Key Highlights:

- Bank of America highlights the U.S. debt is set to increase by $5.2 billion daily or $218 million hourly over the next 10 years.

- The federal deficit has surged by $320 billion, reaching $1.7 trillion in 2023.

- Bank of America warns that heavy borrowing by U.S. policymakers could raise concerns among investors about potential risks such as inflation, bond defaults, and currency devaluation.

- The IMF, through Pierre-Olivier Gourinchas and Vitor Gaspar, highlights the U.S.’s fiscal predicament as the “most worrying” globally.

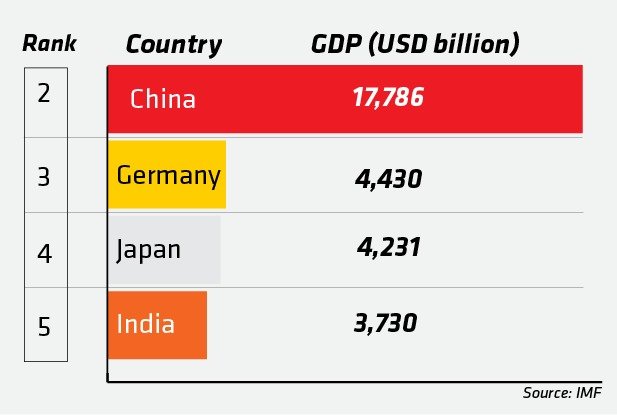

On November 7, Bank of America investment strategist Michael Hartnett said ‘US public debt is more than the combined GDPs of China, Japan, Germany, and India. The outstanding debt is set to surge by $5.2 billion every single day, or $218 million every hour, for the next 10 years.’

Currently, the combined GDP of China, Japan, Germany, and India is $30,177 trillion. Bank of America, citing data from the Congressional Budget Office, said, the debt is currently sits at $33.6 trillion and expected to surge by $20 trillion to $54 trillion within the next decade.

The recent increase in debt aligns with a significant rise in the federal deficit, surging by $320 billion to reach $1.7 trillion in 2023. Consequently, the Treasury Department has been compelled to conduct auctions for trillions of dollars in new bonds. The situation is exacerbated by the escalating bond yields, leading to higher annual interest payments, which exceeded $1 trillion as of October.

Warning from Bank of America

Bank of America warns that as long as US policymakers persist in heavy borrowing, contributing to the growing national debt, investors may become increasingly concerned about potential risks such as inflation, bond defaults, and currency devaluation.

A widely monitored indicator, “debt held by the public,” shows a less alarming but still upward trajectory. At the close of fiscal 2023, it reached $26.3 trillion, equivalent to 98% of the projected GDP, and projections from the Congressional Budget Office anticipate it climbing to 115% by 2033.

Even if interest rates decrease and the federal deficit is managed, the expectation is that the US government will persist in borrowing money. This perpetual rise in debt is seen as essential for stimulating economic growth and facilitating the circulation of money.

IMF Shows Red Flag

On October 10, Pierre-Olivier Gourinchas, the research director of the International Monetary Fund (IMF), issued a cautionary statement, highlighting the United States’ fiscal predicament as the “most worrying” globally. He pointed to the escalating fragility in the corporate sector and a growing number of defaults, primarily attributed to the swift expansion of government expenditures.

During an interview with Bloomberg in October, Vitor Gaspar, the IMF Fiscal Affairs director, echoed Gourinchas’s concerns, emphasizing that US deficits are not only elevated but also appear to be persistently challenging. Gaspar suggested that, under current policies, the debt dynamics in the United States are highly unfavorable, describing the continuation of these policies as leading the nation down an unsustainable fiscal path.

This year witnessed the total federal debt surpassing $33 trillion for the first time in history, equivalent to approximately 121% of the 2022 GDP. However, projections indicate a further escalation in the coming years, heightening the risk of a potential US debt default within the next two decades.

In addition to the daunting debt scenario, the IMF draws attention to the imminent challenges posed by higher interest rates. With over $2 trillion of corporate debt set to mature in the US alone in 2024, the tightening of monetary policy to curb inflation is anticipated to make debt more expensive. The intended consequence, however, comes with a notable risk: borrowers may already find themselves in financially precarious positions, and the heightened interest rates could exacerbate these vulnerabilities, potentially triggering a surge in defaults. This warning was articulated in an IMF blog on November 10.

Impact of Debt on U.S. Citizens

Americans will confront numerous hurdles, such as inequality, exorbitant healthcare costs, and the evolving climate, stemming from the escalating debt of the U.S. government. Concerns about the scale of government debt frequently draw parallels with personal debt. However, the pivotal determinant of the outcomes arising from this borrowed capital lies in its utilization, a factor that may carry more weight than the sheer volume of debt or its relationship to the country’s GDP.

Escalating Healthcare Expenses

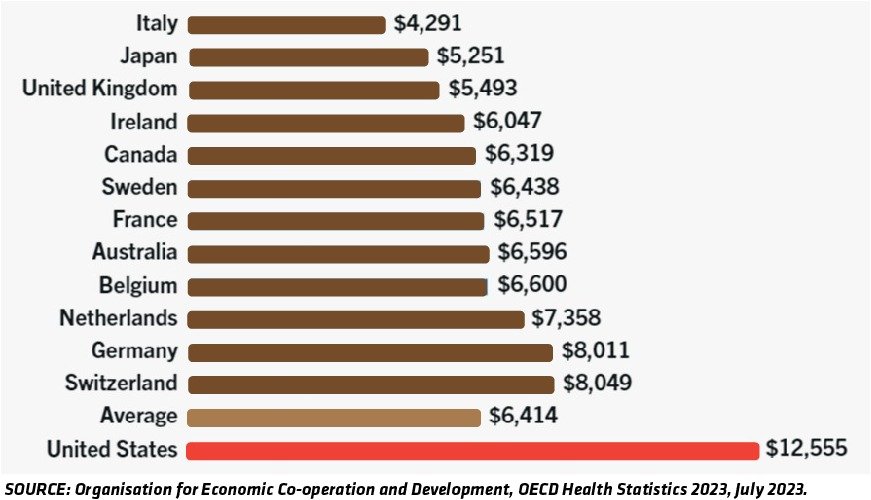

For U.S. citizens, healthcare costs may rise due to the rising debt of US government. Constituting nearly one-fifth of the entire economy, healthcare stands as the second fastest-growing component of the budget.

The nation expends more than twice as much on healthcare compared to other advanced nations, yet the US system fails to deliver superior overall health outcomes. Enhancing the efficacy of the U.S. healthcare system is not only integral to improving the lives of Americans but also plays a pivotal role in stabilizing fiscal and economic prospects.

Insufficient Revenue

The revenue generated by the U.S. tax system falls short of covering the expenditures authorized by policymakers. This swiftly widening gap between income and spending results in escalating annual deficits, contributing to a mounting national debt.

Conclusion

As the U.S. debt skyrockets to unprecedented levels, Bank of America’s warning echoes alongside the IMF’s red flag, painting a picture of economic challenges ahead. The nation’s relentless borrowing, coupled with concerns from global financial institutions, raises urgent questions about sustainability, investor confidence, and the potential impact on citizens’ lives.