Bangladesh is facing a multifaceted crisis where political instability intersects with economic uncertainty.

The recent claim by interim regime figure Yunus about securing $700 million investment from China has

raised alarms

across the diplomatic and investment communities. The statement, rather than restoring confidence, may

exacerbate investor fears given the deteriorating internal conditions.

Political and Economic Instability

Bangladesh’s political atmosphere remains volatile, with no clear roadmap for elections, increasing street-level agitation,

and a judiciary under intense international scrutiny. Foreign investors, particularly those from OECD nations, prioritize legal predictability and governance transparency both of which are currently under stress.

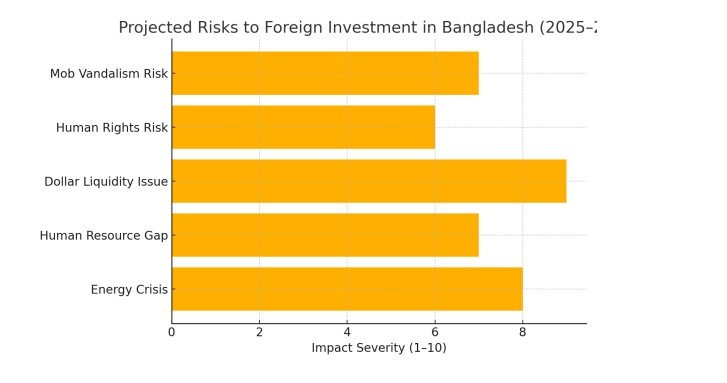

Risk Index and Key Challenges

Based on ongoing assessments and investor sentiment surveys, the following core challenges are projected to threaten

Bangladesh’s investment climate:

Press Xpress | Strategic Analysis

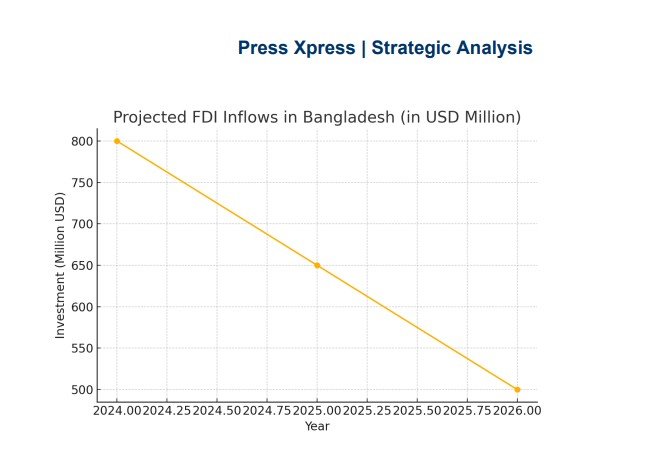

FDI Forecast

Recent trends suggest a sharp decline in foreign direct investment (FDI). If instability continues, Bangladesh may see FDI drop from $800M in 2024 to nearly $500M by 2026. This erosion risks long-term economic growth and infrastructure momentum.

In conclusion, promoting vague investment promises without structural stability is a high-stakes gamble.

The Yunus-led narrative is turning into a strategic misfire, hurting Bangladesh’s credibility and repelling

cautious investors.

Press Xpress urges a reality-based roadmap anchored in elections, governance reform, and investor-friendly legislation not in diplomatic illusions.