The future of BRI in Bangladesh hinges on fostering deeper ties, ensuring transparent practices, and capitalizing on the strategic advantages these projects offer

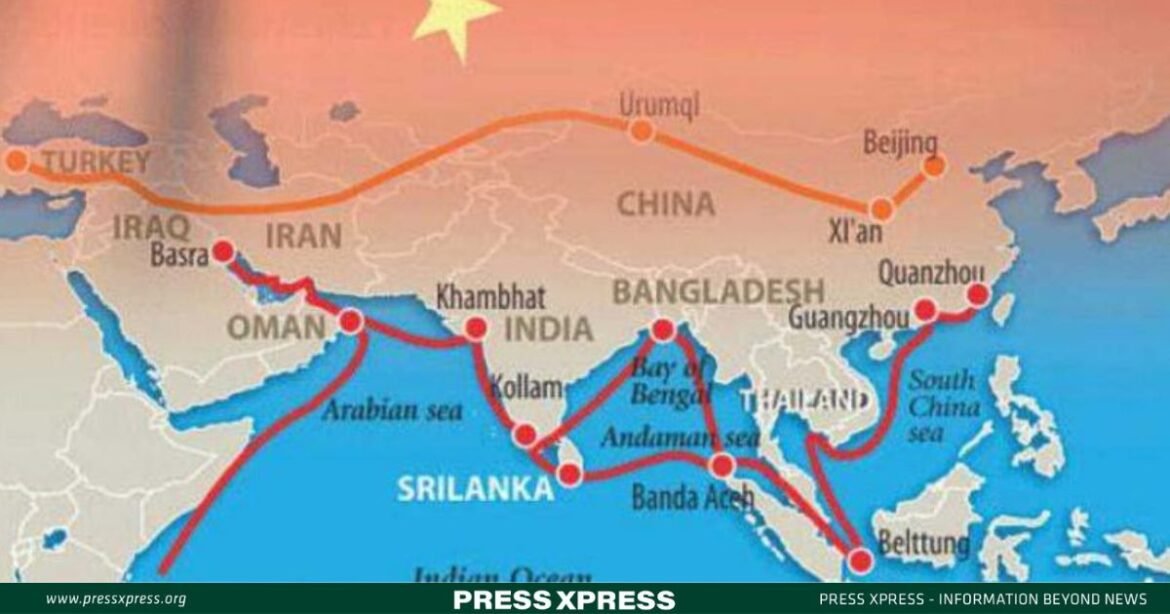

China’s Belt and Road Initiative (BRI) has stood as a monumental force in catalyzing infrastructure development, particularly within the emerging economies. In September 2013, China’s President Xi announced the One Belt and One Road Initiative (OBOR), which later turn into titled as the BRI. This year (2023) marks the 10th anniversary of this initiative that continues to be implemented across the world raising a multitude of discourses, both critical and positive, centered around it.

Global Initiative Under Scrutiny

The BRI stands out as a globally ambitious and contentious development initiative. With a colossal investment exceeding USD one trillion, a substantial segment earmarked for traditional infrastructure like roads, railways, and energy, it plays a pivotal role in driving the growth agendas of emerging economies. Presently, 148 nations have entered into memorandums of understanding (MoUs) with China concerning the BRI, signifying their commitment to its five pillars, encompassing investment, trade, and ‘people-to-people’ exchanges. Despite Italy’s recent decision to withdraw from the BRI, steadfast support persists across Asia, Africa, and significant parts of Latin America. Projections by the Organisation for Economic Co-operation and Development (OECD) suggest a potential infusion of $1 trillion in funding globally from 2017 to 2027 through the BRI, while the World Bank’s estimates highlight an investment of approximately $575 billion, inclusive of energy projects, between 2013 and 2018. Although lauded by African nations, the initiative faces allegations from countries like India and the US, accusing China of practicing ‘debt trap diplomacy’ aimed at acquiring assets when countries fail to repay their loans. This discourse resonates within Bangladesh as well, reflecting the global debate surrounding the BRI’s impacts and implications.

You can also read: Bangladesh’s Vision 2041: Paving the Way at ’60th Investment Fair’

Centre For Alternatives Debunks ‘debt Trap’ In BRI Narrative

In ongoing discussions among various organizations in Bangladesh regarding the merits and drawbacks of the BRI, the Centre for Alternatives recently convened an event addressing the issue of a ‘debt trap’ in-depth. The term itself, ‘debt trap,’ appears to have been politically coined, possibly originating from Indian or US origins. The focus often falls on Sri Lanka (SL) as a prime example of this ‘debt trap’ associated with China, amplified extensively by the media. However, a comprehensive and impartial analysis reveals a more complex scenario surrounding SL’s heavy foreign debt burden. The majority of this burden originated from international capital market borrowing, primarily directed toward post-civil war infrastructure development. This borrowing accounted for nearly 47% of Sri Lanka’s foreign debt, with additional contributions from institutions like the World Bank and Asian Development Bank totaling around 69%. Internal policies, particularly in agriculture, exacerbated Sri Lanka’s situation, contrary to China bearing sole responsibility as portrayed. Despite this, the funding mechanism of BRI projects does not inherently resemble a ‘debt trap.’ While mismanagement by policymakers and implementers could pose financial challenges in the future, the core structure of BRI funding doesn’t inherently promote instability.

BRI Pillars Foster Stability Amid Challenges

- The foundational pillars of the BRI—

- policy coordination

- connectivity

- trade facilitation

- financial integration

- people-to-people exchanges

Navigating Chinese Investments And BRI Dynamics

In Bangladesh, a surge of Chinese investments and forthcoming commitments has significantly bolstered economic growth. Contributions from not only China but also the US, South Korea, Russia, and other nations have propelled Bangladesh’s financial stability over the past decade.

Under the Belt and Road Initiative (BRI), Bangladesh is poised to receive a substantial investment package of $40 billion, directed primarily towards energy and transportation sectors. This infusion, marked by transformative projects like the Padma Bridge, Metrorail, and Karnaphuli Tunnel, showcases the success of China-Bangladesh bilateral engagements. These initiatives, including 12 highways and 21 bridge projects, signify Bangladesh’s integral role in the contemporary ‘Silk Road,’ touching various sectors from transportation to energy, reinforcing China’s presence in the country.

China’s extensive financial involvement, amounting to billions in released funds and construction contracts, has significantly contributed to job creation, generating around 550,000 employments in Bangladesh. The trajectory suggests that China may soon surpass the US as the largest investor in Bangladesh, sparking speculations in Western circles about the implications for the ongoing US-China global competition.

However, the narrative of global dynamics, particularly concerning de-coupling or alignment with specific powers, doesn’t reflect the vivid dichotomy portrayed by media narratives. Globalization’s evolution towards an interdependent production network negates the ‘with us or against us’ rhetoric. Bangladesh, strategically navigating geopolitical challenges, maintains a foreign policy of friendship to all, allowing it to transcend perceived dichotomies.

Fostering Regional Connectivity And Stability

Bangladesh’s positioning as a significant player in both geoeconomics and geopolitics of the region and beyond underscores its role as a pivotal nexus between Indo-Pacific Strategies and the Chinese BRI. Despite the lack of explicit priority status in various strategies, the BRI accentuates Bangladesh’s importance. Therefore, Bangladesh’s emphasis on BRI projects, driven by their potential benefits and efficient loan repayment strategies, aligns logically with the nation’s interests.

To optimize these projects, fostering transparent, profitable approaches and leveraging strategic long-term benefits should be a primary focus. Enhancing diplomatic engagements and academic collaborations between China and Bangladesh stands pivotal in comprehending and maximizing the potential of BRI projects, not just for Bangladesh but for the broader regional connectivity, especially India’s priorities.

Bangladesh’s strategic embrace of the BRI doesn’t merely signify economic gains but emphasizes its pivotal role in shaping regional connectivity and geopolitical alignments, fostering greater opportunities for mutual benefits and regional stability.

In conclusion, as the BRI continues its global trajectory, the debate persists, shifting focus to optimizing projects, fostering transparency, and leveraging strategic benefits. The initiative’s transformative potential remains intertwined with recipient nations’ governance, underscoring the need for collaborative efforts to mitigate challenges and capitalize on opportunities presented by this monumental undertaking.