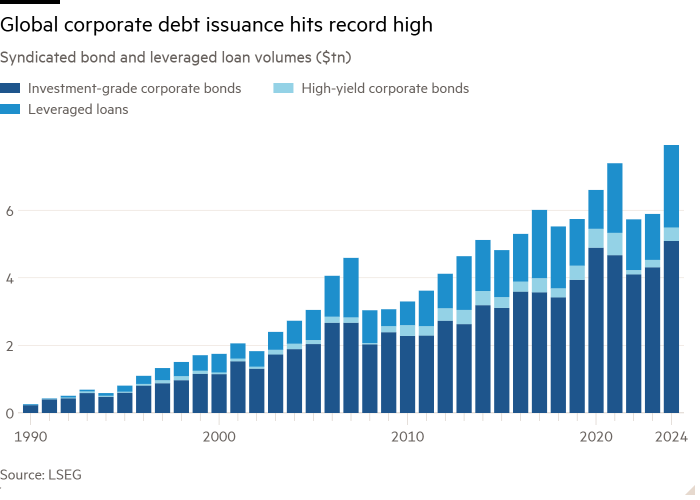

Corporate debt sales skyrocketed to an unprecedented $8 trillion in 2024, fueled by surging investor demand and favorable borrowing conditions. Issuance of corporate bonds and leveraged loans climbed 34% from the previous year to $7.93 trillion, according to LSEG data, surpassing the previous peak in 2021. Companies seized the opportunity to lock in funding as borrowing costs relative to government debt hit historic lows, even before central banks began cutting interest rates.

Red-Hot Demand Spurs Borrowing

Pharmaceutical giant AbbVie was among the year’s largest issuers, raising $15 billion in February to finance acquisitions of ImmunoGen and Cerevel Therapeutics. Other significant borrowers included Cisco Systems, Bristol Myers Squibb, Boeing, and Home Depot. The rush to market was initially driven by a desire to secure funding ahead of potential volatility from the U.S. election. However, Donald Trump’s decisive victory tightened credit spreads further, prompting some companies to accelerate their 2025 borrowing plans.

“Initially, it was about de-risking funding for the year,” said Tammy Serbée, Morgan Stanley’s co-head of fixed income capital markets. “Then it became, Conditions look pretty attractive, so why not pull forward 2025 as well?”

The average spread on U.S. investment-grade bonds narrowed to 0.77 percentage points after the election, the tightest margin since the late 1990s, according to ICE BofA data. High-yield corporate bonds also remained near 17-year lows, although spreads widened slightly in the latter part of the year.

High Yields, Strong Inflows

Despite the narrow spreads, overall borrowing costs remain elevated due to high Treasury yields. Investment-grade corporate debt yields averaged 5.4% in 2024, up from 2.4% three years ago. These higher yields attracted record inflows, with investors pouring $170 billion into global corporate bond funds, according to EPFR data.

“This has been our busiest year for high-grade dollar borrowing since the pandemic-induced frenzy of 2020,” said Dan Mead, head of Bank of America’s investment-grade syndicate. “Every month, actual supply has exceeded our estimates.”

Steady Activity Expected in 2025

Even after this year’s borrowing spree, bankers predict a steady pace of issuance in 2025 as companies refinance cheap pandemic-era debt. JPMorgan’s Marc Baigneres expects “activity will remain steady,” though he noted the potential for more debt-financed mergers and acquisitions as a wildcard.

However, some caution that the borrowing frenzy could cool if credit spreads widen meaningfully. “The market is pricing almost no downside risk right now,” said Maureen O’Connor, Wells Fargo’s global head of high-grade debt syndicate. “With spreads priced to perfection, idiosyncratic risk is picking up.”

A New Benchmark Year

The $8 trillion milestone underscores how favorable market conditions, investor appetite, and strategic corporate planning have reshaped global debt markets. As companies recalibrate for 2025, the long-term impact of this unprecedented borrowing wave will hinge on economic stability and central bank policies.