- 60% of all jobs have at least 30% of activities that could be automated

- By 2025, job losses due to automation could be around 85 million globally

- Financial firms could cut operational costs by 22% by 2030, amounting to savings of $1 trillion

- AI models might not perform as expected during economic downturns

Artificial Intelligence, or AI, has become a ubiquitous term in the 21st century. From self-driving cars to virtual assistants, AI is revolutionizing various sectors of our economy and society. It’s not just about robots and chatbots; AI’s influence extends to fields as diverse as healthcare, finance, education, and transportation. The global AI market size was valued at USD62.35 billion in 2020 and is expected to grow at a compound annual growth rate (CAGR) of 40.2% from 2021 to 2028. In 2024, the market size is valued at USD298.25 billion.

In a recent survey, almost 80% of people said that artificial intelligence (AI) would have a transformative effect on the global economy. the global debate around AI’s consequences has been missing a comprehensive and coherent framework for thinking through all of the ways that it will shape economies and financial markets.

AI and Labor Markets

In the realm of labor markets, AI has been a game-changer. During periods of economic stability, companies often invest in automation to increase efficiency and productivity. For instance, a 2020 report by McKinsey estimated that 60% of all jobs have at least 30% of activities that could be automated. This investment in automation not only boosts the company’s bottom line but also allows employees to focus on more complex tasks that require human ingenuity.

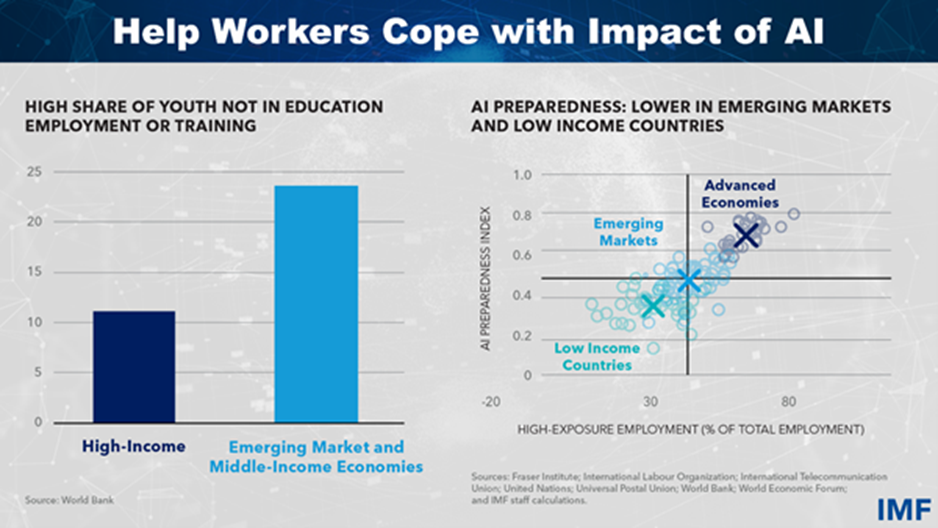

However, the dynamics change during an economic downturn. Companies, in an attempt to cut costs, may resort to layoffs and increase their reliance on automation. A study by the World Economic Forum predicts that by 2025, the job loss due to automation could be around 85 million globally. But it’s not just about the numbers; the impact is also sector-specific. Jobs in sectors like manufacturing, retail, and transportation are more susceptible to automation compared to those in healthcare, education, and the creative industry.

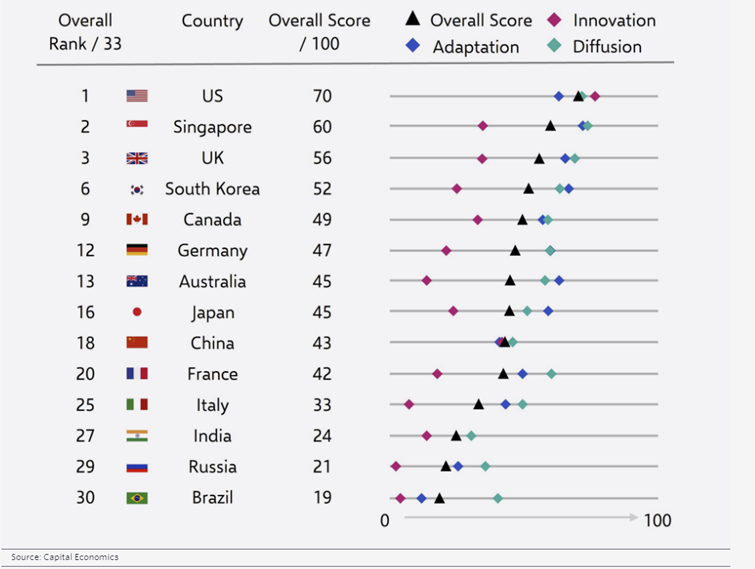

Moreover, research from the International Monetary Fund (IMF) shows that in advanced economies, 30% of jobs are at high risk of AI substitution, compared with 20% in emerging markets, and 18% in low-income countries. This disparity could lead to a broader scale of potential job losses and risks of long-term unemployment, turning an ordinary downturn into a severe economic crisis.

AI and Financial Markets

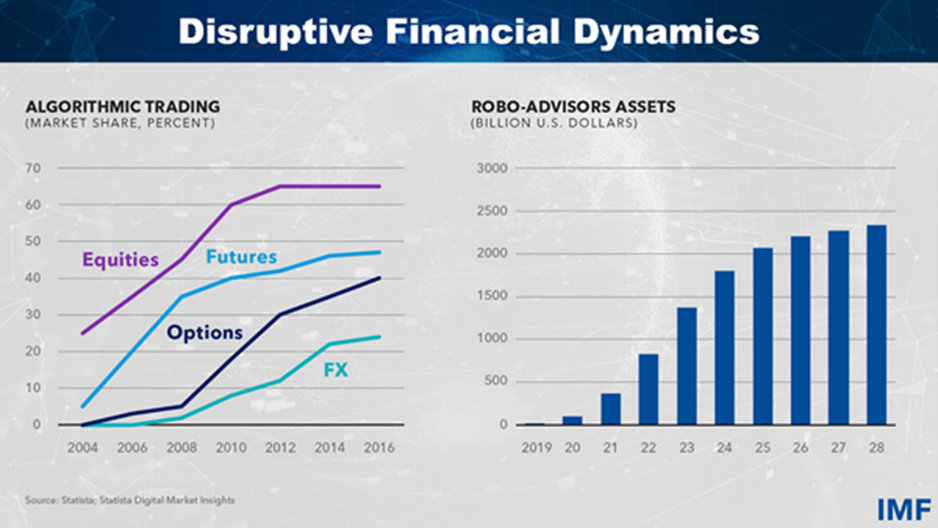

The financial industry has been at the forefront of adopting AI and automation. From robo-advisors for investment management to AI-driven credit scoring and fraud detection, the industry has embraced AI to enhance efficiency, accuracy, and profitability. According to a report by Autonomous Next, financial firms could cut operational costs by 22% by 2030, amounting to savings of $1 trillion, through the use of AI technologies.

However, the integration of AI in financial markets is not without risks. One of the significant concerns is the performance of AI models during novel events, which are different from the scenarios they were trained on. For instance, during an economic downturn or a black swan event, AI models might not perform as expected due to the lack of training data for such situations. This could lead to inaccurate predictions and decisions, exacerbating the financial crisis.

Moreover, AI could spur a rapid, simultaneous move to safe assets, leading to falling prices on risk assets. AI models, trained to react to market signals, could interpret a downturn as a signal to move to safer assets. This could trigger a domino effect, with AI models across the market making similar moves, leading to a sharp fall in the prices of risk assets. Given the ‘black box’ nature of AI, controlling such behavior could be challenging.

A Cautionary Note from the IMF

The International Monetary Fund’s (IMF) Deputy Chief recently issued a warning about the potential disruptive impact of artificial intelligence (AI) on the economy and financial markets. According to her, the full extent of AI’s disruption might only be revealed during an economic downturn, which could escalate into a severe crisis if AI-related risks are not addressed.

In her address at an AI summit in Switzerland on May 30, IMF’s First Deputy Managing Director, Gita Gopinath, highlighted that the discourse around AI risks has been predominantly centered on issues of privacy, security, and misinformation. However, the potential of AI to exacerbate the next recession has received considerably less attention.

Gopinath warned that in a scenario where AI adoption is ubiquitous, the technology could transform a regular economic downturn into a profound crisis. This could occur through AI-induced disruptions in labor markets, financial markets, and supply chains.

Strategies to Counter AI Risks: Recommendations

Gopinath offered some strategies to counter the risks posed by AI, without undermining its positive aspects.

Key measures include:

Tax Policy Reform: Ensure tax policies don’t favor automation over human workers, though she isn’t advocating for a specific AI tax.

Education and Skills Training: Equip workers with new skills and education to adapt to changes.

Strengthening Social Safety Nets: Enhance unemployment benefits to better support displaced workers.

Leveraging AI for Solutions: Use AI to aid in upskilling, targeting assistance, and providing early financial market warnings.

Gopinath emphasizes the need to “AI-proof” the global economy and calls for swift action from governments and policymakers to address potential labor market disruptions.

While artificial intelligence offers immense potential for economic growth and efficiency gains across various sectors, there are valid concerns about its disruptive impact on labor markets and financial stability, especially during economic downturns. To mitigate these risks, policymakers and institutions must act swiftly to “AI-proof” the global economy through a combination of strategies, including ensuring tax policies don’t inadvertently favor automation over human workers, upskilling and reskilling the workforce, strengthening social safety nets, and leveraging AI itself for early warning systems and targeted assistance. A concerted effort involving governments, institutions, and stakeholders is crucial to harness the benefits of AI while minimizing its potential negative consequences on the economy and society.