive approach by Bangladesh Bank.

Bankers express concerns about the potential impact of increased interest rates on liquidity, especially if private sector credit growth falls below the required threshold for achieving GDP growth targets. Striking a delicate balance between interest rates and credit availability is crucial for sustaining economic momentum.

Striking A Balance For Sustainable Growth

As Bangladesh Bank navigates the complexities of monetary policy, there is a consensus among experts that a delicate balance must be maintained. While the current strategy aims to curb inflation, ongoing dialogue with the IMF and consideration of expert opinions highlight the importance of refining and adapting policies to the evolving economic landscape. As the nation strives for a resilient and robust economy, strategic policy interventions, even in the face of challenges, position Bangladesh for sustained growth and stability.

Further Steps Can Be Taken

While the Bangladesh Bank has taken a prudent monetary approach to combat the rising inflation rates; more can be done to further reduce inflation further. An expansion of the tax net and a reduction in tax avoidance can also contribute to net inflation reduction. At present, the tax structure is more reliant on indirect taxiing. This creates a disproportionate pressure on people with lower incomes.

Indirect taxes, such as VAT, are applied uniformly on goods and services irrespective of a person’s income. Since lower-income individuals spend a higher portion of their earnings on basic necessities, they end up paying a larger portion of their income in indirect taxes. The government could, therefore, also consider lowering indirect taxes on some crucial food items in order to ease the pressure on lower-income individuals as well as combating inflation.

Curbing Hundi Activities

Remittance Data

- Total Remittance earnings (2023):$26.61 billion.

- Approximate loss from Hundi: $7.8 billion

Hundi has been the Bangladesh government’s bane for a long, long time. It has not only deprived the government of crucial remittance earnings but also created an unmonitored, illegal market that the government has no control over. It was estimated by the CID that hundi activities cost the nation $7.8 billion in remittance earnings. In a time when the nation’s foreign reserve is under pressure, hundi is of particular threat. It claws away at the remittance earnings that could bolster the national reserve and increase the stress on import restrictions.

Proactive measures to combat and reduce hundi, as well as measures to make formal channels of sending remittance more friendly, can go a long way to increasing foreign currency reserves. An increase in reserves would lead to reduced stress in imports, which would loosen import restrictions and make more goods available inside the country, thus working towards reducing inflation.

A Forward-looking Approach

Bangladesh’s recent policy interest rate hike signifies a forward-looking approach to addressing the pressing issue of inflation. While challenges and differing perspectives exist, the government’s commitment to engaging with international institutions and experts underscores a commitment to finding effective solutions.

As the nation charts its course for economic stability, the strategic balance in policy implementation remains pivotal for a flourishing and resilient Bangladesh. More can be done, however, and the sincerity with which the government has implemented the interest rate hike should be mirrored in other policies to further combat inflation.