“The universal pension scheme is for the people of Bangladesh and this money is preserved by the people of Bangladesh. This scheme is for the common man, whatever the government, your pension money is yours and your nominee’s,”

says Sajeeb Wazed Joy

The Universal Pension Scheme is a vital thread in the broad tapestry of socioeconomic development. It embodies the principles of compassion, solidarity, and inclusiveness that serve as the basis of a welfare state. As the scheme evolves, its lessons will definitely inform the development of future initiatives that together enhance our nation’s social fabric.

The vision of a Bangladesh in which every citizen can age with dignity and security is attainable, and the Universal Pension Scheme is the crucial first step on this transformative path. It augurs a future in which policy innovation and human compassion coexist, laying the groundwork for an equal and prosperous society.

You can also read: Welfare State & Universal Pension Scheme

On August 17th, the universal pension scheme was officially inaugurated. Sajeeb Wazed Joy, the Prime Minister’s Adviser for Information and Communication Technology Affairs, emphasized that the scheme is designed for the general populace of Bangladesh. He clarified that the funds allocated for the universal pension scheme belong to the people of Bangladesh, and it is intended to benefit the common citizens. Regardless of the government in power, the pension funds rightfully belong to the individual and their chosen beneficiary. These statements were made by the Prime Minister’s adviser in response to various queries regarding the recently introduced universal pension scheme. He addressed these concerns through a video shared on his authenticated Facebook page, aiming to counteract any misinformation circulating on social media platforms.

Various inquiries on universal pension scheme

Addressing a question in the comments section, Joy explained that in the unfortunate event of the depositor’s passing after making a deposit, the designated nominee will receive the deposited funds.

When asked about the registration process, he acknowledged that connectivity issues could sometimes lead to registration failures. He mentioned that when numerous individuals attempt to register simultaneously, such problems might arise. He suggested considering off-peak hours for registration attempts, expressing optimism that registrations could then be completed smoothly.

Expressing their gratitude on his Facebook post, numerous individuals extended their thanks to Prime Minister Sheikh Hasina for introducing the universal pension scheme.

Conversely, the official Facebook page of the Awami League (AL) conveyed their appreciation to Sajeeb Wazed Joy for providing comprehensive insights into the universal pension program. Additionally, AL expressed their gratitude towards those who had their questions answered satisfactorily.

What is universal pension scheme?

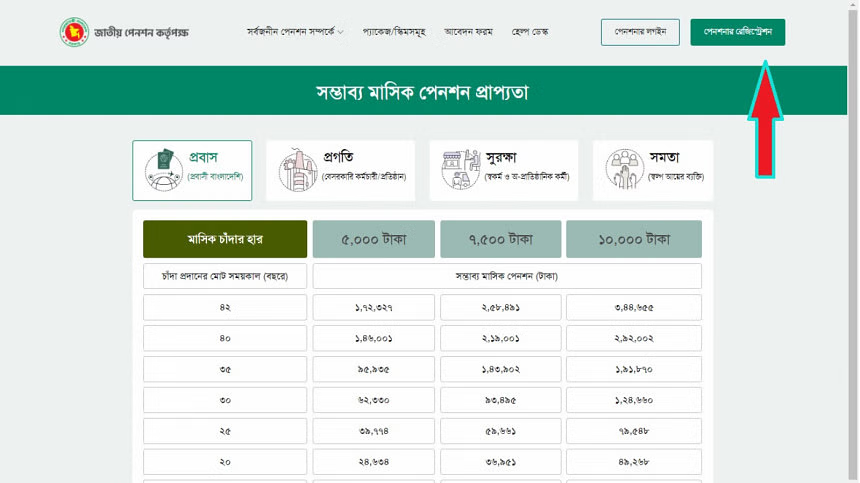

The primary goal of the scheme is to encompass the increasing elderly populace within the nation’s structured social safety framework, offering them a monthly stipend to assist in covering their daily expenditures.

Who are eligible?

Eligibility for the benefit extends to all individuals between the ages of 18 to 50, on the basis of their national identity cards, which includes expatriate Bangladeshis. Presently, only employees of government, semi-government, or autonomous organizations in Bangladesh are entitled to pension benefits.

Additionally, citizens above 50 years of age will also have the opportunity to participate in the pension scheme under specific considerations.

The objective of the new legislation is to encompass private sector employees within the pension scheme.

How to register for Universal Pension Scheme

The video offers comprehensive insights into the registration procedure for the universal pension scheme. Moreover, it provides clear explanations of its assorted advantages and regulations.

https://www.facebook.com/sajeeb.a.wazed/videos/312390654511830/?tn=%2CO-R

The introduction of a website named ‘Upension’ marks the launch of the universal pension scheme.

Individuals wishing to enroll in the scheme can complete the registration process by accessing the National Pension Authority’s website at: www.upension.gov.bd People who are interested need to make sure they fill out every section of the registration form with correct info. If you put in wrong or false details during registration, they’ll scrap your

application and you won’t get your money back.

Once you’re here, a new window will show up with two choices. You’ll see an “I agree” option at the top, and right below it, there’s another one that says “Login” for folks who already have an account.

In the third pop-up, they’ll prompt you to start the registration process. You’ll need to pick the scheme first, and then enter your national identity number, date of birth, mobile number, and email address.

After you complete the Captcha, this screen will move you to the next one.

If you successfully fill out the Captcha, a new window will pop up, requesting you to enter the one-time password (OTP) sent to the mobile number you provided in the previous step.

Now, you’ll see window number five pop up. In this section, you need to provide in-depth details about yourself across five separate tabs: Personal Information, Scheme Information, Bank Information, Nominee Information, and the Complete Form tab.

On this page, you’ll find the applicant’s NID number, photo, names in both Bengali and English, father’s name, mother’s name, and present as well as permanent addresses, based on the NID details provided in the previous section.

On this part, you need to specify your annual income, mention your occupation, pick your division, district, and upazila (sub-district).

Once you’re done with this, you’ll proceed to another page titled ‘Scheme Information’. Here, you’ll have to select the monthly donation amount and the preferred payment frequency. You’ll have three choices for payment intervals: monthly, quarterly, and annually.

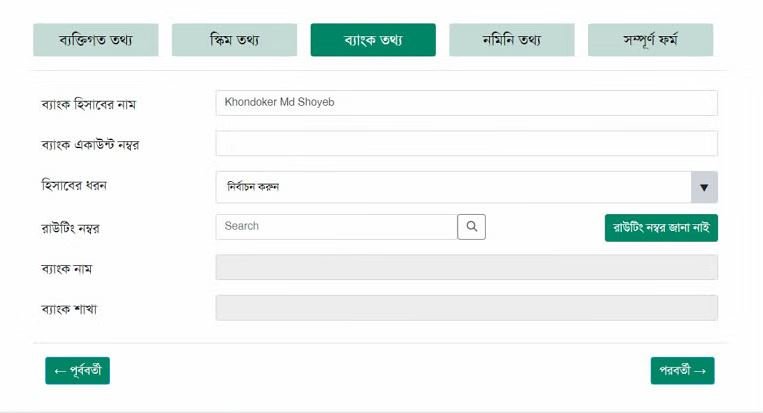

Next, you’ll need to input your bank details. In this section, you’re required to provide the bank account’s name and number, specify the account type (savings or current), mention the bank’s name and branch, and provide the routing number.

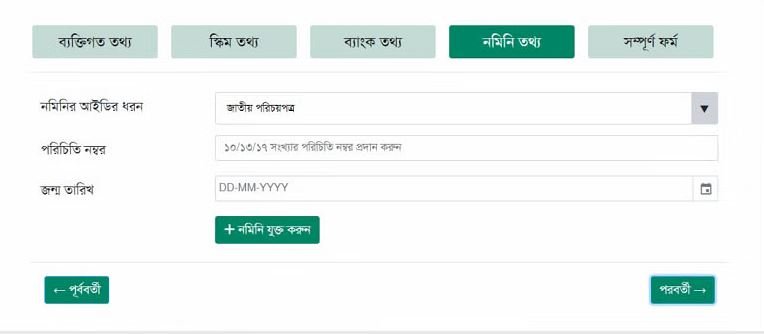

Moving on to the next page, you’ll need to provide nominee details. Here, you’ll have to enter the nominee’s national identity card number and date of birth.

You have the option to include more than one nominee. On this page, you’ll need to provide additional details about the nominee, such as their mobile number and relationship with you.

Moving to the final phase of registration, referred to as the ‘Full Form’. Here, you’ll see a summary of your personal information, chosen scheme, bank details, and nominee information.

If any errors are spotted on this ‘Full Form’ page, you can make corrections. If everything looks accurate, the registration process will conclude once you provide your consent.

What are the schemes?

The government has rolled out four distinct schemes—

- Progoti

- Surokkha

- Somota and

- Probash—with the aim of encompassing individuals from various backgrounds within the pension program.

In 2009, Sajeeb Wazed Joy has been guiding our ICT sector towards achieving its utmost potential for development, leveraging his educational background, exceptional professionalism, and extensive expertise. His unyielding dedication has been a source of inspiration for the youth in the realms of fundamental research and sustainable progress. Sajeeb Wazed Joy stands as a forward-thinking leader who accurately envisioned Bangladesh’s future as far back as 2009, laying out the blueprint for a digital Bangladesh. His active involvement in the country’s developmental endeavors has garnered widespread attention and admiration.