For the first time, the Bangladesh Bank has unveiled an exit policy granting defaulted borrowers up to three years for loan repayment with a 10% down payment. This strategic move aims to maintain liquidity flow and mitigate toxic loans within the banking sector.

You Can Also Read: POSTAL SERVICE ‘EMTS’ REVOLUTIONIZES MONEY TRANSFER CONVENIENCE!

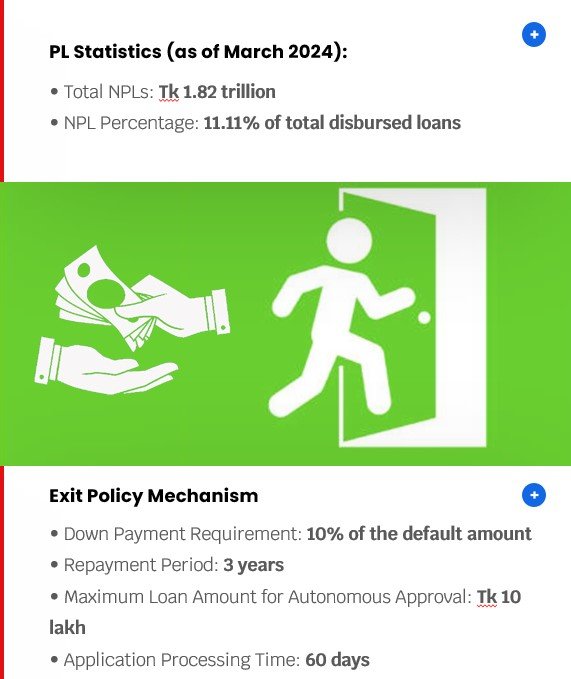

According to a central bank circular issued on July 8, 2024, the exit facility is distinct from debt rescheduling or restructuring, rendering borrowers ineligible for new credit until their existing loans are fully repaid. The policy mandates that banks determine the loan installment period, allowing borrowers to settle their dues through multiple payments within the three-year timeframe. The circular also instructs managing directors of banks to implement the new policy effectively.

New Exit Mechanism Policy to Standardize Loan Collection

Previously, in the absence of a standardized policy, banks followed varied criteria for the exit mechanism in loan collection and adjustment. Central bank officials noted that under the new policy, even if defaulting borrowers utilize the exit facility, they will remain classified as defaulters until the entire loan is cleared. Banks will mark the exit status next to these customers’ classifications (three types of non-performing loans) in the Credit Information Bureau.

According to banking experts, defaulted borrowers are going to be benefitted from the exit facility. By paying 10% of their defaults, they can repay the remaining amount over three years. A prior one-time exit policy for top borrowers resulted in many exiting their loans without full repayment, leaving a significant portion of these loans in default.

This policy is set to address the growing need for liquidity and stabilize the banking sector. The circular mandates that banks must process exit facility applications within 60 days of receipt. Approval of these applications requires the endorsement of the board of directors, though bank management can autonomously grant the exit facility for loans up to Tk10 lakh.

The policy includes provisions for interest waivers, contingent upon timely repayment. Should the loan not be repaid within the agreed timeframe, the waived interest will be reinstated, and the exit facility will be revoked.

Strict adherence to central bank guidelines is required for recovering debt secured under the exit facility. Banks must maintain proper provisions against the loan, ensuring that collateral cannot be released until the loan is fully settled. However, loans may be adjusted through the sale of mortgaged property, subject to negotiation with the customer.

Five-Year Plan Incorporates New Non-Time-Bound Exit Policy

As of March 2024, data from the Bangladesh Bank indicates that the total disbursed loans in the banking sector reached nearly Tk16.41 lakh crore, with over Tk1.82 lakh crore classified as defaulted loans, representing 11.11% of the total disbursed amount. This underscores the urgent need for effective exit strategies to mitigate the burden of non-performing assets.

This policy builds on previous initiatives, such as the 2019 one-time exit policy for borrowers with loans exceeding Tk500 crore. That policy allowed repayment over ten years with a one-year grace period at 9% simple interest, starting with a 2% down payment.

The newly introduced exit facility stands apart from traditional loan-rescheduling mechanisms. Borrowers utilizing this facility will not see a change in their loan status until the full repayment is achieved, and they will be ineligible for new credit lines during this period, as stipulated by the central bank’s banking regulation and policy department.

Previous Initiatives:

- 2019: One-time exit policy for loans exceeding Tk 500 crore

- Repayment Period: 10 years

- Grace Period: 1 year

- Interest Rate: 9% simple interest

- Down Payment: 2%

Previously, in the absence of a standardized policy, banks have resorted to diverse practices to settle such loans, often resulting in inconsistent outcomes. Recognizing this gap, the central bank identified the need for a comprehensive guideline. This move aligns with Bangladesh Bank’s five-year strategic plan, which is synchronized with the country’s eighth five-year plan, explicitly mentioning the issuance of a non-time-bound exit policy.

Crucially, this exit policy maintains the classification status of the loan until it is fully repaid, differing from loan rescheduling, which can convert a classified loan to an unclassified status.

Operational Challenges Ahead

The circular outlines that the maximum tenure for loan repayment under this facility is two years, with the possibility of a one-year extension upon approval from the bank’s board of directors. While board approval is mandatory for implementing the policy, bank management has the discretion to approve loans amounting to less than Tk1 million independently.

This structured and methodical approach is expected to clean up the ‘Augean stables’ of the banking sector, where the accumulation of NPLs has reached critical levels. By introducing this standardized exit strategy, Bangladesh Bank aims to restore stability and confidence within the financial system, setting a new precedent for handling classified loans.

However, the introduction of this exit policy by the Bangladesh Bank raises critical questions about its necessity and operational implications amidst a backdrop of escalating non-performing loans (NPLs). Central to the debate is the definition and identification of unintentional defaulters—a pivotal determination that poses significant challenges for banks tasked with implementation. The absence of clear criteria risks exploitation by willful defaulters, complicating the policy’s effectiveness. Notably, the newly introduced exit facility distinguishes itself from traditional loan rescheduling or restructuring measures, offering relief without altering loan classifications.

Bangladesh Bank has navigated a labyrinth of rules and initiatives to manage default loans, from significant restructuring efforts a decade ago to recent strategies like the 11-point roadmap introduced earlier this year. However, the multiplicity and frequent revisions of these policies have introduced complexities and ambiguities within the banking sector. For instance, recent adjustments allowing businesses to reschedule loans with reduced down payments and extended repayment periods were justified by global crises, yet their overall impact remains unclear due to a lack of comprehensive status reports.

Critically, the outcomes of these initiatives, including controversial large loan restructuring mechanisms, remain elusive, raising concerns about their effectiveness in mitigating NPL burdens. The banking industry awaits clarity on the tangible benefits derived from these policies amidst ongoing uncertainties.

The efficacy of the newly announced exit policy will be closely monitored to assess its alignment with Bangladesh Bank’s objectives. Its success hinges on addressing operational ambiguities and ensuring equitable treatment of borrowers while striving to stabilize the banking sector’s financial health.