Remittances play an indispensable role in Bangladesh’s economic landscape, serving as a significant source of foreign exchange and contributing to the stabilization of the nation’s reserve

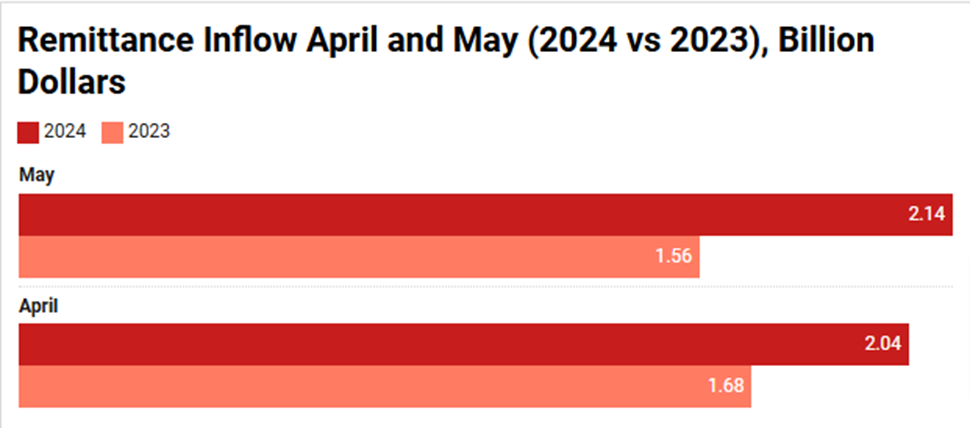

Bangladesh witnessed a consistent increase in remittance inflows, surpassing the $2 billion mark within the first 29 days of May. This represents a 38% increase compared to the same period last year. Notably, April 2024 also witnessed remittances exceeding the $2 billion threshold, continuing this positive trajectory.

You can also read: IMF’s $1.15 Billion Pledge: When Will Bangladesh’s Economy Improve?

According to data from Bangladesh Bank, the total remittances received in May amounted to $2.14 billion, a significant increase from the $1.55 billion recorded in May 2023. Cumulatively, the year-to-date remittance inflow reached an impressive $21.26 billion, showcasing a 10.3% growth compared to the previous year. Experts attribute this surge to the higher dollar exchange rates banks offer and the government’s incentives to encourage remittance flows.

Background

Bangladesh has witnessed a steady upward trajectory in remittance inflows in recent years. During 2023, the country received an impressive $21.5 billion in remittances, positioning it as the eighth-highest recipient globally.

The surge in remittances can be attributed to the higher exchange rates offered by banks and the government’s strategic incentives aimed at encouraging these financial flows. Remittances play an indispensable role in Bangladesh’s economic landscape, serving as a significant source of foreign exchange and contributing to the stabilization of the nation’s reserve.

Increased Remittance and National Reserve

Increased remittance inflows are helping to stabilize Bangladesh’s foreign reserves. The continued inflow is providing a much-needed buffer for the country’s strained reserves, improving economic stability and easing the balance of payments.

Remittances are playing a crucial role in reducing the impact of trade deficits. They are helping to maintain a healthy foreign exchange reserve, which is essential for importing goods and services. The rise in remittances is also reducing the pressure on the national currency, supporting its value and preventing inflation.

Bangladesh Bank’s incentives, such as higher exchange rates for remittances, have been successful in attracting more funds through formal channels. This approach is not only boosting the reserves but also ensuring better tracking and use of foreign exchange, which is further strengthening the economy.

Adverse Effects of Hundi

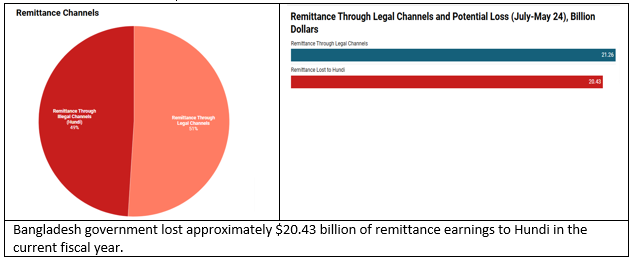

Reducing informal remittance (Hundi) channels like Hundi can greatly increase formal remittance inflows. Hundi transactions bypass official banking systems, leading to large losses in formal remittances. Currently, informal channels account for nearly half of the remittances sent to Bangladesh.

For the fiscal year of 2024 (July-May), Bangladesh received $21.26 billion, according to reports, nearly 49% of all remittances are sent via Hundi. By that calculation, Bangladesh lost a staggering $20.43 billion this fiscal year alone.

Expatriates prefer the hundi due to higher exchange rates. Banks offer lower rates, making informal channels more appealing. Formal remittance inflows could increase if the government closes the rate gap by allowing market-based rates. Bangladesh Bank’s incentives, such as a 5% incentive for remittances sent through banks, are trying to attract more funds through official channels.

Hundi transactions bypass the official banking system, leading to large foreign exchange losses. When remittances come through the hundi, the foreign currency remains abroad, reducing the country’s foreign reserves. This weakens the financial stability of Bangladesh and hampers the country’s ability to pay for imports and manage its balance of payments.

Hundi also makes it easier to launder money. Wealthy individuals use it to move illicit funds abroad, avoiding taxes and regulations. This results in lost revenue for the government, which could be used for public services and infrastructure. Additionally, it encourages the black market and undermines efforts to maintain a stable exchange rate.

The preference for hundi over official channels is driven by higher exchange rates offered by hundi operators. This gap makes formal channels less appealing to expatriates. Efforts to curb hundi are essential to ensure more remittances flow through legal routes, benefiting the national economy and increasing transparency.

Addressing these issues can improve foreign reserves, reduce economic instability, and boost government revenue, supporting overall economic growth and development.

Recommendations

“We cannot get remittance as our potential due to many reasons especially illegal ‘Hundi’. Policing is not the proper way to reduce hundi but reducing cost is. We need to reform our fundamentals to boost remittance.”

– Abdur Rouf Talukder

The government can implement several effective measures to curb the prevalence of hundi (informal remittance channels). Firstly, they should bridge the gap between the exchange rates offered through formal and informal channels. By providing competitive rates through banks, formal channels can become more appealing to remitters.

Secondly, increasing the remittance incentive from the current 5% to a higher rate can motivate more expatriates to utilize legal channels. Simplifying the remittance process and reducing associated transaction costs can further encourage the use of formal remittance pathways.

Thirdly, the government should enhance digital remittance services, making them more accessible and user-friendly. Collaborating with mobile financial service providers can help reach and efficiently serve a broader base of remitters.

Lastly, strict enforcement against hundi operations and public awareness campaigns highlighting the benefits of formal channels are essential components. These concerted efforts can significantly boost formal remittance inflows, ultimately benefiting the national economy.

Conclusion

Remittances play an indispensable role in Bangladesh’s economic landscape. They provide essential foreign exchange and contribute significantly to stabilizing the national reserve. In recent years, remittance inflows have grown remarkably, reaching record highs. This influx of funds supports economic stability and reduces the trade deficit.

Efforts to enhance remittances through formal channels are of paramount importance. Competitive exchange rates, reduced transaction costs, and improved digital services can further augment these inflows. Addressing the challenges posed by informal channels, such as hundi, is crucial to maximizing the benefits derived from remittances.