Finance Minister Rachel Reeves announced the largest tax hikes since 1993 in her first budget, aiming to strengthen public finances and services. This marks Labour’s first budget since returning to power in July’s election, their first in government since 2010, with adjustments to fiscal rules allowing increased borrowing for investment.

The Labour Party’s recent budget, delivered by Chancellor Rachel Reeves, marks a significant policy shift aimed at restoring economic stability, funding public services, and spurring growth. With a substantial £40bn in tax hikes and increased borrowing, the budget aims to revitalize Britain’s infrastructure and social services while addressing the country’s long-standing economic challenges. But will it be enough to steer Britain towards a prosperous future?

Budget Highlights: Tax Increases and Investment Priorities

Chancellor Reeves announced a £40bn increase in taxes, predominantly impacting businesses and high earners. This includes an increase in National Insurance (NI) contributions for businesses from 13.8% to 15% on salaries over £5,000, expected to raise an additional £25bn annually. Capital gains and inheritance taxes will also see substantial hikes, targeting the wealthier sectors. Meanwhile, there were no increases to income tax, employee NI, or VAT, protecting the take-home pay of working individuals.

For businesses, the corporation tax remains at 25%, but a notable increase in employment allowance from £5,000 to £10,500 will offer some relief to smaller companies. The Chancellor’s budget also includes measures to support local communities, such as freezing fuel duties for another year, capping bus fares outside major cities, and dedicating an additional £500m to repair roads in England.

However, a key component of the budget lies in Reeves’ ambitious investment goals. The government has allocated over £100bn in public investment over the next five years, which will fund essential infrastructure projects including hospital upgrades, school rebuilding programs, and improvements to rail and road systems. This injection of funds is expected to improve living standards while addressing Britain’s longstanding infrastructure needs.

Will the Budget Address Economic Challenges?

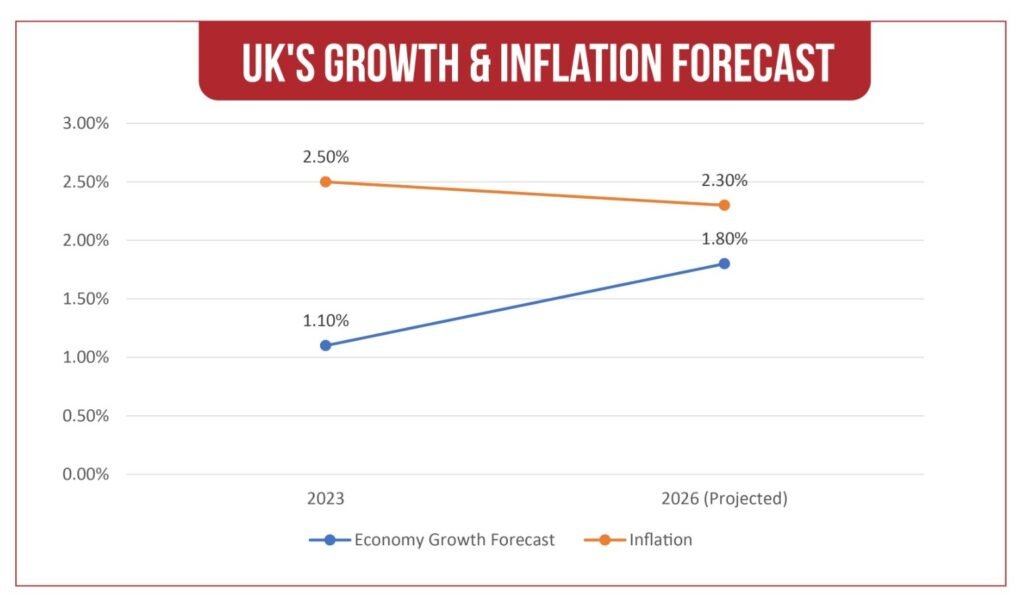

The British economy has faced persistent challenges, including stagnating growth, high debt levels, and declining public service quality. The Office for Budget Responsibility (OBR) forecasts that while the budget will provide a temporary boost to the economy, its effects may not be sustained. The economy is projected to grow by 1.1% this year and 2% next year, but growth could slow to below 2% annually in subsequent years.

One of the budget’s primary goals is to revitalize public services, especially healthcare. With an additional £22bn allocated over two years, the National Health Service (NHS) will have more resources to tackle waiting lists and improve treatment availability.

The Impact on Living Standards and Public Sentiment

The budget reflects a commitment to protect the living standards of working people, evidenced by a 6.7% rise in the National Living Wage and a freeze on employee NI and VAT. These measures, along with extended support for carers and pensioners, are intended to alleviate financial strain on vulnerable groups. Additionally, pensioners will see a 4.1% increase in state pensions, benefitting over 12 million individuals.

Despite these measures, some analysts argue that the budget is unlikely to transform Britain’s economic landscape without further support. Adrian Pabst of the National Institute of Economic and Social Research stated that while adopting a broader measure of debt offers some flexibility, the budget still adheres to a “fiscal straitjacket” that limits expansive reform. Without broader fiscal freedom, the government may struggle to implement the sweeping changes needed to address the systemic issues that hinder economic growth.

Rebuilding Britain: Infrastructure and Long-Term Growth

One of the budget’s most ambitious goals is to “rebuild Britain” through extensive infrastructure projects. Beyond the NHS, the Chancellor has committed £1.4bn to the school rebuilding program and additional funds to improve transportation across the country. Plans to increase public investment to over £100bn over the next five years underscore the government’s commitment to modernizing Britain’s infrastructure. By focusing on essential projects like roads, rail, and housing, the budget aims to create a foundation for long-term growth.

However, questions remain about the budget’s ability to deliver sustained economic expansion.

Is the £40bn Budget Enough?

Chancellor Reeves’ £40bn budget represents a significant shift toward fiscal responsibility and public investment after a period of economic instability. By prioritizing healthcare, infrastructure, and living standards, the Labour government seeks to rebuild public trust and chart a path toward growth. However, while the budget lays the groundwork for recovery, it may not be enough to solve the UK’s economic challenges on its own.

Long-standing issues like high debt levels, wage stagnation, and strained public services will require sustained commitment and further innovation in fiscal policy. In the short term, the budget may offer some relief, but its success in “rebuilding Britain” will ultimately depend on the government’s ability to balance investment with prudent economic management over the coming years.