Remittance plays a vital role in supporting the economy of Bangladesh, with expatriates sending back a significant amount of income. In recent years, the United States has surpassed traditional leaders like Saudi Arabia to become Bangladesh’s leading source of remittances.

Bangladesh is one of the world’s leading recipients of remittances, with a large number of its citizens working abroad in the United States, Saudi Arabia, and the United Arab Emirates. These expatriates’ remittances are an essential source of foreign currency for the country. Post-pandemic recovery has seen a steady resurgence in remittance inflows, which had been stalled by Covid-19 and the global economic shutdown.

You can also read: Transportation, energy, power get highest ADP shares in new budget

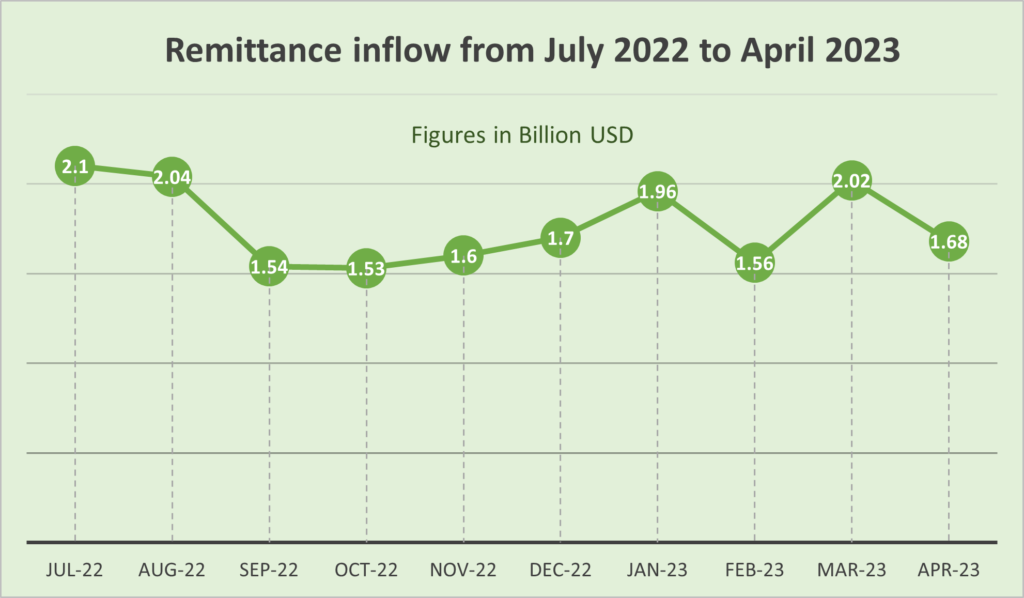

In the first 10 months of the closing financial year, July-April, remittances or expatriate income of $1,772 crore have arrived in the country. This income is 2.36 percent higher than it was during the same period in the prior year. In the first 10 months of the last financial year, the expatriate income was $1,730 crore.

More remittance inflows from US recently

There are about 5 lakh Bangladeshis living in the United States, while 20 lakh live in Saudi Arabia. Workers in the Middle East have historically been at the forefront of remitting money home. In the current fiscal year, however, the United States has topped the list of countries sending the most expatriate income.

According to the report on expatriate income by the Bangladesh Bank, total expatriate income in 2021-22 was $2,103 crore. Saudi Arabia generated the greatest expatriate income of $454 crore. The second highest expatriate income came from the US at $344 crore and the third highest at $207 crore from the UAE.

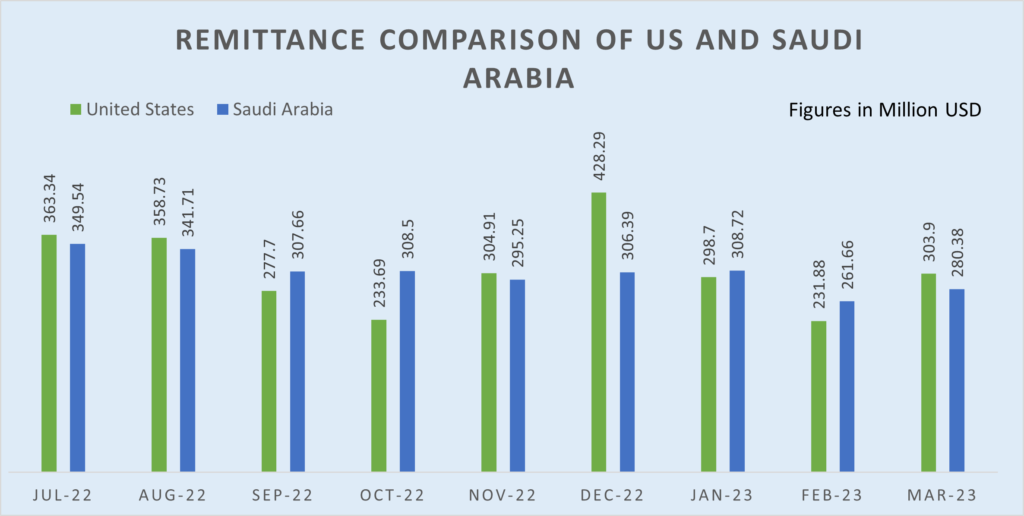

However, the pattern has changed recently. In the first ten months of this fiscal year, expatriate Bangladeshis working and residing in the United States remitted 304 crore 73 lakh US dollars in expatriate income. Furthermore, the second highest expatriate income came from Saudi Arabia, amounting to 303.9 crore dollars. The United Arab Emirates (UAE) accounted for the third-highest expatriate income with 240 crore 85 lakh US dollars.

Data from the Bangladesh Bank show that expatriate Bangladeshis living in the US sent home $834 million in January-March this year, which was $966.89 million in the previous quarter. The US remains the top remittance-earning source for Bangladesh if the total earnings of the first nine months of the current fiscal year are considered. In the first two quarters of the current fiscal year, the United States surpassed Saudi Arabia as Bangladesh’s greatest source of remittances.

In contrast, remittances from expatriates in Saudi Arabia decreased by 19.5% annually to $910 million during the same period. The USA was also the top remittance sender for Bangladesh with $999.76 million, posting a 16.5 percent year-on-year rise in the July-September quarter of 2022. Saudi Arabia was likewise ranked second in this.

Why remittance inflow from US is on rise?

As in the first 10 months of the current financial year, remittances from the United States reached $304 crore 73 lakh, there are a few factors that contributed to the increase in inflow. They are-

COVID-19 facilities:

The United States government provided special allowances to individuals who lost their jobs during the pandemic, leading to increased remittance flows as expatriates received higher income compared to the Middle East countries.

Legitimate Channels and Incentives:

The prevalence of formal banking channels and the ease of sending money through legitimate channels have encouraged expatriates in the United States to remit their income, benefiting the overall remittance inflow. Moreover, the hundi system is not prevalent in the US.

The Bangladesh government has increased the incentive rate from 2 percent to 2.5 percent for sending remittances through banking channels. As a result, the expats are more encouraged to send money via formal channels.

Educational Migration:

The United States attracts skilled manpower from Bangladesh, resulting in higher income for expatriates. The rising number of Bangladeshi students pursuing higher education in the US contributes to increased remittance inflows.

Comparing the academic year 2021-22 to the previous academic year, the number of Bangladeshi students enrolled in American universities and colleges increased by 23.3%.

According to the 2022 Open Doors Report on International Educational Exchange, a record-breaking 10,597 students from Bangladesh chose to study in the United States during the previous academic year.

The number of Bangladeshi students in the United States has more than tripled over the past decade, increasing from 3,314 during the 2011-12 academic year to 10,597 during the 2021-22 academic year.

More skilled workers:

While the number of Bangladeshis employed in the United States is lower than in other main labor destination countries, the higher income of skilled migrants results in substantial remittance contributions.

Syed Mohammad Kamal, vice president of the American Chamber of Commerce in Bangladesh (AmCham), stated that specialized labor migrated primarily to the United States, where their income is higher than in other nations, which may be the cause of increased remittances from the United States.

“Bangladeshis started to migrate to the US from many before and now a generation has matured who are sending money home,” he added.

Shift in Migration Patterns:

The trend indicates a gradual increase in educational migration to North America, Europe, and Australia, driven by attractive facilities, scholarships, and opportunities for higher studies.

Challenges in the Middle East

Saudi Arabia is the largest labour destination country for Bangladesh with nearly 40% share in total exported manpower, according to Bureau of Manpower, Employment and Training (BMET) statistics. Yet, remittance inflow is comparatively less than the US, and factors contributing to the situation include-

Hundi System:

Despite an increase in the export of manpower, Middle Eastern countries still heavily rely on the informal Hundi system for remittance, which limits the amount of remittance sent through formal channels.

Unemployment and Low Income:

The Middle East has experienced economic challenges, resulting in higher unemployment rates and lower income for expatriate workers. Despite the new export of manpower in the last few years, many people have been living unemployed for a long time. These factors contribute to reduced remittance inflows from the region, including countries like Saudi Arabia and the United Arab Emirates.

Remittance inflows increased to a record high in March

The country’s inflow of remittances slowed after the dollar crisis emerged. Pahela Baisakh and Eid ul Fitr, two major holidays in Bangladesh, had record-breaking remittances. During the festivals, remittance reception generally increases. According to data from the Bangladesh Bank, non-resident Bangladeshis sent $2.02 billion in March, an increase of 8.6 percent from the previous year.

Additionally, banks anticipate a substantial increase in remittances during Eid al-Adha.