Key Highlights:

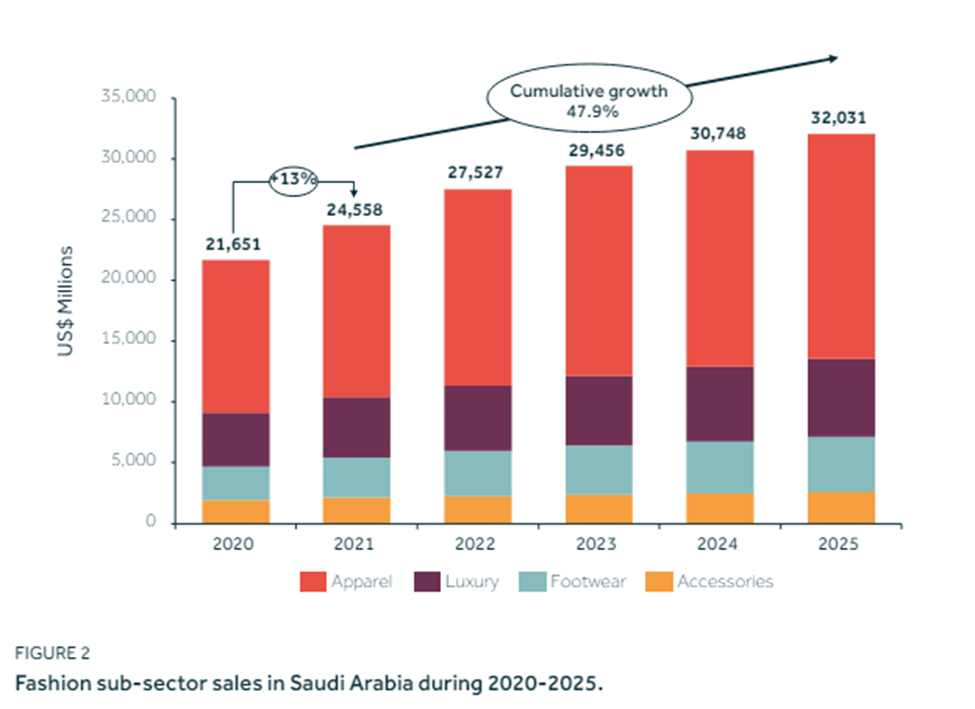

- Fashion sales in Saudi Arabia are expected to increase by 48% from 2021 to 2025

- In the women’s apparel market, shirts and blouses represent the largest category with sales totaling $1.1 billion

- The Saudi Fashion Commission has prioritized the integration of Industry 4.0 technologies into its domestic supply chain strategy

Saudi Arabia is swiftly establishing itself as a significant presence in the global fashion arena, as indicated by a recent report. This report, titled ‘The State of Fashion in the Kingdom of Saudi Arabia 2023’, emphasizes the Kingdom’s ambition to reduce dependence on imports and elevate local talent onto the world stage. The report highlights the remarkable growth prospects of Saudi Arabia’s fashion industry, citing its rapid evolution and alignment with national objectives.

You can also read: Can Labor’s Pro-Business Pivot Win Over Britain?

Central to Saudi Arabia’s Vision 2030, a comprehensive economic diversification strategy, is the development of a self-sustaining fashion ecosystem encompassing design, manufacturing, logistics, and retail. This initiative aims not only to decrease reliance on imported fashion goods, which totaled $7.3 billion in expenditures in 2021, but also to stimulate employment, boost non-oil GDP, and enrich the cultural landscape.

As the domestic fashion sector matures, it is expected to significantly contribute to Vision 2030 goals, positioning Saudi Arabia as a prominent player in global fashion while celebrating its distinctive cultural heritage.

Saudi Cultural Economy Uplifted by Fashion Flare

In the Kingdom, fashion plays a crucial role in the cultural economy. Data from the Ministry of Human Resources and Social Development for 2022 shows 73 fashion occupations, with 13 core occupations (e.g., tailor, model, jewelry designer) and 60 linked occupations (e.g., clothes seller, textile machine operator, tanner). These roles accounted for 23,963 jobs in 2022, with 8,345 in core roles and 15,618 in linked roles.

Fashion sales in Saudi Arabia are expected to increase by 48% from 2021 to 2025, with a 13% compound annual growth rate, driven by economic and population growth. Significant gains are projected in apparel, accessories, footwear, and luxury goods.

The Saudi fashion ecosystem contributes about 1.4% to the GDP and supports around 230,000 jobs or 1.8% of the labor force. Currently, 60% of the ecosystem’s value comes from retail and wholesale activities.

Vision 2030 Fuels Retail Shift to Online Platforms

The shift towards online retailing has accelerated due to the rapid growth of e-commerce during the Covid-19 pandemic.

This trend is further propelled by national policies such as Vision 2030, which aims to achieve a 70% adoption rate of cashless payments by 2025.

In the women’s apparel market, shirts and blouses represent the largest category with sales totaling $1.1 billion (SAR 4.1 billion), followed by jeans with $958 million (SAR 3.8 billion). The market for women’s apparel is expected to grow by 20% by 2027.

For men’s apparel, the dominant product category is underwear, generating $626 million (SAR 2.3 billion) in sales, followed by outerwear including thobes, which totals $499 million (SAR 1.9 billion).

Despite being smaller than the women’s market in size ($3.5 billion, SAR 13.1 billion versus $7.4 billion, SAR 27.8 billion), the men’s apparel market is projected to grow by 27% from 2022 to 2027.

Saudi Style Goes Global – Who’s Buying?

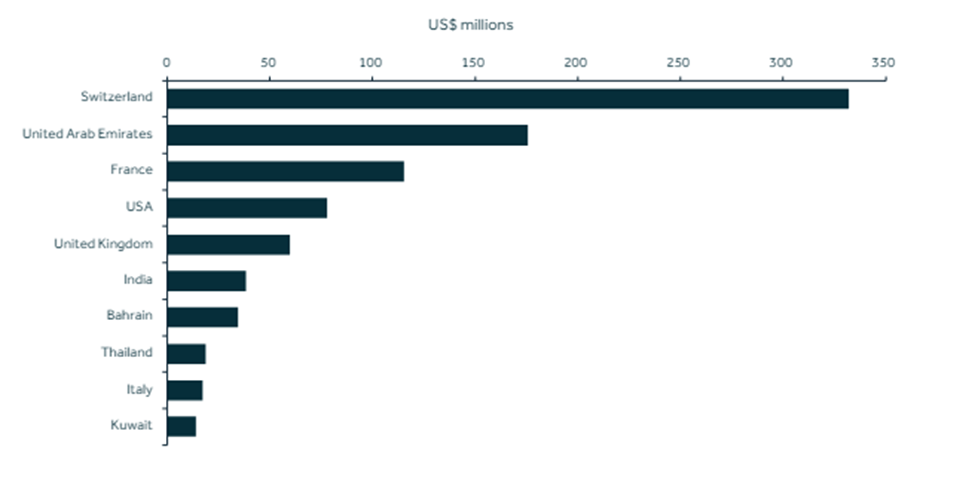

In 2021, Saudi Arabia’s main fashion export destinations were Switzerland ($332 million, SAR 1.2 billion), the UAE ($175 million, SAR 656 million), and France ($115 million, SAR 431 million). Jewelry constituted 99.8% of exports to Switzerland, 96% to France, and 63% to the UAE, with apparel making up the rest.

As a Gulf Cooperation Council (GCC) member, Saudi Arabia benefits from high per capita spending, especially in Dubai, the region’s primary shopping hub. The GCC luxury fashion market was valued at $9.7 billion (SAR 36 billion) in 2021, with Saudi Arabia’s sector expanding by 19%. Projections indicate the GCC luxury market could grow to $11 billion (SAR 41.2 billion) by 2030, largely driven by Saudi Arabia.

Luxury consumer spending in Saudi Arabia is fueled by the allure of limited-edition items and the preference for Middle Eastern collections.

Saudi Invests in the Future Through Massive Scholarship Programs

Since King Abdul Aziz first dispatched a group of six Saudi students to Cairo in 1927 for higher education, the Kingdom’s commitment to investing in its people has steadily grown. At its peak in 2016, the King Abdullah Scholarship Program supported over 100,000 students overseas.

This program, bolstered by several others, including the Custodian of the Two Holy Mosques Scholarship Program overseen by the Ministry of Education, aims to send 70,000 students annually to top-ranked international universities and training institutes by 2030.

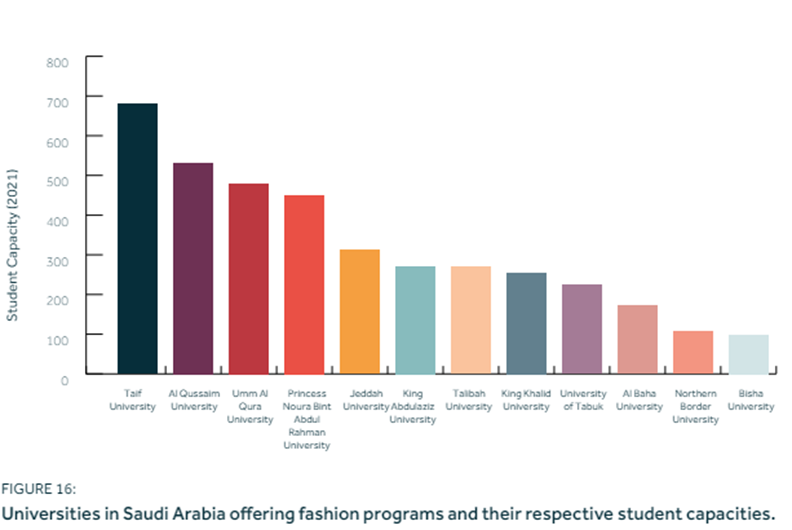

Recognizing the importance of supporting aspiring fashion designers, the Ministry of Culture introduced a new full academic scholarship in 2019 specifically for Saudi students pursuing fashion design at prestigious US fashion schools.

Saudi Fashionistas Favor Planet Over Pockets

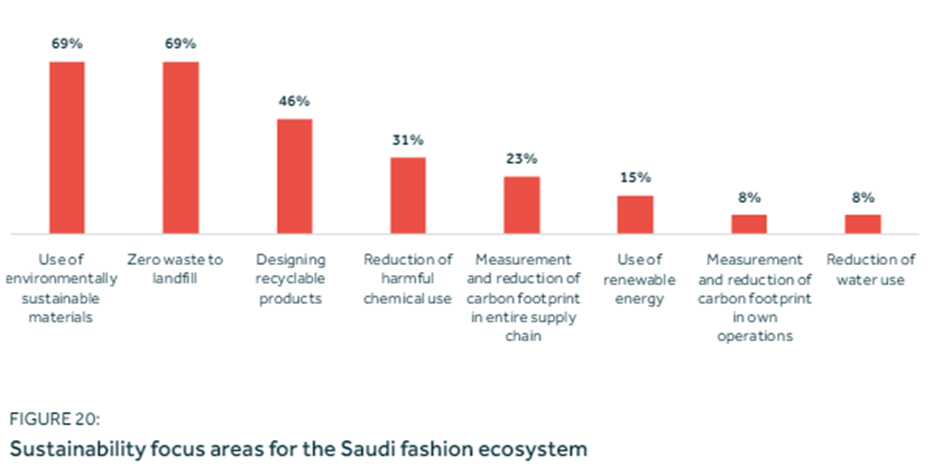

In 2021, the Kingdom announced its national transition to net zero by 2030 as part of the Saudi Green Initiative. Already noted in the Kingdom is the reuse and recycling of clothing for textiles. A 2022 survey at the Fashion Future’s event, involving fashion designers, governmental officials, and education providers, revealed that 84% of respondents consider sustainability important to their customers.

However, the market remains price-sensitive, as 58% of industry respondents noted that customers would not pay more for sustainable fashion products.

Kingdom Pioneers Next-Gen Fashion 4.0

The Saudi Fashion Commission has prioritized the integration of Industry 4.0 technologies into its domestic supply chain strategy. In the manufacturing segments of the fashion value chain, Saudi Arabia has developed significant capabilities in key fashion sectors.

Notably, the Kingdom’s global leadership in petrochemicals presents opportunities for synthetic fiber production, along with associated yarns, fabrics, dyes, and inks crucial for dyeing and printing operations in fashion product assembly.

Advanced materials science, a key theme of Industry 4.0, leverages Saudi Arabia’s leading position in synthetic materials to create a competitive edge in local fashion production. Furthermore, as the world’s top petrochemical producer, Saudi Arabia stands poised to play a pivotal role in the emerging circular fashion economy.

Saudi Arabia is not just envisioning the future of fashion; it is actively shaping it with bold initiatives and strategic investments. From nurturing local talent to fostering sustainable practices and integrating cutting-edge technologies, the Kingdom is setting a dynamic precedent for the global fashion industry.