In 2025, geopolitical risks continue to shape the landscape of global financial markets. Heightened tensions—including the ongoing Ukraine conflict, Middle Eastern instability, and strategic competition in the Indo-Pacific—contribute to market volatility. However, investors and policymakers are adapting with strategies that promote resilience and unlock new opportunities. This article examines the impact of these risks on asset prices, government borrowing, and global economic trends with precise data and forward-looking insights.

Market Volatility and Asset Price Fluctuations

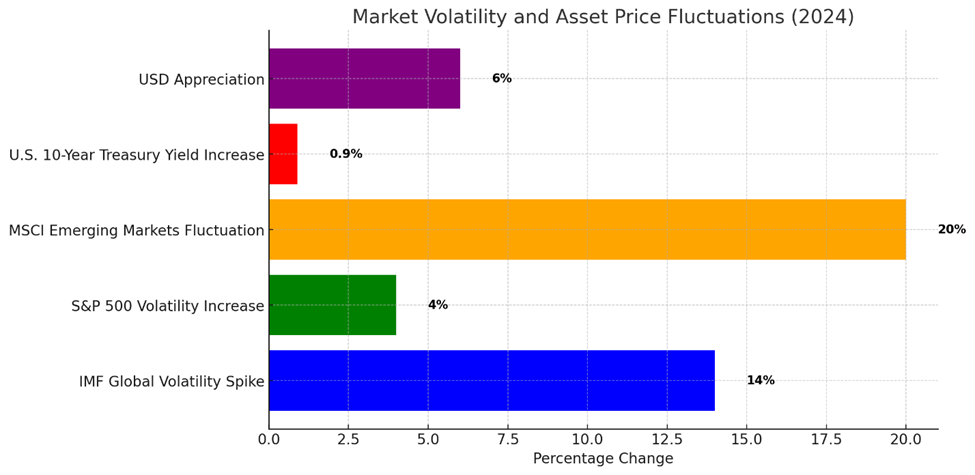

- According to the International Monetary Fund (IMF), global equity markets experienced an average volatility spike of 14% in 2024, with the S&P 500 Index’s annualized volatility rising from 18% to 22%.

- Emerging markets saw similar trends, with the MSCI Emerging Markets Index fluctuating by 20% over the same period.

- Government bond yields increased worldwide; U.S. 10-year Treasury yields rose from 3.2% in early 2024 to 4.1% by year-end, reflecting increased risk premiums.

- Currency markets shifted, with the U.S. dollar appreciating approximately 6% against major currencies as a safe haven.

Positive Adaptations in Response to Risks

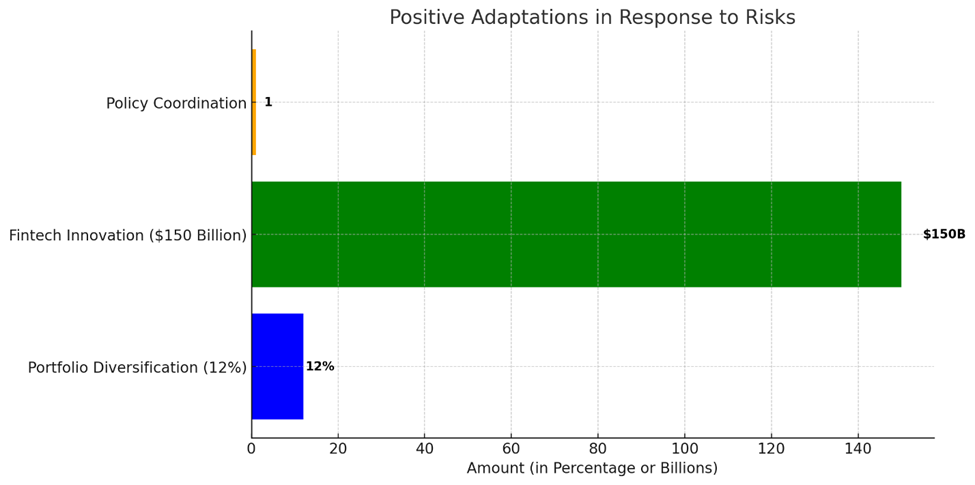

- Portfolio Diversification: Institutional investors increased allocations to alternative assets—including infrastructure, real estate, and sustainable finance—by 12% in 2024 (Preqin report).

- Fintech Innovation: Blockchain-based platforms facilitated improved transparency and liquidity, with global fintech investments reaching $150 billion in 2024.

- Policy Coordination: Central banks coordinated interventions, stabilizing markets through synchronized interest rate adjustments and liquidity injections, mitigating the risk of financial contagion.

Insights from the Global Risks Report 2025

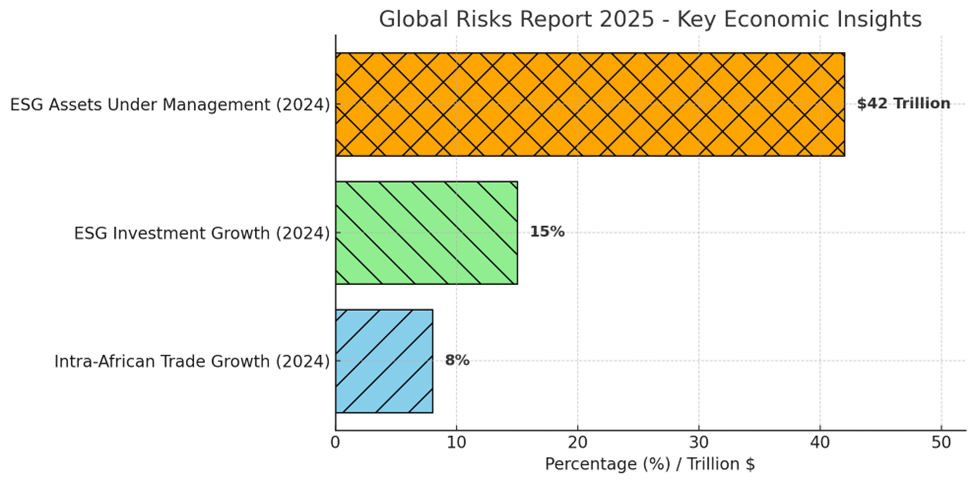

- The World Economic Forum (WEF) emphasizes armed conflicts and economic fragmentation as primary global risks but highlights accelerated efforts in multilateral cooperation.

- New regional trade agreements expanded, with the African Continental Free Trade Area (AfCFTA) increasing intra-African trade by 8% in 2024.

- Environmental, Social, and Governance (ESG) investments grew by 15%, reaching $42 trillion assets under management worldwide.

Economic Growth and Investment Opportunities

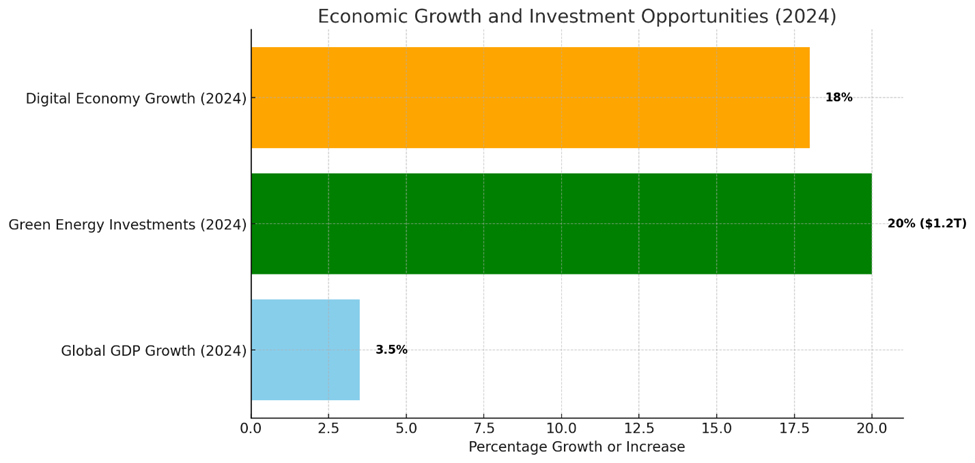

- Despite challenges, global GDP growth averaged 3.5% in 2024, buoyed by strong consumer spending and fiscal stimulus.

- Green energy investments surged by 20%, with $1.2 trillion committed globally in 2024, driven by renewable capacity expansions and decarbonization technologies.

- Digital economy sectors, including e-commerce and cloud computing, grew by 18%, contributing significantly to economic diversification.

Supply Chain Resilience

- Companies invested an estimated $250 billion in 2024 to diversify supply chains and reduce reliance on single-source suppliers, improving resilience against geopolitical shocks.

- Regional manufacturing hubs expanded, particularly in Southeast Asia and Latin America, supported by government incentives and infrastructure development.

While geopolitical risks introduce volatility and uncertainty, they also accelerate transformative shifts in global markets. Through diversification, technological innovation, and coordinated policies, investors and economies are adapting effectively. These positive adaptations not only mitigate risks but also unlock new avenues for sustainable growth and stability.