China’s economy is expected to grow around 5 percent in 2024, President Xi Jinping announced, signaling the world’s second-largest economy is poised to achieve its official target despite a challenging year.

Speaking at a New Year’s event, Xi described the economy as “overall stable and progressing amid stability.” He noted that risks in key sectors had been addressed and that employment and prices remained steady. While final GDP figures will be available next month, Xi’s comments reflect confidence in the country’s recovery after a turbulent year.

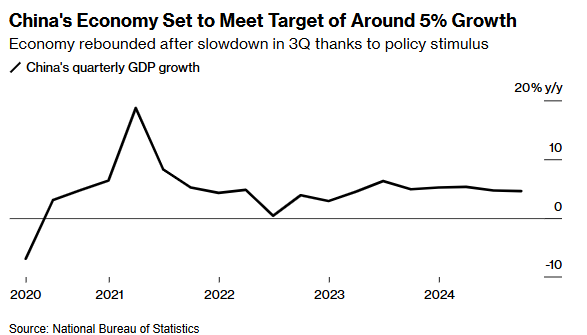

Initial skepticism about achieving the growth target gave way to optimism after policymakers implemented a series of stimulus measures starting in September. Economists now predict China’s economy will expand by 4.8 percent this year.

Proactive Policies into 2025

During his address to the nation’s top political advisory body, Xi reiterated the need for proactive macroeconomic policies, suggesting continued support for the economy in 2025. China’s leadership is expected to set a growth target similar to this year’s, with a focus on combating deflation, boosting domestic demand, and stabilizing exports.

Officials at December’s economic planning meetings pledged greater public spending, increased borrowing, and monetary easing to spur growth. This marked the first shift in monetary policy stance in 14 years, adopting a “moderately loose” approach.

However, challenges persist. Deflation is expected to linger into next year, and the property sector remains in a slump. The government faces the additional challenge of managing external pressures, such as potential tariff hikes from President-elect Donald Trump’s administration, which begins in January.

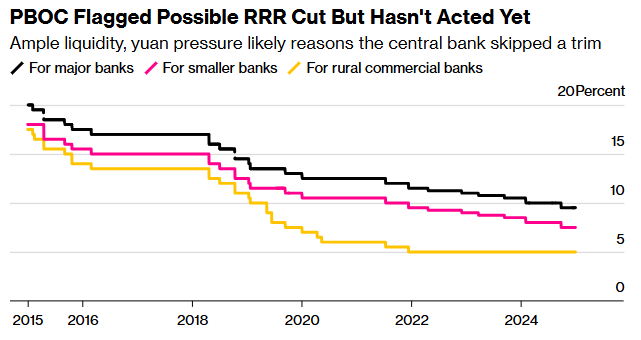

Monetary Easing and Liquidity Measures

The People’s Bank of China (PBOC) has signaled it may cut the reserve requirement ratio (RRR) by 25 to 50 basis points, potentially as early as January, to provide long-term liquidity. This measure, previously flagged for the end of 2024, is seen as critical to sustaining economic momentum.

Yet, such moves carry risks. High-profile monetary easing could put depreciation pressure on the yuan, worsening the yield gap between Chinese and U.S. assets and prompting fund outflows. The yuan already declined to its lowest level in a year last December.

Bruce Pang, a senior research fellow at the National Institution for Finance and Development, noted that the PBOC is “preserving policy space to deal with increasing external uncertainties” and must balance liquidity injections with currency stability.

Economic Challenges

Despite the government’s efforts, weak domestic demand and an uncertain export outlook continue to weigh on growth. Analysts warn that while initial stimulus measures may stabilize the economy, more aggressive action could be required later in 2025 if growth falters.

Liquidity in the banking system remains ample, with borrowing costs for top-rated commercial banks at their lowest since April 2020. However, subdued loan demand highlights the challenge of channeling liquidity into productive areas of the economy.

Sustained Recovery in Focus

China’s government has repeatedly stressed its commitment to maintaining economic stability while navigating external headwinds. President Xi’s remarks underline Beijing’s strategy to balance growth with fiscal and monetary discipline.

As China prepares to reveal its official growth target for 2025 at its annual legislative sessions in March, the nation’s leaders are tasked with ensuring that recovery efforts gain traction amid mounting challenges at home and abroad.