- China’s chip production jumped 40% in Q1 2024

- U.S. chip giants generate more revenue from China than the US

- In 2023, China surpassed 100 AI models with more than 1 billion parameters

The U.S.’s increasing misuse of export controls and aggressive actions against China’s semiconductor industry reflects its apprehension in the high-tech race with China. Washington is considering further restrictions on China’s access to AI chip technology, adding to its ongoing efforts to stifle China’s technological advancements. However, these measures are unlikely to halt China’s progress and may instead harm U.S. industry stakeholders and disrupt the global supply chain.

You can also read: Britain in ‘Purdah’ as elections approach

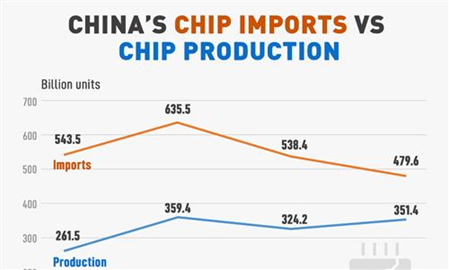

China’s technological competitiveness is evident in its semiconductor sector’s robust growth. From January to May, China’s integrated circuit exports surged 21.2% year-on-year, surpassing vehicle exports. In 2023, China’s import volume of integrated circuits fell by 10.8%, with the total import value declining by 15.4%, indicating increased self-reliance.

Additionally, China developed over 100 AI models with more than 1 billion parameters, revolutionizing sectors like electronics, healthcare, and transportation.

Despite numerous U.S. restrictions on selling advanced semiconductors and chipmaking tools to China, these efforts have not stalled China’s progress but have backfired on the U.S., causing significant disruptions to the global supply chain.

US Semiconductor Export Sanctions Could Be Backfiring

China’s production of traditional semiconductor chips experienced a remarkable 40% growth in the first quarter of 2024. This significant increase in production indicates that China could potentially ascend to the position of a global leader in the production of traditional chips.

There are no trade barriers imposed on ‘mature chips,’ or chips that employ 28nm or older process technology. The U.S. government intentionally excluded these chips from its sanctions to maintain supply chain resilience. These older chips are extensively utilized in a variety of crucial devices, such as automobiles and basic electronics (e.g., toasters, phones, and medical equipment). Disrupting the supply chain could lead to global complications. Furthermore, the U.S. government has determined that these chips do not pose a threat to national security, at least not in the same manner as newer chips do.

Consequently, China’s national output of traditional chips reached an unprecedented high, with a production of 36.2 billion units in March alone. China’s output over the past three months is nearly triple what it produced in Q1 2019, which was when China initiated its plan to internalize chip production.

Due to U.S. sanctions, the majority of new Chinese investments have been directed toward mature semiconductors rather than cutting-edge semiconductor nodes. Strong nationwide support has also played a significant role and is believed to be the primary driver behind China’s massive production gains, to the extent that China is now producing chips in excess.

At this pace, China is on track to dominate the global production of traditional chips, as per reports. China’s production capacity for mature processing is projected to capture 39% of the global market share by 2027, a rise from 31% the previous year.

This trend could persist beyond 2027 if the U.S. continues to uphold its current regulations. China has been compelled to produce chips using older process technologies, as it lacks a mainstream method to compete with companies such as Intel and TSMC on cutting-edge process nodes. China is eager to achieve self-sufficiency, but it lacks access to the necessary lithography tools required to manufacture advanced microchip processors.

In the end, China still heavily depends on chip imports (of the chips it can still receive, that is). In fact, China’s semiconductor imports have increased by 12.7% in Q1 2024, suggesting that it is not yet fully successful in its pursuit of self-sufficiency.

Navigating Export Curbs

U.S. chip manufacturers, including those with a significant portion of their business in the U.S. such as Micron Technology, AMD, and Nvidia, have made concerted efforts to cater to their Chinese clientele despite the imposition of export controls.

When the initial wave of U.S. restrictions took effect towards the end of 2022, Nvidia and Intel responded by creating modified versions of AI chip products specifically for the Chinese market.

A year later, the U.S. revised the export rules to address these perceived loopholes. However, shortly thereafter, it was reported that Nvidia was developing a new chip tailored for China.

Intel has reportedly maintained the sale of laptop processor chips worth hundreds of millions of dollars to the U.S.-sanctioned Chinese telecom company Huawei, facilitated by an export license granted by the Donald Trump administration.

AMD has also engineered an AI chip for China but will need to apply for an export license following its inability to secure approval from U.S. regulators last month.

Executives from Intel, Qualcomm, and Nvidia were reportedly part of a coalition that intended to lobby Washington against stricter chip restrictions in July of the previous year.

These companies are also members of the Semiconductor Industry Association, a prominent U.S. semiconductor trade organization, which issued a statement around the same time calling for a de-escalation of tensions and a cessation of further sanctions due to the significance of the Chinese market for domestic chip companies.

In response to the stringent policy stance adopted by the U.S., China has reciprocated. In May of the previous year, chips manufactured by America’s Micron were prohibited from being used in critical information infrastructure in China after failing an evaluation by the country’s Cyberspace Administration.

Market Share Worries

In response to countries like the U.S. and the Netherlands restricting its access to advanced technology, China has been making concerted efforts towards self-sufficiency by developing its domestic semiconductor industry.

Beijing has allocated billions of yuan in subsidies to its chip companies in an endeavor to stimulate domestic manufacturing. An examination of Huawei’s Mate 60 Pro smartphone by TechInsights unveiled an advanced chip manufactured by SMIC, China’s leading chip maker. The smartphone is also reported to feature 5G connectivity, a technology that U.S. sanctions sought to deny Huawei access to.

The US efforts to restrict China’s access to advanced semiconductor technology through export controls have not only failed to suppress China’s technological progress but have also backfired, fueling China’s drive for self-reliance in chip manufacturing. While China still relies on imports for certain chips, it has made significant strides in ramping up the production of mature chips and developing its domestic semiconductor industry. The tit-for-tat measures between the U.S. and China have disrupted the global supply chain, and the ongoing tech rivalry shows no signs of abating, with both sides determined to gain an edge in the critical semiconductor sector.