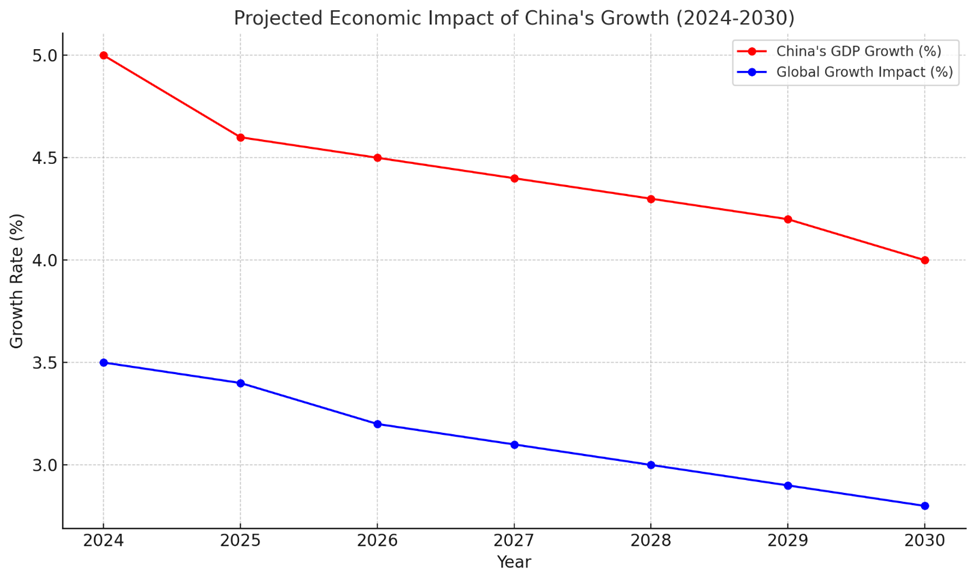

The International Monetary Fund (IMF) recently revised its forecast for China’s economic growth, highlighting a slight improvement over earlier projections. Despite this, concerns remain over China’s economic trajectory and its broader implications for the global economy. As the world’s second-largest economy, any weakness in China’s performance has significant spillover effects, particularly for emerging and developing countries, underscoring its pivotal role in the interconnected global economic landscape.

China’s Economic Challenges: A Need for Domestic Demand

China’s reported 5% growth in 2024 exceeded the IMF’s forecast of 4.8%, a positive sign amidst trade policy uncertainties and structural challenges. The IMF’s Chief Economist, Pierre-Olivier Gourinchas, emphasized the necessity for China to pivot toward domestic demand as a primary growth engine. While external trade has historically fueled China’s rapid expansion, relying solely on global markets is becoming increasingly unsustainable.

Several factors constrain China’s economic growth:

Dependence on External Trade: With global trade volatility and rising protectionism, China’s reliance on exports faces mounting risks. Diversifying its growth model is crucial to mitigating these vulnerabilities.

Aging Population:Recent reforms to raise retirement ages reflect attempts to address labor supply declines. An older workforce challenges productivity and long-term economic sustainability.

Domestic Consumption Gaps: Structural barriers, including income inequality and limited consumer confidence, impede domestic consumption from becoming a more robust economic driver.

Spillover Effects on Emerging and Developing Economies

China’s economic health has profound implications for emerging and developing countries, many of which rely heavily on Chinese demand for commodities, trade, and investment. A slowdown in China could ripple across these economies in several ways:

Commodity Exports: Resource-rich countries that supply raw materials to China—such as Brazil, South Africa, and Indonesia—would face declining export revenues. Lower Chinese demand for commodities like iron ore, coal, and oil directly impacts these nations’ growth prospects.

Supply Chain Disruptions: As a key player in global manufacturing, any slowdown in China could disrupt supply chains, affecting industries worldwide and increasing costs for producers in emerging markets.

Investment and Infrastructure: China’s Belt and Road Initiative (BRI) has provided significant infrastructure investment in developing nations. Economic weakness in China could reduce funding availability, delaying critical projects and stifling economic development in recipient countries.

Financial Instability: Many emerging economies depend on Chinese capital flows and trade partnerships. A weaker Chinese economy might tighten financial conditions, increase borrowing costs, and heighten vulnerabilities to external shocks.

Global Economic Risks

China’s role as a global growth engine extends beyond emerging markets. Advanced economies, too, are susceptible to its economic fluctuations. Europe and the United States, major trading partners of China, would experience slower export growth and potential disruptions in consumer goods supply. Moreover, uncertainties in Chinese trade policies can exacerbate global market volatility, undermining investor confidence.

Additionally, a weaker Chinese economy risks stalling global climate initiatives. China is a leading player in renewable energy production and adoption, and any economic downturn could slow the transition to greener technologies, affecting global efforts to combat climate change.

Policy Recommendations

To mitigate these risks, both China and its global partners must adopt proactive strategies:

Diversifying Growth Models: China needs to accelerate efforts to shift toward a consumption-driven economy, fostering domestic demand through income redistribution and social safety nets.

Strengthening Multilateral Cooperation: Emerging economies should diversify trade and investment partnerships to reduce reliance on China, while China should strengthen global trade frameworks to stabilize international economic relations.

Investing in Resilience: Countries dependent on Chinese demand should prioritize economic diversification and resilience-building to weather external shocks.

Addressing Demographic Challenges: China’s retirement age reforms are a step forward, but further measures are needed to enhance labor productivity and support an aging population.

Conclusion

China’s economic performance is not just a domestic concern but a global one, with far-reaching implications for emerging markets and the broader international economy. Weakness in the Chinese economy risks exacerbating inequalities, stalling development, and disrupting global trade and investment flows. By addressing structural challenges and fostering multilateral cooperation, China and its global partners can navigate these risks, ensuring stability and sustained growth in an increasingly interconnected world.