- Tax policies and proposals affecting wealthy individuals have dampened demand for high-end properties, influencing broader economic sectors catering to high-net-worth individuals.

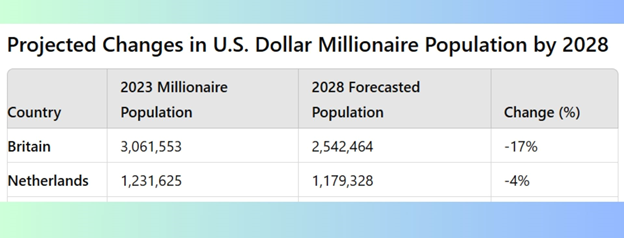

- While Britain faces a decline, other countries like the United States, Germany, and Taiwan are projected to see significant growth in their millionaire populations by 2028

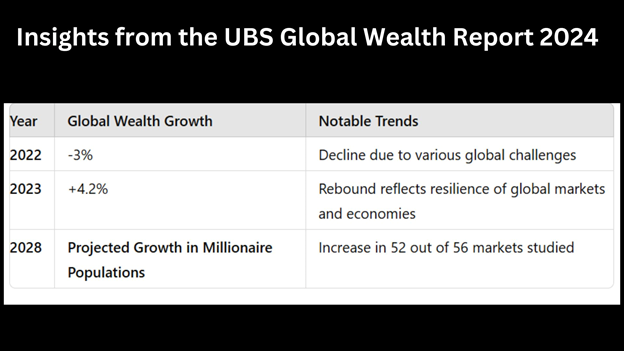

- The UBS Global Wealth Report 2024 highlights global wealth growth of 4.2% in 2023, rebounding from a decline in 2022, with projections indicating widespread millionaire population growth in most studied markets by 2028.

The global landscape of wealth distribution is set to undergo significant changes in the coming years, according to a recent report published by UBS Global Wealth Management. The UBS Global Wealth Report for 2024 provides a comprehensive analysis of wealth trends across 56 markets, accounting for approximately 92.2 percent of global wealth. This report offers intriguing insights into the future of wealth distribution, highlighting notable shifts in millionaire populations across various countries.

You can also read: No Clear Winner: What’s Next for France’s Political Puzzle?

As we move toward 2028, it will be crucial for policymakers, financial institutions, and individuals to navigate these changing dynamics. Countries seeking to attract and retain wealth will need to balance competitive tax policies with sustainable economic development. Meanwhile, rapidly growing economies will need to manage the risks associated with increasing debt levels.

Britain’s Millionaire Exodus

One of the most striking revelations from the report is the projected decline in Britain’s millionaire population. The UBS forecast suggests that Britain is likely to lose nearly one in six of its U.S. dollar millionaires by 2028. Specifically, the number of dollar millionaires in Britain is expected to fall by 17 percent, from 3,061,553 in 2023 to 2,542,464 in 2028. This decline is particularly significant given Britain’s current standing as the country with the third-highest number of millionaires globally.

Is Britain’s Millionaire Decline Due to Global Competition and Policy Changes?

Paul Donovan, Chief Economist of UBS Global Wealth Management, attributes this shift to several factors. Firstly, he points out that Britain’s current millionaire count is ‘disproportionately high,’ suggesting that a correction was likely. Secondly, the implications of sanctions against Russia have affected wealthy individuals in the UK over the past few years, contributing to the projected decline.

Another crucial factor is Britain’s decision to eliminate the ‘non-dom’ status, which previously allowed wealthy foreign residents to avoid tax on overseas income. While Donovan describes this as having a ‘small effect,’ it is part of a broader trend of policy changes affecting wealth distribution in the country.

Donovan emphasizes that the decline in Britain’s millionaire population is not solely a function of UK policies. Rather, it reflects the “pull factors” of other countries that are attracting wealthy individuals. He specifically points to Dubai and Singapore as examples of locations that are becoming increasingly attractive to the “non-indigenous millionaire population.”

This global competition for high-net-worth individuals is reshaping the distribution of wealth across borders. Wealthy individuals are constantly seeking low-tax locations, and countries that can offer favorable tax policies and other incentives are likely to see growth in their millionaire populations.

Impact on UK Real Estate

The changing landscape of wealth in Britain is also affecting the real estate market. British real estate group Winkworth reported that demand for high-end properties has been negatively impacted by tax policies targeting wealthy individuals. Additionally, a proposal by the new Labour government to tax private schools has further dented demand in this sector.

These factors combined are creating a challenging environment for luxury real estate in Britain, potentially leading to a ripple effect across other sectors of the economy that cater to high-net-worth individuals.

Global Trends in Millionaire Population

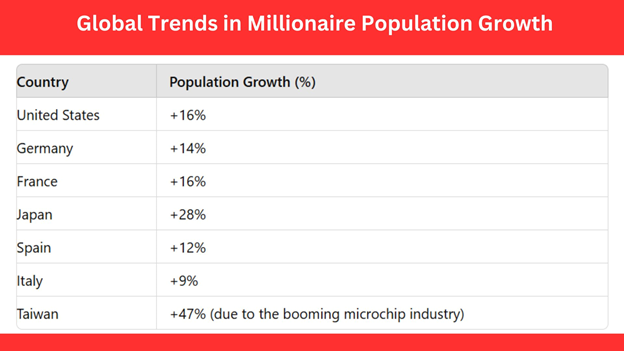

While Britain faces a decline, the UBS report forecasts growth in millionaire populations for several other countries. The United States is expected to see a 16 percent increase in its dollar millionaire population by 2028. Germany is projected to experience a 14 percent increase, while France is also expected to see a 16 percent rise.

Japan stands out with a forecasted 28 percent increase in its millionaire population, reflecting the country’s economic resilience and potential for wealth creation. Spain and Italy are also expected to see growth, with 12 percent and 9 percent increases respectively.

Taiwan: A Standout in Millionaire Growth

Perhaps the most striking projection in the report is for Taiwan. The island nation is expected to see a remarkable 47 percent growth in its millionaire population by 2028. This surge is primarily attributed to Taiwan’s thriving microchip industry, which has positioned the country as a global leader in semiconductor manufacturing.

GLOBAL WEALTH RISES

Defining Wealth

According to UBS Global Wealth Management, “wealth” encompasses the total value of financial assets plus real assets owned by households, subtracting their debts. The Swiss bank’s latest report is based on data from 56 markets, which collectively represent approximately 92.2 percent of global wealth.

Rebound in Global Wealth

After a 3 percent decline in 2022, global wealth bounced back in 2023, growing by 4.2 percent in dollar terms. This recovery reflects resilience in global markets amid ongoing challenges like the COVID-19 pandemic and geopolitical tensions.

Future Millionaire Projections

UBS forecasts a rise in the number of adults worth over $1 million in 52 out of 56 markets by 2028. The report highlights Taiwan as a standout, expecting a remarkable 47 percent growth in its millionaire population driven by the country’s robust microchip industry.

Regional Wealth Growth

The UBS Global Wealth Report for 2024 paints a picture of a rapidly evolving global wealth landscape. While some traditional centers of wealth, such as Britain, are projected to see declines in their millionaire populations, other regions and countries are poised for significant growth.

Conclusion

Ultimately, the UBS report underscores the dynamic nature of global wealth distribution and the ongoing evolution of the world economy. As wealth continues to shift and grow, it will undoubtedly shape economic policies, investment strategies, and global power dynamics in the years to come.