In the fiscal year 2023-24, Bangladesh witnessed a notable downturn in consumption relative to its GDP, marking a stark decline over the past three years. This trend, substantiated by official data from the Bangladesh Bureau of Statistics (BBS), underscores a challenging economic landscape characterized by entrenched inflation, widening income disparities, and diminishing purchasing power among the populace.

You can also read: AL Leads Bangladesh from Post-War Recovery to Economic Boom with Historic Budgets

According to BBS figures, the consumption-to-GDP ratio plummeted by 1.85 percentage points from the previous fiscal year, settling at 72.39% in FY 2023-24 compared to 74.24% in FY 2022-23. This decline signals a palpable strain on the overall economic health of the nation, influenced significantly by reduced expenditures both in the private and public sectors.

Historically, FY 2022 boasted the highest consumption-to-GDP ratio in recent years at 74.78%, reflecting a comparatively robust consumer spending environment. However, this momentum faltered in subsequent fiscal years, with FY 2023 and FY 2024 witnessing a concerning reversal.

Inflation Surge Stifles Consumer Spending

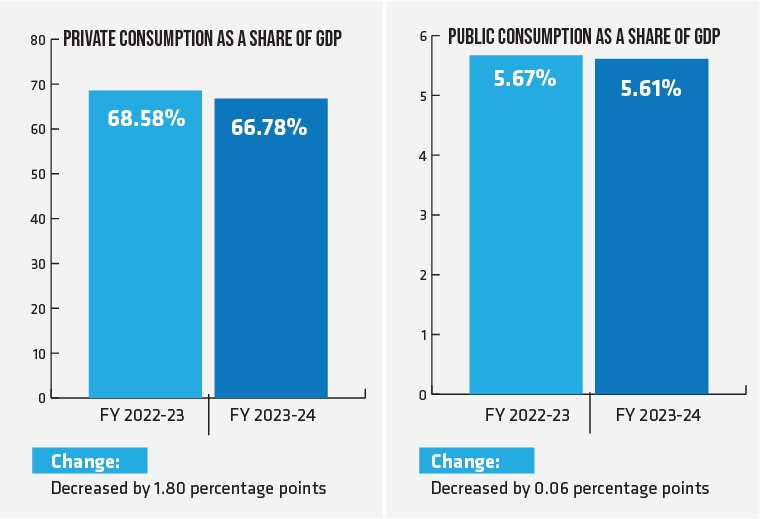

Economists attribute this downturn primarily to elevated inflationary pressures, which have eroded consumer purchasing power across all sectors. The resultant effect has been a pronounced reduction in household spending as families grapple with higher costs for essential goods and services. In particular, private consumption as a share of GDP contracted by a significant 1.80 percentage points to 66.78% in FY 2023-24 from 68.58% in FY 2022-23, indicating a notable decline in consumer confidence and spending capacity.

Meanwhile, public consumption, while declining marginally in proportion to GDP by 0.06 percentage points to 5.61% in FY 2023-24, has also felt the strain of economic pressures albeit to a lesser extent compared to the private sector.

This trend underscores broader economic challenges facing Bangladesh, where inflationary dynamics and income disparities have combined to dampen overall consumption levels and consequently impact economic growth prospects.

Over the past eighteen months, Bangladesh has grappled with sustained inflationary pressures, leading to a significant contraction in overall consumption and exerting a negative impact on production and supply chains.

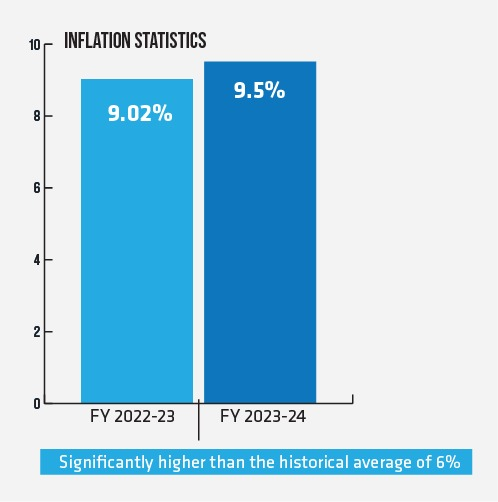

Official data from the Bangladesh Bureau of Statistics (BBS) indicate that point-to-point inflation has consistently remained above 9.0 percent, reflecting the persistent economic strain.

In May 2024 alone, inflation surged to 9.89 percent. The twelve-month average inflation rate from June 2023 to May 2024 was recorded at 9.73 percent, further illustrating the relentless upward pressure on prices.

This inflationary environment has markedly dampened national consumption. Moreover, the deepening income inequality and dwindling purchasing power have exacerbated the situation.

Local Production Suffers as Imports Fall

The ongoing lower import trend has affected the supply side. The import of raw materials and intermediate goods has already declined. So, local production has decreased and consumption has dropped, which underscores the interconnected nature of supply chain disruptions and consumption trends.

Over the last two fiscal years, consumption growth in Bangladesh has remained subdued as consumers have experienced one of the most significant declines in spending power in recent history due to persistently high inflation.

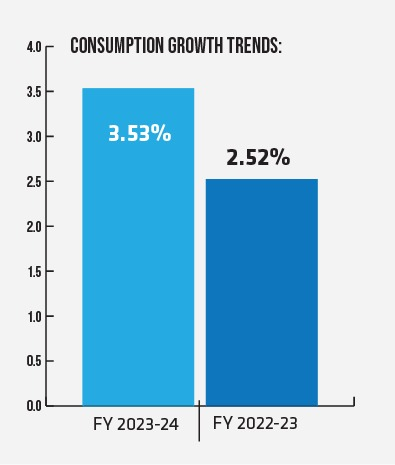

According to provisional estimates from BBS, the growth rate of goods and services consumption was 3.53 percent in FY 2023-24, a slight improvement from 2.52 percent in the previous fiscal year.

These figures are in stark contrast to the pre-pandemic years, where the consumption growth rate consistently exceeded 6 percent.

The economic landscape of Bangladesh has been under immense pressure, driven by a severe depletion of foreign currency reserves and a rapid depreciation of the taka. These factors have collectively fueled an unprecedented surge in inflation, setting record levels and further straining the economy.

Currently, people’s purchasing power has been declining for the past two years. Meanwhile, wage growth has lagged behind inflation, resulting in negative real wage growth.”

Consumers Feel the Pinch

In FY 2022-23, Bangladesh experienced an average inflation rate of 9.02 percent, significantly higher than the recent historical average of 6 percent. The Consumer Price Index (CPI) surged by approximately 9.5 percent in the first ten months of FY 2023-24, according to BBS data.

The elevated consumer prices have forced many to reduce their consumption. With wages and incomes not rising in tandem with the costs of essential goods and services, people have had to adopt coping mechanisms.

These mechanisms include cutting back on consumption, savings, and crucial expenditures on education and health, mirroring the economic strain seen during the peak of the pandemic.

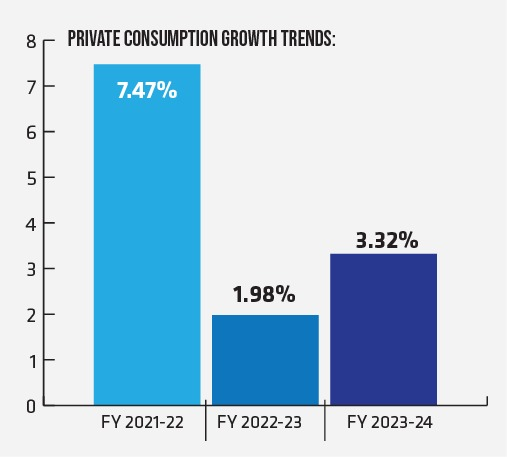

In FY 2023-24, Private consumption growth was projected at 3.32 percent, a modest improvement from 1.98 percent in the previous year, but still a sharp decline from the 7.47 percent growth observed in FY 2021-22, as reported by the National Statistical Agency.

Moreover, lower consumption can lead to increased child marriage and higher infant mortality rates too, which underscores the severe social consequences of the economic downturn.

According to the officials of Shwapno, the country’s largest grocery chain, the market expansion observed in 2021 and 2022 has not been sustained. With access to data from 1.5 million customers, Shwapno has identified significant shifts in consumer behavior, characterized by substantial declines in sales volume across various sectors.

These trends highlight critical challenges facing Bangladesh’s economy, where inflationary pressures, reduced purchasing power, and declining consumption threaten to hinder broader economic stability and growth.

GDP Growth Moderates Across Sectors

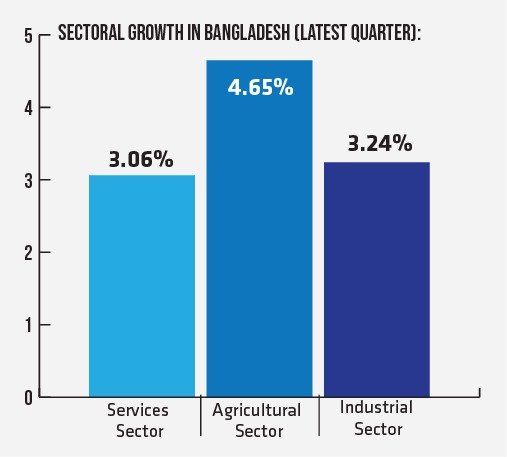

The services sector, which constitutes half of the country’s GDP, experienced a notable slowdown, expanding at only 3.06 percent during the quarter, down from previous levels. This offset a marginal uptick in agricultural production, which grew by 4.65 percent compared to 4.22 percent in the same period the previous year.

The industrial sector, comprising 37.57 percent of the economy, witnessed subdued growth with output expanding by 3.24 percent in the October-December 2023 period, a significant decline from the 10 percent growth recorded a year ago.

These figures come amidst subdued growth projections from international agencies. The World Bank, for instance, forecasts a modest GDP growth rate of 5.6 percent for the current fiscal year, below the average annual growth rate of 6.6 percent seen in the decade before the Covid-19 pandemic. Looking ahead to fiscal year 2024-25, the World Bank anticipates a slight improvement with growth projected at 5.7 percent, driven by a gradual recovery in private consumption supported by easing inflationary pressures.

The quarterly GDP estimates, now a regular feature following the IMF’s conditions tied to a significant loan, provide crucial insights into Bangladesh’s economic performance in shorter intervals. They underscore the challenges facing the economy, including the need for targeted policy interventions to stimulate industrial growth, enhance export competitiveness, and bolster consumer confidence.