Bangladesh’s trade with South Asian Association for Regional Cooperation (SAARC) member nations is in decline, reflecting broader economic issues. According to a recent Bangladesh Bank report, export earnings from SAARC countries decreased from $1.93 billion in FY22 to $1.91 billion in FY23, a nearly 1% drop.

You can also read: Bangladesh-India Ties Grows Beyond Strategic Partnership

SAARC countries, including Afghanistan, Bhutan, India, and others, made up just 3.44% of Bangladesh’s total exports in FY23, with Europe and the U.S. being the main export destinations. Despite a 6.28% overall export growth, reaching $55.55 billion in FY23, exports to SAARC nations fell, highlighting a concerning discrepancy.

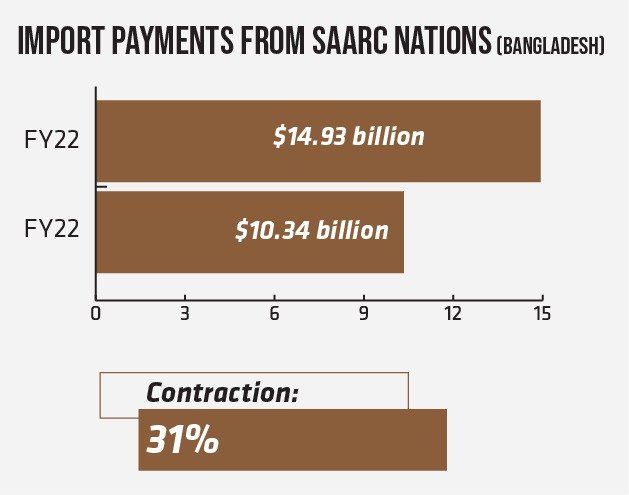

Import Downturn Exposes Fragile SAARC Trade Relations

On the import front, the performance of SAARC nations is equally underwhelming, commanding a mere 15% share of Bangladesh’s total import payments. The precipitous decline in import payments from $14.93 billion in FY22 to $10.34 billion in FY23, reflecting a staggering 31% contraction, amplifies the gravity of the situation. This downturn outpaces the overall import trajectory, attributed in part to the stringent measures imposed by the central bank to navigate the currency crunch, which saw an overall import slump of 15.76%. This accentuates the pronounced underperformance of imports from SAARC countries vis-à-vis the broader import dynamics.

When probed on the causative factors behind Bangladesh’s dwindling trade ties with SAARC nations, there found the confluence of factors, chief among them being the prevailing dollar crisis precipitating a contraction in overall imports. The conundrum lies in the overlap of product portfolios, wherein these nations often produce akin goods, thereby constraining the scope for mutually beneficial trade engagements. Furthermore, Bangladesh’s repertoire lacks specialized products that resonate with the unique demands of SAARC markets, exacerbating the demand-supply mismatch.

Trade Strategy Under the Microscope

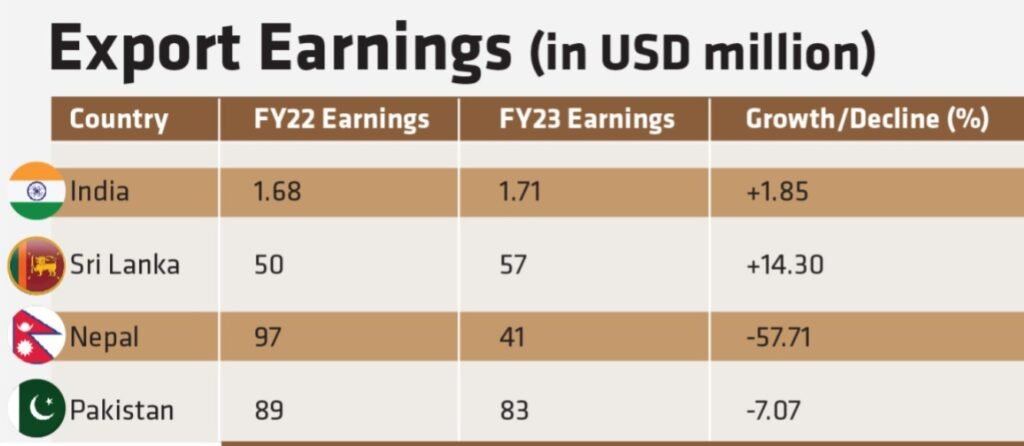

Delving into the specifics, Bangladesh’s export receipts from key players such as India, Sri Lanka, Afghanistan, and Bhutan have witnessed a modest uptick, albeit juxtaposed against a palpable decline from Nepal and Pakistan.

The central bank’s authoritative report serves as a compass, illuminating the contours of this intricate landscape. Noteworthy is India’s commendable surge in export earnings, scaling from $1.68 billion in FY22 to a commendable $1.71 billion in FY23, emblematic of a robust 1.85% growth trajectory over the financial year. Conversely, Pakistan’s export earnings narrate a tale of regression, plummeting from $89 million to $83 million, signaling a disconcerting 7.07% decline. Equally sobering is Nepal’s stark descent, with export earnings nosediving from $97 million to a mere $41 million, marking a precipitous 57.71% contraction in FY23 over FY22. In contrast, Sri Lanka emerges as a beacon of resilience, with export earnings ascending from $50 million to $57 million, showcasing a commendable 14.30% growth trajectory.

Parsing the import dynamics, India emerges as a dominant node, commanding a staggering 92% share of Bangladesh’s import payments within the SAARC framework, with Pakistan trailing at 7%, leaving the residual sliver to the remaining five nations. The report underscores a notable downturn in import payments to India, plummeting from $13.94 billion in FY22 to $9.49 billion in FY23, translating to a seismic 32% contraction within a span of one year.

In explicating the underlying drivers of this import downturn, the import slump to both macroeconomic exigencies and microeconomic dynamics should be taken into thoughts. The overarching specter of the dollar crisis looms large, precipitating a calibrated reduction in overall imports. Concurrently, the waning demand for Bangladeshi exports in the Indian market amplifies this decline. Additionally, India’s sporadic embargoes on key imports, such as onions, contribute to the constrictive import milieu, further stifling the import dynamics.

Bangladesh’s SAARC Balance Sheet

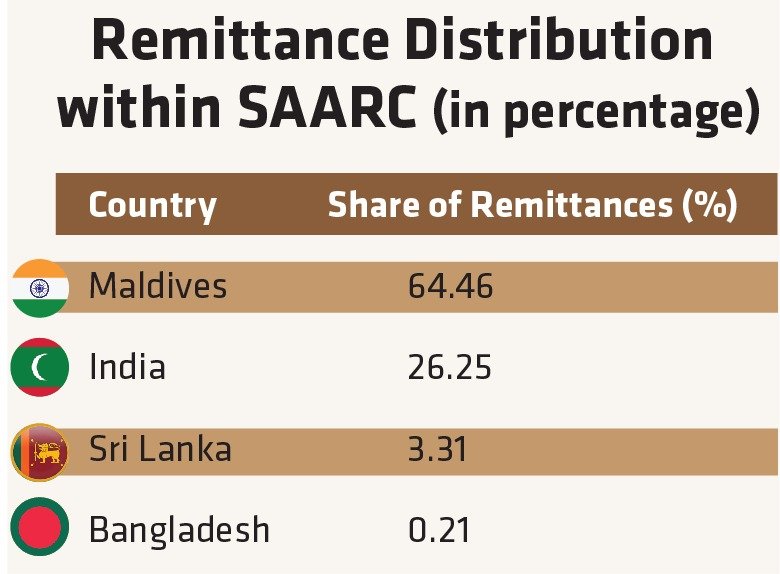

The saga of remittance inflows, as delineated by the report titled “Export receipts, import payments, and remittances with SAARC countries,” paints a contrasting tableau. In the fiscal landscape of FY23, remittance inflows to Bangladesh soared to a commendable $21.61 billion, with a meager $44.99 million emanating from SAARC precincts. The lion’s share of remittance flows emanated from the Middle East, the European Union, and North America, underscoring the palpable asymmetry vis-à-vis SAARC counterparts.

Delving deeper into the intricacies of remittance dynamics within SAARC, a compelling narrative emerges. The Maldives emerges as a lodestar, accounting for a commanding 64.46% share of remittance inflows, followed by India at 26.25% and Sri Lanka at 3.31%. This lopsided distribution underscores the salience of regional disparities within the SAARC remittance tapestry, with Bangladesh standing at the confluence of asymmetrical remittance currents.

In pursuit of enhancing regional business integration, the SAARC Secretariat commissioned a study on trade, manufactures, and services in 1988, culminating in a strong endorsement to establish the SAARC Chamber of Commerce and Industry (SCCI). This recommendation aimed at improving the business environment, disseminating information about tradable goods, and identifying joint ventures within the SAARC region.

SCCI’s Vision: Catalyzing Trade Growth in South Asia’s Booming Consumer Market

Despite rapid consumer market growth, the SCCI faces significant challenges in harnessing untapped trade potential. The private sector is eager to explore collaborations in manufacturing, agro-processing, industrial machinery, clean energy, ICT, and FMCG. South Asia has the opportunity to become a major player in global trade by leveraging its resources and young workforce.

The SCCI must activate its working groups and enhance capacity to improve transport infrastructure, harmonize trade procedures, promote digital connectivity, and foster regional supply chains. Strengthening Bangladesh-India trade ties, and extending LDC treatment to Bangladesh post-2026 until the BD-India CEPA is enforced, could be crucial steps.

Former SCCI President Ruwan Ediringehe noted that SAARC nations have key resources—manpower, market, money, and materials—but have not fully utilized them, emphasizing the need for proactive measures to reduce trade barriers.

Key Sectors for Business Collaboration:

- Manufacturing

- Agro-processing

- Industrial machinery

- Clean energy

- ICT (Information and Communication Technology)

- Fast-moving consumer goods (FMCG)

Conclusion

Beyond import-export tariffs, many other factors hinder trade growth. Complex regulations, difficulties in doing business, poor port infrastructure, and inadequate laboratory facilities all contribute to slowing down trade development. The drop in Bangladesh’s trade with SAARC countries is not just a temporary issue but highlights deeper structural problems.

Addressing these challenges requires coordinated efforts from multiple stakeholders to build a stronger and more resilient trade network in the region. Facilitating cross-border investments, simplifying customs procedures, and developing efficient logistics networks within SAARC can significantly enhance trade. There is vast potential in areas such as tourism, agriculture, fisheries, industries, and human development. Governments must seize these opportunities to tap into the region’s latent potential.